Simmons First Nationwide Company (NASDAQ:SFNC) Q2 2023 Earnings Convention Name July 25, 2023 10:00 AM ET

Firm Individuals

Ed Bilek – Govt Vice President, Director of Investor and Media Relations

George Makris – Govt Chairman

Bob Fehlman – Chief Govt Officer

Jay Brogdon – President and Chief Monetary Officer

Convention Name Individuals

Brady Gailey – KBW

David Feaster – Raymond James

Matt Olney – Stephens

Gary Tenner – D.A. Davidson

Stephen Scouten – Piper Sandler

Operator

Good day, and welcome to the Simmons First Nationwide Company Second Quarter 2023 Earnings Convention Name. All members’ might be in listen-only mode. [Operator Instructions] After right now’s presentation, there might be a possibility to ask questions. [Operator Instructions] Please word this occasion is being recorded.

I’d now like to show the convention over to Ed Bilek. Please go forward.

Ed Bilek

Good morning, and welcome to Simmons First Nationwide Company Second Quarter 2023 Earnings Name. Becoming a member of me right now are a number of members of our Govt Administration Crew, together with our Govt Chairman, George Makris; CEO, Bob Fehlman; and President and CFO, Jay Brogdon.

Earlier than we start the Q&A, I want to remind you that our second quarter earnings supplies, together with the discharge and presentation deck can be found on our web site at simmonsbank.com beneath the Investor Relations tab. Throughout right now’s name, we are going to make forward-looking statements about our future plans, objectives, expectations, estimates, projections and outlook, together with, amongst others, our outlook concerning future financial situations, rates of interest, lending and deposit exercise, credit score high quality, liquidity and web curiosity margin. These statements contain dangers and uncertainties, and it is best to, subsequently, not place undue reliance on any forward-looking assertion as precise outcomes may differ materially from these expressed in or implied by the forward-looking statements on account of a wide range of components.

Further info regarding a few of these components is contained in our earnings launch and investor presentation furnished with our Kind 8-Okay right now, our most up-to-date Kind 10-Q and our Kind 10-Okay for the yr ended December 31, 2022, together with the danger components contained in that Kind 10-Okay. These forward-looking statements converse solely as of the date they’re made, and Simmons assumes no obligation to replace or revise any forward-looking statements or different info.

Lastly, on this presentation, we are going to talk about sure non-GAAP monetary metrics we consider present helpful info to traders. Further disclosures concerning non-GAAP metrics, together with the reconciliations of those non-GAAP metrics to GAAP are contained in our earnings launch and investor presentation that are included as displays to the Kind 8-Okay we filed this morning with the SEC and are additionally accessible on the Investor Relations web page of our web site, simmonsbank.com.

Operator, we’re prepared to start the Q&A.

Query-and-Reply Session

Operator

We’ll now start the question-and-answer session. [Operator Instructions] The primary query comes from Brady Gailey with KBW. Please go forward.

Brady Gailey

Hey, thanks. Good morning guys.

Bob Fehlman

Good morning.

Brady Gailey

I needed to start out with the online curiosity margin, which took a step down right here, which is form of in keeping with what we’re seeing from numerous your friends. How do you consider the online curiosity margin as we glance in direction of the again half of this yr?

Jay Brogdon

So Brady, that is Jay. I will soar in on that with a number of preliminary feedback to your query. The most important driver to margin and form of the development there to date has actually been extra round migration throughout the deposit portfolio than it has been round charge, if you’ll. And we have seen in June, within the again half of the quarter right here and actually form of holding our head to date into July type of a slowing down of that migration. And so I believe that type of encourages me from — as I take into consideration NIM and inflection in NIM trying ahead.

I will inform you this June NIM, the tempo of the strain on NIM was fairly a bit decrease in June than it has been actually in any of the sooner months of the primary half of the yr this yr. In order that, too, is form of holding its head a bit right here in July. So I believe there’s nonetheless some near-term strain in Q3. The importance of that strain shouldn’t be almost as vital as once more, because it has been within the first half of the yr. Which may imply an inflection within the again half of the yr extra like in This autumn.

