UPM-Kymmene Oyj (OTCPK:UPMKF) Q2 2024 Outcomes Convention Name July 23, 2024 6:15 AM ET

Firm Contributors

Massimo Reynaudo – CEO

Tapio Korpeinen – CFO

Convention Name Contributors

Linus Larsson – SEB

Robin Santavirta – Carnegie

Ephrem Ravi – Citigroup

Ram Kamath – Barclays

Charlie Muir-Sands – BNP Paribas Exane

Patrick Mann – Financial institution of America

Massimo Reynaudo

Good day, everybody. Welcome to UPM’s Quarter 2 2024 Outcomes Webcast. My identify is Massimo Reynaudo, and I’m the CEO of UPM. Right here with me is Tapio Korpeinen, the CFO.

Tapio Korpeinen

Good day all on the road.

Massimo Reynaudo

We’ll begin by discussing the quarter 2 outcomes and the outlook for 2024, after which we’ll cowl a couple of strategic steps we have now taken to speed up our future development.

In quarter 2, our comparable EBIT elevated by 60% from final 12 months, consistent with our expectations. To place this within the correct perspective, there are three important parts to have a look at. The market state of affairs is the primary. The demand for our merchandise has clearly improved from final 12 months. Though the restoration moderated considerably in quarter 2 after a powerful development in quarter 1.

The second component is about our transformative investments. The Paso de los Toros pulp mill reached full capability and reached it already earlier than its scheduled upkeep shutdown in June. This provides a great start line into the second half of the 12 months.

The third component is a few time-related component. Quarter 2 included an unusually excessive focus of upkeep actions, which have been holding again our efficiency within the quarter. This being accomplished, we at the moment are within the place to serve our prospects within the second half of the 12 months working at full capability.

Let me illustrate these three factors one after the other, beginning with the market state of affairs. The demand for our merchandise has improved clearly from the low ranges seen across the mid of final 12 months. At first of this 12 months, the expansion of the demand accelerated in many of the markets on the again of a wholesome shoppers demand and a few restocking after the heavy destocking of final 12 months. Throughout quarter 2, the demand improvement moderated however proceed to be clearly extra optimistic than final 12 months throughout quite a few segments. As examples, the worldwide pulp demand was good in quarter 2 and was recovering properly in Europe.

Pulp costs had been growing and the value improvement was additional supported by world provide restrictions.

Equally, the demand of self-adhesive labels and specialty papers was considerably higher than final 12 months, however extra secure sequentially from quarter 1. The demand for communication papers continued to extend from final 12 months within the first a part of 2024, however extra secure, once more, sequentially in quarter 2 in comparison with quarter 1. Plywood demand was seasonally higher in quarter 2 as properly. However however, the marketplace for renewable fuels in Europe proceed to be comfortable in quarter 2 prefer it was in quarter 1.

The second level I discussed in my introduction was in regards to the new Paso de los Toros pulp mill, reaching full run in quarter 2. Particularly, the manufacturing reached nominal capability for a full month already earlier than its first scheduled upkeep shutdown in June. Then the two weeks upkeep shutdown went in accordance with the schedule, and now the mill has moved from ramp-up to common manufacturing.

It is a key milestone and we’ll now be able to function at full capability any further, whereas we’ll proceed optimizing the entire enterprise platform and price base in Uruguay. We’ve now 60% of our pulp capability on a extremely aggressive and productive plantation-based mannequin in Uruguay, the place wooden prices are low and totally beneath our management.

The third level I discussed was about an unusually excessive upkeep exercise in quarter 2. Upkeep is a part of the conventional run of a enterprise, and usually, it isn’t spelled out as upkeep actions usually distribute kind of equally or evenly throughout the 12 months. However for various particular circumstances, we ended up having three giant pulp mills and the three nuclear energy crops, all present process upkeep shuts throughout quarter 2.

The affect of those shutdowns totaled to €130 million simply in quarter 2, that will be €140 million if we embrace additionally the affect in quarter 1. That’s the sum of the mounted value related to the upkeep and the revenues misplaced throughout the cease of those actions. The optimistic facet of that is that now we’ll have the ability to run at full capability for the remainder of the 12 months.

One other distinctive facet that impacted the primary half of this 12 months has been the Four weeks of political strike in Finland. We estimate there are unfavorable revenue affect in about €40 million throughout the two quarters, however with the primary half being within the quarter too. In H2, within the second a part of this 12 months, we don’t count on this type of occasions holding us again.

Now I’ll hand it over to Tapio for some extra feedback and particulars on our quarter 2 outcomes.

Tapio Korpeinen

Thanks, Massimo. So right here, we have now the EBIT bridge sequentially and year-on-year. And beginning now on the right-hand facet, comparable EBIT within the second quarter in comparison with the primary quarter this 12 months. There, you may clearly see the affect of the excessive upkeep exercise Massimo mentioned with decrease supply volumes and €86 million increased mounted prices sequentially.

