We Are

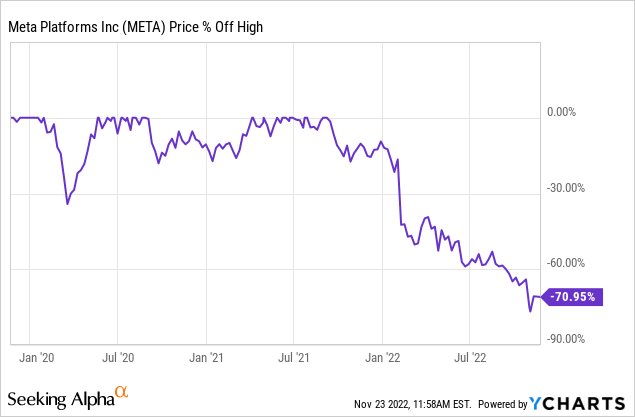

Generations have been evolving all through the years, which has solely been doable by improvements. Modifications made our lives extra environment friendly, safer and created higher dwelling situations. Meta (NASDAQ:META) realigned their embodiment of innovation to fulfill the wants of the next technology. Nevertheless, traders are punishing Meta’s actions. Consequently, the inventory is now down 70% from all-time highs, which makes it a superb time to take a deeper dive.

The Core Enterprise

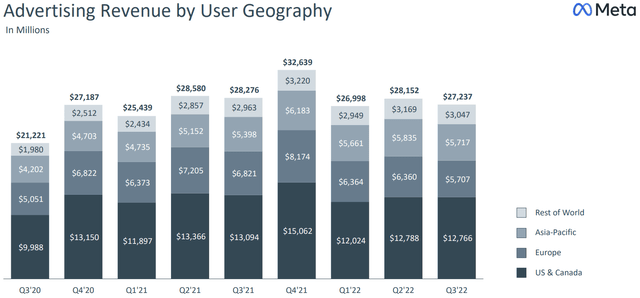

Let’s begin off with saying that Meta’s core enterprise is way from lifeless. Though the promoting market is weaker in the mean time, specifically Europe, it’s nonetheless producing a ton of cash. Yr-over-year promoting income stayed secure in all areas however Europe. Europe’s shopper market is presently extraordinarily weak, that is additionally clearly seen in different companies. So it’s no shock that promoting income is down by 16.3% in Europe, as firms attempt to reduce on advertising efforts within the area.

Meta-Investor Relations Q3 22

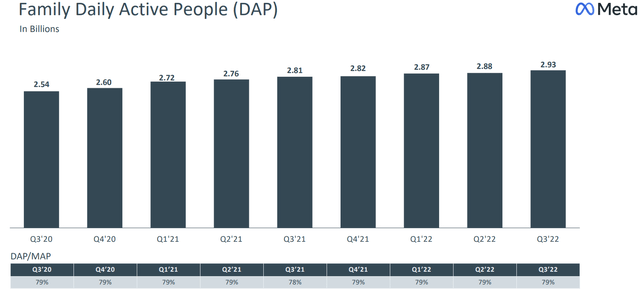

Nonetheless, this doesn’t imply individuals are utilizing much less social media. Meta has been in a position to enhance day by day lively folks and month-to-month lively folks on their platforms. Final weekend, I’ve visited Barcelona (Spain), the place I might witness the social media exercise within the metro, prepare and busses. Barcelona, generally known as one of many busiest cities in Europe, is utilizing Instagram, Reels and WhatsApp very incessantly. Abruptly, I’ve not seen a single individual use TikTok. AI developments within the scaling of advice fashions have led to observe time will increase of 15% for Reels. Therefore, I think that individuals are utilizing Reels increasingly more, as a substitute for the competitor TikTok.

Meta-Investor Relations Q3 22

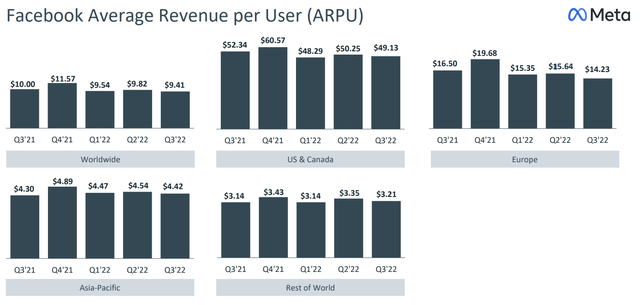

So, Meta’s platforms are fully tremendous and Europe is the one actual laggard for now. Europe just isn’t lagging by way of lively customers, however in income earned per consumer. In Asia-Pacific and the remainder of the world, ARPUs have elevated year-over-year.