After which have in mind, too, that in This autumn you additionally take pleasure in the swap that may kick-in in late September. So I will should say, Q3 doubtless somewhat little bit of strain from what we see in Q2. This autumn, hopefully, we see that inflecting in some unspecified time in the future even within the underlying tendencies. And you then take pleasure in the swap as nicely on high of that.

Bob Fehlman

And Brady, I would just add too, is, clearly, all banks have skilled a reasonably large improve in price of deposits. One of many issues we’re not afraid of is to defend our market share in numerous our markets that now we have an excellent market presence, and we do not need to hand over that market share in these deposits. So we’re keen to defend these and pay up for a few of these. And we did that on this quarter in some choose markets that it was actually important.

Brady Gailey

All proper. And you then guys have made some good progress in taking some bills out of your infrastructure. I do know you are concentrating on a discount of $15 million by the top of the yr, which I believe you guys will hit. When you get past that, are you pleased with the expense base? Or do you suppose you will proceed to search for alternatives to turn into extra environment friendly?

Jay Brogdon

Sure. Positively, we’ll proceed to search for alternatives there, Brady. I believe there are — actually, I do know there are extra alternatives past that. The one factor we’ll be measured and deliberate identical to we had been on this preliminary spherical, the Higher Financial institution Initiative. We talked about it for a number of quarters, actually form of needed to ensure we had our pencils sharpened round form of the online price save quantity. And we’ll do the identical factor if there’s one other spherical of this.

However as we glance into subsequent yr, whereas I do suppose there are incremental alternatives on the expense aspect, I believe there may also be some alternatives simply type of on the funding aspect, and we’ll be opportunistic in making these investments the place we have to and the place we really feel like there are alternatives. So extra to return on that as we form of spherical out the evaluation to these alternatives and be ok with speaking concerning the numbers.

Brady Gailey

All proper. After which lastly for me, you repurchased about 1% of the corporate within the second quarter. Is there any cause to suppose that, that might gradual? Or do you suppose that you will proceed to contemplate the buyback within the again half of the yr?

Bob Fehlman

Brady, I might say, first off, we actually took benefit of our pricing for us and all financial institution shares within the early a part of the quarter when most banks had been trending close to tangible e book values, very accretive to buyback at that time. Purchased again $20 million on this quarter. We’ll proceed to have a look at it on a quarter-by-quarter foundation based mostly on what the market situation is and what our capital wants are. The one constraint, I’d say in there may be we might keep inside — if we did inventory buyback, it might be inside our earnings much less our money dividends can be the utmost quantity. So we predict that is a really prudent manner with the place our steadiness sheet and development is projected.

Brady Gailey

Okay, nice. Thanks, guys.

Operator

Your subsequent query comes from David Feaster with Raymond James. Please go forward.

David Feaster

Hey, good morning, everyone.

Bob Fehlman

Good morning, David.

Jay Brogdon

Good morning, David.

David Feaster

Possibly simply bearing on the mortgage yield aspect, simply the mortgage development aspect. And look, it is good to see the expansion. Clearly, development fundings have been a key driver of it. Once we have a look at the pipeline slowing as we might anticipate. However I imply you are actually doing a fantastic job pushing new mortgage yields. I am simply curious, may you contact on out of your perspective, what are you listening to out of your shoppers? How is demand trending throughout your footprint? And perhaps simply the place are you continue to in a position to get good risk-adjusted returns at this level? And simply what’s your urge for food for mortgage development?

Jay Brogdon

Sure. So David, numerous questions in there form of in a roundabout manner. So let me attempt to deal with a number of completely different components of that subject. I do suppose — I’ve stated this on previous calls and in previous conferences, I believe it nonetheless continues to be true that the speed surroundings, simply the general surroundings proper now has precipitated a good quantity of demand destruction. And we proceed to see that. I believe that, that anyplace the place our pricing self-discipline is exhibiting up, which I believe that is fairly nicely throughout the board at this level and has been.

And our underwriting continues to be very, very sound because it has been all through the cycle. And so after we form of couple our underwriting requirements and our pricing requirements collectively, the amount that we’re seeing come into the pipeline, we really feel could be very, excellent relationship-oriented enterprise with excellent debtors and really sound construction. And that is form of what our urge for food is correct now.

