nayuki

Thesis

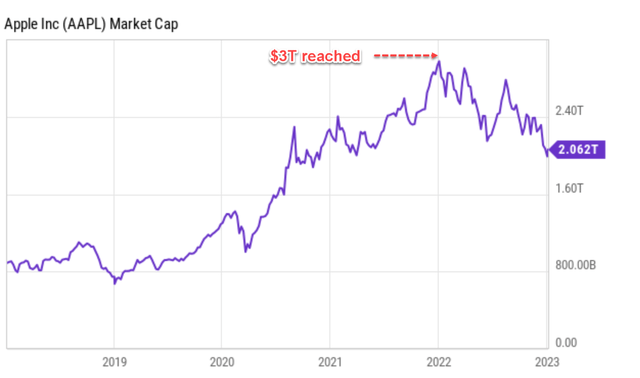

Early in 2022 (Jan 3, 2022 to be actual, as you may see from the next chart), Apple (NASDAQ:AAPL) grew to become the primary firm to achieve a $3T market cap throughout intraday buying and selling. Then a variety of macroscopic headwinds introduced it again to the present $2T stage.

Supply: In search of Alpha information

The thesis right here is to clarify why I see it as solely a matter of time earlier than Apple’s market cap returns to $3T. And, very seemingly, this time it would do it with type and in addition on a extra everlasting foundation. The pullbacks had been largely brought on by macroscopic circumstances, not AAPL’s merchandise’ points. A few of the key points embrace the continuing supply-chain disruptions, the persistence of COVID-19 (particularly in China), excessive inflation, and unfavorable forex alternate charges. And I see all of those points to be solely short-term.

And the time for its market cap to climb again to $3T may be earlier than you assume. Its {hardware} stays vastly well-liked and gross sales in just about all classes set a file in FY 2022 regardless of all of the above challenges. For the 12 months, Apple set sale data for the flagship iPhone (up 9.7% YOY to $42.6 billion), its iconic Mac line of private computer systems (up 25% YOY, to $11.5 billion), and in addition wearables.

Moreover its conventional product traces, there are a minimum of two extra highly effective catalysts at work whilst we communicate: its transformation right into a service firm and its success with its personal chips. And we’ll element these instantly under.

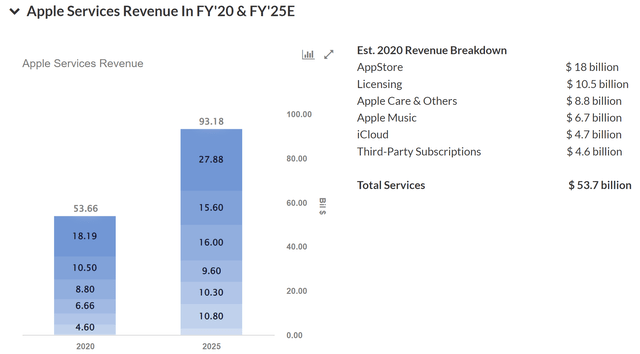

Transformation from a {hardware} firm to a service firm

Many traders affiliate AAPL principally with {hardware} (iPhone, Mac, et al) just because it’s so vastly profitable with them. Nonetheless, the primary purpose I’m bullish on its long-term image is its transformation right into a service enterprise. Apple’s put in base of lively units set all-time highs in all of its main product divisions and geographic areas in 2022. And its services-related revenues are making up an more and more bigger portion of the entire gross sales as seen within the chart under. To wit, based on this Trefis evaluation, APPL’s Providers enterprise raked in a complete of $56B of revenues in FY 2020, which already is its second-largest section and contributed about 19.5% of its complete revenues. Trying ahead, this section is projected to nearly double to achieve gross sales of greater than $93B.

And I feel the projection is completely believable (and you may see the small print of the projection by following the hyperlink supplied above). AAPL’s immense set up base already laid the muse for the fast development in its service revenues, which get pleasure from larger margins and higher recurrence.

Supply: Trefis information

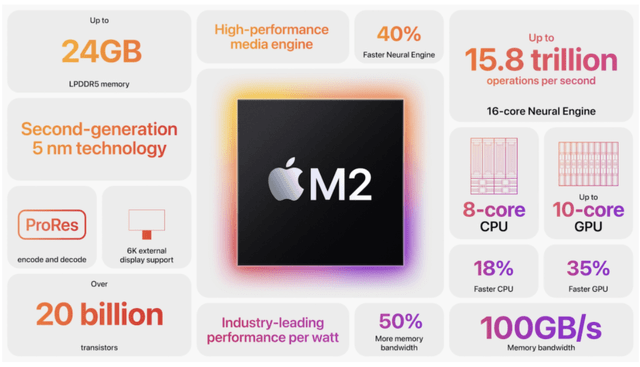

Strategic shift to its personal chips

One other very highly effective catalyst at work in my opinion entails AAPL’s strategic launch of its personal chip traces. Again in June 2022, AAPL unveiled the M2 chip, its next-generation chip following its M1 chip. The M2 chip is designed based mostly on the SOC idea (System on a Chip) and it is developed to be used in each the Macs and iPads product traces. The M2 chip design is vastly higher than its M1 chip and in addition the Intel chip it used to deploy as its CEO Tim Prepare dinner commented within the 2022 Q2 earnings report (barely edited and the emphases had been added by me):

Final month we introduced one other breakthrough with M1 Extremely, the world’s strongest chip for a private laptop. The unbelievable buyer response to our M1-powered Macs helped propel a 15% year-over-year enhance in income, regardless of provide constraints. We now have our strongest Mac lineup ever, with the addition of the solely new Mac Studio.

