Spanish Broadcasting System, Inc. (OTCPK:SBSAA) Q1 2023 Earnings Convention Name June 8, 2023 11:00 AM ET

Firm Individuals

Brad Edwards – Investor Relations

Albert Rodriguez – President and Chief Working Officer

Jose Molina – Chief Monetary Officer

Convention Name Individuals

Operator

Good day, and welcome to the Spanish Broadcastings First Quarter 2023 Convention Name. All individuals will likely be in a hear solely mode. [Operator Instructions].Please be aware this occasion is being recorded.

I’d now like to show the convention over to Brad Edwards of Investor Relations. Please go forward.

Brad Edwards

Thanks Jason, and good morning everybody. Earlier than we start, please acknowledge that sure statements on this convention name should not historic details. They might be deemed subsequently to be forward-looking statements underneath the Non-public Securities Litigation Reform Act of 1995.

Particularly, statements about future outcomes anticipated to be obtained from the Firm’s present strategic initiatives are forward-looking statements. Many essential elements could trigger the Firm’s precise outcomes to vary materially from these mentioned in any such forward-looking statements.

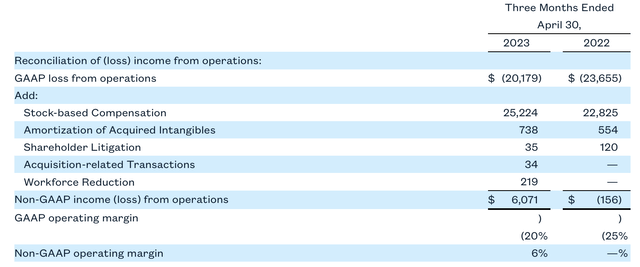

Spanish Broadcasting System undertakes no obligation to publicly replace or revise its forward-looking statements. Please additionally be aware that we’ll be discussing non-GAAP monetary measures. The Firm believes that working revenue earlier than depreciation and amortization loss underneath disposal of belongings, and different working bills, excluding non-cash inventory primarily based compensation, or adjusted OIBDA is beneficial in evaluating its efficiency as a result of it displays a measure of efficiency for the Firm’s stations earlier than contemplating prices and bills associated to capital construction and tendencies.

This data will not be supposed to be thought of in isolation or as an alternative to working revenue, internet revenue or loss, money flows from working actions or some other measure utilized in figuring out the Firm’s working efficiency or liquidity that’s calculated in accordance with U.S. GAAP. A reconciliation to the Firm’s U.S. GAAP data to adjusted OIBDA is supplied within the tables connected to the Firm’s first quarter 2023 earnings launch which is on the market on the Investor Relations part of the Firm’s web site at www.spanishbroadcasting.com.

I’ll now flip the convention over to Mr. Albert Rodriguez.

Albert Rodriguez

Good morning women and gents, welcome to the SBS 2023 first quarter earnings convention name. On right now’s name we’ll present an summary of latest working developments and evaluation our monetary outcomes. Becoming a member of me right now are Jose Molina, our Chief Monetary Officer, and Richard Lara, our Common Counsel.

Our first quarter outcomes demonstrated the facility and attain of our nationwide community and digital capabilities in addition to additional affirmation of our multi-platform technique, our manufacturers proceed to resonate with Latinos nationwide, we elevated our mixture viewers and proceed to spend money on our enterprise to drive speed up development within the years forward. Whereas our stay occasions division influence our outcomes attributable to much less occasions in comparison with final 12 months, we’ve a compelling live performance lineup in the remainder of 2023 and anticipate to see improved efficiency in that division. Our audio stations proceed to carry out exceedingly effectively and sit on the high of the markets they serve. Our Orlando and Tampa stations proceed to develop their market presence and we stay on observe to be worthwhile with each of those stations this 12 months. This confirms our dominant place as the biggest Hispanic audio broadcaster in Florida. We refer our Miami Orlando and Tampa cluster because the Golden Triangle. We additionally not too long ago prolonged our footprint into the Houston market by the acquisition of KROIFM. Houston is likely one of the high audio markets within the nation and we’re excited to deliver our expertise dedication in reference to Hispanics in Texas in and distinctive station format to KROIFM. These investments are key for the 2024 presidential election cycle and SBS advocacy staff is in place to work together with all of the nationwide candidates.