I’ll inform you that basically within the second quarter, the final month or two, one form of optimistic signal probably when it comes to pipeline tendencies as a result of the pipeline tendencies been down and we have been forecasting that, can actually proceed to anticipate pipeline tendencies to form of be an space the place they’re proper now. However one form of optimistic signal is we’re seeing some debtors, some clients that we take care of and have handled up to now, very sturdy relationships, who’re it appears extra keen to place somewhat extra cash and fairness within the offers. And with extra fairness within the tasks that they are taking a look at and with our underwriting and with sturdy pricing, I believe that is an indicator of form of the dearth of financing alternatives which might be on the market.

And so we’ll proceed to have a look at these and be opportunistic the place we could be, once more, with very shut relationships. However I believe that the development you have seen in somewhat little bit of slowing mortgage development however nonetheless good development is a development total that I proceed to anticipate. Paydowns are going to be low, and I do not anticipate that to alter. Unfunded commitments, we’ll proceed to see good fund ups on these over the following few quarters. Pipeline, in all probability going to degree off right here within the space that it is in, however hopefully, we will proceed to see some good alternatives with good debtors.

David Feaster

Are there any markets or segments the place perhaps you are seeing extra alternative and that you just suppose you’ll be able to acquire share simply since you are open for enterprise nonetheless?

Jay Brogdon

There’s nothing that basically jumps out that I believe is price pointing to. You noticed development for us this quarter that was fairly balanced and throughout the board. And I believe that, that also — there’s nonetheless the best manner to consider it for us going ahead. One space I’ll name out that we proceed to have numerous momentum in and be enthusiastic about, it is simply the agri space. We have seen some actually good development and alternatives. We have some nice expertise in our financial institution in that space, an extended historical past in it. However that is not an enormous portfolio for us. That is the one space I might name out. However I believe our focus continues to be diversified and actually throughout the portfolio.

David Feaster

And also you talked about within the presentation that we’re anticipating payment income development to gradual. I do know this has been a giant push for you all for a while, and it is nice to see development you have generated partially from this Higher Financial institution Initiative. I am simply curious perhaps among the tendencies you are seeing within the underlying massive companies? The place you see alternative on the payment aspect going ahead, cross-selling throughout enterprise traces throughout the franchise? And simply — some other ideas on the payment income aspect?

Jay Brogdon

Sure. Effectively, I’ll say within the traces of enterprise that we take into consideration on the market, whether or not it is wealth, mortgage, et cetera, I believe there’s nonetheless numerous alternative for us. I used to be happy to see an uptick this quarter on the income aspect from mortgage with latest charges, that is in all probability going to be somewhat extra of a problem in Q3, however I believe we’ll nonetheless proceed to do nicely there. We have numerous alternatives to develop in each of these areas, particularly, simply by persevering with to raised penetrate among the markets that we have acquired into over the previous a number of years. And in order that’s definitely present and intermediate-term goal and alternative for us.

I believe the place we proceed to actually consider the payment aspect is simply total form of banking providers, deposit costs, et cetera, the place the market surroundings continues to get more and more aggressive in numerous other ways. And in order that’s one thing that we’ll proceed to judge and guarantee to Bob’s earlier level that we will defend and defend in our markets and particularly in markets the place now we have nice market share. And so that is the work that we’re doing now.

David Feaster

Obtained it. That is useful. Thanks, everyone.

Jay Brogdon

Thanks, David.

Operator

The following query comes from Matt Olney with Stephens. Please go forward.

Matt Olney

Hey, thanks. Good morning, everyone.

Bob Fehlman

Good morning, Matt.

Matt Olney

I need to return to the funding technique that was mentioned and I respect Jay’s commentary about deposit migration tendencies stabilized in latest weeks. Any extra colour on simply the funding technique that you just executed within the second quarter? It seems such as you leaned somewhat extra closely on the borrowings within the first a part of the quarter. Would love to only respect the technique as you progress into the again half of the yr in any form of modifications. After which second a part of that’s, with Bob’s feedback about, if any market share in sure circumstances, ought to we learn into that, that the deposit beta there going to be shifting larger within the third quarter as in comparison with 2Q? Thanks.

