Pyrosky

Funding Thesis

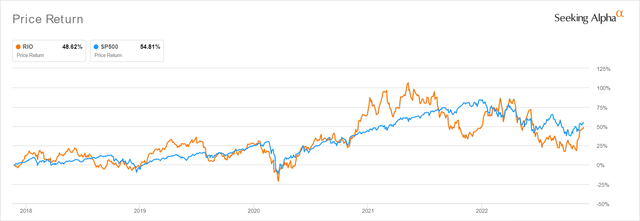

RIO 5Y Inventory Value

In search of Alpha

Contemplating China’s progressive stimulus price $146B and potential reopening post-Zero Covid Coverage, it’s no marvel that the Rio Tinto Group (NYSE:RIO) inventory has rallied by 24.74% over the previous few weeks, considerably aided by the upbeat October CPI studies. Due to this fact, we might even see greater iron ore imports by H2’22, because the nation consumed 1.12B tons of the fabric in 2021, accounting for 43.07% of the worldwide manufacturing then. Moreover, 75.8% of analysts at the moment are projecting that the Feds will pivot early with a 50 foundation factors hike, as seen by the Financial institution of Canada’s latest moderation. Assuming so, we might even see this tsunami of confidence lifting all boats reasonably from 14 December onwards.

However, relying on how the scenario develops, we doubt that this optimism is sustainable over the subsequent few weeks (or months). Most notably, Apple (AAPL) is reportedly having bother securing staff for the Zhengzhou manufacturing unit in China, because of the overly strict quarantine protocols and, consequently, triggering violent riots delaying manufacturing. That is regardless of the supposed ‘focused and exact’ strategy from Beijing and native authorities alike, in an try to reduce the affect on financial development. The ensuing employee unrest has contributed to world delays within the iPhone 14 deliveries, since 4 in 5 iPhones are assembled there. Thereby, triggering extra suspicions amongst the watching worldwide viewers.

There isn’t any telling when President Xi Jin Ping will lastly relent on its hardline strategy, because the latter continues to hinder the restoration of home property and labor sectors. The Chinese language chief has beforehand clamped down on speculative frenzies and induced an ongoing property disaster, as costs proceed to fall drastically since June 2021. It nonetheless stays to be seen, if the latest $30B stimulus is ready to revive the extremely indebted builders. With the housing market in a deep disaster and restricted catalysts for restoration, China’s reopening progress and iron ore urge for food stay dangerously unsure.

RIO Faces Margin Headwinds With Unsure Prospects Forward

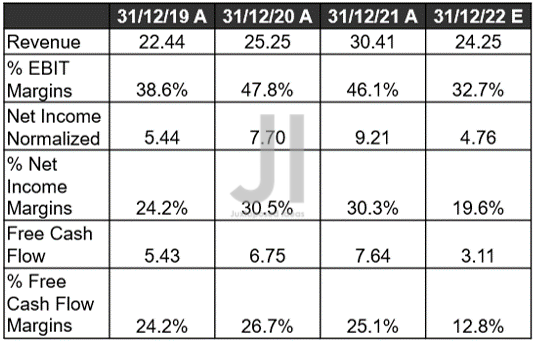

RIO Income, Web Earnings ( in billion $ ) %, EBIT %, and FCF %

S&P Capital IQ

For its upcoming earnings name in February 2023, RIO is predicted to report revenues of $24.25B with EBIT margins of 32.7%, indicating a drastic decline of -20.25% and -13.Four share factors YoY, respectively. With its profitability additionally probably affected by -48.31% and -10.7 share factors YoY, the corporate’s Free Money Stream technology could also be tragically halved to $3.11B then. Due to this fact, it’s no marvel that the inventory has additionally beforehand hit all-time low with a -36.88% plunge from earlier peak optimism ranges of $84 in March 2022.

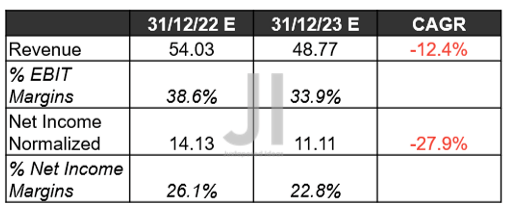

RIO Projected Income, Web Earnings ( in billion $ ) %

S&P Capital IQ

As a result of normalization of iron ore costs, RIO is predicted to report a notable -9.73% drop in top-line development for FY2023, considerably worsened by peak recessionary fears. Its projected EBIT margins of 33.9% additionally symbolize one other underperformance in opposition to pre-pandemic ranges of 39%. Thereby, additionally impacting its profitability by -21.37% YoY, with naturally declining margins to 22.8%, in opposition to FY2019 ranges of 24%.

