AssetMark Monetary Holdings, Inc. (NYSE:AMK) This fall 2023 Earnings Convention Name February 21, 2024 5:00 PM ET

Firm Individuals

Taylor Hamilton – Head of Investor Relations

Michael Kim – Chief Govt Officer

Gary Zyla – Chief Monetary Officer

Convention Name Individuals

Dan Fannon – Jefferies

Jeff Schmitt – William Blair

Patrick O’Shaughnessy – Raymond James

Operator

Good afternoon, everybody and welcome to AssetMark’s Fourth Quarter 2023 Earnings Convention Name. Presently, all members are in a listen-only mode. Later, we’ll conduct a question-and-answer session and introductions might be given on the time. Right this moment’s name is being recorded.

Now I’d like to show the decision over to Taylor Hamilton, Head of Investor Relations. Please go forward, Mr. Hamilton.

Taylor Hamilton

Thanks, Victoria. Good afternoon, everybody and welcome to AssetMark’s fourth quarter 2023 earnings convention name. Becoming a member of me are AssetMark’s Chief Govt Officer, Michael Kim; and Chief Monetary Officer, Gary Zyla.

Right this moment, they are going to focus on the outcomes for the fourth quarter and introduce AssetMark’s enterprise outlook for 2024. Following our introductory remarks, we’ll open up the decision for questions. We even have an earnings presentation that Michael and Gary will reference throughout their ready remarks. It may be accessed on our IR web site at ir.assetmark.com.

Earlier than I get began, I’d like to notice that sure statements made throughout this convention name are forward-looking statements. These forward-looking statements symbolize our outlook solely as of the date of this name, and precise outcomes might differ materially.

Moreover, throughout immediately’s convention name, we’ll be discussing internet income, adjusted EBITDA, adjusted EBITDA margin and adjusted internet earnings, all of that are non-GAAP monetary metrics. Please seek advice from our earnings press launch and SEC filings for extra info on forward-looking statements, danger elements related to our enterprise and required disclosures associated to non-GAAP monetary info.

And with that, I’ll flip the decision over to my colleague, Michael, take it away.

Michael Kim

Nice. Thanks, Taylor. Good afternoon and welcome to our fourth quarter earnings name. Right this moment, my ready remarks will deal with three subjects. First, I’ll spotlight our document 2023 outcomes. Second, I’ll unveil our refreshed and simplified technique. And lastly, I’ll present an replace on our long-term priorities that I laid out throughout our final earnings name. Gary will then focus on our monetary and working outcomes for the fourth quarter and introduce our 2024 outlook.

Beginning on Slide 3. 2023 was one other document yr for AssetMark throughout many key working and monetary metrics. We ended the yr with a document $109 billion of platform property. We’re serving an all-time excessive of over 254,000 households and over 9,300 advisers, of which 3,123 are engaged. We realized an all-time excessive NPS rating of 72, a testomony of our dedication to our purchasers.

From a monetary standpoint, whole income in 2023 was a document $709 million, up 15% year-over-year, whereas internet income was a document $545 million, additionally up 20% year-over-year. These all-time excessive high line outcomes allowed us to realize greatest ever backside line outcomes.

Particularly, adjusted EBITDA was $250 million for the yr. Adjusted EBITDA margin was a document 35.2% and was up 290 foundation factors year-over-year. Web earnings was $123 million, up 19% year-over-year, whereas adjusted internet earnings was $171 million, up 31% year-over-year. Adjusted earnings per share was $2.30 for the yr, up 30% year-over-year.

In 2023, we additionally superior our penetration into adjoining channels reminiscent of RIA channel with integration of Adhesion Wealth and the financial institution belief channel with our introduced partnership with Accutech Cheetah. We’re already seeing significant contribution from Adhesion and have a couple of early wins to announce from Cheetah, together with First State Financial institution in Texas and Nationwide Alternate Financial institution in Wisconsin.

Turning to Slide 4. We’re simplifying our technique, changing our earlier 5 strategic pillars, our three refreshed and simplified pillars that higher align to our mission of constructing a distinction within the lives of our advisers and their purchasers. For these which were following the AssetMark story for some time, these new pillars will sound acquainted.

Our first pillar is providing a versatile built-in know-how. Our know-how suite is absolutely built-in with our core proprietary know-how with third-party instruments that assist advisers get issues accomplished extra effectively and successfully, which permits them to spend extra time with their purchasers. This fosters deeper adviser and shopper relationships, which in flip contributes to larger loyalty and extra property on our platform. We consider that our know-how is a key differentiator and serves as a aggressive benefit amongst our friends.