Jay Brogdon

Thanks, Matt. Effectively, I might say that firstly, simply on the funding technique aspect, actually all through the quarter, I believe we had been simply opportunistic the place we would have liked something, whether or not it was something within the wholesale markets. There have been numerous ebbs and flows, particularly popping out of timelines again in March and the issues that occurred there inside our trade, the place we had been in a position to simply be opportunistic. That meant at instances leaning extra into borrowings versus brokered CDs. So I believe we’ll proceed to only form of consider these markets as we have to depend on them.

Usually talking, I believe the technique going ahead, as we have talked about, is extra alongside these traces of steadiness sheet optimization and needing to rely much less on that kind of funding. And that ought to bear out as development slows right here somewhat bit. We went from double-digit mortgage development for the final a number of quarters to nonetheless good single-digit development right here. However I believe we’re getting again to a spot the place type of our inherent steadiness sheet money flows can hopefully fund nearly all of our mortgage development and subsequently, lean much less into any kind of wholesale borrowing. So that might be the larger a part of, I believe, the technique going ahead.

The one could also be nuance or two in there this quarter, we popping out of March and the early quarter, we positively stored somewhat bit larger money balances early within the quarter than what was essential. You may even suppose again to type of debt ceiling talks that had been occurring within the quarter. So there have been some issues concerning the macro surroundings in Q2 that we felt it was simply prudent to take a fairly cautious tone round liquidity and what we had been maintaining on the steadiness sheet. So these had been perhaps simply once more, some nuances for the quarter to consider.

Matt Olney

And simply following up on that, Jay, any feedback or ideas on betas within the third quarter because it pertains to what we noticed in 2Q?

Jay Brogdon

Sure. I believe — sure. Sorry, I missed that piece of the query. Sure, on the deposit beta entrance, I believe just like the feedback on total NIM, I believe there — we’ll nonetheless — I do not suppose betas have type of stopped right here. There’s nonetheless total strain actually from the aggressive surroundings on deposits that I believe will proceed and can proceed to drive some motion in betas. However once more, I hope — I believe the bigger a part of the beta transfer has been quantity, if you’ll, greater than charge. It has been that migration out and in of lower-cost deposits.

I am hopeful a number of weeks shouldn’t be sufficient to actually name the complete development but, however I’m optimistic in what we’re seeing there and what I am listening to from others as nicely. So if the amount piece or the migration piece does, actually, gradual whereas there might be some continued strain, I believe, on each NIM and on deposit betas, that is a associated strain there. I do consider that, that — the importance of that development appears to be slowing down right here.

Bob Fehlman

And Matt, only one different I’d level out on NIM is we did have our sub-debt that repriced from fastened to floating within the quarter. That was a few million greenback unfavorable affect to our web curiosity earnings. That is a one-time reset there. It might go up somewhat bit with the following transfer, however not on the identical degree it did on this quarter. That is an excellent name out. Sure.

Matt Olney

If I bear in mind appropriately, I believe 2Q received the complete affect of that reset.

Bob Fehlman

That was April 1.

Jay Brogdon

Sure, each little bit of it…

Matt Olney

Okay. Excellent. After which, I suppose, switching over to the mortgage repricing alternatives. I believe that your debt known as out somewhat over $1 billion of principal maturities over the following yr at a decrease charge. I’d like to know simply basic ideas concerning the repricing alternatives inside that? And form of what the directives are to your manufacturing workers about the place you are concentrating on a few of these repricing ranges?

Jay Brogdon

Sure. I believe what you see when it comes to tendencies in our pipeline can be the same — that form of trajectory is the place we might anticipate repricing to be taking place on renewals there and even larger as a result of that pipeline is constructed up over time as charges proceed to maneuver. Present-day pricing in that pipeline is larger than type of the complete pipeline itself. So I believe our renewal alternatives are fairly vital right here on that $1 billion or $1.1 billion that we name out within the deck.

And Matt, the opposite factor I might throw in there that we’re actually targeted on is enhancing these relationships at these renewal alternatives. So the place now we have renewals and alternative to herald an working account or extra deposits or extra payment enterprise again to a query that was requested earlier within the name, we predict these are actually good alternatives. There’s simply not numerous credit score availability within the market right now for our clients. And so we’re attempting to take full benefit of that to actually improve and develop our relationship even past simply the pricing, the mortgage yield piece of that equation. We predict there’s numerous different alternative at each renewal date.

