JasonDoiy

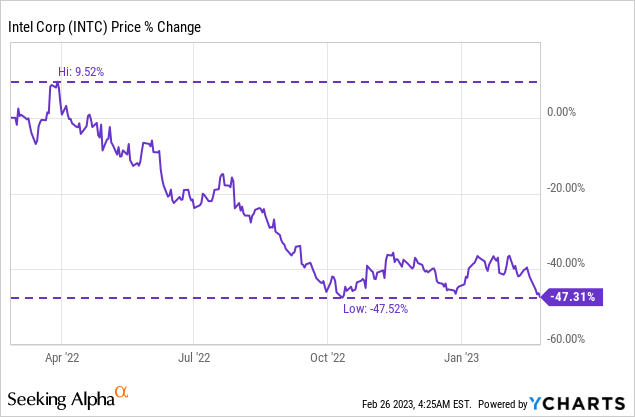

Shares of Intel (NASDAQ:INTC) are as soon as once more buying and selling close to 1-year lows after the chip maker reported final week that it was gutting its dividend. The dividend minimize follows final month’s earnings launch which confirmed that Intel’s Consumer Computing Group, which is accountable for almost all of the corporate’s revenues, suffers mightily from shrinking client demand for computer systems, laptops and tablets. Though Intel recovered shortly from the earnings sell-off final month, the dividend minimize has created new adverse sentiment overhang for the chip maker. Gartner’s forecast for a second consecutive 12 months of falling machine shipments in FY 2023 means that adverse sentiment may drive shares of Intel to new lows.

Intel is lastly chopping its dividend

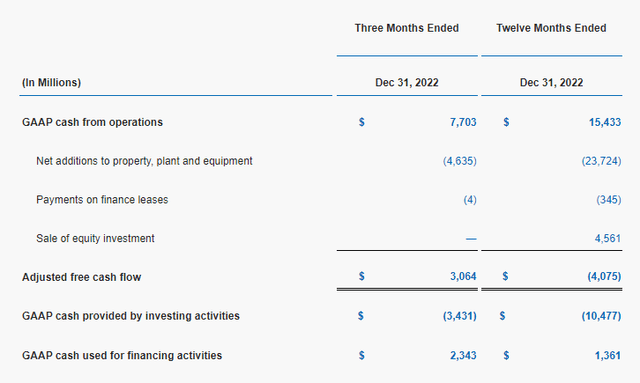

That Intel was going through a dividend minimize was an open secret. In my work “Intel: This autumn Earnings Will Be A Second Of Fact“, revealed on January 22, 2023, I warned of an accelerating PC cargo down-turn that was placing Intel’s free money movement and dividend in danger. Intel’s free money movement noticed a pointy down-turn in FY 2022 and it was broadly adverse even earlier than the discharge of This autumn’22 earnings. The down-turn within the PC market, which actually gained steam within the second half of FY 2022, resulted in Intel’s revenues dropping 20% 12 months over 12 months to $63.1B and free money movement falling to $4.1B. Since dividends receives a commission out of free money movement and Intel’s FCF turned adverse because of mis-timed CapEx (Intel invested in new capability simply at a time when the market disappeared), a dividend minimize was extremely prone to happen.

Supply: Intel

Intel lastly acknowledged this actuality final week and introduced that it was chopping its dividend by 66%. Going ahead, traders are going to obtain a quarterly dividend cost of $0.125 per-share which calculates to a complete annual dividend pay-out of $0.50 per-share. Because of the change in capital allocation coverage, Intel’s dividend yield dropped from 5.8% to 2.0%. The decline within the payout is making Intel considerably much less engaging for dividend traders.

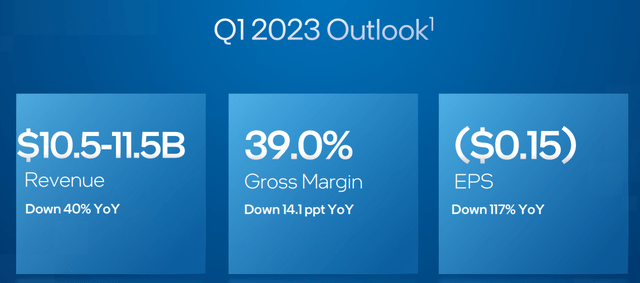

Intel, nonetheless, did affirm its outlook for the first-quarter. The chip maker continues to anticipate $10.5-11.5B in revenues and adverse EPS of $0.15.

Supply: Intel

Intel reiterated that its dividend minimize is a part of a multi-tiered restructuring strategy that requires the rightsizing of the group and $3B in price financial savings in FY 2023. As a part of its restructuring, Intel introduced the gutting of a whole lot of jobs and instituted wage cuts for its executives. Intel’s price financial savings are anticipated to scale to $8-10B by FY 2025 which ought to assist Intel get better over time.