Now let’s evaluation our operations and we’ll begin with our AIRE Radio Networks. For the primary quarter of 2023, AIRE Radio Networks outpaced {the marketplace} by 25%. Miller Kaplan reported networks spot down by 13% whereas AIRE Radio Networks delivered an excellent efficiency of plus 12%. The important thing classes is this era had been dwelling enchancment plus 93% tv plus 214% automotive plus 45% in pharmaceutical plus 62%.

Miller Kaplan additionally confirms that Spanish broadcasting is the quickest radio income audio linear broadcaster within the nation outpacing the trade by 700 foundation factors. AIRE Radio Networks the biggest minority owned Hispanic audio community delivering 95% of Spanish language listeners throughout all of the nation continues its dedication to tremendous serving Hispanics. AIRE Radio Networks reaching 15 million weekly Hispanic listeners throughout greater than 300 associates. NMSDC licensed with presence within the high 50 U.S. Hispanic markets. A number of the key highlights for AIRE new initiatives included, present their [indiscernible], launching the summer time’s nationwide is the closely morning present, La Mezcla con Alex Sensation, the influencer community delivering marketing campaign messaging by a nationwide platform whereas penetrating native markets and I feel that 360 had been manufacturers on-line with Latin artists.

Now we have a look at our audio division with celebrating ranking success engagement and loyalty throughout New York, Los Angeles, Miami, Puerto Rico, Chicago, San Francisco Tampa in addition to in Orlando with our relentless dedication and information of the Hispanic market not solely have we achieved spectacular scores in all of our markets, however we’ve additionally skilled a major development in listener loyalty and engagement. Our major purpose has all the time been to create distinctive engagement and top quality content material that resonates with our numerous Hispanic viewers, our creativity teamwork have made it attainable for us to attain this goal.

We’re primary in New York with WSKQ FM Mega 97.9 primary in Los Angeles mornings KXOL, Mega 96.Three Primary in Miami with WXDJ FM El Zol 106.7. Primary in Orlando WPYO FM El Zol 95.3. Primary in Puerto Rico WMEG FM Mega 106.9 and I can go throughout the board in Puerto Rico we’re primary in all places in Puerto Rico. Primary in San Francisco the KRZZ La Raza 93.3, primary, 18 to 34 in Miami with WRMA FM, 95.7.

In New York, our programming and on air staff continues to captivate the hearts and minds of one of the crucial demanding Hispanic audiences on the earth, our capacity to innovate and keep forward of the curve has enabled us to change into a staple within the each day lives of thousands and thousands within the nation.

WSKQ mega 97.9 is the primary station in New York and the primary most listened to on-line streaming station within the nation. In Los Angeles, our programming has struck a chord with the colourful and bustling Hispanic neighborhood as our morning present, Omar and Argelia on KXOL FM Mega 96.Three has now change into one of many high rated morning reveals within the metropolis beating all of Spanish up to date stations within the newest Nielsen April 2023 scores ebook.

This can be a testomony to our capacity to grasp and adapt the style and preferences of our listeners. In the meantime, in Miami, we’ve tapped into the distinctive cultural mix of town providing content material that displays its numerous and dynamic character. This has allowed us to ascertain a presence within the metropolis as we proceed to develop our listener base and develop our affect the place we’re creating a private contact factors with our Hispanic area people. As we transfer ahead, we have fun these accomplishments and do not forget that our success is constructed on the muse of pushing boundaries and creativity and innovation as we attempt to take care of our place as main supply of leisure and data for our household of listeners. We have now so many extra to spotlight; listed here are a number of. Orlando WPYO, Nuevo Zol 95.Three continues to dominate the Orlando and Central Florida market.

Our morning present El Despelote with Rocky the Child is once more the primary within the Orlando market beating each station available in the market adults 18 to 49.

KLAX La Raza is the primary regional Mexican station with El Chikilin middays 10 to three. Chikilin can be on our San Francisco station and throughout our AIRE Radio Community. In Puerto Rico, we’ve a station with the primary in each demographic group with adults 18 to 34 Mega 106.9 is primary with 9.Three share WODA FM La Nueva 94.7 is a quantity two with a 8.7 share and with adults 18 to 49 WMEG Mega is primary throughout the board.

