shaunl

Article Thesis

World Ship Lease (NYSE:GSL) is a container shipowner that’s producing extremely engaging earnings due to having locked in excessive constitution charges throughout the pandemic. I believe World Ship Lease will simply earn greater than the present share worth over the subsequent couple of years, and it gives a hefty dividend yield to traders at present costs which have fallen to a way-too-low stage.

Firm Overview

World Ship Lease is a container shipowner. In contrast to liners resembling Maersk, ZIM Built-in Delivery (ZIM), and so forth, it’s not making a living by shifting containers from A to B (e.g., from China to the US West Coast). As an alternative, GSL’s enterprise mannequin is completely different. It owns ships that it charters to liners such because the aforementioned ones. Most of the constitution contracts World Ship Lease has agreed to are working for a number of years, thus there may be excessive visibility in terms of future income technology, which doesn’t maintain true for container liners which might be far more depending on (and uncovered to) actions in container transport charges within the close to time period. Which means World Ship Lease’s enterprise mannequin is manner much less cyclical than that of ZIM, Maersk, and so forth, usually making it extra appropriate for risk-averse traders that need a sure diploma of visibility and consistency in terms of future income technology.

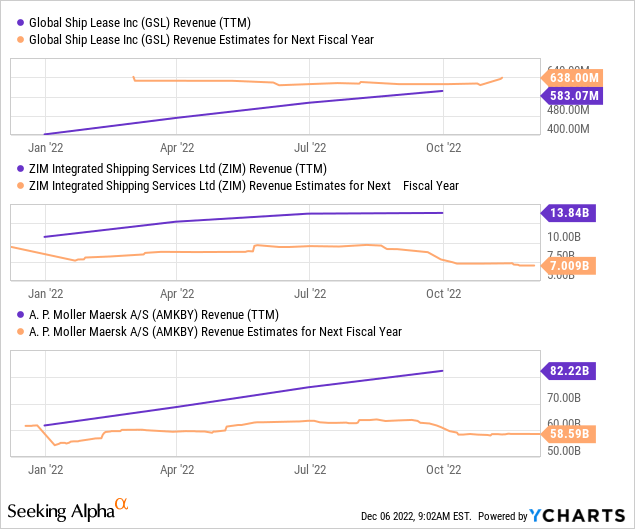

The character of the enterprise mannequin is why World Ship Lease is anticipated to generate steady or rising revenues for years to return, whereas container liners are anticipated to see their earnings fall massively subsequent 12 months. In contrast to the house owners resembling GSL, the liners did not lock in compelling revenues for years to return by way of long-term contracts:

World Ship Lease is forecasted to see its income develop by round 10% subsequent 12 months, relative to the trailing twelve months interval. That may be defined by the truth that already-locked-in contracts will present increased charges subsequent 12 months, relative to the lower-rate contracts on a few of GSL’s ships that have been nonetheless in place over the past 12 months. As these lower-rate contracts ran off, GSL was capable of negotiate and lock in increased charges for 2023 and past on a few of its ships.

Liners resembling ZIM and Maersk, in the meantime, are forecasted to see their revenues fall by ~50% and ~30%, respectively, subsequent 12 months. There thus is a transparent disconnect between the anticipated efficiency of a container shipowner resembling GSL (the identical holds true for Danaos (DAC) and others), and the anticipated efficiency of liners resembling Maersk, ZIM, and so forth. Whereas one of the best occasions for liners have handed, in the meanwhile, house owners which have long-term leases in place are able the place they’ll see their outcomes enhance going ahead.

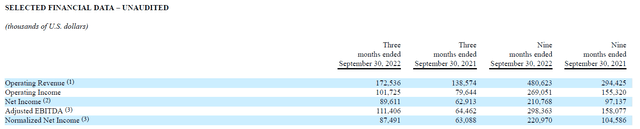

The influence of bettering charges on GSL’s outcomes are clearly seen within the following desk from the corporate’s most up-to-date quarterly earnings launch:

GSL

Not solely is the year-to-date interval in 2022 a a lot stronger one than in 2021, as income, working revenue, internet revenue, and EBITDA are up meaningfully. However on prime of that, the Q3 numbers are higher than the Q1-Q3 common, suggesting that constructive developments are nonetheless in place. Once we annualize the Q3 normalized internet revenue, for instance, we get to greater than $350 million (on a $605 million market capitalization firm), whereas the Q1-Q3 numbers, annualized, lead to $295 million of normalized internet revenue. That will nonetheless be very sturdy for an organization the dimensions of World Ship Lease, however the numbers are suggesting that ongoing enhancements make the story even higher over time.