It’s obvious that Mr. Market is extra bearish than we thought, since RIO’s operations could additional undergo from cyclical price inflation and elevated vitality prices within the brief time period.

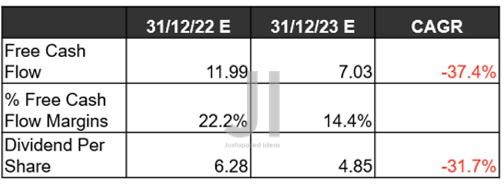

RIO Projected FCF ( in billion $ ) % and Dividends

S&P Capital IQ

It’s no marvel then, that RIO selected to chop dividends to $2.67 for H1’22, comprising 50% of earnings in opposition to H1’21 ranges of 75%. The administration’s prudent name has allowed for a more healthy stability sheet, with money and equivalents of $11.4B by the top of final quarter. Nevertheless, market analysts are additionally comparatively optimistic that the corporate will revert to its earlier stance by H2’22. That is because of the projected $3.61 payout then, indicating a wonderful annual yield of 11.41% for individuals who had entered on the mid $50s. We’re extra real looking with in-line payouts $2.67, sadly.

Moreover, we anticipate to see extra headwinds to RIO’s inventory efficiency, since its FCF margins are anticipated to additional deteriorate to 14.4% by FY2023, in opposition to FY2019 ranges of 21.8% and FY2021 of 28.3%. Thereby, additionally impacting its projected dividends payout subsequent yr, with a possible YoY reduce of -22.77% then.

However, market analysts additionally anticipate RIO to proceed paying down debt, because it did up to now few quarters. By the newest quarter, the corporate has efficiently paid off -$2.13B of its long-term money owed since H2’20, whereas anticipated to additional deleverage by -$1.5B via FY2023. Moreover, buyers needn’t fear, because the weighted common maturity is estimated at ten years, with the closest one due by 2024 at $1.5B. Thereby, securing the corporate’s rapid liquidity via the unsure financial situations forward.

So, Is RIO Inventory A Purchase, Promote, or Maintain?

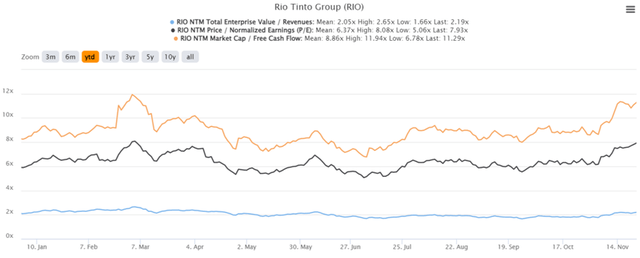

RIO YTD EV/Income and P/E Valuations

S&P Capital IQ

RIO is presently buying and selling at an EV/NTM Income of two.19x, NTM P/E of seven.93x, and NTM Market Cap/ FCF of 11.29x, comparatively inflated close to its YTD highs of two.65x, 8.08x, and 11.94x, respectively. Nonetheless, we’ve got to confess these ranges are nonetheless considerably affordable in comparison with its 5Y means of two.44x, 8.57x, and 10.86x, respectively. In that case, buyers who don’t thoughts the smaller margin of security should still nibble at a value goal of roughly mid $50s to $60s. Portfolios ought to naturally be sized appropriately, within the occasion of volatility as properly.

Iron Ore Costs

Buying and selling Economics

For now, iron ore spot costs have additionally briefly lifted from $73.62 to $98 per tonne on the time of writing, nearer to pre-pandemic highs in 2019. Nevertheless, bulls would probably nonetheless be discouraged by the huge distinction of -18.30% from latest highs in August 2022 or a catastrophic -56% plunge because the peak in Might 2021. Within the brief time period, we anticipate demand and costs to stay stunted till property markets increase once more globally. Issues are unlikely to enhance, because of the cooling property markets within the US & unsure Zero Covid Coverage in China. Ouch, since each nations comprise 73.61% of RIO’s revenues in FY2021.

One other phrase of warning, because the Feds could not pivot this early, because of the raised terminal charges of over 6%. Assuming so, we might even see one other backside re-test, as seen in July and September 2022. Consequently, conservative buyers could need to anticipate extra readability earlier than including RIO to their portfolio. There isn’t any level chasing this rally.