The second pillar is delivering distinctive service and consulting. Our advisers are within the relationship enterprise, so we’re within the relationship enterprise. Nearly half of our workers are adviser-facing, with the only mission of constructing a distinction with our advisers and their purchasers. Our greatest-in-class enterprise consulting providing helps our advisers with enterprise technique and planning, shopper expertise in operations, advertising and marketing and different key applications to extend the adviser’s enterprise worth and effectivity.

The third and remaining pillar is our compelling wealth options. Our deal with asset administration begins with the shopper. Our merchandise and people of our companions are simple to grasp and use and they’re constructed with the advisers and their purchasers in thoughts. We carry out cautious due diligence to assist be certain that we provide a variety of well-suited merchandise to assist traders attain their long-term targets.

As well as, we’re dedicated to a holistic suite of wealth planning options to empower our advisers to serve the rising wants of their purchasers much more successfully. 2023 was a monumental yr executing on these three pillars, and we now have plans to double down in 2024. Let’s go into every one in additional element.

Turning to Slide 5. We now have made vital progress enhancing our know-how providing in 2023. It begins with our enhanced eWealthManager platform, most notably the pilot of our new adviser dashboard, which engages customers in a pretty cohesive design and gives instruments that permit advisers and customers to be proactive and handle their expertise. The adviser dashboard has obtained optimistic critiques from advisers within the pilot who’ve raised about its helpful and intuitive nature.

In 2023, we additionally launched our cell app, which has over 6,400 downloads. Adhesion continues to deal with enhancing their adviser platform as nicely, together with the Adhesion Tax Alpha Dashboard, which brings the power to visualise tax alpha, not just for accounts, but additionally at a enterprise unit and agency stage.

Voyant launched the Voyant Wellness in late 2023, a module-based resolution designed for enterprise firms to supply their purchasers, a customized mixture of self-directed instruments and providers that assist them plan for his or her monetary futures.

As we now have mentioned earlier than, applied sciences on arm’s race. And in 2024, we now have plans to proceed to boost our know-how providing. We are going to proceed to advance to work on constructing out the subsequent model of eWealthManager specializing in the rollout of the adviser dashboard to all advisers and their groups.

Our plan is to boost our adviser insights, permitting the advisers to see a complete e-book view of their property, internet flows and charges. We’re planning so as to add options that permit the advisers to assemble extra info from prospects, deepening the connection and growing the chance to show prospects into purchasers.

In 2024, Adhesion will speed up growth efforts to advance their know-how and platform. They’re investing in offering the {industry}’s perfect mannequin market for RIAs and specializing in enhancing their Adhesion Alliance program. Voyant additionally has thrilling plans for 2024 with the launch of recent wealth administration options, together with social safety optimization, uncooked conversion and superior insurance coverage modeling. They’re additionally launching new retirement planning options, most notably Voyant Longevity Danger and Voyant Lengthy-term Care and Incapacity applications. Merely put, we’re reimagining the adviser’s digital expertise.

Turning to Slide 6. Our second pillar is delivering distinctive service and consulting. As I discussed earlier than, we consider this can be a aggressive benefit for AssetMark. In early 2023, we launched our InvestmentConsulting providing, offering choose advisers direct entry to the funding, the AssestMark InvestmentConsulting group for steerage and creating personalized mannequin portfolios utilizing methods out there in our platform.

Our Funding Consulting group labored on 60 totally different alternatives in 2023 with over $2.5 billion in asset commitments. Additionally in 2023, we tackled one of many largest obstacles going through our advisers, succession planning by means of the launch of AdvisorLink, a personal succession market for our advisers to put up and seek for alternatives amongst vetted advisers. As of year-end, over 200 advisers had been leveraging AdvisorLink with roughly two-thirds setup as consumers on the platform. In 2024, we’ll proceed to deal with constructing out our service and consulting technique to additional distance ourselves from the competitors.

The most important spotlight is introducing the touchless new account opening at AssetMark Belief, which can speed up the onboarding of purchasers by means of a quicker account setup and funding. Adhesion can be dedicated to elevating the adviser expertise to new heights. To try this, Adhesion has expanded their Govt Management group to deal with enhancing the advisers expertise, expanded their service group, including seven new shopper service specialists and is concentrated on additional integration with AssetMark to drive extra scale and expertise for advisers.

Let’s flip to Slide 7 and focus on our third pillar, compelling wealth options. As we talked about earlier, our 2023 share pockets survey exhibits that we now have over $380 billion of whole enterprise alternative for all advisers who’ve responded. By persistently including our wealth options providing, we construct a greater providing for our advisers and their purchasers, whereas growing the chance to achieve share of pockets from current advisers and, after all, attracting new advisers.