Turning now to our stay occasions division. SBSC generated 5.9 gross ticket gross sales for Q1, with the heritage reveals, [Indiscernible]. The division continues to see a excessive demand for occasions by the remainder of the 12 months, and shut a multi-year settlement with Oak View Group, the biggest developed of sports activities and stay leisure venues on the earth, to provide SBS heritage reveals corresponding to Megabash, Megametha and others in venues in New York, Austin Palm Springs, and plenty of extra. SBS Leisure additionally secured a strategic partnership with touring associate to co-produce the [Indiscernible] in Orlando later this 12 months. The division continues to see nice demand for reveals as Mega Bash, Miami Bash, [indiscernible] to call a number of for 2023 and has a complete present schedule for the rest of the 12 months effectively into 2024.

Now turning to our cellular and digital platforms and strategic initiatives. Over the past a number of years, we have had nice success of reworking SBS into a number one multimedia Hispanic media firm. Right now, we join manufacturers with far more Hispanics than ever earlier than and our mixture viewers continues to develop.

For our model companions, there has by no means been a extra essential time to have a Latino centered advertising and marketing technique and outreach program. The Latino inhabitants is rising quickly in dimension, cultural affect and buying energy. SBS has the multimedia belongings to achieve in over 4 a long time of expertise and dedication to the Latino neighborhood throughout the U.S. And as such, we will ship compelling and built-in promoting alternatives that cross all main media platforms and supply entry to coveted demographic teams.

Because it was said within the final 2020 census, the Hispanic inhabitants was the quickest rising group in the USA and as such it’s our duty to proceed to develop that Hispanic viewers inside our platforms. As I said, our mixture viewers continues to develop and it’s our fiduciary duty to proceed to develop it and we do have the primary station in America WSKQ no matter language. Nobody comes near the station mega in New York. It’s the primary linear station and the primary stream station in America per Nielsen interval.

As of March 31st, our complete viewers was up 48% in comparison with Q1 the prior 12 months. March 2023 we had a document 3.Four million distinctive listeners to stay viewers in comparison with 1.Eight million in 2022. The overall division grew by 16% year-over-year.

LaMusica platform reaches over 3.9 million individuals throughout all of our gadgets who mix for over 26 million streaming hours per 30 days, utilization and adaption of LaMusica continues to speed up because it affords a very distinctive cellular and digital expertise together with authentic each day video content material, quick type programming, thousands and thousands of songs and a personalised expertise. Total, we’ve positioned strategic emphasis on figuring out new digital income streams in addition to rising our CPMs on current digital choices.

We have now launched this concept and in-house company to permit us to promote extra digital merchandise to our shoppers — want corresponding to search engine optimisation, SCM, OTT adverts and extra, we’re additionally within the technique of launching a model new podcast division that may add dozens of latest distinctive podcasts unrelated to our current audio primarily based podcasts. We have now excessive expectations for each of these new initiatives. Throughout the first quarter, our complete streaming viewers surpassed 3.Four million distinctive listeners per 30 days. This viewers delivered 38 million listening hours and over 80 million complete classes within the quarter giving Hispanics overly index on cell phone possession and utilization cellular stays the first driver of our cellular digital site visitors and accounted for roughly 95% of our complete digital site visitors within the quarter are key driver of our development in streaming hours and classes has been the growth of our La Musica consumer base in addition to rising consumption of our podcast and playlist merchandise with common time spent listening of over 45 minutes in the preferred classes.

In abstract, our audio stations stay on the high of their markets and our mixture multi platform viewers is considerably in comparison with the final 12 months. The Latino client base has by no means extra extremely wanted right now. We join manufacturers with interact multi-platform viewers in additional methods than ever earlier than. 2023 will likely be one other thrilling and profitable 12 months for SBS and we will’t wait to maintain you up to date on our progress. And we’re so excited be that to SBS of the highest 20 stations in America, SBS has Three of the highest 20 rated stations in America, they occur to be SKQ, Mega New York, KXOL, Mega in Los Angeles and KLAX La Raza in Los Angeles.

Mega in Los Angeles is the best rated extra streamed station in all the California area by Nielsen nationwide. Thanks to your time and your consideration right now. Now let me flip the decision over to Jose Molina for the monetary evaluation. Jose?