On group degree, gross sales costs largely offset adjustments in variable value value — variable prices. Then on the left-hand facet, we present the second quarter EBIT improvement year-on-year. On this comparability, the optimistic affect of decreased variable prices outweighed the unfavorable affect of decrease gross sales costs. Supply volumes grew clearly pushed by restoration within the product markets after which additionally by the ramp-up of Paso de los Toros mill. Fastened prices had been €5 million decrease than final 12 months, which is an effective achievement given the excessive upkeep exercise.

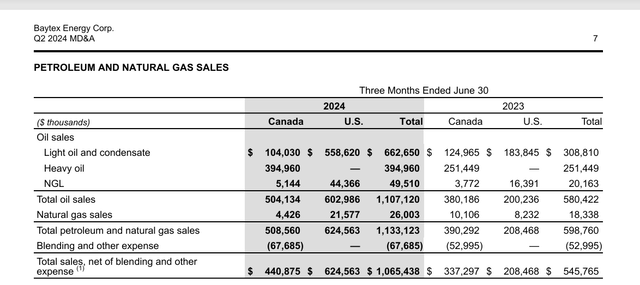

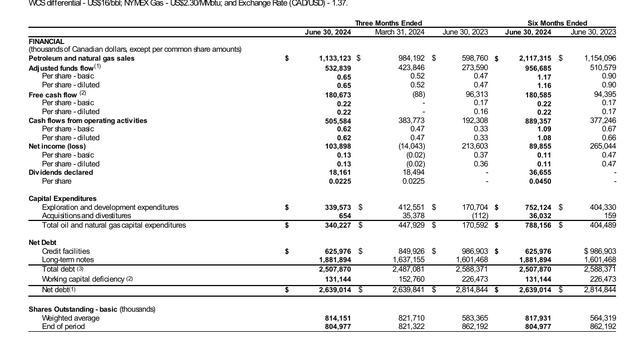

Then trying on the enterprise areas, beginning with fibers. In fibers, comparable EBIT improved from final 12 months and remained broadly secure in comparison with the primary quarter. Common pulp gross sales value elevated 8% from final 12 months and 12% from the primary quarter of this 12 months.

Deliveries of pulp grew by 16% from final 12 months. However sequentially, from the primary quarter, decreased by 5%, positively impacted by the ramp-up of Paso de los Toros, however then additionally held again by upkeep. And as talked about, three pulp mill shutdowns impacted the second quarter with a complete affect on the underside line of €100 million.

Then in Power enterprise space, we had a weak quarter seasonally. Electrical energy costs being low, after which additionally impacted by the excessive upkeep exercise within the nuclear energy crops. Within the second quarter, all three models at Olkiluoto nuclear energy plant had their scheduled upkeep shutdowns impacting the quarter by €30 million.

Raflatac continued profitable margin administration within the second quarter. Demand for labels in Europe was 23% increased than final 12 months and 4% down sequentially from the primary quarter.

Specialty Papers delivered good outcomes, making an allowance for the upper pulp prices. Demand for specialty grades was good, whereas demand for advantageous papers in Asia stabilized throughout the quarter.

Communication Papers profitability decreased within the second quarter on account of decrease supply volumes, which had been partially impacted by the political strike in Finland. Margins had been burdened as fiber value elevated and the rise is materialized extra shortly than paper costs elevated.

The Plywood enterprise continued regular efficiency in a seasonally good quarter. The EU antidumping measures on the imports of birch plywood from Russia entered into pressure and had a optimistic affect on the European market.

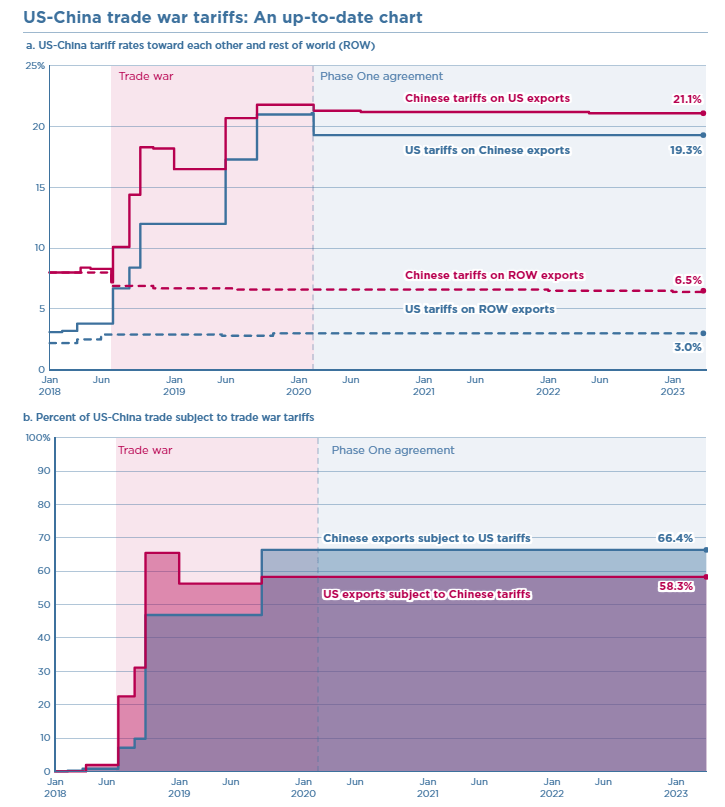

Then different operations. The efficiency of our biofuels enterprise remained on the degree of the earlier quarter and weaker than final 12 months. The European marketplace for superior renewable fuels continued to be comfortable, impacted by low-priced gas imports from China and upstream emission reductions from outdoors of Europe.