In April, we launched three First Belief methods that span the funding spectrum from core to satellite tv for pc. In October, we launched Kensington Managed Earnings technique to offer traders with the potential to generate secure above-average whole returns with low drawdowns. These new methods have been utilized by over 650 advisers and have gathered near $1 billion in property to this point.

In September, we launched the pilot of Tax Administration Companies. Early TMS customers have celebrated the intuitive consumer expertise, client-facing proposals and informative reviews. The worth offered by the service relative to its price is especially compelling. Adviser adoption throughout the three month, early entry interval has exceeded our expectations with greater than $100 million in property already utilizing this service. In 2023, Adhesion additionally executed on enhancing their compelling wealth options, including 88 merchandise from 33 distinctive managers. Of the 33 managers, 9 had been new introductions to the Alliance program.

This yr, we’re targeted on persevering with so as to add and improve our wealth options. In the beginning, final month, we formally launched TMS to all our advisers. Within the first half of the yr, we’re launching Certificates of Deposit Account Registry Companies or CDARS, CDARS are time period financial institution deposits and are an environment friendly approach to entry CDs with enticing charges and prolonged FDIC insurance coverage by means of a community of banks. Merely put, it will improve our money administration providing, making it extra aggressive, whereas additionally assembly advisers to primary request, increased charge choices out there for purchasers of all wealth ranges.

Subsequent, we’re targeted on enhancing our Donor Suggested Fund Program with decrease account minimums, sturdy reporting capabilities, streamline processes for grants and talent to customise portfolios by means of current platform methods. These enhancements will assist advisers entice extra traders, particularly within the increased internet value section, whereas strengthening relationships with current purchasers. As you possibly can see, we now have achieved quite a bit in 2023, and we’ll proceed to boost and add to our platform in 2024 to present our advisers and their purchasers an industry-leading expertise.

Turning to Slide 8. I need to present a short replace on how we’re progressing on our long-term targets that we carried out final quarter with the aim of enhancing shareholder worth. First, hyper progress. As I mentioned final quarter, we’re completely dedicated to exceeding 10% natural progress charge and exceeding 5,000 engaged advisers by finish of 2026. We’re persevering with to see inexperienced shoots that natural progress is coming again. In December, we realized internet flows north of $625 million and noticed internet flows north of $430 million in January of this yr.

Relating to our AM 5K initiative, we ended the fourth quarter with 3,123 engaged advisers at all-time excessive. We’re targeted on initiatives to get our greater than 800 advisers who’re between $Three million and $5 million of property on our platform to the engaged stage, whereas additionally bettering the time and charge of NPAs to the engaged stage. Gary will present much more particulars on this later throughout his ready remarks.

Second, we elevated our CapEx as a share of whole income to eight% to 10%, permitting us to take a position extra into the enterprise, particularly into initiatives that drive progress and scalability reminiscent of Accutech Cheetah. Lastly, we’re targeted on scaling our enterprise. In 2023, we expanded margins 290 foundation factors, and we’ll take a look at alternatives like our touchless new account opening initiative as mentioned earlier, to drive additional scale into the enterprise. Particularly, we’re targeted on lowering the fee per account by over 30% by 2026.

With that, I’ll now flip the decision over to Gary to take us by means of a deeper dive on our fourth quarter outcomes and introduce our 2024 outlook.

Gary Zyla

Thanks, Michael and good afternoon to all these on the decision. As Michael talked about earlier, 2023 was one other document yr for AssetMark. Throughout my remarks immediately, I’ll spotlight our leads to the fourth quarter after which introduce our 2024 outlook.

So beginning on Slide 9. Fourth quarter platform property elevated 19% year-over-year to $108.9 billion. Quarter-over-quarter, platform property had been up 9%, pushed by a market influence internet of charges of $8.1 billion and quarterly internet flows of $1.Three billion. Annual internet flows as a share at first interval property was 6.7%. We’re incurring for our robust internet flows in December and early 2024.

Turning to our advisor metrics. We added 154 new producing advisers or NPAs within the quarter and 666 NPAs for the complete yr. We’re happy of the standard of those NPAs is far increased than it has been prior to now. Out of the 666 NPAs in 2023, 7.5% have already achieved engaged adviser standing throughout their first calendar yr, an enchancment of roughly 20% over the prior yr’s charge.