Jose Molina

Thanks Albert. Earlier than we flip to our outcomes, I wish to point out that our tv section and its associated actual property belongings that are pending to be bought had been categorized as belongings held on the market and their operations have been reclassified as discontinuing operations for the present and prior 12 months intervals. Additionally our working outcomes had been impacted by our particular occasions schedule which had much less present nights and decrease ticket gross sales and associated occasion bills.

As well as, our working outcomes proceed to be impacted by our investments in our Orlando and Tampa startup stations, distinctive Spanish language expertise and content material for our terrestrial and digital properties, and our digital infrastructure and capabilities, personnel, and choices, corresponding to our SBS International Podcasting Group and DGLA, our PurePlay Digital Advertising and marketing Division.

We consider that these are mandatory and the best investments to drive accelerated long-term development whereas additionally sustaining and constructing on the facility of our manufacturers and market management positions.

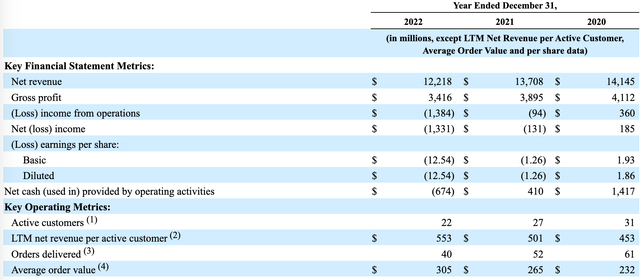

Now, let’s flip to our first quarter outcomes. Our consolidated revenues totaled $34.5 million in comparison with $38 million for a similar prior 12 months interval, leading to a lower of roughly 3.5 million, or 9%. The lower was primarily the results of decrease particular occasion revenues, native and barter gross sales partially offset by will increase in nationwide, community, and digital gross sales.

Our working bills elevated 5% primarily attributable to will increase in compensation and advantages, allowance for duffel [ph] account, music license charges, and transmitter hire, partially offset by a lower in particular occasion bills.

Our station working revenue, a non-GAAP measure, totaled $6.Eight million in comparison with $11.7 million for a similar prior 12 months interval. Company bills decreased 10% attributable to decreases in compensation and advantages, journey and leisure, {and professional} charges.

Adjusted OIBDA, a non-GAAP measure, totaled $3.Four million in comparison with $7.Eight million in the identical prior 12 months interval. Capital expenditures throughout the first quarter had been roughly $805,000. As of yesterday, we had money readily available of roughly $8.6 million, which incorporates the $3.Eight million deposit associated to the Voz tv transaction.

As I discussed on our final name, we anticipate capital expenditures to be within the vary of $Three million to $Four million for the total fiscal 12 months 2023. And money taxes to be within the vary of $4.5 million to $7 million, excluding any extra taxes wanted to be paid on the Voz tv transaction.

This may conclude our formal remarks, and with that, I wish to flip the decision over to Brad for any questions.

Query-and-Reply Session

Q – Brad Edwards

Thanks, Jose. So, for Albert and Jose, wanting nearer on the first quarter income efficiency, are you able to get away income by class, native, nationwide, digital, in addition to what the important thing drivers had been, and to do the identical for working bills as effectively?

Albert Rodriguez

Certain, look, nationwide was up 22%, community was up 16%. Digital was up 20%. It was off by the a number of the decreases native was off by Single digits it was off by 6% half. It was down by 31% and occasions had been off by they had been down by 37%. However once you take all the things into consideration the occasions had been a giant had been a giant a part of why the Spanish broadcasting had been down. However once you have a look at the important thing drivers of why we had been up Nationwide once you have a look at all the info administration platforms and Miller Kaplan we had been primary when it comes to income development. There was nobody that was even shut. We utterly outpaced all the massive Broadcasters we’ve an unimaginable nationwide staff. We’re on the forefront of all the large classes automotive, the retailers the prescription drugs and well being care and finance in addition to with community Telecom is beginning to come again. So I feel we’re performing exceptionally effectively in these key drivers specifically these classes.