Meta-Investor Relations Q3 22

Personally, I nonetheless see alternatives of development within the core enterprise. Reels has a superb likelihood to take again market share from TikTok. Reels are included in Instagram and Fb, which makes it a greater all-in-one expertise. Additional, the monetization of Messenger and WhatsApp is one other big alternative. Mark Zuckerberg, CEO of Meta, mentioned within the Q3 2022 earnings name:

We began with Click on-to-Messaging advertisements, which let companies run advertisements on Fb and Instagram that begin a thread on Messenger, WhatsApp or Instagram Direct to allow them to talk with prospects immediately. That is one in every of our quickest rising advertisements merchandise, with a $9 billion annual run fee. This income is totally on Click on-to-Messenger as we speak since we began there first, however Click on-to-WhatsApp simply handed a $1.5 billion run fee, rising greater than 80% year-over-year.

Paid messaging is one other alternative that we’re beginning to faucet into, and it continues to develop rapidly however from a smaller base. We’re placing the muse in place now to scale this with key partnerships like Salesforce, which lets all companies on their platform use WhatsApp as the principle messaging service to reply buyer questions, ship updates, and promote immediately in chat. We additionally launched JioMart on WhatsApp in India and it is our first end-to-end procuring expertise that reveals the potential for chatbased commerce by means of messaging.

Between Click on-to-Messaging and paid messaging, I’m assured that that is going to be a giant alternative.

Click on-to-Messenger/WhatsApp is rising extraordinarily quick and will take an even bigger share of complete income within the following years.

Total, promoting is experiencing a brief downturn, however this shouldn’t be troublesome for traders in the long run, because the underlying enterprise remains to be sturdy.

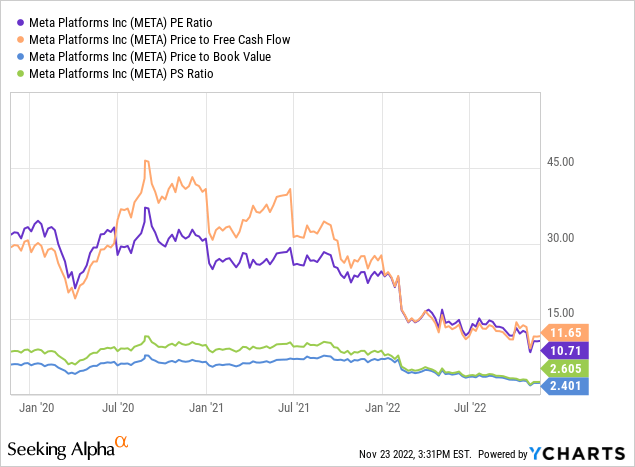

The Valuation

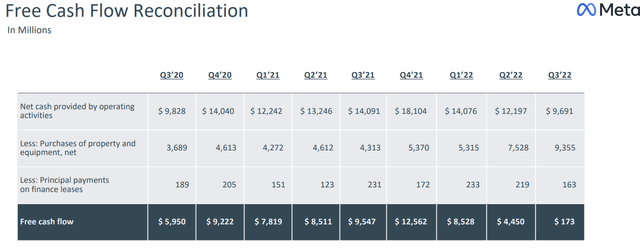

Up to now, I’ve not talked concerning the metaverse enterprise, given that it doesn’t matter. Meta is buying and selling at 11.65x earnings and 10.71x free money move, even within the COVID-19 crash the corporate was not this low-cost. The metaverse has a unfavourable affect on PE and PFCF ratios, because it generates unfavourable earnings and desires a whole lot of free money move, but these metrics are going decrease.

So, if Meta’s journey within the metaverse involves an finish, no extra unfavourable impacts on earnings and free money move, then the inventory would look much more discounted. Equally, if the metaverse begins producing optimistic earnings and free money move, then the inventory would additionally look extra discounted. Additional, the present valuation might be the underside, as Meta is slicing prices and the core enterprise and the greenback energy is stabilizing.

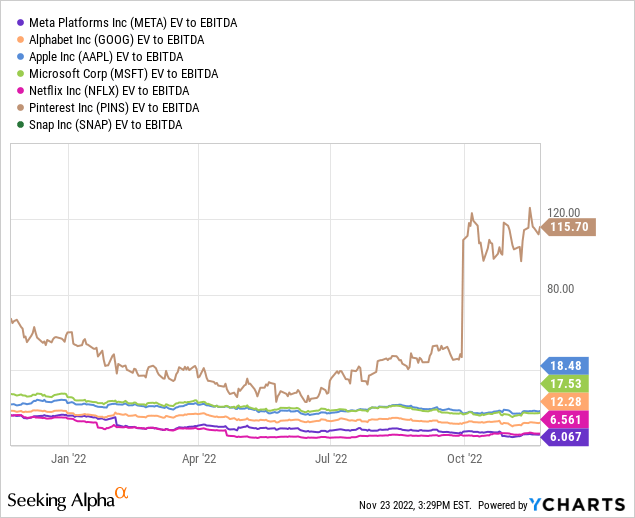

By way of EV-to-EBITDA, solely Netflix (NFLX) is near the valuation of Meta. Different friends and advertising-based firms commerce at a big increased a number of.

