ekinyalgin

This text was printed on Dividend Kings on Tuesday, December 27th.

—————————————————————————————

$366,000, an sum of money that most individuals would envy. That is how a lot I’ve personally misplaced in a lifetime on account of hypothesis and day buying and selling.

That was earlier than I discovered the straightforward fact about easy methods to really retire wealthy and keep wealthy in retirement.

Many individuals consider Wall Avenue as a on line casino, and they’re proper. Within the brief time period, something can occur. However in the long run, it is all about stacking the chances in your favor.

Billion-dollar casinos aren’t constructed on the backs of winners, however from long-term chances, particularly that the home at all times wins.

Charlie Bilello

Within the short-term, shares can do something, particularly in a bear market. Within the long-term, barring an apocalypse, they solely go up.

And have you learnt the one factor higher than shares for the long-term if you wish to retire in security and splendor?

Legacy Analysis

Dividend development blue-chips. Why? As a result of a diversified dividend development portfolio harnesses the facility of everybody on earth to fund your monetary desires.

How’s that? Take into account the Dividend Kings ZEUS Revenue Development portfolio, which owns stakes starting from 0.01% to six% within the 578 biggest firms on earth.

There is not an individual on earth that is not a buyer of this portfolio. Each one of many Eight billion individuals on the earth is sending dividends to this portfolio each quarter.

All through historical past, each emperor and dictator has dreamed of conquering the world and bending all of humanity to their will. Guess what? When you personal a blue-chip revenue portfolio you could have completed simply that.

Each individual on earth is voluntarily sending you cash, from each nook of the globe, so that you could grow to be financially impartial.

You do not have to kill or conquer anybody as a result of, by means of the magic of blue-chip dividends, all of humanity is united behind one easy aim. Letting you retire in consolation or splendor and develop steadily richer over time.

Right now I need to spotlight two tremendous star high-yield dividend blue-chips which are firing on all cylinders proper now, Amgen Inc. (AMGN) and Broadcom Inc. (AVGO). These aren’t essentially the most undervalued high-yield blue-chips you should purchase, however they’re two of the best high quality and most secure.

Not only for 2023, a recession yr, however for doubtlessly many years of superior revenue, revenue development, and life-changing returns.

So let me present you why Amgen and Broadcom are two of the very best high-yield dividend blue-chips you should purchase right this moment to assist construct your revenue development empire and obtain your monetary desires.

Amgen: A World-Beater Biotech Blue-Chip

Amgen is not a dividend aristocrat…but. It started paying a dividend 11 years in the past. But when this world-beater, high-yield blue-chip would not grow to be an aristocrat in 2037, I will eat my hat.

Why is Amgen such an exquisite dividend development blue-chip?

Let’s begin with the Horizon Therapeutics (HZPN) mega-deal for $28 billion, its largest acquisition ever.

S&P

Amgen will tackle a variety of debt to fund this deal, which is able to imply elevated leverage for the subsequent few years.

We anticipate the corporate to droop share repurchases and deal with debt reimbursement over the subsequent a number of years. We undertaking that leverage will decline to three.1x-3.3x two years publish the shut of the acquisition, nonetheless barely excessive for the ‘BBB+’; ranking. We’d contemplate reducing the ranking additional if leverage stays over 3.3x past the 2 years.” – S&P

Nonetheless, this deal makes a variety of sense from the attitude of future development.

The acquisition improves Amgen’s portfolio, including a number of fast-growing commercialized medicine. Horizon’s key belongings overlap with Amgen’s energy in auto-immune illnesses and leverage its presence in nephrology. We anticipate Tepezza and Krystexxa to develop at a double-digit fee over the subsequent few years. This may probably increase Amgen’s development fee, which we anticipate to speed up in 2023 with the expansion of Lumakras and Tezspire and the launch of Amjevita within the U.S.” – S&P

What concerning the unfavorable outlook?

The outlook is unfavorable due to elevated leverage and the chance that if Amgen continues to pursue extra acquisitions, leverage will stay excessive.

We might decrease the ranking if the corporate makes different acquisitions or makes a large tax settlement that may maintain leverage elevated and above 3.3x for greater than two years.

