tadamichi

By Tom Nelson, CFA, Head of Asset Allocation Portfolio Administration, Franklin Templeton Funding Options; Miles Sampson, CFA, Lead Asset Class Analyst, Franklin Templeton Funding Options; and Spencer Walling, Analysis Affiliate, Franklin Templeton Funding Options

Whereas some shares might appear costly, there are areas of alternative that characteristic enticing valuations and progress catalysts, based on the Franklin Templeton Funding Options workforce.

Are buyers too optimistic?

In some areas, together with the USA, the macro backdrop has been enhancing. Progress stays resilient, with robust service sector exercise and a stabilizing manufacturing atmosphere.

Inflation continues to abate, with inflation surprises close to three-year lows. Federal Reserve (Fed) coverage is restrictive, however the odds of “peak Fed” charges have grown considerably over latest months. General, the chance of a delicate touchdown has actually risen.

How are asset costs reacting to this information? Dangerous belongings – such as equities and high-yield credit score – didn’t look forward to the “all clear” signal from macro-land. Their rally started almost a 12 months in the past in October 2022 on the first indicators of a peak in inflation, however properly earlier than a considerable enchancment in progress or financial coverage. Most fairness markets have achieved bull market standing, whereas company bond spreads are close to cyclical tights.

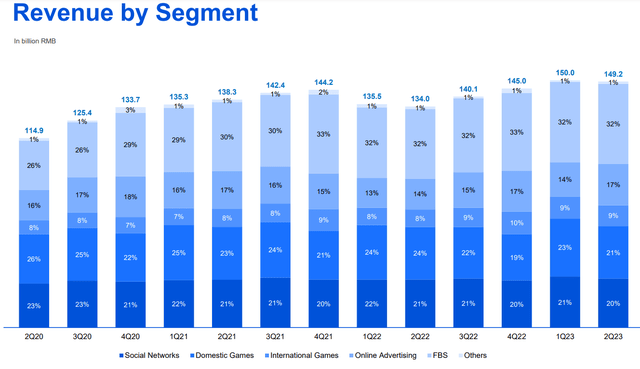

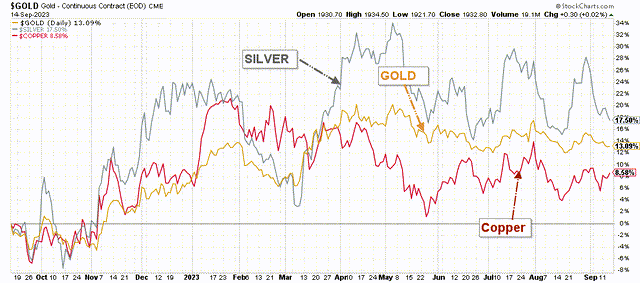

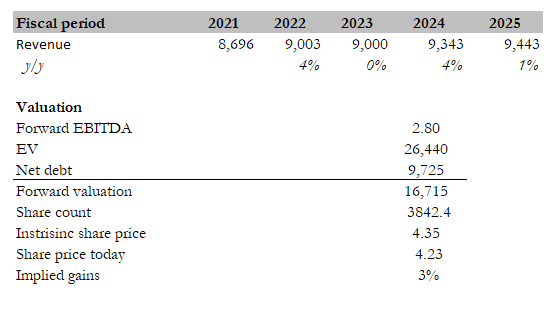

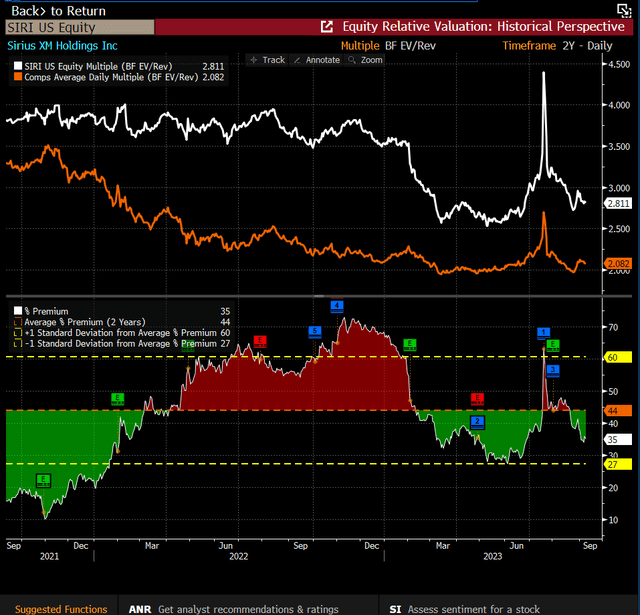

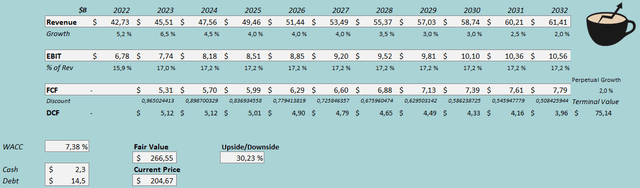

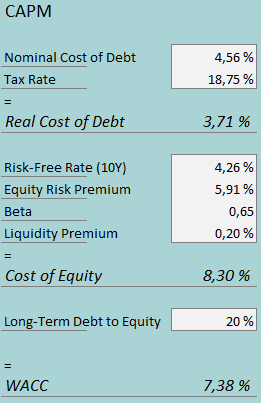

The problem right this moment is that almost all dangerous belongings have rallied forward of each the present and projected macro atmosphere (see Exhibit 1). In our view, most dangerous belongings are pricing in macro expectations which are overly optimistic. Whereas the macro backdrop has improved, we nonetheless consider there’s appreciable uncertainty over what lies forward subsequent 12 months.

Exhibit 1: Dangerous belongings are overly optimistic

The mispricing of dangerous belongings is a key cause why we stay barely defensive on the portfolio degree. We favor fastened revenue over equities, the place it’s now comparatively straightforward to seek out high-quality bonds yielding over 5% with little length or credit score danger.