The M2 chip is extra energy environment friendly and computationally highly effective on the identical time. To wit, based on information from CPU Ninja, drawing the facility, the M2 integrates 25% extra transistors than the M1 (20 billion transistors in complete) and 50% quicker reminiscence velocity than M1 (as much as 100GB/s) reminiscence velocity. These developments are straight mirrored in its finish merchandise akin to battery life and spectacular multi-threaded efficiency in apps just like the Mac Studio Tim Prepare dinner talked about above. Take the battery life in an M2 Mac for instance. With M2 chips, it might probably last as long as 2x longer in comparison with earlier generations put in with Intel chips.

Supply: CPU Ninja information

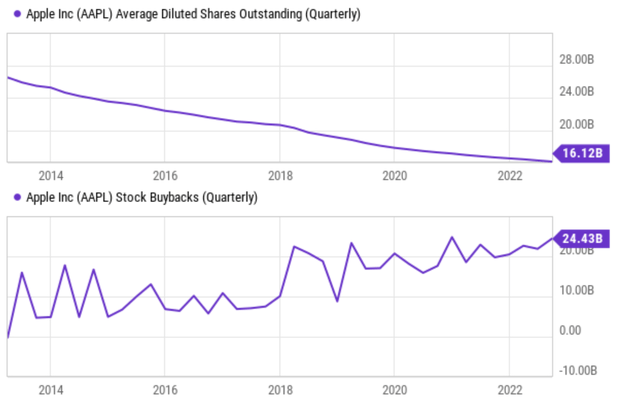

Share buybacks are much more potent now

Lastly, AAPL’s aggressive share repurchases will add one other catalyst, monetary catalysts along with the above enterprise catalysts, to push its valuation again to $3T.

AAPL is a big purchaser of its personal shares lately as seen from the next chart. In 2014 when it first began its share repurchase program, its complete shares excellent stood at 23.5B shares (adjusted for its break up). And now it stands at 16.12B as seen, translating into a complete discount of virtually 1/3 (32.5% to be actual). Every AAPL shareholder now owns 1/Three extra of the corporate than in 2014.

Supply: In search of Alpha information

Trying ahead, AAPL’s tempo of repurchasing will very seemingly proceed, and its money movement definitely can assist it with no drawback. As its CFO Luca Maestri repeatedly talked about the Board’s dedication to share repurchases and AAPL’s plan to change into web money impartial over time. All instructed, in 2022, the board has approved an extra $90 billion for share repurchases within the years to return. And this large $90 billion repurchases solely grew to become stronger on the present compressed valuations as illustrated in my evaluation under.

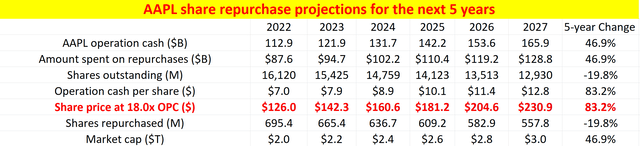

The outcomes are my projected of the share buybacks within the subsequent few years, and my numbers are based mostly on a couple of easy assumptions as detailed in my earlier articles:

- I assumed AAPL distributes the $90B as a continuing proportion of its working money movement, which seems to be 78%

- I assumed that AAPL income develop at an 8% CAGR based on consensus estimates.

- Lastly, I additionally assumed a mean repurchase worth of 18.0x of its working money (which is about its present a number of as of this writing).

You may see that its complete shares rely would additional shrink by one other 19.8% within the subsequent 5 years. And every AAPL shareholder would personal ~20% of the corporate with out actually doing something. Lastly, you may see that its market cap would attain $3.0T someplace round 2026~2027.

Supply: Writer based mostly on In search of Alpha information

Dangers and remaining ideas

To reiterate, there’s certainly a variety of quick headwinds going through AAPL as aforementioned, together with supply-chain congestion, the COVID-19 pandemic, inflation, and in addition the attainable U.S. and even financial development slowdown. These headwinds may immediate companies and particular person shoppers to ease up on their discretionary spending. Nonetheless, I don’t see any long-term structural dangers to AAPL. However these headwinds are extra basic and never distinctive to AAPL. A extra distinctive and severe threat to AAPL is its giant reliance on China. And I’ve a devoted article analyzing its China publicity, entitled Apple’s China Antithesis.

By way of upside dangers to my above evaluation, I see the belief of an 18x money movement a number of as too conservative. A enterprise like AAPL ought to be simply price a minimum of 20x of its money movement. And if its valuation certainly reverts again to 20x money movement, this little reversion would hasten its climb again to $3T to a timeframe round 2025~2026 – you’ve already been warned that the time may be earlier than you assume!