Justin Sullivan

Funding Thesis

Roku (NASDAQ: NASDAQ:ROKU) achieved a double-digit progress for the primary time since 3Q FY2022, primarily pushed by a gradual rebound in total advert spending. We additionally noticed each Google (GOOG) and META (META) reported better-than-expected advert income of their current earnings, resulting in a rise of their inventory costs within the aftermarket.

Though Roku’s 2Q FY2023 earnings report suggests a possible progress inflection, I nonetheless do not see a transparent sign of margin growth and profitability breakeven within the close to time period. Nevertheless, wanting on the macro perspective, Roku, which is perceived as a non-profitable progress inventory, is prone to profit from the soft-landing narrative and decrease inflation.

So long as Roku can preserve its progress acceleration momentum and obtain constant double-digit income progress within the upcoming quarters, there’s potential for an growth in its valuation a number of. After a 30% post-earnings rally, its P/E TTM continues to be treading at 3.9x. Subsequently, I nonetheless stay bullish on the inventory.

2Q23 Takeaway

2Q23 Shareholder Letter

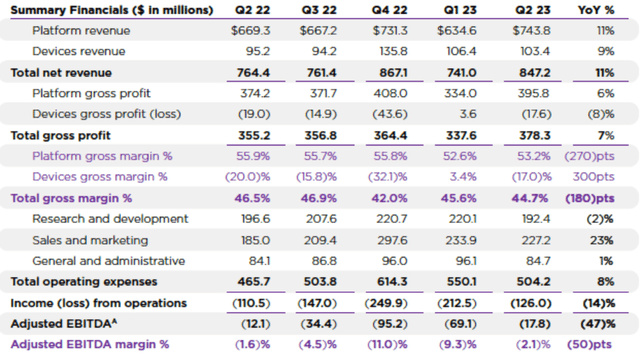

Roku shocked traders with a outstanding 30% rally after exceeding each income and GAAP EPS estimates. I feel this optimistic worth motion stems from a formidable 11% income progress, which may be attributed to a 11% rebound in its platform income. It is a important enchancment as Roku’s platform income declined by 1% YoY in 1Q FY2023.

The double-digit progress reignited the expansion optimism, reaffirming its standing as a progress inventory. Nevertheless, we needs to be cautious that the corporate’s margins are nonetheless experiencing deterioration on this quarter.

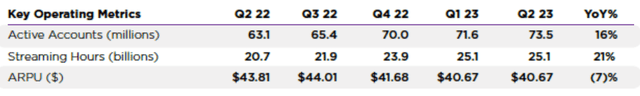

I imagine that Roku’s major focus lies in two areas: first, rising energetic accounts, and second, enhancing person engagement. Within the close to time period, I feel they’re extra necessary than prioritizing common income per person (ARPU) now. I’ll delve into extra particulars within the following dialogue.

2Q23 Shareholder Letter

In response to previous shareholder letters, Roku has persistently maintained a minimum of 20% YoY progress on streaming hours and excessive teenagers YoY progress on energetic accounts. Nevertheless, throughout the identical interval, this progress in key working metrics did not instantly translate into a considerable enhance in income. This remark aligns with our earlier dialogue, the place the corporate prioritized rising energetic accounts and enhancing person engagement throughout the cyclical downturn in advert business final 12 months.

We noticed Roku’s progress in ARPU began declining from 21% in 2Q FY2022 to -7% in 2Q FY2023, which negatively impacted income progress. I feel this decline in ARPU is probably going a results of intensified competitors in advert market. Over the long run, Roku ought to successfully monetizing customers to spice up ARPU. I imagine this may grow to be a vital think about driving up each top-line progress and valuation a number of.

As well as, relating to Roku’s steering, the corporate forecasts a 7.1% YoY income progress in 3Q FY2023. Nevertheless, additionally they see a -$50 million adjusted EBITDA, implying a -6% adjusted EBITDA margin. This means an extra margin contraction regardless of the quantity being greater than the consensus. If the advert market continues to get well underneath the soft-landing narrative, it’s potential that the corporate’s steering is conservative and achievable.