Final week, the EU Fee introduced it’s going to impose provisional anti-dumping duties on Chinese language biodiesel from mid-August onwards. After which there’s a separate course of happening investigating this upstream emission reductions traded out there and a few of these seem like fraudulent and should be corrected.

Such processes are welcome to begin bettering the steadiness of the renewable fuels market and in addition to strengthen the credibility of the European regulation for lowering emissions from site visitors.

Within the first half of the 12 months, biofuels when it comes to efficiency was considerably on the unfavorable facet on comparable EBIT degree. That is reflecting the present short-term turbulent market circumstances. And this additionally represents majority of the change within the different operation’s consequence within the first half of the 12 months as in comparison with final 12 months first half efficiency. And within the first half of final 12 months, the biofuels efficiency was very enticing. Nonetheless, biofuels now solely represents solely a minority of the full unfavorable EBIT within the different operations.

Then biochemicals, which can be a part of the opposite operations in the present day. Biochemicals is making ready at full velocity for the beginning of manufacturing on the finish of the 12 months. However that’s not all. We’re not solely investing in a brand new biorefinery manufacturing unit, however we’re launching an entire new enterprise. That signifies that we at present have most people, functionalities and prices in place for an entire enterprise ready for the beginning of manufacturing and launch on the finish of this 12 months.

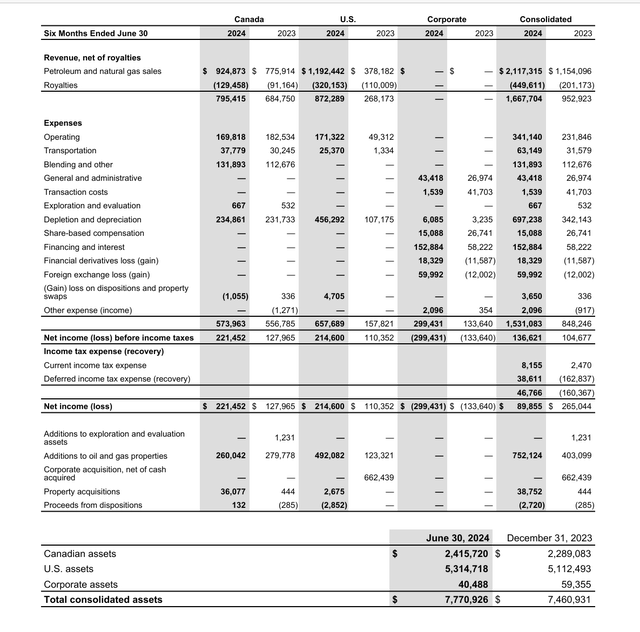

Then trying on the funds and steadiness sheet. Monetary place continues to be sturdy for UPM. Within the second quarter, our internet debt elevated considerably to €2.763 million and internet debt-to-EBITDA was 1.64x. That is impacted by the truth that throughout the second quarter, we paid the primary dividend installment for the 12 months 2023, totaling €400 million.

And this slide presents our outlook for 2024. The complete 12 months outlook is unchanged. We count on increased comparable EBIT than final 12 months, supported by increased deliveries, the ramp-up of Paso de los Toros and decrease mounted prices. Right here, we additionally launched an outlook for the second half of the 12 months. We count on second half comparable EBIT to extend from the primary half of this 12 months.

This enchancment is predicted to return particularly from fibers with the pulp capability totally out there and pulp value is at present at a better degree than on the time of the beginning of this 12 months.

For additional shade, we spotlight right here that our first half outcomes had been impacted by excessive upkeep exercise and by the political strikes in Finland, as Massimo already mentioned this affect or this impact on the primary half of the 12 months being in whole €180 million. We count on no such occasion for the second half of the 12 months. Moreover, we count on that the customary annual energy-related refunds will materialize within the fourth quarter, to illustrate, having an analogous impact that we have now had within the earlier 12 months, as an example.

So now I will hand over to Massimo for some steps we have now taken to speed up development and to safeguard competitiveness.

Massimo Reynaudo

Superb. Thanks, Tapio. Properly, a big reality of the second quarter has been the optimistic final result of the negotiation with the worker representatives in Finland. By means of these negotiations, we reached settlement on 5 new differentiated and business-specific CLAs.

That is undoubtedly a optimistic achievement because the business-specific phrases agreed to assist the long-term competitiveness of our Finnish operations. The validity of those CLA agreements is 2 years.