We might revise the outlook to steady if we grow to be extra sure that leverage will stay under 3.3x. This might happen if the corporate steadily reduces leverage and builds capability for future acquisitions.” – S&P

Horizon has a number of medicine already available on the market which are a great match for Amgen’s medicine available on the market. Combining medicine right into a single remedy for a affected person is turning into extra frequent, and for this reason analysts are so enthusiastic about what this mega-deal means for Amgen’s development potential.

FactSet Analysis Terminal

For context, Moody’s estimates that the pharma trade’s long-term earnings development fee is 4%. Amgen is rising virtually 4X as quick due to its Horizon acquisition.

Nonetheless, the largest potential development driver for the Horizon portfolio could possibly be improved uptake amongst sufferers with persistent thyroid eye illness; key knowledge must be accessible within the second quarter of 2023 that would broaden the penetration of this market. We additionally see important potential from Horizon’s latest key drug, Uplizna, for neuromyelitis optica. Extra potential indications in testing (like myasthenia gravis) would match nicely with Amgen’s upcoming launch of a biosimilar model of Soliris.” – Morningstar

In different phrases, Horizon is doubtlessly turbocharging AMGN’s robust pipeline of present and future medicine and can assist it keep really distinctive profitability.

FactSet Analysis Terminal

Inside just a few years, Amgen’s free money move (“FCF”) is anticipated to develop about 30% to round $13 billion. How spectacular is that?

- 2022 FCF margin consensus: 39%

- 2023 FCF margin consensus: 49%

- 2027 FCF margin consensus: 44%.

For context, Amgen’s present free money move margin is within the high 5% of all firms on earth. And it is anticipated to get even stronger with Horizon’s excessive margin medicine added to its arsenal.

Amgen is at the moment spending $4.5 billion on its dividend, or roughly 33% of what analysts anticipate it to be producing inside just a few years.

That leaves round $Eight to $8.5 billion per yr it could spend on de-leveraging or much less aggressive buybacks.

Or, to place it one other manner, if AMGN had been to spend 100% of its post-dividend retained free money move on paying down debt, it might pay for this complete deal in about 3.5 years.

However here is even higher information. Not solely does Amgen has a plan to soundly deleverage and obtain among the finest development charges in its trade, but it surely’s more likely to stay a double-dividend development super-star.

- 5-year dividend development consensus 10.2% yearly.

Amgen simply raised its dividend by 12% for 2023, and analysts anticipate it to develop one other 47% by 2027.

Meaning the at the moment beneficiant and really secure 3.2% yield might attain 4.7% on right this moment’s value by 2027.

Gurufocus Premium

That is a may enticing very secure yield for a future dividend aristocrat whose moat is as huge as they arrive.

That features gross margins of 76% and returns on capital of 170%, 12X that of the S&P 500 and 65% higher than the dividend aristocrats.

Lengthy-Time period Consensus Return Potential

| Funding Technique | Yield | LT Consensus Development | LT Consensus Complete Return Potential | Lengthy-Time period Threat-Adjusted Anticipated Return |

| Amgen | 3.2% | 14.3% | 17.5% | 12.3% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% | 8.5% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

| Schwab US Dividend Fairness ETF | 3.4% | 7.6% | 11.0% | 7.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% |

(Supply: DK Analysis Terminal, FactSet, Morningstar, Ycharts)

Do I consider that AMGN can actually ship 17% to 18% long-term returns? It is really not as loopy because it sounds.

Amgen Rolling Return Since 2011 (The Dividend Period)

Portfolio Visualizer Premium

Since Amgen began paying a really secure and double-digit development dividend 11 years in the past, it is constantly delivered 15% to 18% annual returns, operating circles across the S&P.

31% Annual Revenue Development Over The Final 11 Years

Portfolio Visualizer Premium

Amgen’s dividend development over the past 11 years has been about 4X quicker than the S&P’s, an distinctive 31% per yr. That is clearly going to sluggish over time, particularly because it focuses on deleveraging.

However the level is that Amgen is actually a high-yield dividend development tremendous star, with many different admirable qualities.