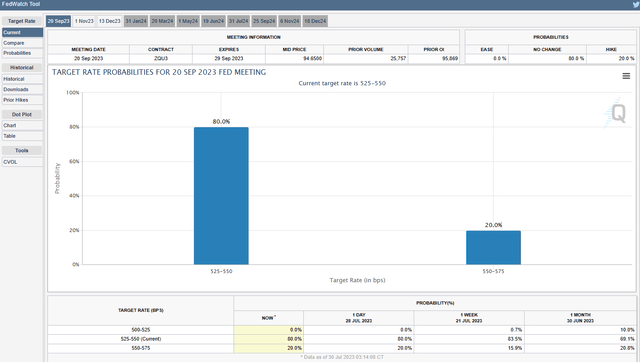

Moreover, whereas the administration expects a modest progress in client spending, they continue to be involved a few potential financial downturn regardless of some indicators of restoration. The impression of the Fed’s 5% charge hikes final 12 months might have important impression on the U.S. economic system. As I discussed in my earlier articles, the consequences of financial tightening sometimes manifest with lengthy and variable lags, often 6-24 months after the tip of the climbing cycle. The market is at the moment priced in 80% of no additional charge hike within the coming assembly. If inflation continues to pattern downward, this might doubtlessly sign the tip of the present climbing cycle.

CME Group

What May Go Incorrect

In my view, the 30% post-earnings rally may be justified by three key situations. With out these situations, my bullish stance on Roku would possibly face challenges, and this important worth response is probably not cheap.

Firstly, the market’s optimistic sentiment is basically based mostly on the expectation of a soft-landing state of affairs within the economic system. Which means there will not be a extreme recession within the close to future, as financial information continues to point out power and resilience. In such an setting, there’s potential for an acceleration in advert spending, which might profit on-line streaming corporations like Roku.

Secondly, the market has additionally factored in a much less hawkish tone by the Fed, as headline inflation has been reducing. The height in rates of interest can positively impression long-duration, non-profitable progress shares like Roku. Provided that Roku’s important quantity of FCF is anticipated to be generated over the long run, its valuation turns into extremely delicate to rates of interest. If the market believes that the Fed will not aggressively elevate rates of interest from present ranges, shares like Roku might have a reduction rally.

Lastly, the market’s optimistic response is likely to be influenced by a better progress outlook for Roku. For instance, the double-digit income progress seen in 2Q FY2023 is encouraging, and traders could count on a gradual and constant progress reacceleration within the upcoming quarters, significantly in tandem with the restoration of the advert business.

Valuation

Searching for Alpha

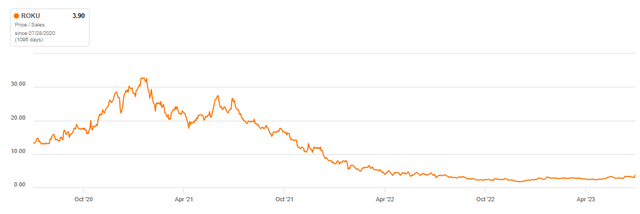

Roku’s close to and mid-term outlooks point out that the corporate is anticipated to stay unprofitable, with damaging adjusted EPS and EBITDA. Moreover, the corporate’s steering suggests a breakeven in adjusted EBITDA by FY2024. Subsequently, some valuation strategies like P/E and EV/EBITDA will not be appropriate.

Let’s contemplate Roku’s P/S TTM. Though the inventory was beforehand buying and selling at a lofty valuation in FY2021, its valuation has considerably decreased from +30x since then as a consequence of a deteriorated progress outlook and substantial charge will increase in 2022. Even after experiencing a 30% post-earnings rally, we will see the inventory is at the moment buying and selling at 3.9x P/S TTM, which continues to be 66% under its 5-year common. Subsequently, I am nonetheless optimistic in regards to the inventory’s upside momentum if the mentioned situations maintain within the close to time period.

Conclusion

In sum, Roku’s outstanding 30% post-earnings rally, pushed by a double-digit income progress as a consequence of advert restoration. This implies a possible return to progress inventory standing, which created a optimistic market response. The corporate is heading in the right direction to prioritize long-term progress by increasing energetic accounts and enhancing person engagement over ARPU. Nevertheless, I nonetheless see challenges stay as Roku is anticipated to remain unprofitable within the close to and mid-term with damaging adjusted EPS and EBITDA. Roku’s P/S TTM is at the moment buying and selling at 3.9x, nonetheless 66% under 5-year common. Lastly, I imagine the inventory’s upside momentum largely relies on a soft-landing state of affairs, Fed’s charge stance, and the corporate’s progress outlook. So long as these three situations proceed to carry, I preserve a bullish view on the inventory.