In Might, however, we have now introduced plans to shut the Hürth newsprint mill and 1 advantageous paper machine, paper machine #three on the Nordland Papier, each in Germany by the tip of this 12 months. Each mill belongs to the Communication Paper enterprise space. The plan as soon as applied, will lower our communication paper capability of about 600,000 tonnes or 12% of our whole capability and can end in annual mounted value financial savings of €45 million.

These initiatives comes from the necessity to alter the capability to the brand new buyer demand and assist making certain the continued competitiveness of the opposite belongings and a great money stream technology of communication paper sooner or later. However in the present day, we additionally introduced the acquisition of Grafityp, a Belgium-based firm, serving the graphic options market.

The graphics world market is a extremely enticing market. It has a measurement of roughly €Four billion and it’s estimated to develop by about 4% to five% every year. That is an adjoining synergistic market to the self-adhesive label market the place we have now a big presence already with Raflatac.

Typical graphics purposes embrace indoor and outside promoting like for instance, signage and automobile wrapping. Raflatac’s new graphic enterprise has been initially established after buying AMC AG and its graphic enterprise in 2022. This new acquisition will full the product supply in order that we are able to now be a one-stop store answer for graphic’s prospects globally.

Due to this fact, leveraging Raflatac’s world scale and infrastructure, in the present day’s acquisition will speed up Raflatac’s development, and strengthen its aggressive place additional on this enticing enterprise.

On a broader scale, this may develop the load of Raflatac a great margin and a excessive return on capital enterprise within the UPM portfolio, contributing to our strategic ambition of producing a balanced profitful development throughout all enterprise cycles.

Right now, we have now additionally given an replace on the deliberate biofuel refinery in Rotterdam. The key a part of the essential engineering has now been accomplished. The idea features a new UPM proprietary know-how, enabling the processing of a mixture of feedstocks coming from our personal worth chain.

We imagine that competitively sourced UPM-integrated feedstock coupled with distinctive know-how characterize the bottom for a worthwhile enterprise case. The know-how we did select has been validated at an illustration scale. Subsequent, we’ll deal with testing this new know-how at a bigger scale and securing the feedstock provide. That is anticipated to take roughly 2 years earlier than we might be prepared for the potential funding resolution.

With this, we reconfirm our strategic curiosity for biofuels. The longer term demand development for

superior renewable fuels stays enticing. And a differentiated aggressive and sustainable feedstock vary distinctive to us would be the key to making sure profitability over market cycles and doubtlessly regulatory developments.

Lastly, our Biochemical enterprise is getting near the beginning of the manufacturing of the refinery in Leuna. With it, we’ll enter out there of chemical merchandise with a particular and distinctive worth proposition based mostly on supplying low CO2 emission merchandise based mostly on renewable, wood-based various feedstock, various to fossil-based merchandise.

The commissioning of the refining in Leuna is continuing at full velocity towards manufacturing startup that we count on occurring by the tip of this 12 months, as beforehand communicated.

The operations staff and enterprise perform groups are all in place and the core processes required to run the enterprise have been established. The business curiosity for our merchandise has continued to be excessive and the chance pipeline is powerful. The refinery will produce various merchandise primarily or principally glycols and renewable purposeful fillers.

Previously months, we have now introduced various buyer agreements and partnerships

for the glycol merchandise in segments like beverage, textiles, coolants and others. In June, we introduced a partnership with the Nokian Tyres which marks an entry within the giant quantity tires market, which is essential and important for our renewable purposeful fillers’ merchandise. So backside line is that we’re all trying with optimism to this subsequent part that’s approaching.

After which lastly, I might prefer to remind you all our upcoming Capital Market Day in London on the fifth of September. Myself and our group govt staff hope to see you there to debate our UPM future development and ambitions. So please go to our web site at upm.com and register when you’ve got not completed it but.

And this concludes the presentation. So pricey operator, we’re able to take the questions from the members.

Query-and-Reply Session

Operator

[Operator Instructions] The following query comes from Linus Larsson from SEB.

Linus Larsson

I might like to begin on the opposite line really. And if you happen to might perhaps shed some extra gentle on suppose now going into the second half of the 12 months. Should you might please remark individually on the trajectory of biofuels profitability, your forest EBIT, together with the revaluations, which had been fairly important on the unfavorable facet within the second quarter?

And likewise perhaps the restructuring inside biocomposites, whether or not that had a significant affect within the second quarter, whether or not there’s some enchancment potential within the second half, please?

Massimo Reynaudo

Okay. So thanks in your questions. To begin with, you are touching upon totally different factors. I’d say — I’ll touch upon the restructuring for biocomposites and biofuels and I’ll let Tapio to touch upon others and the valuation of forest.

So let me begin from the underside and the biocomposites. Sure, you — the purpose you are elevating refers back to the, to illustrate, our resolution to discontinue this enterprise. This has been, I’d say, a pleasant enterprise. Nonetheless, over the time, it has not succeeded in constructing a scale regardless of being an fascinating enterprise.

