Sean Pavone

Earnings of Impartial Financial institution Corp. (NASDAQ:INDB) will likely proceed to surge via the top of 2023. The rate of interest hikes of 2022 will increase the web curiosity margin for subsequent yr. Additional, subdued mortgage progress will supply some assist for the backside line. General, I am anticipating Impartial Financial institution to report earnings of $5.63 per share for 2022, up 62%, and $6.44 per share for 2023, up 15% year-over-year. In comparison with my final report on the corporate, I’ve elevated my earnings estimates for each years principally as a result of I’ve raised the margin estimates following the third quarter’s surprisingly good efficiency. Subsequent yr’s goal worth suggests a reasonable upside from the present market worth. Due to this fact, I am sustaining a maintain ranking on Impartial Financial institution Corp.

This Yr’s Charge Hike to Increase Earnings Subsequent Yr

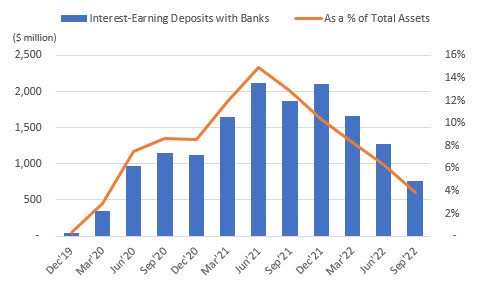

Impartial Financial institution’s internet curiosity margin surged by 37 foundation factors within the third quarter following the 18-basis factors progress within the second quarter of this yr. The third quarter’s efficiency beat my estimates given in my final report on the corporate. A part of the margin growth was attributed to the deployment of extra money into higher-yielding belongings. The money place is now nearly again to regular; due to this fact, this issue will not contribute towards margin growth in upcoming quarters.

SEC Filings, Creator’s Calculations

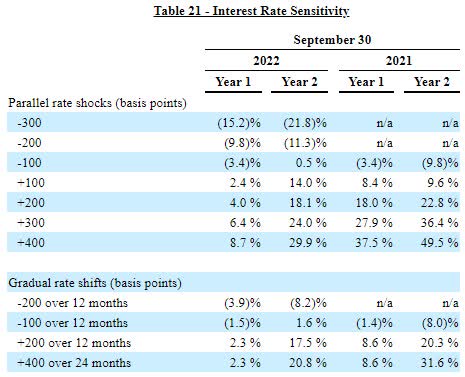

Nonetheless, the margin outlook stays vibrant due to the 425 foundation factors fed funds fee hike this yr and its lagged affect on the margin. Impartial Financial institution’s loans are slower to reprice than the deposits; due to this fact, the margin stands to profit extra within the second yr of a fee hike than the primary yr. The administration’s rate of interest simulation mannequin reveals {that a} 200-basis factors hike in rates of interest might increase the web curiosity revenue by 4.0% within the first yr and 18.1% within the second yr of the speed hike, as talked about within the 10-Q submitting.

3Q 2022 10-Q Submitting

Contemplating these elements, I am anticipating the margin to develop by 5 foundation factors within the final quarter of 2022 and 30 foundation factors in 2023. In comparison with my final report on Impartial Financial institution, I’ve raised my margin estimates for each years due to the third quarter’s efficiency which exceeded my earlier expectations.

Revising Downwards the Mortgage Progress Estimate Following the Third Quarter’s Disappointing Efficiency

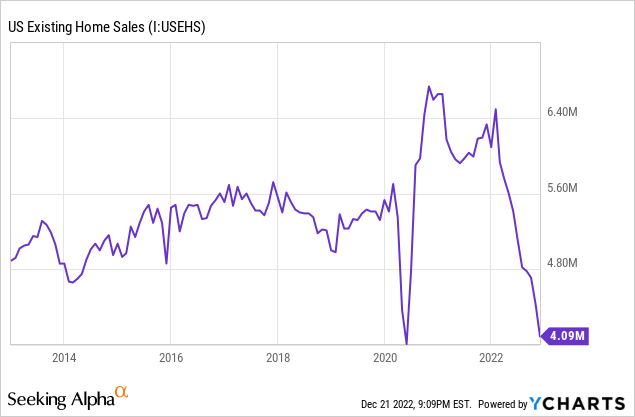

Impartial Financial institution’s mortgage portfolio grew by solely 0.2% within the third quarter, which missed my expectations. The outlook for residential mortgages and residential fairness loans is bleak because of the excessive interest-rate setting. Residential loans are an essential focus space for Impartial Financial institution as they made up 22% of whole loans on the finish of September 2022. Because of high-interest charges, U.S. house gross sales have plunged this yr, as proven beneath.