Matt Olney

Okay. I respect that. After which, I suppose, simply lastly for me, I believe the development mortgage balances proceed emigrate larger. I believe you disclosed you are at 99% on the C&D form of threshold measurements. We would love simply to understand form of ideas round these ranges, and will that act as a governor on the buyback? Or would you be keen to maneuver over that 100% guideline for 1 / 4 or two? Simply any form of ideas on that degree?

Jay Brogdon

Sure, Matt, I will soar in on that one, too. It is definitely not our technique to function at above 100% for sustained durations of time. On the identical time, we have got numerous experience in these areas of manufacturing and inside our enterprise. We’re not afraid to go over 100% for a time period. However I do not suppose you’d see us simply type of sustained working above these ranges. It is actually simply going to be a operate of time, stabilization charge on these tasks, et cetera.

Matt Olney

Okay. Thanks for taking my questions guys.

Bob Fehlman

Thanks, Matt.

Jay Brogdon

Thanks, Matt.

Operator

The following query comes from Gary Tenner with D.A. Davidson. Please go forward.

Gary Tenner

Thanks. Good morning guys. A few follow-up questions. I suppose on the deposit aspect, until I missed it within the deck, and I apologize if I did, however may you give us the June 30 interest-bearing spot charge simply as type of a jumping-off level into the third quarter?

Jay Brogdon

I do not suppose we have got that in there. Sure, I haven’t got that proper off hand right here, Gary. I will get again to you with that, Gary.

Gary Tenner

All proper. After which when it comes to the commentary concerning the service costs, I do not recall you all making bulletins about reductions in service costs or something alongside these traces. And I do know final quarter, you guided to payment earnings within the 43 to 45 vary, which you had been on the high finish this quarter. Does that vary nonetheless maintain even with some strain on service costs? Or is there a bigger delta there probably?

Bob Fehlman

Effectively, I will simply begin off on the service costs on all of our service costs, whether or not it is on deposits, whether or not it is in wealth or investments, we proceed to have a look at that each quarter to see the place we’re available in the market and the place we have to regulate for profitability. We talked about our service costs within the This autumn of final yr and nonetheless haven’t made any modifications. We nonetheless consider it on a month-by-month foundation. So have no plans to announce right now. However on a go-forward foundation, Jay, you could need to touch upon the general as a result of we did have a pair changes this quarter.

Jay Brogdon

Effectively, I believe you are proper. We have commented traditionally that low to mid-40s is form of the place we anticipate total charges to be on a quarterly run charge. We have been on the high finish of that vary, actually form of exceeded that vary in my thoughts for a few quarters in a row right here. That is consisted within the final couple of quarters of some truthful worth changes and a authorized reserve reversal final quarter, et cetera. So I nonetheless suppose that low to mid-40s vary is an efficient vary for us right here. Relying on actions that we would have to take from a aggressive dynamic standpoint on the deposit service aspect, may put me extra towards the underside, the center of that vary, whereas we have been hitting the highest finish of that vary for a few quarters right here.

Gary Tenner

Okay. I simply need to ensure I did not miss any bulletins about reductions in deposit service cost aspect. So I respect the colour. After which the low cost accretion for the quarter or the acquisition accounting changes for the quarter, may you give us what that quantity was?

Jay Brogdon

I believe now we have that in right here.

George Makris

It is on web page 17.

Jay Brogdon

17 stays. That is what stays. About $three million for the quarter, somewhat over $17 million left.

Gary Tenner

Okay. Sure, I do know you flagged form of the delta versus the primary quarter. I simply need to ensure I’ve the quantity precisely. After which final for me. When it comes to the truthful worth hedges on the securities portfolio, we received a hike this week, then they’re much more within the cash. Simply — you have talked up to now concerning the potential to unwind half or all, and I believe you form of word that within the slide deck. Simply total ideas on that. Is the working plan to maintain them in place? Or how are you evaluating that?