So this has led to the choice to discontinue this enterprise having in our pipeline various different funding alternatives in enterprise with increased potential. As a result of these will not be — this enterprise has not succeeded to have the ability to scale prior to now has not constructed revenues and revenue on, I’d say, any significant degree so to think about important impacts in quarter 2 or in different quarters, okay? So that is about biocomposites.

Then about biofuels, I feel Tapio has commented earlier on, the truth that the present market conditions or not less than within the first a part of the 12 months, has been significantly difficult on the again of, to illustrate, chip imports from Asia, principally from China and these upstream greenhouse gasoline certificates, which depressed costs additional.

After all, future is difficult to foretell. However coming again to what Tapio’s talked about, is a latest, to illustrate, indication from — sorry, this latest data that anti-dumping duties might be utilized beginning in August. The vary is variable relying on the totally different topics, however these duties vary between 12.8% and 36.4%. So they’re materials. They are often materials.

And subsequently, this will have an effect on these imports and finally lead into a greater rebalancing of the market.

After which once more, I am form of repeating but additionally underlining some extent that Tapio talked about earlier than, beside that or on prime of that, there are, to illustrate, upstream greenhouse gasoline reductions claimed outdoors Europe. There’s an investigation ongoing as a result of that may be — a few of them will be unlawful, so ought to this be proved then decided motion, this may once more characterize a tailwind for this enterprise going ahead.

Tapio Korpeinen

Possibly on the opposite factors of your query, to illustrate, apart from what Massimo already went by there, I would not form of form of predict right here any form of occasions in any other case on this space, we’ll then see afterward within the 12 months what the parameters for forest valuation might be.

However if you happen to have a look at the precise — to date, really, whereas there was a change in valuation then on the similar time, it is being balanced by increased EBITDA generated from harvests of our — on forest lands, which had been form of seasonally excessive throughout the quarter.

So if you happen to bear in mind, there is a form of a steadiness all the time, we have now some development in our forest however then however, we additionally harvest which depletes then a number of the stock and people form of 2 elements make the web impact from our personal forest operations and no form of materials change really on that internet foundation between first and second quarter.

And so far as the biocomposites are involved as we’re detailing within the report, the form of restructuring costs have been taken as a part of the clear EBIT or as gadgets affecting comparability than in any other case when it comes to the form of outcomes going ahead, the form of ongoing enterprise affect on these different operations has not been materials.

Linus Larsson

Nice. Might I simply add that relating to Leuna, you are — as you stated, carrying a little bit of prices already for the group, varied elements of that enterprise already in place with none gross sales.

May you give us any sense of timing and tempo as to the way you count on this enterprise to be ramping up in 2025 and past? What is the nature of this enterprise? What are your expectations when it comes to enterprise ramp up?

Massimo Reynaudo

Okay. Sure. As I stated earlier, we count on to begin manufacturing by the tip of the 12 months. However on the similar time, with regards to the ramp-up, it is essential to remind, it is a refinery. And the everyday ramp-up curve of a refinery is often longer than a ramp-up curve of a pulp mill, simply to offer a benchmark and reference.

Beside that, it is a fully new idea. First kind of refinery of this sort within the business. So we wish to keep prudent in indicating, to illustrate, extra detailed time line with regards to the ramp-up. After all, we have now all of the curiosity in ramping up it as quickly as attainable, however it’s going to take time, sure.

Sure. So this, I imagine, was the query. Was there the rest within the query that I missed.

Linus Larsson

No, that is appropriate.

Operator

The following query comes from Robin Santavirta from Carnegie.

Robin Santavirta

Sure. Can I ask in regards to the Uruguay platform and the fee per tonne outlook for H2 in that market. Ought to we count on it to begin to method near the $300 per tonne form of degree? Or is it anticipated to stay clearly above that now in H2?

Associated to that then, what are the levers that will, from the tip of this 12 months, proceed to drive down value, however on — in manufacturing in 2025 or 2026?

Massimo Reynaudo

Okay. Okay. When it comes — thanks for the query, Robin. In terms of the Uruguayan platform, we have now indicated optimistic and earlier on that we intention to a money value of $280 per tonne. That’s our ambition.

And that may be a goal we have now set to ourselves, within the actuality, not only for Paso de los Toros, however for the total platform, which incorporates, subsequently, additionally the Fray Bentos mill.

The explanation I am mentioning that’s as a result of, for instance, with the start-up and the ramp-up of Paso de los Toros, we have now had already value enhancements for Fray Bentos as a result of, for instance, we have now been in a position to distribute a certain quantity of mounted value. We’re able now to optimize the administration of plantations and various different issues. So Paso de los Toros is driving advantages, value advantages additionally for the total platform, not per se.

Now the place we stand with it, we set ourselves as a primary goal to achieve the nominal capability as Paso de los Toros — in Paso de los Toros, as a prerequisite, then to implement various course of enchancment and fine-tuning that we’ll proceed to enhance the fee going ahead.

However equally and beside that, we at the moment are — we have now began to function at first of April, the railway connection between Paso de los Toros and the terminal within the port of Montevideo, which is ramping up and can attain a regime by the tip of this quarter.