As a part of our AM 5K initiative, we’re actively targeted on 4 key areas to enhance our NPA to have interaction conversion charge. First, attracting extra NPAs by means of digital lead technology, robust broker-dealer relationships and RIA initiatives; second, specializing in higher-value NPAs or those that initially onboard not less than $1 million of property to the platform. Third, implementing a a lot smoother onboarding course of with the rollout of touchless new accounts, which Michael talked about earlier. And lastly, enhancing our product providing, which can entice extra high-value advisers to our platform.

On Slide 10, we present our engaged adviser depend. We ended the fourth quarter with a document 3,123 whole engaged advisers, up from 2,995 engaged advisers within the third quarter and up 8.4% from final yr. Whereas the quarter-over-quarter improve was largely pushed by market, we did add 34 new engaged advisers organically with incremental internet flows.

Our engaged advisers account for 33% of all of the advisers utilizing our platform and make up 93% of our platform property. Along with the asset stage and adviser depend, the third approach we measure our progress, which is non-asset based mostly, is the variety of households on our platform. The variety of households had been up greater than 5% year-over-year to 254,000.

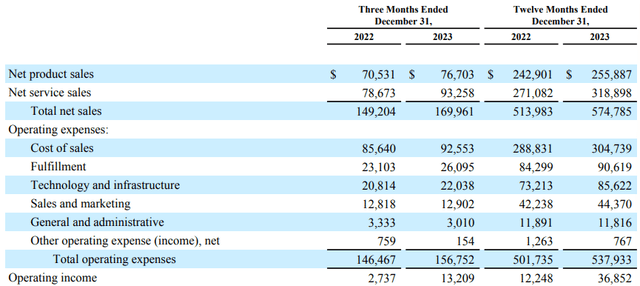

Now let’s flip to Slide 11 to debate this quarter’s income. Earlier than we start, I need to name your consideration to a $30.5 million reclassification and spread-based bills to spread-based income. This quantity displays the curiosity credited to buyer accounts for all of 2023. Bills associated to curiosity credited to buyer accounts was beforehand recorded in spread-based expense. And in prior years, this was not materials. As a part of our technical accounting assessment for 2023, we’ve elected to make this adjustment to internet this price out of the gross income line.

As famous, the adjustment equally offsets our 2023 gross income and spread-based bills. There is no such thing as a influence to internet income and no influence to our earnings from this reclassification. For readability, proven on this web page is our whole income on a professional forma foundation, reflecting the brand new accounting therapy.

As proven within the fourth quarter, whole income on a professional forma foundation was $180 million, up 13% year-over-year. However as you understand, we deal with our income internet of associated variable bills. For the fourth quarter 2023, our internet income was $137 million, up 11% year-over-year. All 4 parts of our income elevated year-over-year with subscription-based earnings main the best way, up 22%.

Slide 12 particulars our year-over-year internet income stroll. Asset-based income was up $9.7 million year-over-year, $12.9 million of that improve might be attributed to the $12.2 billion improve in billable property, excluding the Adhesion acquired property. Asset-based income was additionally augmented by an incremental $1.Eight million of income from Adhesion Wealth. These will increase had been partially offset by charge compression of roughly 1 foundation level, which is consistent with our said expectations.

Unfold earnings was up $1.1 million year-over-year, pushed by yield enchancment of 327 foundation factors to 405 foundation factors. Of this whole yield, our securities-backed line of credit score program or SBLOC, contributed 10 foundation factors, excluding the contribution from SBLOC, internet yield for the quarter was 395 foundation factors. Subscription income from Voyant was of roughly 22% year-over-year, pushed by progress in software program income. Lastly, different earnings elevated $2.5 million year-over-year pushed largely by increased curiosity earnings earned on our company money.

Now let’s focus on bills. Turning to Slide 13. You’ll word that we’re displaying unfold bills professional forma for the accounting change famous earlier. On a professional forma foundation, whole adjusted bills elevated 7.8% year-over-year to $122.5 million. Quarterly adjusted working bills had been up rather less than 2% year-over-year to $70.6 million, pushed by a rise in worker compensation, partially offset by a lower in SG&A. Worker compensation elevated $2.Three million or 5.9%, whereas headcount remained primarily flat year-over-year. SG&A decreased $1.2 million or 3.9% year-over-year, pushed by strategic and timing objects.

Now I’ll rapidly run by means of our changes for the quarter as we all the time did. Within the fourth quarter, we added again roughly $12 million pre-tax, which is primarily composed of three objects. For a $4.1 million in non-cash share-based compensation, we anticipate roughly $4.5 million per quarter within the first half of 2024 and $5 million per quarter within the second half of 2024. The second adjustment is $4.Eight million associated primarily to reorganization and integration prices. And lastly, $2.2 million of acquisition-related amortization.

