Jira Pliankharom

By Sean Bogda, CFA, Grace Su, & Jean Yu, CFA, PhD

Worth Lags Broader Worldwide Rally

Market Overview

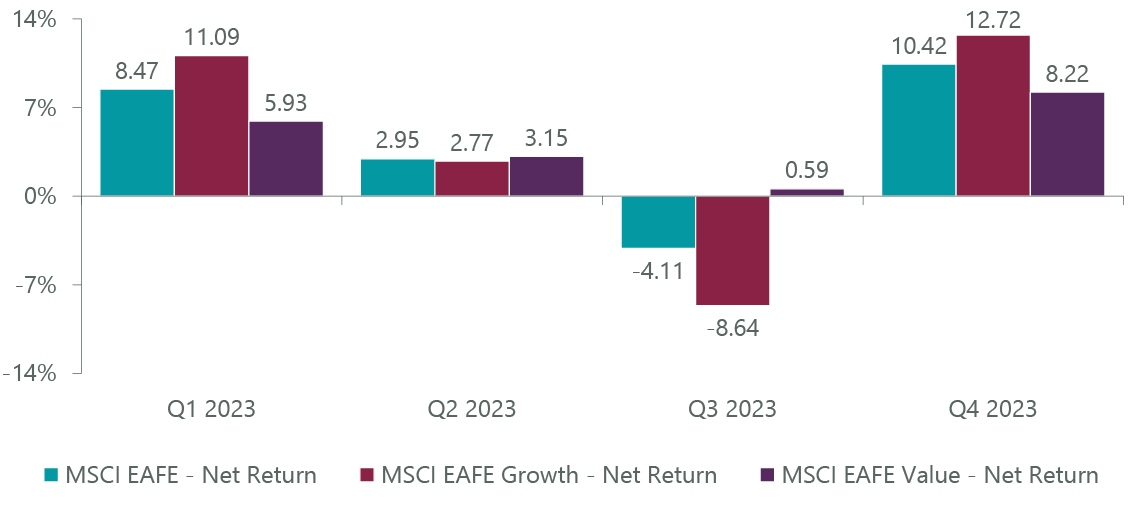

Worldwide markets generated optimistic returns within the fourth quarter, as disinflationary information, renewed hopes of an financial smooth touchdown and declining bond yields within the U.S. and Europe overcame issues over renewed hostilities within the Center East and continued financial challenges in China. The benchmark MSCI EAFE Index returned 10.42% for the quarter. A dovish coverage pivot by the Federal Reserve helped to spur progress shares forward of worth shares for the quarter, with the MSCI EAFE Progress Index returning 12.72% versus the 8.22% return of the MSCI EAFE Worth Index (Exhibit 1). Whereas the fourth quarter helped to slender the complete yr efficiency hole, the MSCI EAFE Worth Index nonetheless ended the yr forward of the Progress Index by roughly 140 foundation factors.

Exhibit 1: MSCI Progress vs. Worth Efficiency

Information as of Dec. 31, 2023. Supply: FactSet.

Regardless of investor issues over the chance and timing of a recession coming into the quarter, worldwide markets rallied as disinflationary information in Europe and the U.S. helped to resume traders’ hopes that financial tightening had peaked. This helped to spur a rally in November and December, significantly benefiting longer period sectors like data know-how (‘IT’) in addition to cyclical sectors on hopes of financial re-acceleration.

Nevertheless, this optimistic sentiment was not common. The fourth quarter additionally noticed the outbreak of conflict in Israel and reprisal assaults on cargo ships within the extremely trafficked Purple Sea, leading to elevated investor fears of a deteriorating geopolitical atmosphere within the Center East and a detrimental affect on world provide chains as ships have been re-routed to safer, albeit longer, delivery channels. On the opposite facet of the globe, financial information out of China continued to show disappointing and failed to revive market confidence regardless of a myriad of measures and applications rolled out by Beijing geared toward re-igniting the home economic system. The state of affairs was additional exacerbated by a selloff in December, as investor redemptions and geographic repositioning resulted within the Chinese language market’s worst performing month of the yr and third-largest month-to-month outflow on document, in line with Morgan Stanley. Buyers’ exit from China continued to assist bolster the Japanese economic system, which confirmed continued optimistic efficiency within the fourth quarter due to elevated investor demand stemming from company reform potential and perceived beneficiaries of a strengthening home economic system.

