Tom Cooper

Introduction

As I write this, the capitalization of AMC Leisure Holdings, Inc. (NYSE:AMC) is altering considerably chaotically in after-hours buying and selling. Nonetheless, the upside isn’t going decrease than +50% [at one point there was even a doubling]. Why is that this occurring? A Delaware courtroom rejected a settlement that paved the best way for a share conversion, In search of Alpha Information reported on Thursday final week:

SA Information

The rejected settlement was meant to assist AMC increase extra money, however the courtroom stated it couldn’t be accredited as is. This information excited some retail buyers (the “Ape Military”) who believed within the firm and its potential – their enthusiasm prompted the gang to purchase AMC inventory and short-sellers to cowl, which drove up the share value so considerably.

However does it make sense now to comply with the gang and purchase AMC inventory to reap the benefits of the irregular uptrend? Let’s determine it out.

AMC Inventory Is A Double-Edged Sword

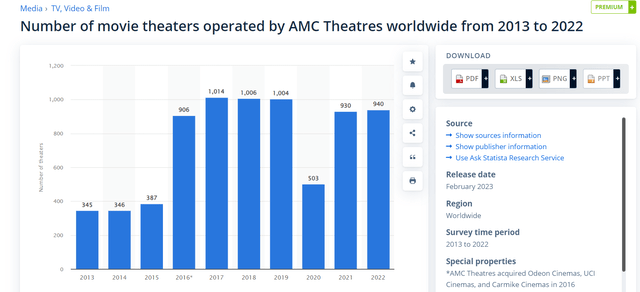

AMC Leisure Holdings, Inc. is an organization within the theatrical exhibition enterprise. It owns, operates, or has pursuits in 940 theaters in america and Europe [as of 2022]:

Statista

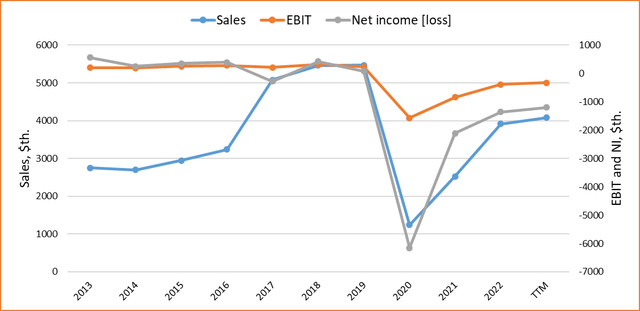

Moviegoers at AMC Theaters-operated theaters totaled ~200 million in FY2022 [based on Statista], up from 128.55 million the 12 months earlier than. Nevertheless, the 2022 determine continues to be nicely under the 356 million reported in 2019, earlier than the COVID-19 outbreak. Zooming out additional, we see that attendance at AMC theaters declined 63% between 2017 and 2021. Consequently, AMC’s web loss continues to be a significant drawback for the agency:

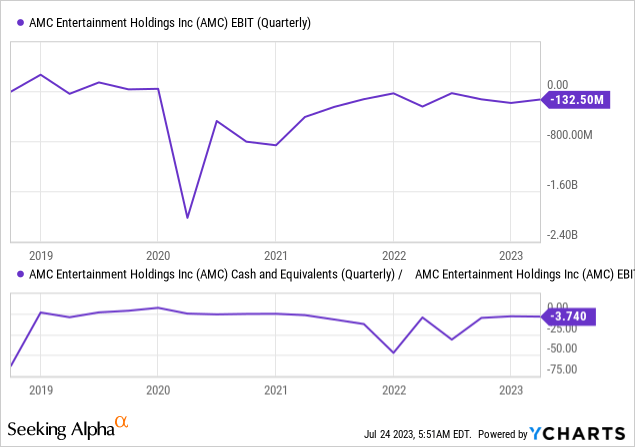

Creator’s work, In search of Alpha knowledge

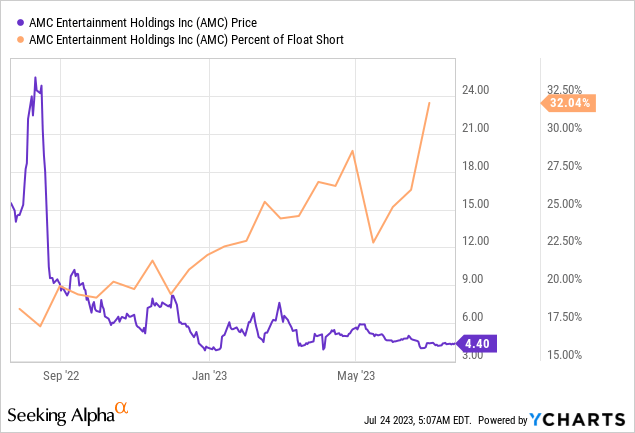

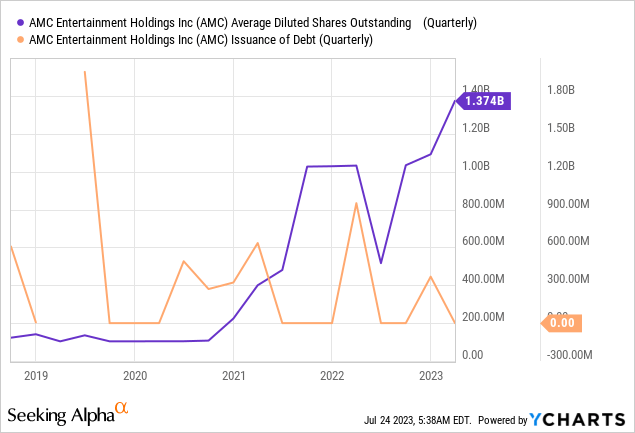

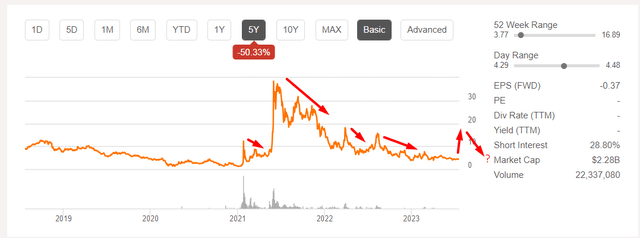

Confronted with this dramatic change in moviegoers, AMC’s administration confronted the problem of financing operations. So far as I can inform, they selected to extend fairness over taking up debt, steadily diluting the shares of present shareholders [the share price has fallen by >50% in the last 5 years]:

For this reason the information that AMC won’t be able to dilute within the close to future has brought on a lot pleasure amongst buyers, particularly amid the sharp improve briefly curiosity within the meantime.

Financially, the scenario continues to be not wanting good for AMC – on the stage of working revenue, the corporate nonetheless struggles to interrupt even. However the money on the steadiness sheet must be enough for an additional 3.5 quarters – it is unlikely that the corporate will delay elevating new funds for that lengthy, however for my part, one other Three months with out dilution may change into a base case state of affairs.

Due to the current courtroom ruling, the availability of shares has hit a sort of restrict, so to talk, at the very least for a short while. That’s the reason speculatively, I would think about shopping for AMC inventory as a result of my additional analysis exhibits that strikes just like the one we’re seeing now in after-hours buying and selling don’t finish with a one-day pump. It’s normally a short-term swing transfer that lasts at the very least a couple of buying and selling days. Let me present you some charts.

![YCharts, Seeking Alpha data [author's compilation and notes]](http://static.seekingalpha.com/uploads/2023/7/24/49513514-16901944039312594.png)

YCharts, In search of Alpha knowledge [author’s compilation and notes]

I want to level out once more that that is simply the speculative aspect of AMC – in the long run, every pump led to a bursting of the shaped bubble, when fundamentals once more took over from market sentiment and apes’ pleasure:

In search of Alpha, AMC inventory, creator’s notes

I could also be improper, however AMC’s offline cinemas are progressively giving up their share to on-line cinemas and varied providers, and this began earlier than the pandemic and subsequent closures:

Forbes, creator’s notes

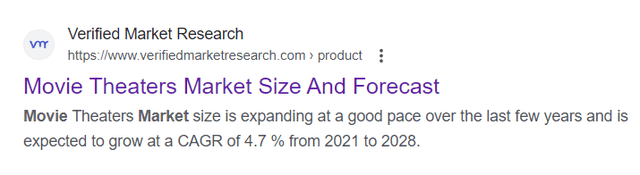

Trade consultants predict that this pattern, initially accelerated by the pandemic, will progressively proceed over the subsequent few years. Choose for your self – in accordance with a current report by Grand View Analysis, the worldwide video streaming market is anticipated to succeed in $416.84 billion by 2030, registering a CAGR of 21.5% between 2023 and 2030. This progress shall be pushed by the growing reputation of streaming providers corresponding to Netflix, Hulu, and Amazon Prime Video. These providers supply a big selection of films and TV exhibits and might be accessed on a wide range of units together with smartphones, tablets, and good TVs. On the identical time, the offline cinema market will develop way more slowly:

Verified Market Analysis

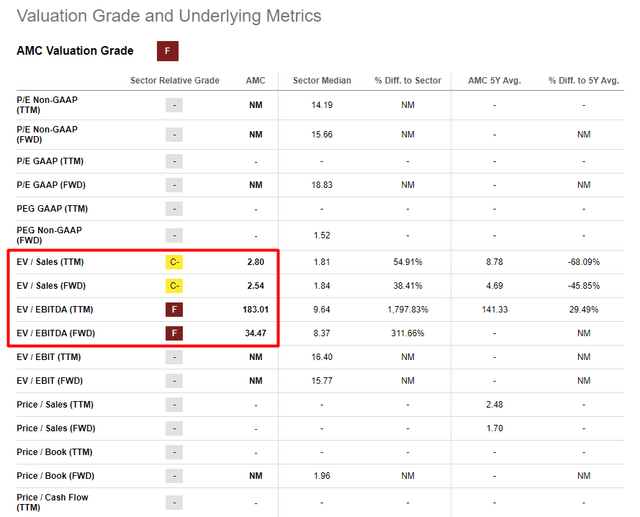

Because of this, I might not purchase AMC shares in the long run, as a result of even now – earlier than the post-market value improve materialized – we see a powerful overvaluation, for my part:

In search of Alpha, AMC, creator’s notes

AMC’s forwarding EV/EBITDA of 34.47x is even larger than Netflix’s (NFLX) one [26.58x]. The latter agency is cheaper regardless of being extra secure financially and operationally – the relative overvaluation of AMC is obvious with the bare eye I consider.

Your Takeaway

I believe a return of the apes to the market is the probably state of affairs after AMC inventory rose greater than 50% from Friday’s shut. The rally is more likely to final for a couple of extra days, and the inventory may proceed to pressure quick sellers to cowl, fueling the upward motion on the best way to new native highs. Nevertheless, this can’t go on for too lengthy. In the long run, AMC inventory is more likely to fall off the cliff once more as a consequence of its poor fundamentals.

Since my short-term view doesn’t match what I see for AMC in the long run, I fee the inventory a Maintain immediately. I urge all speculators to not neglect the stop-losses when shopping for AMC and want all long-term buyers good luck in deciding on different corporations for his or her portfolios.

Thanks for studying!