Causes To Doubtlessly Purchase Amgen Right now

| Metric | Amgen |

| High quality | 83% 13/13 Extremely SWAN (Sleep-Nicely-At Evening) High quality Drug Maker |

| Threat Score | Very Low Threat |

| DK Grasp Record High quality Rating (Out Of 500 Firms) | 264 |

| DK Grasp Record High quality Percentile | 48% |

| Dividend Development Streak (Years) | 11 |

| Dividend Yield | 3.2% |

| Dividend Security Rating | 82% |

| Common Recession Dividend Minimize Threat | 0.5% |

| Extreme Recession Dividend Minimize Threat | 1.95% |

| S&P Credit score Score |

BBB+ Adverse Outlook |

| 30-Yr Chapter Threat | 5.00% |

| LT S&P Threat-Administration World Percentile |

97% Distinctive, Very Low Threat |

| Truthful Worth | $273.53 |

| Present Value | $263.92 |

| Low cost To Truthful Worth | 4% |

| DK Score |

Potential Cheap Purchase |

| P/E | 14.9 |

| Money-Adjusted P/E | 10.5 |

| Development Priced In | 4.0% |

| Historic PE | 13.5 to 15 |

| LT Development Consensus/Administration Steering | 14.3% |

| PEG Ratio | 0.73 |

| 5-year consensus whole return potential |

8% to 10% CAGR |

| Base Case 5-year consensus return potential |

9% CAGR (About Equal to The S&P 500) |

| Consensus 12-month whole return forecast | 4% |

| Basically Justified 12-Month Return Potential | 7% |

| LT Consensus Complete Return Potential | 17.5% |

| Inflation-Adjusted Consensus LT Return Potential | 15.2% |

(Supply: Dividend Kings Zen Analysis Terminal)

Amgen is not a discount, but it surely does symbolize a traditional Buffett-style “fantastic firm at an affordable worth.” Its cash-adjusted P/E of 10.5X is decrease than the typical personal fairness deal in 2022 of 11.3X.

For one of many widest moat pharma giants on earth, and one of many most secure double-digit rising 3.2% yields on the planet.

Amgen 2024 Consensus Complete Return Potential

FAST Graphs, FactSet Analysis

AMGN’s sluggish development in 2023 signifies that its short-term return potential is modest.

Amgen 2028 Consensus Complete Return Potential

FAST Graphs, FactSet Analysis

However over the subsequent 5 years, AMGN provides the potential to greater than double the market’s returns, a really enticing 13% yearly.

Amgen Funding Choice Rating

Dividend Kings Automated Funding Choice Rating

AMGN is an above-average high-yield alternative for anybody snug with its danger profile. Take a look at the way it compares to the S&P 500.

- 4% low cost to honest worth vs. 1% low cost S&P = 3% higher valuation

- 3.2% secure yield vs. 1.8% (2X greater and far safer)

- roughly 17.5% long-term annual return potential vs. 10.2% CAGR S&P

- about 50% greater risk-adjusted anticipated returns

- 2X greater revenue potential over 5 years.

Broadcom: A Free Money Stream Minting World-Beater Tremendous Star Dividend Grower

Broadcom is one among my favourite chip shares for a number of causes.

First, nobody does M&A on this trade higher than CEO Hock Tan.

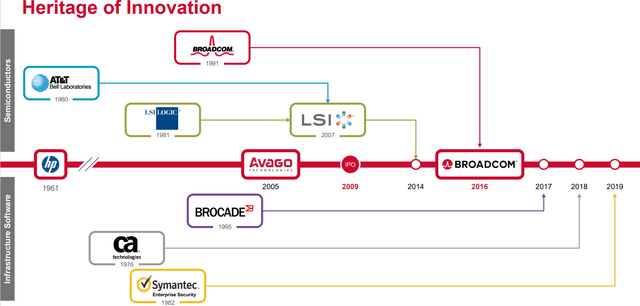

Investor Presentation

Broadcom is just like the Berkshire of chip makers, making quite a few good offers which have helped to enhance the corporate’s profitability and turbocharge development.

Broadcom makes use of the money move generated from its current companies to take care of its aggressive edge in core finish markets by bolstering analysis and growth in addition to future acquisitions. As a serial acquirer, Broadcom has seemingly perfected the method of buying expertise firms with best-of-breed merchandise at enticing valuations, trimming noncore product strains to streamline the enterprise, and in the end driving value synergies.” – Morningstar

What’s extra essential for revenue buyers is that it is centered on shopping for software program firms with recurring contracted money flows. AVGO spends $5 billion yearly on R&D, rising its portfolio of 19,00Zero patents that assist it ship among the most spectacular profitability within the trade.