Towards this backdrop, the ClearBridge Worldwide Worth Technique underperformed its benchmark within the fourth quarter, as a mix of inventory choice within the industrials, financials and well being care sectors overcame optimistic contributions from our client discretionary shares.

Industrials proved to be the largest detractor from relative efficiency. Regardless of our obese allocation to the sector, a number of of our holdings did not hold tempo with the rally within the broader industrials sector. The varied nature of the sector, each geographically and throughout enterprise strains, could make it troublesome to find out short-term actions, however somewhat than chase value developments we proceed to deal with corporations with sturdy underlying companies and leveraged to long-term developments reminiscent of automation and power transition. As an illustration, one in every of our high performers throughout the quarter was Schneider Electrical (OTCPK:SBGSF), a French firm specializing in digital automation and power administration. We imagine the corporate might be a long-term beneficiary of the worldwide power transition given its sturdy place in varied electrical power-related markets. The corporate’s inventory value rose after one other quarter of sturdy earnings, and we imagine the corporate’s rising ahead bookings level to continued progress.

Well being care additionally weighed on efficiency, centered in pharmaceutical holdings Bayer (OTCPK:BAYRY) and Sanofi (SNY). Sanofi, a French drug maker, confronted challenges as a consequence of revisions in its strategic and monetary outlooks after saying a $1 billion improve in analysis and improvement to speed up its drug improvement pipeline. Likewise, Bayer, a German pharmaceutical and agriculture firm, noticed its share value decline after seeing disappointing outcomes from one in every of its most anticipated anticoagulant pipeline medicine, in addition to a authorized challenges in its crop enterprise resulting in elevated legal responsibility estimates. Our opinion is that the reactions in each circumstances have been overdone. With Sanofi, we imagine that future value cuts and elevated R&D investments are anticipated to offset short-term earnings impacts and be helpful to long-term gross sales progress. Likewise, Bayer’s low valuation signifies that traders have largely given up on any turnaround, which means that any excellent news – pharma value chopping, client well being sale, a rebound within the crop enterprise or any optimistic outcomes on the litigation entrance – could possibly be a optimistic catalyst.

“From a geographic perspective, the clear worth alternative stays China.”

Inventory choice within the client discretionary sector was a optimistic driver. Our high holding within the sector was Spanish clothes, footwear and equipment retailer Industria de Diseno Textil (OTCPK:IDEXY). The corporate’s flagship vacation spot retail model, Zara, has seen sturdy optimistic efficiency due to a rebound in tourism and the comparatively sturdy efficiency in southern European markets in comparison with northern Europe as a consequence of sturdy service parts of their economies. The corporate continues to ship sturdy execution pushed by funding in each its e-commerce and omnichannel operations to drive balanced progress. One other optimistic contributor was Arcos Dorados (ARCO), a Latin American proprietor/operator of McDonald’s fast service restaurant franchises. We imagine the market has inherently sturdy progress prospects, and the corporate’s positioning as a pacesetter within the area has allowed them to seize important share. Moreover, we imagine the corporate’s focused funding in its digital operations helps to additional drive gross sales.

From a regional standpoint, inventory choice in Europe was a detractor from efficiency. The biggest geographical allocation within the portfolio, Europe displays a difficult financial backdrop, and we proceed to judge our publicity to the area by specializing in investing in best-in-class companies at engaging costs. Relatively than see these downticks as disappointing, we imagine these durations of underperformance present alternatives and this quarter isn’t any exception. We proceed to watch our European holdings to make sure they’re performing in-line with our expectations.

Portfolio Positioning

We made a number of changes to the portfolio throughout the interval, initiating three new positions and exiting one.

We added a brand new place in Cellnex Telecom (OTCPK:CLNXF), within the communication companies sector, a Spanish-headquartered operator of wi-fi telecommunication infrastructure. As Europe’s largest unbiased tower firm, Cellnex had capitalized on the low-rate atmosphere to develop considerably however has been challenged in latest instances as charges spiked. Spurred by calls for from activist shareholders for a brand new administration workforce, Cellnex has refocused its efforts on deleveraging its stability sheet, value optimization and enabling natural progress.

