Shahid Jamil

This text was initially printed for members of Leads From Gurus on January 23.

Apple Inc. (NASDAQ:AAPL) has averted layoffs amid the present financial downturn that has compelled a lot of its rivals to slash their workforce large time. The tech big has attracted reward from many top-tier information shops, analysts, and economists for its prudent administration main as much as the financial disaster. We are going to dig deep into the numbers briefly, however to summarize, Apple appears to be essentially the most effectively managed large tech firm right now. One might go on a limb to say that a few of the tech giants acquired forward of themselves within the final 5 years when the going was straightforward. Apple’s prudent choices at the moment are starting to bear fruit, prompting traders to conclude the corporate is superior to different large tech firms.

Huge Tech Layoffs

Earlier than we talk about the potential elements behind Apple’s stellar monitor file in avoiding mass layoffs, let’s take a look at how the tech sector has suffered for the reason that starting of 2022. In response to information from www.layoffs.fyi, a web site that tracks tech layoffs, 158,951 workers have been laid off in 2022. A stunning 55,970 tech workers have been laid off in 2023 up to now. Because the under chart illustrates, layoffs have intensified in the previous couple of months.

Exhibit 1: Tech layoffs since 2022 January

Layoffs.fyi

Though Apple has up to now averted mass layoffs, the identical just isn’t true for a few of the largest tech firms on this planet. The under desk highlights the most important tech layoffs since Covid-19, which exhibits how Alphabet, Inc. (GOOG) (GOOGL), Meta Platforms, Inc. (META), Microsoft Company (MSFT), and Amazon.com, Inc. (AMZN) have slashed their workforce aggressively within the final 12 months.

Exhibit 2: Largest tech layoffs for the reason that starting of the pandemic

Layoffs.fyi

These numbers might look daunting, and they’re. To seek out the foundation trigger of those layoffs at a time when Apple has been avoiding the identical destiny, one has to look deep into the monetary efficiency metrics of those firms. One apparent cause behind Apple’s standout efficiency is that the corporate – just like what it has accomplished over the past 25 years – used a measured method to increasing its enterprise, though the outlook for the tech sector appeared rosy in the previous couple of years.

Exhibit 3: Workforce growth from September 2019 to September 2022

| Firm | Workforce Enlargement |

| Apple | 20% |

| Alphabet | 57% |

| Meta Platforms | 94% |

| Microsoft | 53% |

Supply: Barron’s

Apple, as evident from the above information, has expanded its workforce at a a lot slower tempo in comparison with different large tech firms, which is now proving to be a genius transfer amid difficult macroeconomic situations.

Layoffs May Be A Poor Lengthy-Time period Choice

The thought behind shedding hundreds of workers is to achieve value efficiencies and enhance margins. Historical past suggests these expectations are tough to be was actuality. In response to Stanford Graduate College of Enterprise Professor Jeffrey Pfeffer, who has researched layoffs extensively, there are a number of main the reason why firms fail to indicate any enhancements of their monetary efficiency after mass layoffs.

- The excessive prices related to severance packages.

- A rise in unemployment insurance coverage premiums.

- A notable decline in office morale amongst remaining workers.

The Professor goes on to assert that many firms battle for a similar expertise that was laid off when macroeconomic situations flip for the higher, and often pay the next bundle to lure laid-off workers. As a rule, firms lay off workers solely to rent them again as contractors by means of a contracting company, thereby paying hefty charges to those companies as effectively. In response to Professor Pfeffer, mass layoffs are nothing greater than a social contagion.

The tech trade layoffs are principally an occasion of social contagion, wherein firms imitate what others are doing. In case you search for causes for why firms do layoffs, the reason being that everyone else is doing it. Layoffs are the results of imitative conduct and aren’t notably evidence-based. May there be a tech recession? Sure. Was there a bubble in valuations? Completely. Did Meta overhire? In all probability. However is that why they’re laying folks off? In fact not. Meta has loads of cash. These firms are all making a living. They’re doing it as a result of different firms are doing it.

Apple, up to now, appears to have averted many of those unfavourable outcomes ensuing from mass layoffs.

Why Traders Want To Look Past Simply Layoffs

Company America has seen super success over the past century, however there have been main downturns. When issues are darkish and gloomy – like they’re right now – it’s straightforward to lose give attention to empirical proof as worry takes over. At the moment, with many traders specializing in tech layoffs, it’s straightforward to conclude that AAPL is the perfect guess within the tech sector. I am unable to fully agree with this stance for a number of causes.