Now you have seen due to the economic system a slowdown within the first a part of the 12 months the primary quarter and the second quarter. However we’re seeing that there is optimism within the third within the fourth quarter, so the advert market is optimistic of that and we’re hopeful that that there is an advert restoration for that and specifically however there is a presidential election cycle that’s in place for 2024 and in my remarks firstly of the decision we’re in the important thing battleground states and specifically with our robust audio platform we’ve a really very strategic dominant viewers platform and we will do very well within the subsequent election cycle. So we’re very enthusiastic about it and we will see hopefully some robust {dollars} are available and perhaps late fourth quarter, however very very late or or early first quarter of 2024.

Jose Molina

And as to the working bills simply to stroll you thru so sure bills elevated roughly 1.Four million of which 1.9 million was associated to the a rise in compensation and advantages primarily associated to programming and promoting roughly 400,000 was associated to a rise within the allowance for uncertain accounts, 300,000 was associated to music license charges associated to the brand new GMR license. Roughly 700,000 was associated to varied different bills which included transmitter rep promotions ranking providers etcetera. And these will increase had been partially offset by a lower of 1.9 million associated to particular occasion bills.

To reconcile it slightly bit otherwise form of parceling out Orlando and Tampa. So bills went up by 1.Four million of which 1.6 million was associated to the Orlando and Tampa bills 1.2 million was associated to compensation and advantages which exclude Orlando and Tampa. Roughly 400,000 was associated to the rise within the allowance for duffle account. Roughly 300,000 was associated to music license charges and these will increase had been partially offset by the 1.9 million lower in particular occasion bills and roughly 200,000 of assorted different bills.

Brad Edwards

Proper, thanks after which turning now to an replace on the Orlando and Tampa stations. How did these stations carry out on a income and all a perspective in Q1 in comparison with your expectations and second, might you discuss a bit extra concerning the pathway to profitability for these stations?

Albert Rodriguez

Nice look with respect to scores, we simply went into that market late April of 2022 and that is a market that we checked out for a very long time and there was an unimaginable development with Hispanics specifically each in Orlando and Tampa and the Hispanic inhabitants simply boomed there and we had been taking a look at that market for a very long time and Cox had been there for a very long time and that is why we purchased the station from Cox and IHeart had a really dominant a place there with their Hispanic format and inside 90 and 120 days we mainly took with our format the primary Hispanic place we blew everybody out of the water with our El Zol format and we’ve the primary Hispanic place in each single demographic group over IHeart and Cox and over everyone and so they’re not IHeart and Cox aren’t even near us. And the opposite complete market stations are very very distant from us. Within the morning we’ve a 20 share in all the important thing demographic teams which means we’ve 20% in Orlando 20% of the Orlando viewers is listening to our station. And we have been there for mainly slightly bit lower than a 12 months in order that speaks volumes.

Not solely are we going to be worthwhile not solely are we going to be worthwhile, however we will make some huge cash in Orlando. Tampa we have grown not as rapidly as Orlando however we have grown very effectively and we’re happy with the development that we have made and we proceed to develop week after week and we proceed to really feel that we will be primary in that market nevertheless it hasn’t been an explosive development that we have seen in Orlando however we’re nonetheless happy with what we’re seeing there. However the message is Tampa and Orlando we will be worthwhile in 2023 and we talked about it final 12 months and we’re on observe to be worthwhile in 2023.

Jose Molina

As to the outcomes of the primary quarter, Orlando and Tampa had mixed internet revenues of roughly $1.5 million and for adjusted OIBDA Orlando reached breakeven and Tampa had a small working loss.

LTM adjusted OIBDA loss totaled roughly $3.Three million as of the primary quarter of 2023. Our working LTM outcomes embody vital promotional expenditures largely one-time in nature which occurred in 2022. On condition that vital promotional expenditures occurred in 2022 and that in Q1 of 2023 these stations had been practically breakeven, we anticipate Orlando and Tampa operations to have optimistic adjusted OIBDA development in 2023.

Brad Edwards

Nice. Thanks for that, after which the following query the stay occasions SBSC was one other a part of the enterprise that buyers had been in search of a broader replace on. A lot of the questions had been centered on the year-over-year decline in Q1. What had been the motive force, the opposite two areas of questions had been to quantify how the general enterprise carried out, general SBS enterprise carried out excluding the leisure division in addition to what the ahead occasion calendar appears like for the rest of 2023?