So that is simply to say that the fee base is consistently evolving. It is evolving down, I’d say in a big manner. We’re not anyway able proper now to be keen to open up rather more on that given the variety of variables in play. However, one, our ambition stays excessive and above or I’d say, under USD 300 per tonne that you simply talked about, and we’re taking essential steps in lowering our value base over there.

However let me additionally underline that our value base now, as we communicate, is already one of the aggressive globally. So that’s the reason trying into the following half of the 12 months, having full capability out there and a really aggressive value base, properly, we have a look at it with some positiveness.

Robin Santavirta

Can I ask in regards to the Finnish pulp mills you have got nonetheless some greater than 2 million tonnes of pulp capability in Finland. And it is clearly very troublesome for us to form of perceive what sort of margin degree profitability you for the time being are producing in Finland provided that we have now now the brand new mill and really 2 mills in Uruguay and the start-up curve and mill upkeep and so forth.

Is there a way you may describe what sort of profitability are you producing for the time being in Finland with the present fairly excessive pulp costs, however clearly additionally the excessive wooden value?

Massimo Reynaudo

Sure. Properly, your query or the assertion, which was the preamble to your query described properly the state of affairs, wooden prices are excessive and so they proceed to develop throughout the second quarter in Finland, I’d say, in your complete Nordic platform. I’d say, good pulp costs have supported the profitability of that platform. However absolutely, prices are excessive.

I’d say that the state of affairs we’re confronted with within the Nordic international locations and Finland being a part of that may be a structural state of affairs of lack of wooden ever for the reason that embargo to Russian imports and the expansion of inner demand on account of investments from a few of our friends.

And the structural demand might be solved solely with structural choices or actions. By that standpoint, we have now giant belongings and fairly environment friendly belongings. So we aren’t immune from the challenges there, however we’re in a comparatively good place in that setting.

Rather more on margins. Properly, they stated they rely on wooden value however it’s going to additionally rely loads by value evolution. So I’d be reluctant to offer something extra outlined at this time limit given the potential volatility there.

Robin Santavirta

Massimo, can I ask this manner, had been your completed pulp mills final 12 months on the backside pulp value arrange, had been they nonetheless EBIT worthwhile?

Massimo Reynaudo

Sure, they had been.

Operator

The following query comes from Ephrem Ravi from Citigroup.

Ephrem Ravi

Three questions. Firstly, on CapEx. After Leuna, there are not any huge initiatives within the pipeline earlier than the Rotterdam mission doubtlessly that it seems to be like the fabric funding is not less than 2 years away given your additional feedback on additional research being required. Does this imply that the CapEx will come right down to the €300 million form of degree in 2025? Or is there one thing that’s going to maintain that increased than that?

Secondly, once more, on Leuna, I perceive it is a longer ramp up, however you had talked about a 15% ROCE earlier than that. Does that form of return nonetheless maintain at present biochemical spot costs if the — after the total ramp-up.

And final query, on the self-adhesive labels in Europe chart that you simply put as much as illustrate the destocking. When there is a destocking, one would count on gross sales to get well considerably near the place it was within the peak within the restock. The chart signifies that it is principally at 2014, 2015 ranges earlier than ticking down once more final quarter. Does this imply that the market is plateauing out when it comes to a restock at these form of ranges?

Massimo Reynaudo

Okay. Good. Thanks, Ephrem, in your questions. The primary query about CapEx and CapEx wants for the longer term. I’d — that is what — and what we make investments upon or how we’ll assist our development ambitions for the longer term is one thing we might increase or we’ll increase some extra in our Capital Market Days assembly in September.

However really, I’d say the extent of CapEx you have got indicated — CapEx want you have got indicated is the conventional, name it, burn price or CapEx want to take care of our present belongings going. So that’s, I’d say, the very minimal.

However we might have, to illustrate, we could also be pursuing development alternatives beside and on prime of enormous funding or funding in giant mills or we expect to couple doubtlessly the two parts. However let me — let’s talk about this in some extra depth and as a part of an total technique view at first of September.

Then with regards to Leuna, the return on capital indicated earlier on to be 14%. I’d say, sure, the indication holds that 14% is a return on capital goal we set for all our capital-intense companies and this biochemical enterprise is certainly certainly one of them. I’d say it is a goal we set for the enterprise.

Now if we speak particularly about Leuna, being the primary funding in that area, that got here in with, I’d say, some structural start-up value that won’t repeat in potential new investments on this area. After which, in fact, it got here burdened by personal particular and further value. I am referring right here to the truth that the CapEx ended up being increased than the unique estimate.

So we undoubtedly maintain our steerage and ambition for the biochemical enterprise over time. It isn’t one thing we might be reaching with Leuna day 1, however it’s undoubtedly what we intention to going ahead and towards the tip of the ramp-up.

Lastly, the query in regards to the self-adhesive demand evolution. I haven’t got the graph in entrance of me, however I imagine that absolutely the peak within the self-adhesive demand was reached someday round 2022 or one thing like that.