Now let’s flip to Slide 14 to debate our earnings for the quarter. Fourth quarter adjusted EBITDA was $63.Eight million, up 21% year-over-year, whereas our adjusted EBITDA margin, once more, on a professional forma foundation is 35.4%. Our reported internet earnings for the quarter was $34.6 million, whereas adjusted internet earnings was $44 million or $0.59 per share. That is based mostly on the fourth quarter diluted share depend of $74.6 million. Our estimated tax charge for the complete yr is 24%. For additional colour, please see the adjusted internet earnings stroll on Slide 22.

Now let’s take a look at the reported fourth quarter stability sheet. I might spotlight two objects. First, we proceed to do an amazing job of producing money. We generated a strong $175 million in money from working actions within the full yr 2023. Second, our capital spend was $11.Four million or 6% of whole income from the fourth quarter. As we now have talked about beforehand, we’re growing our CapEx run charge in 2024 to eight% to 10% of whole income in order that we will put money into extra progress and scalability initiatives.

Now turning to Slide 15. I wish to present my quarterly replace on our spread-based income and its drivers. First, let’s focus on our money balances. Within the fourth quarter, whole money as a share of property ATC was 3.8%, of which, ICD or our non-discretionary money was 3.2%. Money as a share of platform property is down barely because of the rising market worth of property with increasingly more methods placing cash to work meet fairness of this earnings markets.

Though the Fed goes to take down charges in 2024, we stay nicely forward in having a portion of the insured money deposits in mounted charge agreements. As of December 31st, 45% of money at ATC is in a set charge time period with a median maturity of two.28 years and a progress charge of 4.77%. Additionally as a reminder, our income combine as a pure hedge as we might anticipate Fed fund reductions to have a positive influence on our asset-based income.

Lastly, let’s flip to Web page 16 to introduce our 2024 outlook. We’re uber thrilling about 2024, robust progress with a singular deal with serving our monetary advisers. Our platform asset steerage is 12-plus % as we anticipate to extend flows year-over-year, roughly 50%, reflecting robust progress in our core enterprise and outsized progress in our Adhesion enterprise.

We might be concentrating on internet flows as a share of beginning-of-period platform property within the vary of 8% to 10%, coupled with our annual market appreciation assumption of three.5%. Our 2024 internet income annual progress goal of 10% to 14% because of robust momentum in the long run of 2023. Our first quarter billing accomplished in January was boosted by the robust year-end market, and we’re inspired by our internet flows year-to-date. Our forecast has double-digit progress throughout our main income line objects.

We now have set working bills, which encompass compensation SG&A to extend 8% to 10%. We’re assured at this stage of such progress permits us to proceed to meaningfully make investments sooner or later enterprise, whereas sustaining self-discipline in order that expense progress is not going to outpace income progress. As all the time, we’re targeted on realizing improved margins on our income and rising earnings. We anticipate our adjusted EBITDA to be up 15% plus year-over-year, and we anticipate margin growth north of 50 foundation factors for the yr.

With that, I’ll hand the decision again to Michael for his concluding remarks.

Michael Kim

Thanks, Gary and thanks to everybody on the decision immediately. I sit up for seeing you in particular person on the upcoming investor conferences. This concludes our ready remarks. I’ll now flip the decision again to the operator to start our Q&A.

Query-and-Reply Session

Operator

In fact. We are going to now start the question-and-answer session. [Operator Instructions] Our first query comes from the road of Dan Fannon with Jefferies. Your line is now open.

Dan Fannon

[Technical Difficulty] You’re clearly bettering in January or to start out the yr. Simply curious as to what you suppose are among the drivers of that acceleration as you concentrate on the yr progressing? I believe you talked about Adhesion being part of that. I don’t know for those who’re capable of break down what you suppose the contribution from that platform could be versus the remainder of the enterprise?

Michael Kim

Hey, there. Thanks in your query. You chop out somewhat bit on the entrance finish, however I believe actually the gist of your query was the contributors and the drivers for our progress and actually type of ideas round Adhesion and its contribution to the general progress. So let me begin right here after which Gary, please chime in with extra particulars.

So we’re completely seeing actually a renewed turnaround from the advisers and their traders and their purchasers and actually the sentiment. A few issues I simply need to point out, and we noticed this, clearly, with the market enchancment within the fourth quarter, and definitely, we’re seeing this as we begin the primary quarter of this yr.