Albert Rodriguez

Look we did few nights in Q1 and final 12 months in 2022 we’re coming off a 12 months let the prior 12 months in 2021 for apparent causes they had been individuals had been doing much less occasions and folks had been even questioning us if we had been going to take action many occasions in 2022. So we had an unimaginable first quarter final 12 months with occasions and what we did was we scaled again and doing much less occasions in Q1 to unfold them out to the remainder of the 12 months. And we had been additionally concerned in a really prolonged strategic negotiation in finalization of a strategic long-term multi-year settlement with Oak View Group the biggest developer of sports activities and stay leisure venues on the earth and that is a multi-year settlement.

And we did a long-term 12 months settlement with them and so we have pushed again a number of the a number of the dates that we will do in Q1 and we’re pushing it again for the remainder of the 12 months and a few of them we will be collaborating with Oak View. So we needed to strategically push a number of the occasions and we’re incorporating with Oak View however on the finish we really feel that not solely we will make up a number of the EBITDA that we missed or our plan is to not solely make it up however hopefully generate much more money movement.

Jose Molina

Simply to place some numbers round it. For the primary quarter of 2023 our occasion revenues totaled $5.9 million as Albert talked about and that was a lower of about $3.5 million in comparison with prior interval and occasion earnings totaled $1.5 million, a lower of $1.5 million in comparison with the prior 12 months interval.

Brad Edwards

Nice, transferring on. One other space the place there’s been a variety of questions on was Q2 pacings in addition to our ideas on working bills for full 12 months 2023. So perhaps we might begin, Albert, perhaps we might begin with a view into the present pacings after which Jose perhaps you possibly can present slightly bit extra element on how we should always take into consideration working bills for full 12 months 2023.

Albert Rodriguez

Certain, so look April, April for nationwide it was down double digits for nationwide however low double digit was about 12%. Native was down about 3% and, excuse me, Community was about flat, after which in nationwide for Could it utterly rebounded. It is plus 20%. No different broadcaster in America for Nationwide is plus 20. Just about I feel all of the broadcasters in America are down about 15 or 12 factors. Native is about flat for Could, perhaps off a proportion level or two and community is up about a number of factors. So Jose, I am unsure if you happen to needed so as to add the rest.

Jose Molina

Certain, look, as to our full 12 months working bills, we consider that our full 12 months working bills would enhance give or take mid-single digit vary and that excludes any Houston startup funding prices and we consider that company bills will lower within the low to mid single digit vary for the total 12 months.

Albert Rodriguez

I needed so as to add yet one more factor, Brad. For the month of June, we had been going over the numbers with our nationwide staff. The month of June, I’ve already surpassed within the month of June what Nationwide did in all the month of June final 12 months. So our June is thru the roof proper now for Nationwide and our native is about flat and Community is about flat, however they’re planning so as to add some huge cash. And like I discussed, the latter a part of the 12 months, third and fourth quarter, we’re hoping, the trade is hoping that there is going to be an advert restoration and there sometimes is correct earlier than a presidential election cycle.

And I feel we’re sitting fairly stable specifically due to the stronghold with all of the states that we’re masking in proper now. The stronghold in Florida, we’re in key areas in Florida, Tampa, Orlando in Florida, and people are key battleground districts in Florida for the presidential cycle. Nobody’s going to be in a way more dominant place than Spanish broadcasting. And specifically with the attain that radio has proper now, specific Hispanic radio. Hispanic radio, the attain that Hispanic radio has proper now has surpassed actually even the whole market radio in essence, once you evaluate it to sure video features, and once you have a look at different battleground states, once you have a look at the attain that we’ve in Georgia, Pennsylvania, even New York, Michigan, Arizona, Nevada, Texas, Texas is essential for us, that is why we’re in Houston, and even with our audio platforms, and the viewers that we’ve in Dallas, and all of those different markets, so we’re in an especially dominant place with our audio platform on La Musica.