Now it’s settling right down to a degree which is round 2018, 2019 degree. However I’d say that doubtlessly, the height on the time was impacted by some overstocking linked to all of the logistic disruptions and dynamics, which have characterised 2022. And doubtlessly in the present day, it isn’t but reflecting the present and future potential of the market.

So we imagine that upon the present base past the form of settling that you’ve got seen in quarter 2. Over the midterm, not less than we’ll resume, we’ll begin to see once more a development profile, and it shouldn’t take too lengthy earlier than it’s going to attain ranges reached earlier than as a result of the basics of the patron calls for that did drive it prior to now past the stock degree will not be modified.

Operator

The following query comes from Ram Kamath from Barclays.

Ram Kamath

I’ve a pair please. The communication paper quantity has declined by round 9% for the primary half of this 12 months. I perceive that political strike has an affect on it. However excluding that, might you assist us to grasp what’s the deliberate utilization for this quarter as a result of implied utilization seems to be like under 17 now for the time being, even additional down from 1Q. So simply wish to perceive from that.

And since your operational efficiency is about to enhance within the second half of this 12 months because of the varied causes that you’ve talked about and your funding in biofuel mission is now delayed, I wish to perceive what your — what’s your capital allocation technique trying from right here. Do you intend to extend shareholder distribution or presumably you search for the chance inorganically as a result of simply to focus on that one of many giant pulp producer had — was seeking to purchase packaging firms. So do you have got any such plan to combine your online business or searching for a brand new alternative in several discipline?

Massimo Reynaudo

Okay. Sure. Thanks in your questions. Let’s go sequentially. Sure, communication paper volumes have declined.

The demand in the marketplace is now properly under what it was 1 12 months in the past, the decline being huge. And subsequently, working charges throughout the business have been beneath stress. And we have now not been, to illustrate, seeing a unique actuality from the business. We do not know the working price of others, however we do not have causes to imagine we’re performing considerably totally different from that.

However that is really the explanation for which we have now introduced this choices of stopping manufacturing in Hürth and stopping, which is in regards to the uncoated product grades after which stopping this line in Nordland, which is in regards to the advantageous paper grades which goal is to deliver our — is to switch volumes from these belongings to others, that are extra value environment friendly and restoring an working price that’s environment friendly.

So I would not have the ability at this time limit, haven’t got the info with me to offer any extra particular indications about working price, if not that with this resolution, we’re going to be working our belongings in that area in an environment friendly manner.

Then coming to your second query about CapEx technique. I’d say that we’ll take into account inorganic alternatives. Certainly one of them, we have now simply talked about earlier on in our name, enlargement on this graphic market area.

So sure, we take into account them a part of our toolbox going ahead. The place to, wherein space? Properly, as all the time, we’ll do issues — we’ll allocate our capital with a variety of self-discipline, making certain good return on our capital, no matter is the type of the funding.

However then in September, once more within the Capital Market Day, we’ll open a bit up extra round the place we see the primary worthwhile development and subsequently funding alternatives being within the years to return. And we are able to then remark a bit extra about this then. However sure, the reply to your query is we’ll take into account that if good alternatives might be out there, however in a really focused and disciplined manner.

Tapio Korpeinen

Possibly to the second level of your query there on shareholder distribution that clearly now the latest huge investments coming into manufacturing first in Paso after which in biochemicals. And naturally, which means enchancment in money flows and earnings. And subsequently then, in fact, over time, our goal is that the shareholders in a way, get to take pleasure in that as properly when it comes to the form of development in distribution to the shareholders over time.

Operator

The following query comes from Charlie Muir-Sands from BNP Paribas Exane.

Charlie Muir-Sands

A few follow-ups, please, on matters which have already come up, if I could. The primary one on the biofuels market and the state of affairs there, it is clearly welcome to listen to that the regulators are trying into a few of these issues which were suppressing market costs. However do you even have any alternative to attempt to get prices down. Are you able to remind us how a lot of your feedstock in the present day you are externally sourcing and whether or not there’s any alternative to return and ask for decrease costs there?

After which secondly, on Leuna. Are you able to simply make clear the tempo of the ramp up? Do you see that as extra of an operational constraint or business or to place it one other manner, are you able to form of give us some indication about how a lot of the nominal capability you now successfully have offered or have dedicated to with the ability to promote to these prospects that you’ve got recognized already?

Massimo Reynaudo

Superb. Thanks in your query, Charlie. Concerning the first level on biofuels and cost-down actions, they’re a part of the character of the enterprise. So we’re taking prices down in each attainable events. And naturally, when margins are careworn, it is a further alternative to — or further have to look into that.

However that’s regular exercise.

We’ve in the present day a big a part of the feedstock feeding the Lappeenranta mill that comes from personal sources. So that’s, to illustrate, not less than partially, is supporting the fee base of our enterprise. However I would love then to extrapolate from that and transcend this level as a result of we have now talked about Rotterdam earlier on. And this — and feedstock provide availability, management of the worth chain, our elementary component for the longer term competitiveness, we see it as a elementary component for the longer term competitiveness of this enterprise.