Jay Brogdon

Effectively, that is — we proceed to judge these hedges in addition to some other alternatives, hedging charges candidly in both route. In order that’s only a steady train for us. I do not suppose there’s something in type of what I’d name rapid plans to unwind that hedge proper now. However it’s completely one thing that may proceed to observe. And to your level, we might anticipate these to be additional within the cash whilst quickly as tomorrow.

Gary Tenner

Alright. Thanks, guys. Admire it.

Jay Brogdon

Thanks.

Operator

This concludes — truly, there’s yet another query right here. Stephen Scouten, Piper Sandler. Please go forward.

Stephen Scouten

Hey, good morning. Admire it. Guys, I used to be simply curious on the progress of the $15 million, how a lot of that in expense saves — annualized expense saves was already within the run charge? Or if that $15 million would form of be incremental to ranges right now?

Jay Brogdon

No, Stephen, I nonetheless suppose that we made progress this quarter, excellent progress. I really feel like — I do not — I am undecided that we had any of our initiatives absolutely achieved within the quarter from a full form of 90-day interval, if you’ll. We’ll definitely have full good thing about a few of these initiatives right here within the third quarter. There are different issues underway that we’ll have partial profit right here and full profit in This autumn. So I believe we’ll proceed to chip away at that. The steering that we have given is to type of be capable to absolutely hit that quantity web in This autumn, and have that form of out of the run charge as we go into subsequent yr, nonetheless really feel excellent about our skill to fulfill that. Hope to even exceed that quantity by somewhat bit as we form of flip the yr subsequent yr.

And as we talked about earlier within the name, we hope there’s extra and anticipate there are extra alternatives past that, however we additionally consider there might be some alternatives for us to make some investments, whether or not that is expertise acquisition or in any other case that may additional improve our enterprise, improve our development profile, improve our scalability. So we’ll be balanced as to how we take into consideration that web price save expectation shifting past this primary $15 million, and we’ll proceed to tell you all of our progress round that as we transfer ahead.

Stephen Scouten

Okay. Nice. That is actually good. After which simply very last thing for me. I am curious how you consider form of common incomes asset development from right here. It seems like working down among the borrowings and perhaps mortgage development within the low mid-single digits. If I heard your reply to Brady’s query appropriately, perhaps a pair extra foundation factors of NIM compression within the third quarter. So simply how do you consider the route of the steadiness sheet and common incomes belongings? And with that compression on the NIM, what do you suppose the trail is for total NII {dollars} for the remainder of this yr?

Jay Brogdon

Sure. Effectively, I believe that chatting with the expansion piece of it, Stephen, as we have stated now for a number of quarters, the technique greater than something is steadiness sheet optimization. So it is remixing the incomes belongings form of day in and day trip, each month, each quarter that we transfer by. We’re having success with that. I believe we proceed to have success with that as we transfer ahead. Actually anticipate to have the ability to rely much less form of on wholesale funding as that continues as nicely. And that must be fairly engaging for us from a NIM standpoint as we form of transfer out from there. Absolute {dollars} on NII, I haven’t got a fantastic information for you there that I need to be that particular with. However I believe that as we remix the steadiness sheet, you consider incomes asset combine, form of risk-weighted asset density, I believe there is a good alternative for us to develop NII as we transfer ahead.

Stephen Scouten

Obtained it. Thanks, Jay. I respect the time guys.

Jay Brogdon

Thanks.

Operator

This concludes our question-and-answer session. I want to flip the convention over to George Makris for any closing remarks.

George Makris

Thanks very a lot and I respect all of you becoming a member of us right now. I believe what you’re seeing Simmons is what it is best to have anticipated based mostly on the historical past of our firm and that’s conservative, various, markets, product, and danger profile. And that is enjoying out nicely, in right now’s market. We’re definitely dedicated to our neighborhood banking philosophy and relationship banking. And fortuitously for us in among the markets that we entered by acquisition, that buyer base is beginning to actually perceive who Simmons is and what our philosophy is, and the which means of relationship banking. I believe our pause in M&A [Indiscernible] to our Higher Financial institution Initiative, is definitely well timed and might be very useful in the long run.