So I feel we’re in a really, very dominant place for 2024 to proceed to drive and ship big outcomes. And look, the 2020 census was clear, the Hispanic viewers grew, there was no different group that grew as a lot because the Hispanic viewers, and we’ve a fiduciary duty to our platform, to our shareholders, as a result of the opposite audiences did not develop as a lot as our audiences, and like I discussed in my formal remarks earlier than, once you have a look at the highest 20 stations in America, we’ve three of the highest 20 stations, we’ve the primary linear station, primary stream station, the final I checked on video, Netflix might be one of many dominant stream platforms in America, they are not the dominant power on linear on video, we’ve the dominant power in audio and linear in America, nobody comes near WSKQ, Mega in New York is primary in linear and in audio and stream, so we’re very happy with our accomplishments, we’re very happy with our programming and content material in our content material staff, and nobody comes close to that, and nobody in America can say that they’ve each underneath their wing like we do, so.

Brad Edwards

Nice, thanks for the colour. We acquired a variety of questions on technical construction and what the corporate’s plans are transferring ahead, so that is most likely for Jose, however clearly, Albert, weigh in if you wish to, however you realize, Jose, might you stroll by what the priorities are transferring ahead?

Jose Molina

Certain, positive, so look, SBS’s administration, we have been laser centered on the deleveraging transaction of promoting our tv and actual property belongings to Voz Media, which ought to shut by the tip of the month or early subsequent month, and we don’t anticipate any delays. For months, we have been engaged on separating our tv operations from our persevering with operations and offering a easy transition of those operations to Voz.

We have acquired a non-refundable $3.Eight million deposit, which is at the moment in our financial institution accounts, and at shut, we should always obtain roughly $58.2 million with a further $2 million inside a 12 months. As a preliminary estimate, the gross asset proceeds of $57 million, which is $64 million of a purchase order worth minus the $7 million of a pay as you go promoting purchase, that ought to internet proceeds within the low $40 million vary after contemplating transaction prices and taxes.

We proceed to investigate and take into account the very best use of the online asset proceeds after we shut on this transaction, such because the acquisition of Houston Station KROI-FM. Additionally, as I’ve talked about in my ready remarks, the latest and continued investments that we’re making throughout our enterprise will drive future top-line development, however has and can proceed to have a near-term influence on our working outcomes. We stay dedicated to lowering our leverage and anticipate leverage to start enhancing within the latter half of the 12 months as our margins and profitability start to enhance and normalize, Professional forma, any start-up prices associated to the Houston Station.

Brad Edwards

Nice. Thanks, Jose. After which the final query, so once more, on the Houston Station acquisition, are you able to and Albert present some extra shade on the way you see the station’s income and bills trending within the close to time period, and what does the pathway to profitability for the station appear like?

Jose Molina

Certain. Certain. So, first, I wish to simply begin by mentioning that this was an opportunistic and strategic buy, given the engaging buy worth of $7.5 million and the truth that, as Albert talked about, it is within the third largest DMA, Hispanic DMA, per Nielsen.

Second, this acquisition offers us a chance, it offers us a footprint in Texas and permits us to unpack all of our choices in Houston, our programming, our streaming belongings, our radio community, SPS’s international podcasting, DigIdea, our digital in-house company, SBS Leisure, stay occasions, and extra along with giving us the chance to enter into the Texas political market. I feel that’ll be large in 2024.

The closing of the Houston transaction is scheduled for late third quarter, perhaps early fourth quarter, and it will likely be funded by the asset sale proceeds of the Voz transaction. After the shut, we will likely be reformatting the station and have customary start-up prices which might be required when the station’s reformatted clearly. These prices can vary primarily based available on the market and the synergies that we will present. Presently, we’re not going to be offering any estimates on the start-up prices or any near-term profitability. What we’ll say and what we really consider, we consider that Houston can attain break-even in 12 months two of its operation, and its projected EBITDA after its start-up stage needs to be within the vary of $1 million to $Four million.

Albert Rodriguez

Thanks, Brad. And because of the operator. Look, I need to thank everybody who participated on right now’s name, and I need to thank everybody who has despatched us questions. We take your questions very critically, and we checked out all the things, and I hope we addressed everybody’s questions. And any future questions, please ship it to us. I look ahead to collaborating in second quarter 2023, and I look ahead to answering all of these questions, and nothing, I hope everybody participates once more, and have an excellent day. Thanks.

Operator

The convention has now concluded. Thanks for attending right now’s presentation. You could now disconnect.