The place so as to add danger in multi-asset portfolios

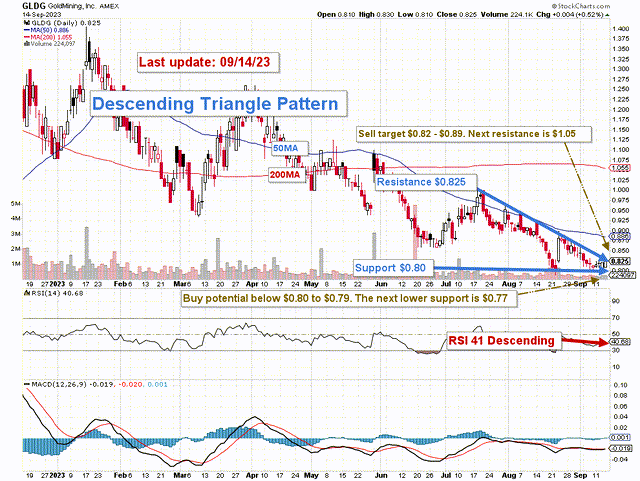

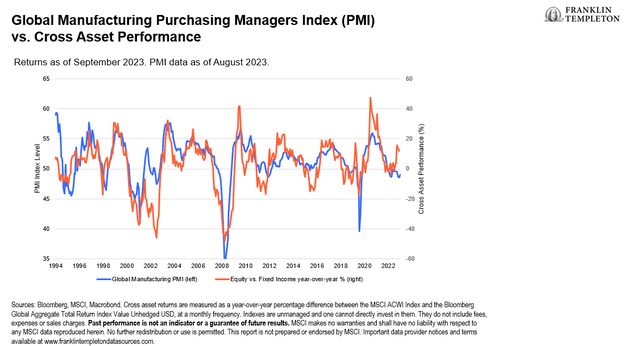

Whereas most world fairness markets have rallied since final October, not each index has carried out equally. We look at fairness pairings that traditionally carry out properly when progress is starting to enhance from below-trend ranges, which is the atmosphere many areas are in right this moment (see Exhibit 2).

Whereas some elements of the fairness market have carried out properly – cyclicals and progress shares – different elements have lagged significantly, specifically US small caps and rising markets.

Exhibit 2: What Has Outperformed Through the Most Latest Fairness Rally?

It isn’t laborious to rationalize why these fairness markets have lagged.

US small cap shares are usually extra delicate to larger rates of interest, resulting from a bigger quantity of variable fee debt and weaker stability sheets (i.e., decrease curiosity protection ratios).

Plus, publicity to the factitious intelligence (AI) theme and the “magnificent 7” group of expertise shares is far more restricted inside small caps. In rising markets, China’s economic system continues to wrestle for momentum, and extra broadly, now we have noticed a weak world manufacturing atmosphere.

The excellent news is that these dangers seem like largely priced in. Valuation ratios, like price-to-earnings or price-to-book, recommend these belongings are attractively valued. Nonetheless, valuations usually are not good tactical indicators.

Due to this fact, we establish some key catalysts which are growing in assist of US small caps and rising market equities that we consider markets have but to completely replicate.

US small caps

- US rates of interest are unlikely to maneuver a lot larger from right here. Traditionally, fee will increase have had a lagged impact, with Treasury yields decrease a 12 months following the tip of the Fed’s fee hike cycle. Usually, efficiency for small-cap shares one 12 months following the Fed’s remaining fee hike within the cycle has been strong.

- Small-cap inventory efficiency has traditionally benefited from falling inflation.

- Small caps are likely to outperform when main indicators get well from below-trend, which our workforce believes is at the moment happening.

Rising markets

- Some measures of relative progress, like manufacturing PMIs, recommend stronger progress for EMs over developed markets (DMs).