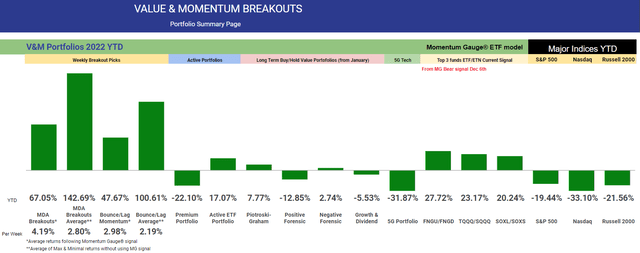

First, Apple is a well-managed firm that’s more likely to develop at a gentle fee within the coming years, however as a growth-oriented investor, I’m looking out for firms that might outpace the expansion of the worldwide financial system. One of many main the reason why the likes of Meta employed aggressively within the final couple of years is the large progress forward of the corporate. Even within the final 5 years, Apple grew at a a lot slower tempo in comparison with different large tech firms.

Exhibit 4: Income progress comparability between Apple and different large tech firms

YCharts

Though I’m not justifying over-hiring by any stretch of the creativeness, I consider it might be affordable to count on Apple to rent on the slowest tempo amongst large techs on condition that the corporate operates in a number of mature enterprise segments whereas its different large tech counterparts are aggressively increasing into new enterprise segments that require aggressive hiring.

Second, layoffs aren’t a dependable indicator of future prospects. Mass layoffs have been part of Company America’s historical past, though proof suggests these mass layoffs have had little affect on saving firms from additional struggles throughout recessions. As illustrated under, mass layoffs reached file highs in the course of the dotcom bubble and the monetary disaster in 2001 and 2008, respectively.

Exhibit 5: Mass layoffs by cause classes

U.S. Bureau of Labor Statistics

From large banks to tech giants to startups, firms of each scale and dimension slashed jobs in 2001 and 2008. If an investor tried to keep away from shares of tech firms that laid off folks in these two recessions, it might have been unimaginable to seek out one apart from Apple. The likes of Google, Microsoft, and Amazon have come out strongly from such dire circumstances to ship triple-digit beneficial properties within the years that adopted. Layoffs, subsequently, can’t be used as a dependable indicator of what the long run holds for an organization.

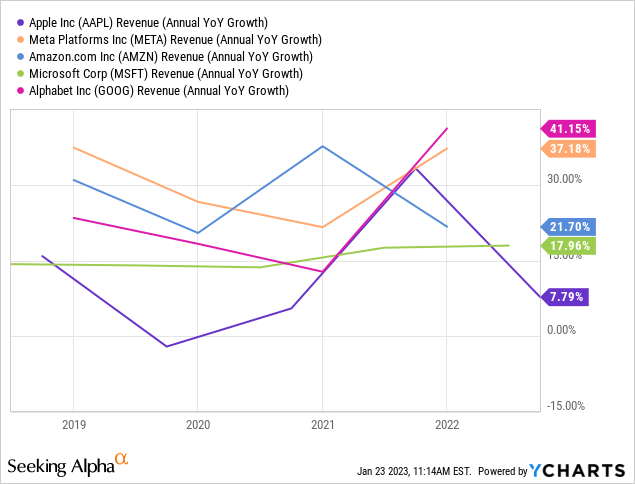

Third, Apple just isn’t out of the woods simply but. Simply because the corporate has averted mass layoffs up to now doesn’t imply that the corporate will carry out higher than its large tech counterparts within the coming quarters. Apple inventory, as illustrated under, has been the best-performing inventory amongst large tech firms within the final 12 months, and this efficiency may be instantly attributed to its superior monetary efficiency.

Exhibit 6: Efficiency comparability of Apple inventory and different large tech shares (as of Jan. 23)

YCharts

Previous efficiency is commonly not a very good indicator of future efficiency, and on this case, I consider this argument holds. With the worldwide financial system nonetheless dealing with a number of challenges, the demand for smartphones may deteriorate in 2023 amid the anticipated slowdown in international financial progress. Apple may begin exhibiting some cracks this yr, and if this occurs, AAPL will doubtless take successful even when its tech counterparts come again strongly later this yr.

Takeaway

Apple has accomplished tremendously effectively to keep away from mass layoffs. This, nonetheless, just isn’t a adequate cause for me to spend money on the corporate, though it highlights the standard of the administration. Apple, for my part, can nonetheless be a very good decide for worth traders, however progress traders are higher off investing within the likes of Meta and Microsoft as these firms have a protracted runway for progress within the post-recession period.