cmart7327/E+ by way of Getty Photos

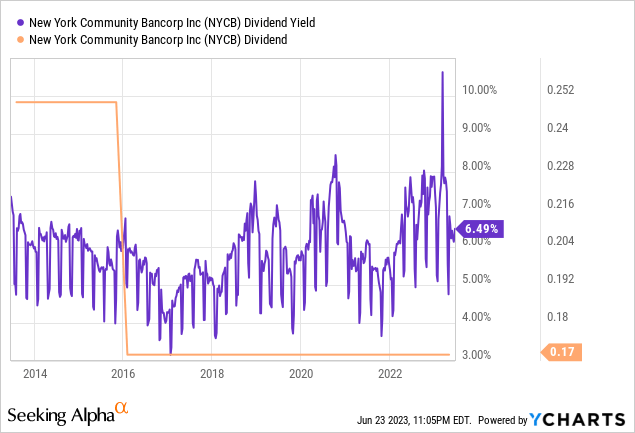

New York Group Bancorp (NYSE:NYCB) has come out as an anticipated winner of the March 2023 banking panic. The widespread shares of the Lengthy Island-based regional financial institution are up 21% year-to-date, outperforming its friends and in addition forward of the S&P 500 by simply over 500 foundation factors. The dividend earnings is the prize right here and NYCB final declared a quarterly money dividend of $0.17 per share, in step with its prior cost and a 6.5% annualized ahead yield. Crucially, the acquisition of property of FDIC-seized Signature Financial institution in March stands to thoroughly change the expansion profile of TBV and dividends which have stagnated for a lot of the final decade.

What is the play right here? That the deal has materially derisked the funding case for NYCB and opened up a chance to build up a place in both the widespread shares or the popular shares. The fixed-income construction of the preferreds, their present giant yield on value, and their low cost to par worth regardless of being backed by a extremely worthwhile enterprise have heightened their funding case.

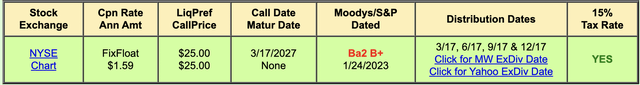

The Sequence A Preferreds And The 7.4% Yield On Value

New York Group Bancorp 6.375% Sequence A Preferreds (NYSE:NYCB.PA) began buying and selling in 2017 when the financial institution offered 20 million depositary shares every representing a 1/40th curiosity in a share of fixed-to-floating price Sequence A most popular inventory. The mounted annual coupon at $1.59 means a 7.4% yield on value in opposition to preferreds presently swapping arms for $21.67 per share. They’re noncumulative like all financial institution preferreds, inherently lowering a layer of safety for its holders and making them much less engaging to comparative most popular securities in industries not topic to the identical stringent capital necessities. Nevertheless, this danger of a coupon suspension is basically near-zero as it could solely ever occur in a state of affairs the place the financial institution was on the trail to FDIC receivership.

QuantumOnline

There are a number of causes to be lengthy right here. Firstly, there are presently buying and selling at a $3.33 distinction to their $25 par worth, a 13% low cost to par worth that may be aggregated with the coupon for complete doable future returns. To be clear, these may be purchased for slightly below 87 cents on the greenback with their name date developing on the 17th of March 2027. While they’re perpetual so NYCB has no obligation to redeem at par at this date, their present yield to name stands at 10.7%. Do you assume the broader inventory market indices just like the S&P 500 or the Dow Jones will be capable of present a close to 11% return per yr over the subsequent 4 years? If not, these preferreds type a low-risk and extra steady various.

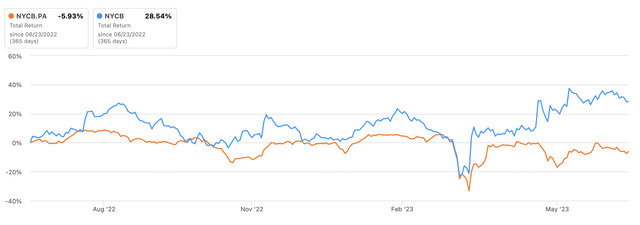

In search of Alpha

Nevertheless, the preferreds have drastically underperformed the commons over the past 1-year by dropping 5.93% versus a acquire of 28.54% for the commons. Zoom out over the past Three years and the Sequence A sport a 1.46% acquire versus a 21.85% acquire on the commons. That the preferreds have underperformed the commons over a interval marked by the kind of macroeconomic disruption that sparks a flight to their sort of security highlights the resilience of the underlying enterprise and market optimism round the advantages of the Signature Financial institution acquisition. Critically, with some forecasts putting inflation as set to stay above the Fed’s 2% goal for a lot of the subsequent yr, each foundation level of potential return needs to be chased and these preferreds have a pretty base coupon price.

Robust Operational Gearing As Deposits Rise And Internet Earnings Ramps Up

The March banking panic was the direct end result of the Fed climbing rates of interest ten consecutive occasions to their highest stage since 2008 at 5% to five.25%. It has probably basically catalyzed a change within the zeitgeist of banking. NYCB’s core danger is that there might be a pertinent flight of insured and uninsured banking deposits to the 4 systematically necessary banks Citi, Financial institution of America, Wells Fargo, and JPMorgan Chase. NYCB final reported income for its fiscal 2023 first quarter of $2.65 billion, an enormous 665.9% enhance over its year-ago comp on account of the acquisition.

In search of Alpha

NYCB introduced in web earnings to widespread stockholders of $159 million, a sequential development of 14% over the fourth quarter as its web curiosity margin expanded by 32 foundation factors to 2.6%. Complete deposits had been $84.eight billion as of the top of the primary quarter, up $26.1 billion from $58.7 billion as of the top of the fourth quarter. Crucially, the $7.65 billion market cap NYCB now has non-interest bearing deposits that type 27% of its complete deposits. Tangible e book worth (“TBV”) per share of $9.86 was a development of $1.63 sequentially over the fourth quarter. Therefore, NYCB’s commons are presently buying and selling at a small 6.2% premium to TBV. The financial institution has meandered by way of intervals of buying and selling at a premium and low cost to TBV over the past 5 years however its TBV soar within the first quarter is unparalleled and set in opposition to TBV that is primarily flatlined for years. I am impartial on the commons on the again of this premium however would contemplate a place later in the summertime was this to invert.