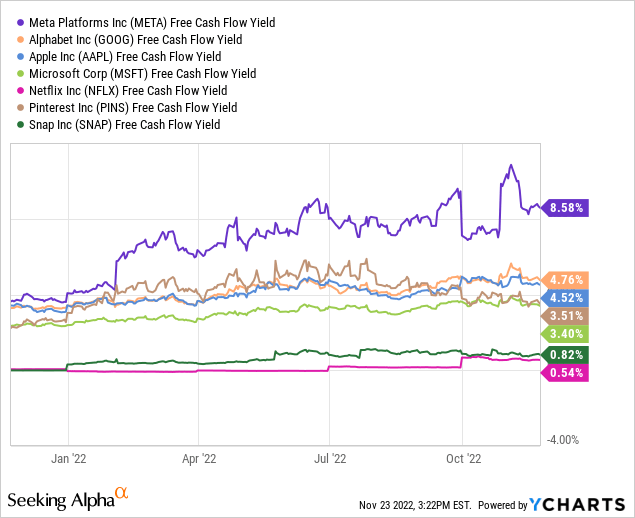

As well as, Meta’s free-cash-flow yield is manner superior than firms like Alphabet (GOOG) and Apple (AAPL). Subsequently, Meta seems to be discounted based mostly on fundamentals. One may argue that Apple, Microsoft (MSFT) and Alphabet are increased high quality companies and deserve a extra premium valuation. Nevertheless, the discrepancy between them is simply too giant for me to contemplate that argument.

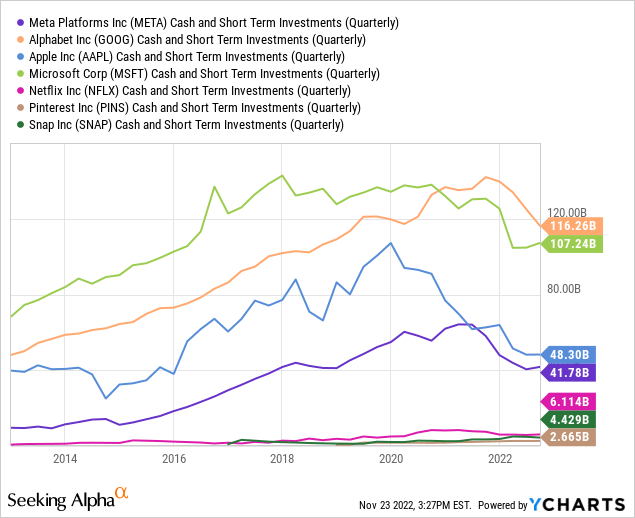

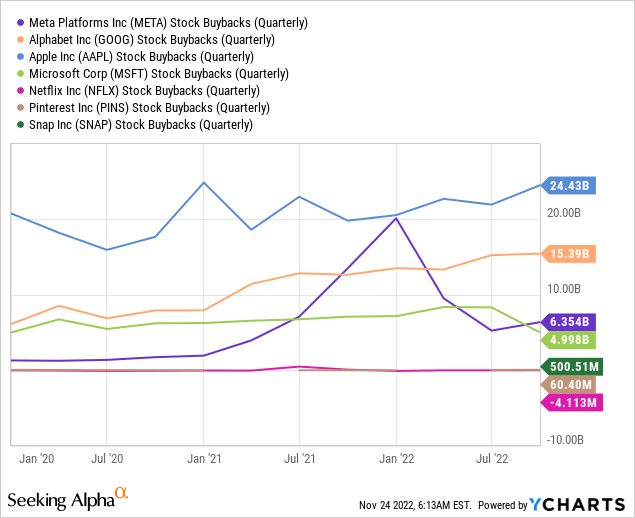

Lastly, Meta’s liquidity is matching that of Apple’s. The stability sheet makes it doable to do investments or give again to shareholders by means of buybacks. Meta has been actively shopping for again shares, but the corporate nonetheless has 14% of the present market cap in liquidity. Snap (SNAP)’s and Pinterest (PINS)’s money and short-term investments are exhausting to match with that of the bigger firms.