Quite a lot of the property that had been sitting on the sidelines, among the {industry} surveys level to over $2.5 trillion of money sitting on the sidelines, and we see a variety of these money coming again into the market and actually advisers working very intently with their purchasers to assist them discover the suitable options to satisfy the purchasers’ targets. And so we’re seeing on the macro stage, that sentiment bettering.

Secondly, from an Adhesion perspective, we’re completely seeing a really accelerated momentum with Adhesion. Actually, their January of 2024 flows had been nearly double what they did final yr’s January. And so we’re completely seeing the momentum develop. An enormous a part of the Adhesion story is basically round our dedication to bringing our world-class service and operational expertise to the Adhesion advisers. There’s been a variety of arduous work amongst the groups to essentially combine the AssetMark service and operation processes into the Adhesion platform. So we’re beginning to see dividends repay of that effort.

The opposite facet is basically the expanded govt and gross sales administration group, one of many key issues that we’re targeted on is working intently with the strategic purchasers of Adhesion to not solely increase the share of pockets, but additionally assist with their recruiting efforts. Lots of the purchasers of Adhesion are the strategic RIA companies on the market recruiting both breakaways and/or different advisory companies. And so, Adhesion is an integral a part of that recruiting course of, and we’re delighted to see the momentum proceed with Adhesion. Gary, every other ideas so as to add on to that query?

Gary Zyla

Yeah. Hey, Dan, how are you doing? Good to speak to you once more. I believe we’re nonetheless not going to be breaking out Adhesion’s outcomes while you say from the remainder of the enterprise. I’ll word Adhesion got here on the platform on the finish of 2022 with about $7 million of property. It includes somewhat bit over $9 billion of property in our platform now. And that’s actually indicative of the robust natural progress that Michael was speaking about, and its robust contribution to our enterprise. So we’re actually enthusiastic about each the initiatives we now have on the core enterprise, new advisor acquisition, pockets share alternatives in addition to the Adhesion enterprise mannequin.

Dan Fannon

Nice, thanks. After which simply as a follow-up, final quarter, you talked about an elevated deal with M&A and partnerships, and it was reiterated once more immediately. So possibly discuss in regards to the present setting that you simply’re seeing and the sort of prospects of areas that usually you’re to doubtlessly fill these holes.

Michael Kim

Yeah. No, thanks once more for that query. And also you’re completely proper. M&A, as we talked about final quarter and definitely reiterated this quarter, it stays a vital a part of our total progress technique. There’s two areas that we’re targeted on when it comes to key M&A alternatives. One is basically the consolidation alternatives. And the second is capabilities.

One of many key issues that we deliver to a possible vendor within the market is basically the size that we deliver, our credibility and the famend the service and the adviser expertise that we ship, the distribution community that we now have. And so we’re engaged in quite a lot of high-quality companies that want to be a part of the AssetMark ecosystem.

And what’s actually distinctive right here is that along with these companies, we now have a chance to deliver this distinctive joint worth to the advisers. And so we’re completely excited and dedicated to accelerating our acquisitive mode that we now have. And positively, even on the potential aspect, we’re quite a lot of totally different know-how suppliers, asset administration suppliers and even advertising and marketing and lead technology suppliers for advisers to assist them develop.

And so there’s a variety of distinctive property. Our company growth group is heads down, working very arduous and managing a really lively pipeline. And so we hope to share quite a lot of nice information with the viewers within the close to future, however that’s completely an necessary a part of our total technique. Gary?

Gary Zyla

Yeah. And Dan, I might simply add to that, as Michael mentioned, over the previous, let’s name it, six months, we’ve actually reinvigorated most of these dialogue. And, after all, M&A, there’s a variety of methods to consider it. As Michael mentioned, consolidation and the capabilities and what you’re wanting so as to add, however you should buy, you possibly can companion, you possibly can change into a minority investor, there are lot of various methods we’re attempting to place that capital to work. Accutech Cheetah is one instance the place an acquisition occurring there, however we’re investing some huge cash to create this partnership. And whereas that’s not actually M&A that’s actually one thing that’s an inorganic place to begin to sort of for progress.

Dan Fannon

Nice. Thanks.

Gary Zyla

Thanks, Dan.

Operator

Thanks in your query. The subsequent query comes from the road of Jeff Schmitt with William Blair. Your line is now open.

Jeff Schmitt

Hello, thanks. On shopper money, it seems to have stabilized round $2.9 billion to $Three billion while you modify for seasonality. And simply concerning the place which will go, what are you seeing when it comes to new money coming in from natural progress? Is that largely sorted already? And so it isn’t offering a lot of an uplift to shopper money? Or ought to we anticipate to see some uplift from that this yr?