The $61 billion acquisition of VMWare (VMW) will imply that 50% of all gross sales are from software program, creating essentially the most steady money move within the trade.

Meaning its PE ought to proceed to rise steadily over time because it turns into extra of a tech utility.

Is Broadcom with out danger? After all not, and one of many greatest proper now could be regulatory approval for the VMWare deal.

- Broadcom, VMware sink as EU opens up ‘in-depth’ investigation into $61B merger.

Each the U.S. and EU are carefully scrutinizing this deal, fearful that it’d lead to a tech conglomerate with an excessive amount of market energy.

Gurufocus Premium

AVGO’s masterful use of M&A has helped it grow to be one of the crucial worthwhile firms on earth, in any trade. That features insane returns on capital of 622%, 43X higher than the S&P 500 and 6X greater than the dividend aristocrats.

- 4X greater than Amgen

FactSet Analysis Terminal

Broadcom’s free money move margins are distinctive due to its low capital-intensive enterprise mannequin.

Broadcom’s dividend is operating $7.9 billion per yr, that means that it is anticipated to retain $10 billion subsequent yr after dividends. Administration’s coverage is to pay a secure 50% FCF payout ratio and use the remainder for buybacks and de-leveraging.

- 49% free money move margins in 2022

- high 1% of all firms on earth

- 2024 consensus FCF margin 52%.

Usually you anticipate 50% free money move margins from firms like Visa (V) and Mastercard (MA), not a chip maker. Not even biotechs like Amgen and AbbVie (ABBV) are capable of maintain such margins over time, a lot much less maintain enhancing upon them.

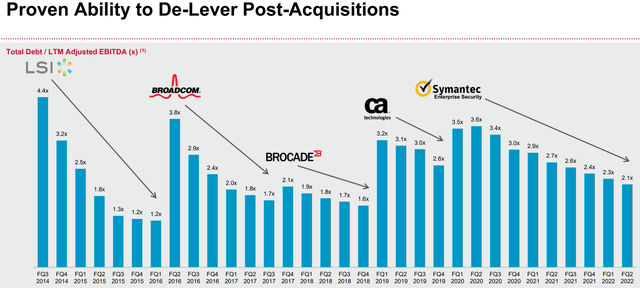

Investor presentation

There’s naturally danger concerned with debt-funded M&A, and within the arms of a lesser firm, this technique might spell catastrophe.

44% Annual Revenue Development For 11 Years

Portfolio Visualizer Premium

Within the arms of Hock Tan, Broadcom’s M&A-focused development technique has resulted in spectacular revenue development. Traders who purchased Broadcom in 2011 when it grew to become a dividend inventory now get pleasure from a 75% yield on value.

OK, however clearly, development goes to sluggish sooner or later. And that is very true if regulators block the VMware deal or ones just like it. We have already seen an tried $117 billion acquisition of Qualcomm (QCOM) nixed by the Trump administration, and the VMW deal has a possible $2.25 billion in termination charges related to it.

What does Broadcom’s development outlook seem like on a risk-adjusted foundation if it isn’t allowed to purchase VMW?

FactSet Analysis Terminal

Broadcom’s development outlook was 15.5% earlier than the EU and FTC elevated the chance of one other failed mega-deal. However 12.5% development remains to be 50% greater than the S&P 500 and about 25% higher than dividend development shares, as represented by VIG.

Lengthy-Time period Consensus Complete Return Potential

| Funding Technique | Yield | LT Consensus Development | LT Consensus Complete Return Potential | Lengthy-Time period Threat-Adjusted Anticipated Return |

| Broadcom | 3.4% | 12.5% | 15.9% | 11.1% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% | 8.5% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

| Schwab US Dividend Fairness ETF | 3.4% | 7.6% | 11.0% | 7.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% |

(Supply: DK Analysis Terminal, FactSet, Morningstar, YCharts.)

Broadcom nonetheless provides a sexy yield rising at double-digit and the potential for 16% long-term returns. When you’re trying to turbocharge a core ETF place to spice up yield, development, and return potential, it is the most effective long-term selections you may make.