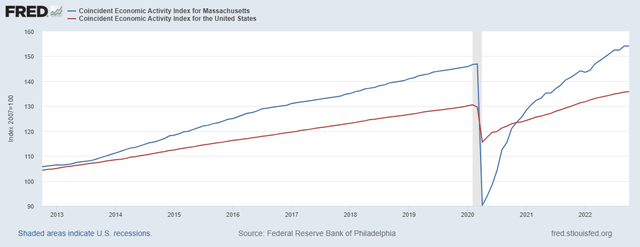

Nonetheless, the outlook for business loans stays optimistic. Impartial Financial institution principally operates in Massachusetts, whose present financial exercise is in a greater situation than the nationwide common.

The Federal Reserve Financial institution of Philadelphia

Contemplating these elements, I am anticipating the mortgage guide to develop by 0.75% within the final quarter of 2022, taking full-year progress to 1.6%. For 2023, I am anticipating the portfolio to develop by 3.0%. In comparison with my final report on the corporate, I’ve lowered my mortgage progress estimates following the third quarter’s below-expected efficiency.

In the meantime, I am anticipating deposits to develop considerably in keeping with loans. The next desk reveals my stability sheet estimates.

| Monetary Place | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Internet Loans | 6,842 | 8,806 | 9,279 | 13,440 | 13,655 | 14,069 |

| Progress of Internet Loans | 8.7% | 28.7% | 5.4% | 44.8% | 1.6% | 3.0% |

| Securities | 1,075 | 1,275 | 2,348 | 4,789 | 3,935 | 4,015 |

| Deposits | 7,427 | 9,147 | 10,993 | 16,917 | 16,462 | 16,961 |

| Borrowings and Sub-Debt | 259 | 303 | 181 | 152 | 114 | 115 |

| Frequent fairness | 1,073 | 1,708 | 1,703 | 3,018 | 2,563 | 2,558 |

| E book Worth Per Share ($) | 38.8 | 49.7 | 51.5 | 74.8 | 55.9 | 55.8 |

| Tangible BVPS ($) | 29.0 | 34.1 | 35.5 | 49.6 | 33.8 | 33.7 |

| Supply: SEC Filings, Creator’s Estimates(In USD million until in any other case specified) | ||||||

Anticipating Earnings to Surge by 15%

The anticipated margin growth and subdued mortgage progress will drive earnings via the top of 2023. Alternatively, heightened inflation will push up working bills, which can prohibit earnings progress. Additional, the tight labor market will increase wage bills, which may also damage the underside line.

In the meantime, I am anticipating the provisioning for anticipated mortgage losses to stay close to a traditional stage. Non-performing loans have been 0.41% of whole loans, whereas allowances have been 1.08% of whole loans on the finish of September 2022. Though this protection isn’t excessive, it appears enough for a doable financial recession. General, I am anticipating the web provision expense to make up 0.06% of whole loans in 2023, which is similar as the common for 2017 to 2019.

Contemplating these elements, I am anticipating Impartial Financial institution to report earnings of $5.63 per share for 2022, up 62% year-over-year. For 2023, I am anticipating earnings to develop by 15% to $6.44 per share. The next desk reveals my revenue assertion estimates.

| Earnings Assertion | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Internet curiosity revenue | 298 | 393 | 368 | 402 | 607 | 686 |

| Provision for mortgage losses | 5 | 6 | 53 | 18 | 3 | 8 |

| Non-interest revenue | 89 | 115 | 111 | 106 | 111 | 108 |

| Non-interest expense | 226 | 284 | 274 | 333 | 373 | 398 |

| Internet revenue – Frequent Sh. | 122 | 165 | 121 | 121 | 258 | 295 |

| EPS – Diluted ($) | 4.40 | 5.03 | 3.64 | 3.47 | 5.63 | 6.44 |

| Supply: SEC Filings, Creator’s Estimates(In USD million until in any other case specified) | ||||||

In my final report on Impartial Financial institution, I estimated earnings of $5.29 per share for 2022 and $5.81 per share for 2023. I’ve raised my earnings estimates principally as a result of I’ve elevated my margin estimates.