The Metaverse

I’ve all the time had this thought; that no matter is unknown, is strenuous to grasp, till it turns into actuality. Attempting to think about what lies past the identified boundaries of the universe is a reasonably troublesome train. What creatures might be on the market? Your thoughts will flood you with photographs that you’ve seen prior to now; however cannot there be one thing new that has by no means been seen earlier than? One thing even your thoughts struggles to examine…

There’s… and it’s known as innovation. Innovation is a broad time period and stands for implementing a brand new product, service or course of. As traders, we’re cautious about this time period:

Because the earnings that firms can earn are finite, the value that traders needs to be prepared to pay for shares should even be finite – Benjamin Graham.

The metaverse is nearly totally calculated into the inventory worth. To not the upside, however to the draw back. Traders assume nothing will come out of the Metaverse, for that motive, the inventory is likely to be an important alternative. As we all know, a decreased inventory worth lowers the chance and creates the next doable return. The inventory is now down 70%, which implies the inventory is much less dangerous than it was at increased costs. Subsequently, I might say that the margin of security on Meta is sizeable at as we speak’s worth.

Nevertheless, if the metaverse would in some way handle to make some optimistic free money move, the inventory worth might see some promising returns. And as a matter of reality, the metaverse does look fairly reasonable. Studying by means of imaginative and prescient and bodily training are the perfect methods to enhance your abilities. Globalization might be much more environment friendly than the present web of issues that we’ve now. Moreover, productiveness has nonetheless room to develop. Individuals need progress, one thing higher, extra environment friendly, compact and so forth… If these issues can be found, it is going to be purchased very quickly.

Nevertheless, I do agree that Meta’s storytelling has not been the perfect. It is vitally necessary to grasp that the metaverse doesn’t solely resemble digital actuality, but additionally augmented actuality. Not like digital actuality, which creates a very synthetic atmosphere, augmented actuality customers expertise a real-world atmosphere with generated perceptual data overlaid on high of it.

Personally, I see extra real-life use in augmented actuality. In the intervening time, deaf folks lastly have an opportunity to create significant conversations by means of augmented actuality glasses. The glasses can transcript spoken language to subtitles that seem within the glasses.

Proper now, I’m writing this text on my laptop with a second display screen. However with the Meta headset, you’ll be able to have as many screens as you need and even select the place to position them with augmented actuality. Moreover, the screens can have touchscreen functionalities to extend productiveness. House and cable administration received’t be an issue any longer.

Meta – Web site

This innovation just isn’t all glamour, the corporate is spending billions of {dollars} within the mission, which is absorbing a whole lot of the free money move. But, you will need to know that Meta just isn’t solely spending on the metaverse. Meta is in a brand new funding cycle to enhance infrastructure, increase AI capability and produce extra information heart capability on-line. In Q3, Meta spent $4billion on Actuality Labs, the remaining went into different components of the enterprise. For instance, AI developments have led to observe time will increase for Reels.

Meta-Investor Relations Q3 22

Meta is partnering up with firms like Microsoft, Adobe (ADBE), Autodesk (ADSK), Zoom (ZM), Accenture (ACN) and plenty of extra to create new options and functions on the metaverse units.

Investing in a start-up is kind of dangerous as the corporate just isn’t making any cash, burns money and dilutes shareholders. In an growing rate of interest atmosphere, it’s not as straightforward as earlier than to get maintain on capital. Consequently, it needs to be averted by clever traders. Nonetheless, Meta has the capital, the infrastructure and a powerful underlying enterprise to make this metaverse start-up work.

Takeaway

The downturn within the promoting cycle mixed with towering investments make Meta a scary place for traders. The corporate is now more durable to mannequin with numbers and enterprise analysts are blacked out.

Even so, Meta’s enterprise has been round for nearly 2 a long time, has a powerful core enterprise with 2.93 billion day by day customers and doesn’t dilute shareholders (the truth is in lowering excellent share rely). Would you actually thoughts them innovating to fulfill the wants of the subsequent technology?

Absolutely, free money move will probably be struggling for some years by the excessive investments. However higher returns might come ahead shortly within the Reels, Messenger and WhatsApp segments, because the core enterprise just isn’t out of focus. The weak promoting market and the sturdy greenback headwinds briefly overshadow the standard of the enterprise.

For my part, traders are manner too bearish; due to this fact I see worth in Meta. The danger-reward stability is beneficial on the present costs. I’ll say that Alphabet gives a safer deal for me with much less threat and the same reward. At all times keep in mind that it’s a must to search for an funding that matches you.

I fee Meta a Purchase. Should the inventory worth go down beneath $100 a share, I would re-rate it to a Robust Purchase.

Let’s finish with a considerate quote of Carl Jung:

The creation of one thing new just isn’t completed by the mind however by the play intuition appearing from inside necessity. The inventive thoughts performs with the objects it loves.