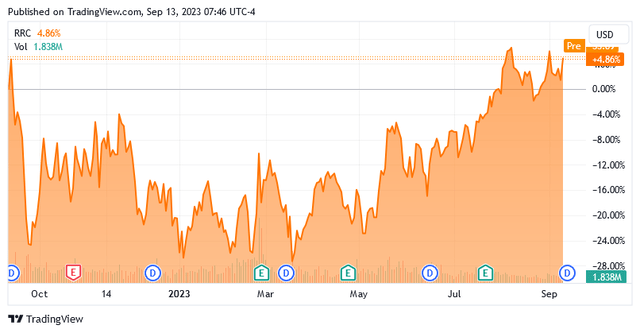

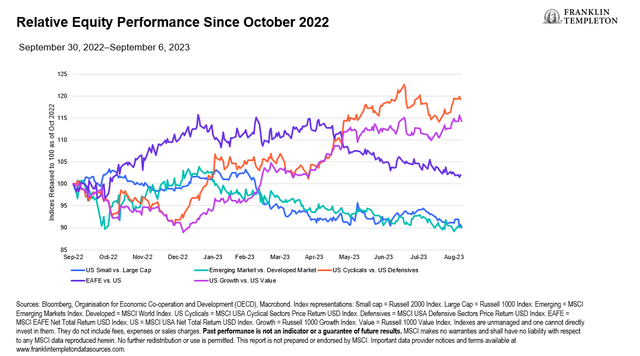

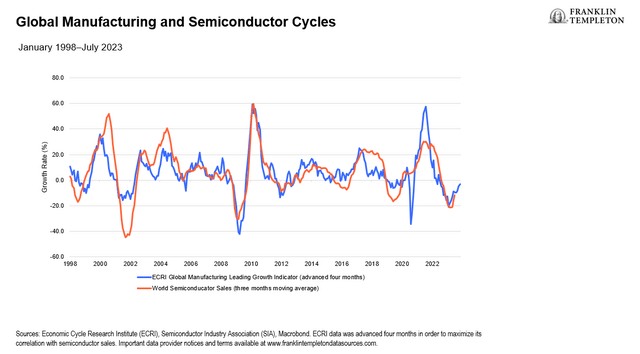

- Some main indicators of worldwide manufacturing are additionally rebounding. Together with rising AI demand, this development ought to bode properly for semiconductors (see Exhibit 3), a key export for EM Asia (Taiwan and South Korea). In keeping with World Commerce Semiconductor Statistics, world semiconductor gross sales are forecast to develop by 11.8% in 2024.1

- China’s coverage atmosphere is exhibiting indicators of proactiveness. In September alone, greater than 30 provinces and cities have enhanced property insurance policies to assist progress.

- Disinflation is prevalent throughout many EM nations after robust fee climbing cycles. Over the following 12 months, we count on coverage easing to be extra supportive in comparison with DM markets.

Exhibit 3: Main Manufacturing Indicators Ought to Enhance Semiconductor Gross sales

Placing all of it collectively

We stay barely defensive on the portfolio degree as a result of common expensiveness of dangerous belongings, like equities and excessive yield credit score, particularly relative to many developed market authorities bonds.

Nonetheless, now we have proven that not all fairness markets appear costly; US small caps and rising markets have enticing valuations, in our view.

Moreover, they’re geared to an enhancing macro atmosphere, have near-term catalysts, and might supply optimistic efficiency asymmetry over the following 12 months.

General, we predict US small caps and rising markets are sensible locations so as to add danger in multi-asset portfolios.

What are the dangers?

All investments contain dangers, together with potential lack of principal.

Fairness securities are topic to cost fluctuation and potential lack of principal. Small- and mid-cap shares contain higher dangers and volatility than large-cap shares.

Mounted revenue securities contain rate of interest, credit score, inflation and reinvestment dangers, and potential lack of principal. As rates of interest rise, the worth of fastened revenue securities falls. Low-rated, high-yield bonds are topic to higher worth volatility, illiquidity and risk of default.

Worldwide investments are topic to particular dangers, together with foreign money fluctuations and social, financial and political uncertainties, which might improve volatility. These dangers are magnified in rising markets.

The federal government’s participation within the economic system remains to be excessive and, subsequently, investments in China might be topic to bigger regulatory danger ranges in comparison with many different nations.

There are particular dangers related to investments in China, Hong Kong and Taiwan, together with much less liquidity, expropriation, confiscatory taxation, worldwide commerce tensions, nationalization, and alternate management laws and speedy inflation, all of which might negatively impression the fund. Investments in Taiwan may very well be adversely affected by its political and financial relationship with China.

Various methods could also be uncovered to doubtlessly vital fluctuations in worth.

Energetic administration doesn’t guarantee features or defend in opposition to market declines.

1. There is no such thing as a assurance any estimate, forecast or projection might be realized.

Authentic Put up