So that is actually what we have now targeted upon and are the core of the idea we’re growing for Rotterdam. So I took your query as a chance to characterize a bit extra the truth that over there, we aren’t aiming to have customary feedstock fed into a typical know-how as a result of if we had been doing that, we couldn’t hop into a lot better efficiency than the market, which might not make the funding case fascinating.

We’re aiming to hound feedstock coming from principally intra — managed worth chain and utilized by a particular and proprietary know-how. So sorry for the little bit of long-winded reply, however it was some extent I used to be eager to make clear.

Then with regards to Leuna and the ramp up of what’s influenced within the ramp-up. I’d say that if I exploit your characterization, it’s only a regular operational ramp-up. From a business standpoint, our alternative pipeline is powerful. And we would not have, I’d say, considerations at this time limit across the skill to promote the manufacturing of the unit.

Additionally in consideration, I’d say, 2 elements. One, the capability on the regime of the unit is 220,000 tonnes is sizable, however in comparison with the dimensions of the markets we’re addressing, we’re speaking minus coal area of interest doubtlessly. So we’re assured, and we have now it into, to illustrate, the agreements already signed with the contracts we have now. We’ve confidence we are able to promote that capability. So that’s the first component.

The second component, we’re going into some technicalities, however the glycol — monoethylene glycol we might be producing from a merchandise standpoint, it’s the similar because the equal from fossil sources. In order that makes it a dropping answer, which makes the adoption from prospects very straight ahead.

And right here, we come to the second a part of your query, how a lot of the present output we have now contracted. We’re not aiming to contract the total capability. That could be a deliberate alternative. We wish to hold a sure a part of the output, to illustrate, out there as a result of demand being fairly sturdy, that can give us the likelihood to distribute the output on a broader buyer base and maximize the profitability from that funding.

So backside line is we’re assured on the business ramp-up. It should observe the operational ramp-up. And with all the weather we have now proper now, we have now causes to imagine it is going to be an fascinating and worthwhile enterprise. After all, various parts are — begin to be nailed down, and that is what we’ll study alongside the way in which, however the confidence is there.

Charlie Muir-Sands

Unbelievable. And simply to observe up on one reply you gave to a earlier query. You stated you didn’t count on to realize the 14% return on capital on day 1. You talked about various form of one-off further factor burdens. However do you count on to earn the 14% return finally on the €1.15 billion capital mission, barely on the unique €750 million?

Massimo Reynaudo

No, that’s on the present capital that goes with — if that is a query, okay, I get it now, that refers back to the — properly, the funding we’ll put into the development of a biochemical enterprise. However that — in that calculation, we’ll consider the true CapEx that went into that mission and the unique estimation of €750 million just isn’t a part of the concerns anymore proper now for the explanations defined.

Operator

The following query comes from Patrick Mann from Financial institution of America.

Patrick Mann

Two questions. The one you stated, Paso de los Toros hit its nominal capability for a full month earlier than shutdown. Are you able to simply form of give us a steer on the way it’s doing after the shutdown? Are you again to full capability? Can we assume form of the place full capability from right here on out?

After which the second query is you guys identified that the web debt did transfer slightly bit increased, and I respect that there was the dividend fee within the first half of the 12 months. However simply pondering by the second half of the 12 months, you’ve got acquired form of no main scheduled upkeep and form of a teen run at manufacturing. How ought to we take into consideration how the steadiness sheet will evolve right here?

And I suppose as a subpart of that query is, will we nonetheless have fairly a big funding in working capital wanted for Paso de los Toros and perhaps for Leuna as properly?

Massimo Reynaudo

Okay. Thanks for the query — properly, the questions. I’ll depart the second in regards to the steadiness sheet and the web debt evolution to Tapio. I will touch upon the primary one and the capability earlier than and after the shutdown. Sure, the ramp-up after the shutdown proceeded as deliberate, which signifies that within the quick days after the shutdown, there’s been a progressive ramp-up, however manufacturing is at capability ever since fairly some days. So we have now no affordable or no concern on that going ahead.

After which I depart the following query to Tapio.

Tapio Korpeinen

Sure. So after we have a look at the web debt and — on one hand after which the form of money stream profile on the opposite, as you may bear in mind, we had form of important improve in working working capital within the first quarter of the 12 months, then second quarter really fairly form of flat.

We do have the second installment of the dividend that we’ll pay additionally throughout the second half of the 12 months so that can form of have an effect on the web money. However then however, to illustrate, the development in profitability will clearly assist and assist money stream in comparison with the primary half of the 12 months.

Because the volumes improve within the Paso de los Toros manufacturing, that, in fact, does put some form of want for added working capital. However to illustrate, I would not count on that to be any extra as huge because it has been throughout the starting of the 12 months.

Massimo Reynaudo

I am conscious that we have now used on a regular basis that we have now deliberate for this session. I wish to take the chance to thanking all people for having attended and took part to this session, renewing the invitation to fulfill both personally or on-line on the fifth of September. Thanks very a lot. Have a pleasant day.

Supply: Path Monetary, through Forbes.com

Supply: Path Monetary, through Forbes.com