Causes To Doubtlessly Purchase Broadcom Right now

| Metric | Broadcom |

| High quality | 83% 12/13 Tremendous SWAN (Sleep-Nicely-At Evening) High quality Chip Maker |

| Threat Score | Medium Threat |

| DK Grasp Record High quality Rating (Out Of 500 Firms) | 259 |

| DK Grasp Record High quality Percentile | 49% |

| Dividend Development Streak (Years) | 12 |

| Dividend Yield | 3.4% |

| Dividend Security Rating | 85% |

| Common Recession Dividend Minimize Threat | 0.5% |

| Extreme Recession Dividend Minimize Threat | 1.80% |

| S&P Credit score Score |

BBB- Optimistic Outlook |

| 30-Yr Chapter Threat | 11.00% |

| LT S&P Threat-Administration World Percentile |

41% Common, Medium Threat |

| Truthful Worth | $609.20 |

| Present Value | $551.91 |

| Low cost To Truthful Worth | 9% |

| DK Score |

Potential Cheap Purchase |

| P/E | 14.5 |

| Money-Adjusted P/E | 11.4 |

| Development Priced In | 5.8% |

| Historic P/E | 14.5 to 15.5 |

| LT Development Consensus/Administration Steering | 12.5% |

| PEG Ratio | 0.91 |

| 5-year consensus whole return potential |

14% to 25% CAGR |

| Base Case 5-year consensus return potential |

17% CAGR (About 2.5X The S&P 500) |

| Consensus 12-month whole return forecast | 23% |

| Basically Justified 12-Month Return Potential | 14% |

| LT Consensus Complete Return Potential | 15.9% |

| Inflation-Adjusted Consensus LT Return Potential | 13.5% |

(Supply: Dividend Kings Zen Analysis Terminal)

Broadcom is not an important discount proper now, simply one other Buffett-style “fantastic firm at an affordable worth.” Its 11.4X cash-adjusted P/E is what personal fairness is paying for firms now.

Broadcom 2025 Consensus Return Potential

(Supply: FAST Graphs, FactSet)

As a result of slower development within the subsequent few years, partially as a result of smartphone improve cycle, AVGO’s return potential by means of 2025 is roughly equal to the market’s.

Broadcom 2029 Consensus Return Potential

(Supply: FAST Graphs, FactSet)

Even at a modest low cost to honest worth, AVGO’s robust yield and regular development are anticipated to ship about 2.5X the returns of the S&P over the approaching 5 years.

Broadcom Funding Choice Rating

Dividend Kings Automated Funding Choice Rating

AMGN is an above-average high-yield alternative for anybody snug with its danger profile. Take a look at the way it compares to the S&P 500.

- 9% low cost to honest worth vs. 1% low cost S&P = 8% higher valuation

- 3.4% secure yield vs. 1.8% (2X greater and safer)

- roughly 15.9% long-term annual return potential vs. 10.2% CAGR S&P

- about 33% greater risk-adjusted anticipated returns

- 2.5X greater revenue potential over 5 years.

Backside Line: Amgen And Broadcom Are Two Of The Greatest Excessive-Yield Blue-Chips You Can Purchase For 2023 And Past

Let me be clear: I am NOT calling the underside in AMGN or AVGO (I am not a market-timer).

Not even Extremely SWAN high quality does NOT imply “cannot fall onerous and quick in a bear market.”

Fundamentals are all that decide security and high quality, and my suggestions.

- over 30+ years, 97% of inventory returns are a perform of pure fundamentals, not luck

- within the brief time period; luck is 25X as highly effective as fundamentals

- in the long run, fundamentals are 33X as highly effective as luck.

Whereas I am unable to predict the market within the brief time period, here is what I can let you know about AMGN and AVGO.

Each are high-yield dividend superstars which are more likely to grow to be dividend aristocrats.

Each provide far superior development prospects than virtually any standard ETF or funding technique.

Each are Buffett-style “fantastic firms at affordable costs.”

Each have delivered robust double-digit dividend development for 11 to 12 years and are anticipated to proceed to take action sooner or later.

And each are fantastic examples of why world-beater dividend development blue-chips are the best-performing asset class in historical past.

When you’re bored with shedding cash in bear markets, then perhaps it is time to cease speculating and begin investing in your long-term future.