My estimates are primarily based on sure macroeconomic assumptions that won’t come to fruition. Due to this fact, precise earnings can differ materially from my estimates.

Sustaining a Maintain Ranking

Impartial Financial institution is providing a dividend yield of two.6% on the present quarterly dividend fee of $0.55 per share. The earnings and dividend estimates counsel a payout ratio of 34% for 2023, which is beneath the five-year common of 43%. As Impartial Financial institution has solely not too long ago elevated its quarterly dividend, I’m not anticipating one other dividend hike in 2023.

I’m utilizing the historic price-to-tangible guide (“P/TB”) and price-to-earnings (“P/E”) multiples to worth Impartial Financial institution. The inventory has traded at a median P/TB ratio of 1.92 previously, as proven beneath.

| FY19 | FY20 | FY21 | Common | |||

| Tangible BVPS ($) | 34.1 | 35.5 | 49.6 | |||

| Common Market Worth ($) | 77.8 | 66.4 | 80.0 | |||

| Historic P/E | 2.3x | 1.9x | 1.6x | 1.9x | ||

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/TB a number of with the forecast tangible guide worth per share of $33.7 provides a goal worth of $64.Eight for the top of 2023. This worth goal implies a 23.5% draw back from the December 21 closing worth. The next desk reveals the sensitivity of the goal worth to the P/TB ratio.

| P/TB A number of | 1.72x | 1.82x | 1.92x | 2.02x | 2.12x |

| TBVPS – Dec 2023 ($) | 33.7 | 33.7 | 33.7 | 33.7 | 33.7 |

| Goal Worth ($) | 58.1 | 61.4 | 64.8 | 68.2 | 71.5 |

| Market Worth ($) | 84.7 | 84.7 | 84.7 | 84.7 | 84.7 |

| Upside/(Draw back) | (31.5)% | (27.5)% | (23.5)% | (19.5)% | (15.5)% |

| Supply: Creator’s Estimates |

The inventory has traded at a median P/E ratio of round 18.9x previously, as proven beneath.

| FY19 | FY20 | FY21 | Common | |||

| Earnings per Share ($) | 5.03 | 3.64 | 3.47 | |||

| Common Market Worth ($) | 77.8 | 66.4 | 80.0 | |||

| Historic P/E | 15.5x | 18.2x | 23.1x | 18.9x | ||

| Supply: Firm Financials, Yahoo Finance, Creator’s Estimates | ||||||

Multiplying the common P/E a number of with the forecast earnings per share of $6.44 provides a goal worth of $121.9 for the top of 2023. This worth goal implies a 44.0% upside from the December 21 closing worth. The next desk reveals the sensitivity of the goal worth to the P/E ratio.

| P/E A number of | 16.9x | 17.9x | 18.9x | 19.9x | 20.9x |

| EPS 2023 ($) | 6.44 | 6.44 | 6.44 | 6.44 | 6.44 |

| Goal Worth ($) | 109.0 | 115.5 | 121.9 | 128.4 | 134.8 |

| Market Worth ($) | 84.7 | 84.7 | 84.7 | 84.7 | 84.7 |

| Upside/(Draw back) | 28.7% | 36.4% | 44.0% | 51.6% | 59.2% |

| Supply: Creator’s Estimates |

Equally weighting the goal costs from the 2 valuation strategies provides a mixed goal worth of $93.4, which means a 10.2% upside from the present market worth. Including the ahead dividend yield provides a complete anticipated return of 12.8%. For my part, this return isn’t excessive sufficient; due to this fact, I’m sustaining a maintain ranking on Impartial Financial institution.