Falcor

Funding Thesis

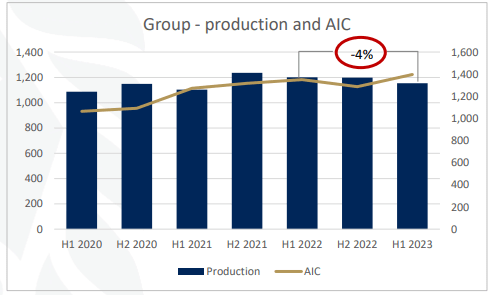

Gold Fields Restricted (NYSE:GFI) is a gold mining firm headquartered in South Africa with 2.25Moz in gold equal manufacturing per yr and $1,381/ouncesin AISC (all-in sustaining prices).

Along with natural growth by GFI, there are vital secular tailwinds for gold, which we focus on in our article on the fashionable gold market. Gold reached a historic all-time excessive of $2,122/ounceson December 3. Gold has been a traditionally steady worth asset, one of many few choices now that Treasuries have fallen out of favor internationally, hinting at its potential to maintain excessive costs.

GFI has skilled vital headwinds with above-inflation labor value will increase and reduces in manufacturing. Nonetheless, GFI has a major low-AISC growth alternative with the Salares Norte Venture and has lately entered JVs in Ghana and Canada. GFI’s strategic expansions, future portfolio actions, and powerful monetary well being, mixed with the favorable dynamics of the gold market, place it as a robust dividend payer with modest development.

Estimated Honest Worth

EFV (Estimated Honest Worth) = EFY25 EPS (Earnings Per Share) occasions P/EPS (Worth/EPS)

EFV = E25 EPS X P/E = $1.40 X 13.2 = $18.48

Analyst consensus places the E25 EPS at $1.33, nonetheless, we really feel that gold costs being sustained for longer a better estimate for the longer term. Equally, the consensus P/E is round 10.0, which we really feel is a low a number of given the peer group and broader mining market circumstances.

|

E2024 |

E2025 |

E2026 |

|

|

Worth-to-Gross sales |

2.7 |

2.6 |

2.5 |

|

Worth-to-Earnings |

12.4 |

13.2 |

12.3 |

Portfolio Overview

|

Quarter ending September |

AISC (all-in sustaining prices) ($/Oz) |

Manufacturing (Gold Equal kOz) |

As a % of complete Adjusted Free Money |

|

Americas |

$1,762 |

51.7 |

15% |

|

West Africa |

$1,485 |

185.4 |

24% |

|

Australia |

$1,272 |

244.1 |

41% |

|

South Africa |

$1,309 |

80.7 |

20% |

|

Complete |

$1,381 |

546 |

Adjusted FCF is the same as working cashflow much less capex, capital leases, and environmental funds.

Manufacturing is concentrated in Australia and Ghana, making up a lot of the manufacturing within the portfolio. Whereas usually dearer on common, these areas are geopolitically way more steady, with excessive security requirements and restricted labor disputes. South Africa had some difficulties with weather-caused floor circumstances, lowering full-year steering by 5%. The strongest space was Peru, with a 4% improve in manufacturing as a consequence of larger grades recovered.

The Americas’ AISC has spiked following a major uptick in working expenditures related to the early levels of manufacturing for the Salares Norte challenge. Salares Norte is the most important absolutely owned growth asset and is predicted to see its first gold in April 2024. Mining operations have already begun, with an estimated 520kOz of gold stockpiled in 2.Three million tons of ore. Nonetheless, the mill is the ultimate uncompleted step.

|

AISC (all-in sustaining prices) ($/Oz) |

Yearly Manufacturing (Gold Equal kOz) |

|

|

2024E |

$700 |

220-250 |

|

2025E |

$700 |

600 |

|

2024E-2029E (Prime Years) |

$700 |

500 |

|

2024E-2033E (Full Life) |

$780 |

355 |

The $700/ouncesAISC estimate would make Salares Norte one of many most cost-effective gold mining operations on this planet.

Enlargement

With the conclusion of the total $1.2 Billion expenditure related to the Salares Norte mine, we count on a discount of capital expenditure over the brief time period. Nonetheless, there are two additional main growth initiatives that, as soon as authorised, will probably improve capex spending.

In March of 2023, GFI introduced the Tarkwa growth JV with AngloGold Ashanti in Ghana, with ongoing negotiations with the Ghanaian authorities. The present Tarkwa mine is reaching the top of its life, with gold output lowering 13% yearly as a consequence of decrease yield. The growth JV might develop into the most important gold mine in Africa, considerably increasing output and decreasing AISC. Preliminary reviews from GFI count on an AISC of $1,000/ouncesfor the primary 5 years, with over 18 years of mine life.