Gary Zyla

That’s an amazing query, Jeff, and good discuss to you once more. So right here I’ll begin after which Michael be happy to return up on any extra particulars. However right here I need to body this. Most of that money debt is the non-discretionary money. This isn’t the top investor selecting it. That is allocating a part of their technique to money.

And subsequently, it’s not likely inclined to the money finding out what the banks are coping with. However it’s a reflection as that % has settled. It’s positively round 4% of our whole AssetMark Belief property. And as that money and that share is settled proper now within the 3.8% we mentioned immediately, that’s a mirrored image motion to the technique is placing that cash to work as a result of they’re getting extra confidence within the fairness markets.

Now that being mentioned, the money stability grows as our asset stage grows. So once we consider our total asset stage rising that 10% to 12% we talked about for the upcoming yr, that’s going to be mirrored in our money balances at our Belief firm. To the extent that we now have an outsized amount of cash undergo our Belief firm versus different custodians, that may even additional assist the expansion of our money that we are going to put to work.

Michael Kim

I believe possibly simply to construct off of that, Jeff. A few different issues to think about. So primary, to Gary’s level, we’re seeing simply given the improved sentiment and the traders coming again into the fairness market that we’re seeing increasingly more of the strategist deploying the money into their methods and to the fairness allocation.

On the similar time, actually, given the growth into adjoining markets, and Gary alluded to the Accutech Cheetah, which is basically our partnership that may assist us increase into the regional banks and regional belief firms. We consider that the brand new relationships that we signal on, which may even be custodied at ATC, that may add to the general money balances as nicely. So we’re tremendous enthusiastic about that new partnership and the extra balances that we all know will these relationships will drive.

After which the opposite factor that, once more, simply to underscore Gary’s factors earlier, one of many distinctive issues about our mannequin is simply the pure income hedge that we now have. And I believe all of us anticipate in some unspecified time in the future, in all probability longer than anticipated. However in some unspecified time in the future, the Fed will start to scale back their charges.

In a approach, we really welcome that in that given our income mannequin, we all know that, that’s going to create a tailwind for the asset-based income stream as nicely. So one of many key and actually the distinctive features of our income mannequin is that there’s this pure hedge in-built between the unfold income and the asset-based income. And so we’re absolutely ready for these adjustments which are forthcoming.

Jeff Schmitt

Okay. Yeah, that’s very useful. After which I assume that takes me to the subsequent query. Simply , I believe you might have 45% of money getting mounted charge now. Common maturity continues to be pretty low 2.Three years. Is there doubtlessly – might we anticipate to see roll that over into 4, five-year contracts, particularly with the Fed more likely to lower in some unspecified time in the future right here? And like what kind of charge, I assume, might you get for that if you’re that?

Gary Zyla

In order that’s an amazing level, Jeff, and we even have simply began that. So I consider beforehand once we talked, we had like a one, two and three-year ladder when it comes to our contracts. We did only in the near past add one contract for 4 years and one contract in a 5 yr to increase it. I believe it was like simply we prolonged the time period from like 2% to 2.2%, no matter it’s now. So we completely are targeted on extending that. Now there’s the trade-off in charge and whatnot.

And I can’t really inform you what these charges at the moment are within the 4 and 5 yr on high of my head, however that’s our consideration to be sure that we’re not giving up an excessive amount of worth in extending it. The aim of getting the mounted charge but is to present us a great glide path 18, 24, 30 months or so, that good glide path, the place Michael identified, we now have this pure hedge that charges come down, fairness markets ought to rebound and that glide path may also help us match the income offsets successfully.

Michael Kim

Yeah. I imply, Jeff, the one factor I might add is that our product group, they do a wonderful job. We now have a month-to-month pricing committee assembly, and it’s actually our approach and the method that, that group has integrated, it’s a approach for us to actively monitor and make the suitable changes. We need to be sure that we put actually the liquidity and the shopper expertise as our first precept, however actually, there’s a very stringent course of in place to have common and lively monitoring of the mounted phrases and be sure that we’re optimizing the money balances at ATC immediately.

Jeff Schmitt

Okay, nice. Thanks.

Gary Zyla

Thanks, Jeff.

Operator

Thanks. Thanks in your query. The subsequent query comes from the road of Patrick O’Shaughnessy with Raymond James. Your line is now open.

Patrick O’Shaughnessy

Hey, good afternoon. So in December, Bloomberg reported that Huatai was exploring strategic choices for its funding in AssetMark. I’m positive you possibly can’t or don’t need to converse for them immediately, however what have they communicated to you guys about this course of?