We respect you becoming a member of us right now and we look ahead to doing this once more three months from now. Have a fantastic day.

Operator

The convention has now concluded. Thanks for attending right now’s presentation. You might now disconnect.

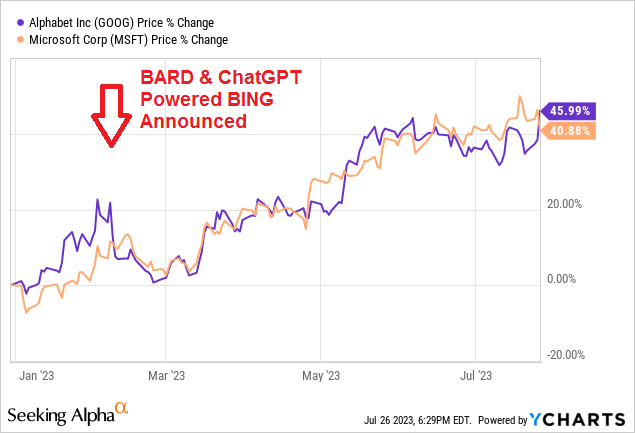

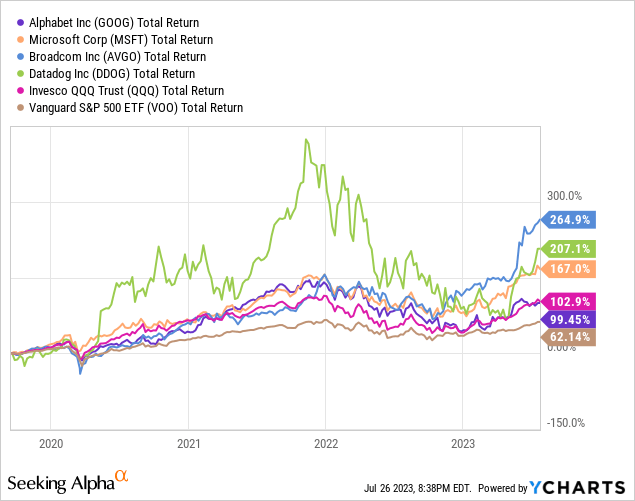

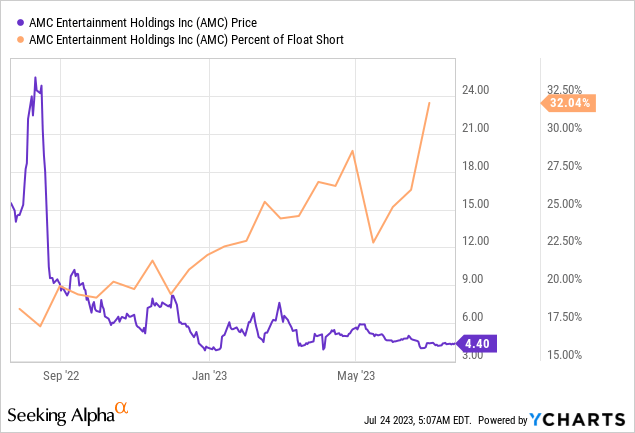

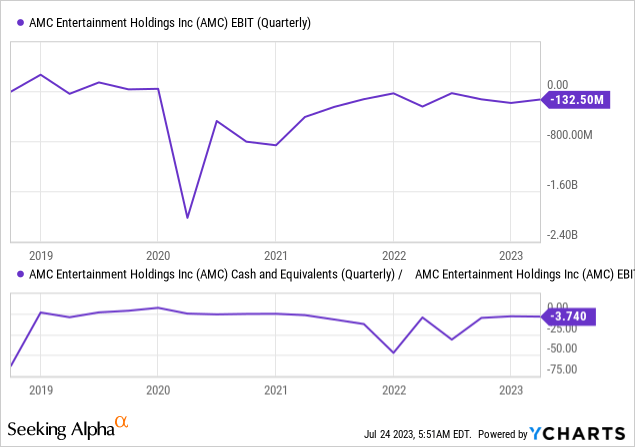

![YCharts, Seeking Alpha data [author's compilation and notes]](http://static.seekingalpha.com/uploads/2023/7/24/49513514-16901944039312594.png)