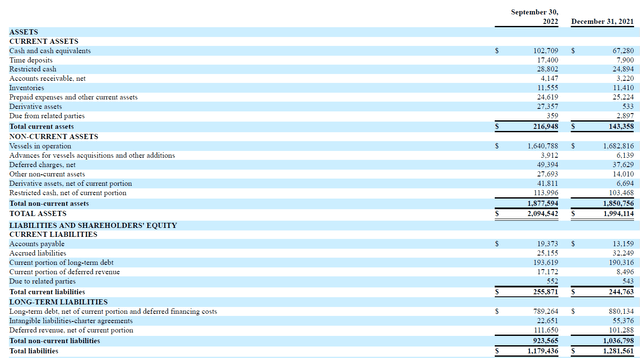

Wanting into World Ship Lease’s steadiness sheet, we see the next:

GSL report

On the finish of the third quarter, World Ship Lease had a money place of a bit of greater than $100 million, which partially offset its present indebtedness of $983 million, which incorporates short-term debt and long-term debt. Web debt thus stood at $880 million on the finish of the interval. Once we annualize Q3’s EBITDA of $111.Four million, we get to a $445 million EBITDA run price. The online debt to EBITDA ratio, or leverage ratio, thus stands at just under 2.Zero proper now. That isn’t a excessive leverage ratio, I consider, particularly after we take into account that GSL operates an asset-heavy enterprise with long-living investments.

The steadiness sheet has improved meaningfully over the past 12 months. On the finish of the final fiscal 12 months, internet debt had nonetheless totaled a bit of greater than $1 billion, whereas the EBITDA run price was decrease than. Thus, GSL has managed to enhance its steadiness sheet and leverage even whereas rewarding shareholders handsomely this 12 months, which will get us to the subsequent level.

GSL Affords Hefty Shareholder Returns

Because of large earnings and money flows, World Ship Lease is able the place it might probably supply a really good yield to its house owners. On the present run price, World Ship Lease is paying out $1.50 per 12 months in dividends ($0.375 per share per quarter). With shares buying and selling at $16 proper now, that leads to a dividend yield of 9.4%.

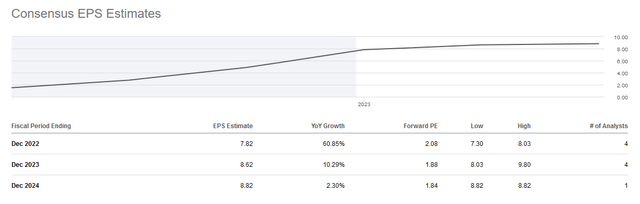

A dividend yield this excessive oftentimes offers traders pause, and rightfully so. Dividend yields this excessive can, in spite of everything, be the results of the market anticipating {that a} dividend reduce is probably going within the close to time period. However that may most certainly not be the case with World Ship Lease. Not solely has the corporate simply coated its dividend in the newest quarter – the $0.375 payout was coated 6.3x by its adjusted earnings per share of $2.38 – however the firm can even simply cowl its dividend within the foreseeable future. The next chart exhibits the corporate’s anticipated earnings per share for 2022, 2023, and 2024:

In search of Alpha

Not solely is the corporate anticipated to generate constructive earnings per share development within the subsequent two years, however the dividend protection ratio can be wonderful. With a $1.50 payout, the corporate can have large surplus earnings within the subsequent two years. There may be little or no threat that the dividend shall be reduce by means of 2024, I consider, because the visibility of its future earnings is excessive due to long-term contracts which might be in place. Since GSL’s counterparties have earned document earnings over the last two years, there may be additionally little counterparty threat.

It will likely be vital to see how GSL will use its surplus money flows over the approaching quarters and years. If analyst expectations are appropriate, the corporate will roughly earn round $19 to $20 per share by the top of 2024. Solely round $three of that shall be paid out by way of dividends, except there’s a dividend enhance down the street. The corporate might thus spend round $16 to $17 – roughly equal to the present share worth – on different issues. Additional debt discount will most certainly be one merchandise, but when GSL have been to make use of all of its extra funds for debt discount, it could scale back its internet debt to simply $200 million to $300 million or so. It’s, I consider, unlikely that administration shall be that aggressive in terms of lowering debt ranges, as GSL already has a wholesome steadiness sheet right this moment.

Buybacks can be extremely accretive and engaging, I consider, however it’s not assured that administration shall be spending closely on buybacks. The corporate has elevated its buybacks in current quarters, however the tempo continues to be removed from excessive relative to what can be doable – the corporate has spent $10 million on buybacks in Q3, which is a bit more than 10% of its normalized internet revenue. Nonetheless, even this reasonable buyback spending leads to an annualized share rely discount of ~7% with shares buying and selling at $16, which is much from unhealthy.

Development spending is another choice for administration. Relying on what ships the corporate acquires, this might work out properly, however bares the danger of overspending. I do consider that buybacks are extra engaging than buying further ships with shares buying and selling at a really low valuation, however we’ll need to see whether or not administration turns into extra aggressive with buybacks or not.

Takeaway

World Ship Lease is a container transport firm with a variety of visibility in terms of earnings and money stream within the coming years. At present costs, its shares are very low-cost – it’s doubtless that earnings by means of the top of 2024 shall be increased than the present share worth. Except administration squanders these earnings, the present valuation thus makes shares look engaging for funding, I consider.

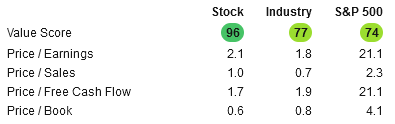

stockrover.com

The above chart exhibits that GSL may be very cheap in absolute phrases. Even relative to its trade, the place some others had a document 2022, GSL is trying like a very good worth. The dividend yield of greater than 9% that’s well-covered is one other good cause to personal a stake in GSL.