Michael Kim

Hey, Patrick, thanks for the query. Yeah, I imply, clearly, I believe we’ve seen all these totally different articles as nicely. And as you talked about, our place is that we don’t touch upon these rumors and most of these articles. What we will inform you, Patrick, is that, we now have common conversations with our majority shareholder in addition to your complete Board, they continue to be very, very supportive of the enterprise and your complete administration group.

With that in thoughts, one of many key issues that we speak about on a really common foundation as a administration group is, actually desirous about the three key areas of our focus. The natural progress, we discuss continuous about getting again to that 10%-plus natural progress charge, as we talked about. Quantity two, let’s be sure that we deploy the capital in a proper approach and focus and have that basically focused deal with the fitting M&A alternatives. We consider that we now have a chance to essentially win in a strategic approach, leveraging the entire monetary assets that we will deliver in addition to our place available in the market.

After which the third space of focus is basically driving scale. We talked about quite a lot of the automation initiatives, the touchless new accounting opening initiative for instance. And our aim is to essentially take away as much as about $25 million of operational prices over the subsequent few years. And so these are the important thing areas that we’re tremendous targeted on, Patrick.

Look, clearly, there’s a variety of distractions and rumors and discuss. One of many key issues that we now have the management group, we discuss quite a bit about is a much less deal with what’s inside our management and never get hung up on the totally different articles and the rumors which are floating on the market. And once more, going again to the Board, they’re simply tremendous supportive of your complete group and the enterprise. And so we’re excited by the chance and actually the momentum that we now have within the enterprise right here immediately.

Gary Zyla

Yeah. Patrick, I might simply add that we’ve received 1,000 workers and our 9,000 advisers right here, and we’re targeted on an amazing 2024. Speaking somewhat in regards to the outlook already and the Board has been so supportive of the funding that Michael has stepped up for 2024 and for our know-how spend, et cetera. And so we received our mission clear for ourselves, and that’s fixed, and that motivates all our workers and our service to the advisers.

Patrick O’Shaughnessy

Okay. Honest sufficient. Admire that. After which along with your Tax Administration Companies resolution, is that an incremental monetization alternative for you guys?

Michael Kim

Yeah, completely. I’ll begin after which Gary, please share some specifics on the monetary worth there. So Tax Administration Companies or TMS, it’s an incremental service with an incremental income alternative, 10 foundation factors progress when it comes to what we cost to our purchasers. And Patrick, I can inform you, I imply, I’ve been with the agency for over 13 years now. And this is among the most enjoyable initiatives that we’ve launched and that it’s being obtained so nicely by our advisers, they usually see the worth. They’re tremendous excited by it.

As I discussed earlier, we’re getting extra property being enrolled into this program than ever earlier than. And so that is a type of distinctive applications the place we all know that it’s resonating. And whereas the top purchasers, they’re engaged with their advisers and understanding and wanting to grasp totally different portfolio development methods and all of the nuances in regards to the portfolio.

However on the finish of the day, the top purchasers, the traders, they perceive taxes they usually view, they give the impression of being to their advisers as actually the steward of not solely the assembly the monetary targets, however tax administration. And so I can’t say sufficient in regards to the alternatives that TMS is creating not solely from a income and tax perspective, but additionally to essentially entice new producing advisers onto the platform.

And one of many large upticks that we’re seeing from an NPA perspective is basically associated to the joy round TMS. And so Gary, you know the way a lot I’m enthusiastic about TMS. And why don’t we share with Patrick among the monetary worth that TMS will deliver to the agency?

Gary Zyla

Positive. So Patrick, this can be a nice alternative for us to – usually, most round pricing, the wrap pricing, which is like Michael mentioned 10 foundation factors, so many people at AssetMark have spent a great 18 months constructing the system, a major capital spend to set this up and the partnership we now have. And it’s a pleasant instance of the place this win-win-win throughout, purchasers to be realizing materials enhancements of their tax place. Advisers now have one other instrument of their quiver, one other arrow of their quiver to service their purchasers, and we had been capable of tax a few of these economics.

Patrick O’Shaughnessy

Nice, thanks.

Operator

Thanks in your query. There are presently no questions registered. [Operator Instructions] There aren’t any extra questions ready presently. I might now prefer to move the convention again to Michael Kim for any closing remarks.

Michael Kim

Nice. Thanks. Let me simply wrap up with an enormous, large thanks to all of you which have joined us right here immediately in addition to everybody that’s supporting AssetMark. We actually worth the partnership and your continued help, and we’re enthusiastic about 2024 and an enormous, large shout out to the entire AMK workers who make it occur each single day. So with that, thanks, everyone, and we’ll name it a wrap. See you everyone.