Bleak outlook for Intel’s working surroundings in FY 2023

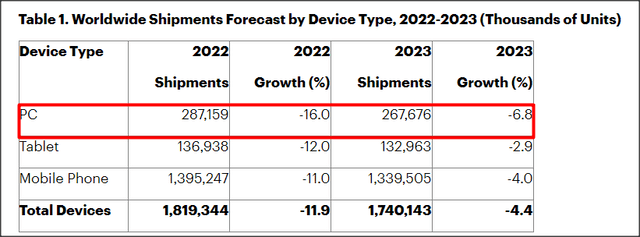

Regardless of the dividend minimize, traders should not anticipate a lot with respect to Intel’s working efficiency this 12 months. Consulting firm Gartner lately projected that the PC market is about for continuous weak point in FY 2023 and is going through its second consecutive 12 months of falling machine shipments. PC shipments are projected to fall 6.8% whereas complete machine shipments together with tablets and cell phones are anticipated to see a 4.4% drop on a 12 months over 12 months foundation. In FY 2022, international machine shipments dropped 11.9% 12 months over 12 months to 1.8B models. Gartner additionally mentioned that it expects a normalization of stock ranges within the second half of FY 2022. Morgan Stanley additionally lately lowered its forecast for PC shipments.

Supply: Gartner

If Gartner’s projections grow to be correct, the PC market may backside out within the second half of FY 2022, however the brief time period outlook stays gentle. Weak client demand for computer systems, notebooks and tablets ought to subsequently be anticipated to proceed to place strain on Intel’s prime line and inventory valuation, a minimum of within the first two fiscal quarters.

Intel’s valuation

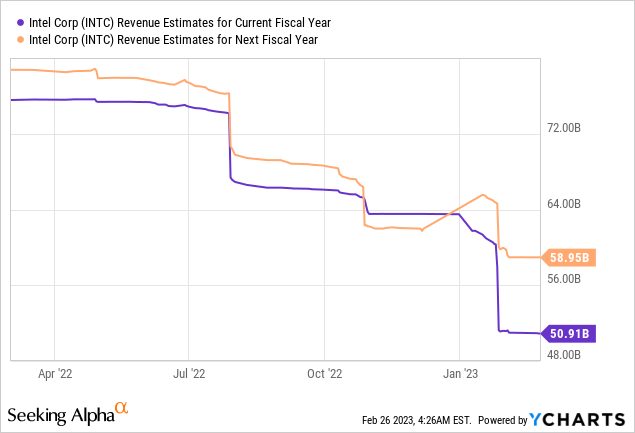

Though Intel has seen a 47% draw back revaluation during the last 12 months, I do not imagine shares have bottomed but… even after the corporate minimize its dividend by 66%. Intel’s income estimates have dropped sharply and traders should brace for extra ache if Gartner’s projections grow to be true and client demand does not rebound.

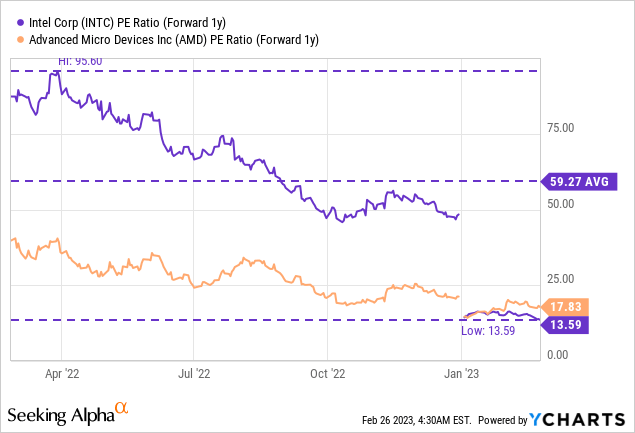

Intel is presently valued at a P/E ratio of 13.6 X which compares towards a P/E ratio of 17.Eight X for primary rival AMD (AMD). Intel is, nonetheless, extra depending on client demand — and subsequently extra uncovered to the well being of the PC market — than AMD. AMD has made heavy investments in its Knowledge Heart capabilities lately and even acquired new corporations equivalent to Xilinx and Pensando so as to develop its market share within the server market.

Intel is presently buying and selling close to its 1-year low of $24.59 and the inventory may very properly re-test this degree within the coming days and weeks.

Dangers with Intel

The plain and instant danger is that slowing client demand will end in additional income declines for Intel’s necessary Consumer Computing Group which accounted for 49.9% of revenues in FY 2022. There may be additionally a danger that Intel must drive a more durable restructuring if the corporate continues to undergo from a continuing PC market stoop. A successive slowdown in PC shipments in Q1’23 and Q2’23 may drive shares of Intel to new lows and probably spotlight the necessity for a extra aggressive restructuring.

Ultimate ideas

The writing was already on the wall and lots of writers have warned {that a} dividend minimize was inevitable contemplating that the down-turn within the PC market accelerated within the fourth-quarter and that Intel was not incomes its dividend with free money movement. Nonetheless, I do not imagine that the dividend minimize is sufficient to make Intel’s shares a pretty purchase for traders simply but. Gartner’s projection for FY 2023 machine shipments exhibits that the PC market is about to additional contract which is able to proceed to place strain on Intel’s prime and backside line. Contemplating that the working surroundings is predicted to stay very difficult for a minimum of the subsequent six months, I imagine Intel goes to re-test its newest lows.