The Windfall challenge is a brand new Canadian growth and a 50-50 JV with Osisko Mining. GFI has paid the preliminary cost of $222 million, with a further $34 million in pre-construction prices. In Could of 2023, GFI submitted its first environmental affect evaluation for approval by the Canadian authorities. It will probably obtain preliminary approval by the quarter ending June 2024, with full approval for building by the top of 2024. As soon as authorised, GFI pays one other $220 million and cut up the longer term building prices with Osisko, which is estimated to be $415 million for GFI. Preliminary manufacturing is predicted in 2026, with AISC round $800/oz, with 10 years of mine life.

Additional restricted growth has been thought-about in non-gold areas, similar to copper. GFI has acquired a 20% stake in Chakana Copper, a brand new miner in Peru with two growth initiatives. Nonetheless, whether or not GFI intends to open a copper operation is unknown.

Portfolio Optimization

GFI is contemplating portfolio optimization actions. In response to GFI, Cerro Corona in Peru is starting to see decrease manufacturing related to lower-grade materials extraction. On the present manufacturing ranges, Cerro Corona will shut in 2031, with a ramp-down of output starting in 2025. With the Salares Norte mine reaching full manufacturing across the time of ramp-down, trimming the Cerro Corona place is on the desk.

Moreover, with the numerous funding within the Tarkwa mine, the sister Damang mine could also be offered off to consolidate Ghanaian operations. We imagine that that is the most definitely divestiture to occur in 2024. On December 21, GFI introduced its intention to promote its 45% stake within the Asanko mine for $65 million in preliminary money compensation and a further $85 million via 2026. This transaction additionally contains a further $20 million in Galiano inventory.

Danger

Within the Australian and South African working areas, GFI has struggled to search out and retain expert labor, inflicting above-inflation expense will increase. Nonetheless, we don’t count on the stress related to this to be maintained over the long run as gold costs have elevated.

Salares Norte was over capex price range and didn’t open on time. Initially, there was an estimated value of $860 million, and manufacturing in March of 2023. This grew to $1.2 billion in prices with a delayed opening of April 2024.

The mining world has lately been filled with labor disputes, with large strike actions affecting rivals’ operations in South Africa and Mexico. Moreover, hostile climate and security issues brought about mine closures for GFI throughout 2023. Mining is unpredictable, with many surprises throughout a breadth of dangers: labor, regulatory, prices, mine high quality, pricing, and climate.

A high precedence for GFI is a major discount within the environmental affect of its mining operations. Environmental impacts of mining prolong past power consumption via tailings, the poisonous after-product of stripping gold from rock. This contains linking credit score revolvers and loans to ESG targets.

Outlook

GFI

Full 2023 manufacturing is predicted to be between 2.2-2.Three Moz, with a full-firm AISC within the $1,300 space. This represents a small yearly manufacturing shrinkage and a major value improve. Nonetheless, we count on a restoration in 2024 manufacturing as Salares Norte comes on-line, with divestitures within the yr doubtlessly serving to the company-wide AISC transfer again consistent with the historic pattern.

|

Quarter ending September |

12 months-over-12 months Change |

|

Manufacturing (excluding royalties) |

-9.2% |

|

Income (excluding royalties) |

13.2% |

|

AISC (all-in sustaining prices) |

30.2% |

Regardless of vital growth efforts and inflationary pressures, GFI has a debt-to-EBITDA of 0.48x and a coated ratio of 27.8x, making it one of many strongest stability sheets within the sector. Whereas changing belongings and new acquisitions has slowed down lately, GFI nonetheless has a strong free money base and a low debt degree that will enable it to broaden with debt. Nonetheless, GFI states it’s unlikely to interact in any main M&A exercise just like the ill-fated Yamana deal. Will increase in gold costs and international manufacturing have made the economics of main M&A within the space much less interesting.

The present dividend yield is 3.08%, however we count on the dividend to develop to $0.48 by 2025, which might be a 3.7% yield on the present value. As Salares Norte comes on-line and different JV initiatives start to provide, earnings are anticipated to extend meaningfully, probably leading to a dividend improve.

GFI’s outlook is bolstered by its potential for margin growth, significantly with the Salares Norte mine set to develop into one of many most cost-effective gold mining operations on this planet and two JVs in geopolitically steady areas. In conclusion, with its strategic expansions, strong monetary well being, and alignment with favorable market developments, GFI is well-positioned for each dividend yield and capital appreciation.