We additionally added Capgemini (OTCPK:CAPMF), one of many world’s main know-how outsourcing companies. The French firm noticed its shares come underneath stress as a consequence of elevated issues of a slowing macroeconomic backdrop and uncertainty surrounding the affect of generative AI on the demand for IT companies. Nevertheless, as extra readability has emerged surrounding the unbelievable complexity of generative AI, we imagine this can truly show a tailwind for Capgemini and result in compelling, long-term returns.

We exited Tencent (OTCPK:TCEHY), a Chinese language-based communication companies firm working within the value-added companies, internet marketing, fintech and companies companies industries. The corporate’s shares have been underneath stress for the previous couple of years as a consequence of investor issues surrounding the Chinese language authorities’s scrutiny of the digital economic system, and the fourth quarter witnessed one other episode of potential regulatory modifications within the gaming enterprise. We imagine these rules create important challenges to Tencent’s capacity to deploy capital freely and maximize shareholder worth, and we elected to exit the place in favor of investments with a greater threat/reward profile.

Outlook

In distinction to the pessimism coming into 2023, the market seems to be pricing in a hopeful outlook for 2024, anticipating higher actual earnings progress, much less constraints from rising charges, margin upside from enter disinflation, and a return of accommodative financial coverage as sequential inflation information eases again to focus on ranges. With the bar of expectations now raised, we imagine it’s helpful to extend portfolio diversification.

On the one hand, we proceed to love corporations with secular progress tailwinds from megatrends reminiscent of infrastructure spending and power transition, a lot of that are concentrated within the industrials sector. Complementing this, we additionally keep excessive publicity to deep worth areas, believing that fairness returns ought to broaden out to laggards at engaging valuations. The power sector is an efficient instance of this, with the sturdy profitability and capital self-discipline permitting corporations to return important quantities of capital whilst underlying commodity costs stay vary sure. Equally, in financials, we’re invested in nicely capitalized banks which have dedicated to important capital returns over the following few years. Vitality and financials may additionally show to be good hedges if the market’s disinflation narrative fails to play out and we stay in a higher-for-longer regime. Lastly, selective defensive teams reminiscent of utilities and client staples considerably underperformed final yr, permitting us to purchase insurance coverage in opposition to a progress slowdown at compelling entry factors.

From a geographic perspective, the clear worth alternative stays China, the place the market is buying and selling at half the valuation of the worldwide index and the earnings yield to bond yield differential (5.7%) is the best in 20 years. We hesitate to take a position on the following strikes of the Xi administration however keep just a few high-quality names within the portfolio the place upside optionality is excessive. The opposite giant contrarian alternative we see is the U.Ok., the place Brexit and the price of dwelling disaster in recent times have deterred investor curiosity. Nevertheless, as actual wage progress and client confidence proceed to enhance, it’s a market that would play catchup, significantly within the client and monetary sectors which stay very out of favor and attractively priced. Lastly, we proceed to search for alternatives so as to add to our Japan publicity because the economic system exits the deflationary period and additional implements governance reforms to bolster returns. As at all times, the aim is to construct a diversified portfolio of shares the place we imagine threat/reward is mispriced and important alpha era is feasible.

Portfolio Highlights

The ClearBridge Worldwide Worth Technique underperformed its MSCI EAFE benchmark throughout the fourth quarter. On an absolute foundation, the Technique had beneficial properties throughout seven of the 10 sectors wherein it was invested (out of 11 sectors complete). The IT, client discretionary and industrials sectors have been the principle contributors, whereas the well being care and power sectors detracted.

On a relative foundation, total inventory choice and sector allocation weighed on efficiency. Particularly, inventory choice within the industrials, well being care, financials, supplies and communication companies sectors and an obese allocation to the power sector detracted. Conversely, inventory choice within the client discretionary and client staples sectors and an underweight allocation to the well being care sector proved helpful.

On a regional foundation, inventory choice in Europe Ex U.Ok., Asia Ex Japan, the U.Ok. and Japan and an obese to North America weighed on efficiency. Inventory choice in North America and an obese to rising markets positively contributed.

On a person inventory foundation, Samsung Electronics (OTCPK:SSNLF), Industria de Diseno Textil, Holcim (OTCPK:HCMLF), Schneider Electrical and Arcos Dorados have been the main contributors to absolute returns throughout the quarter. The biggest detractors have been Bayer, Julius Baer (JBPCF), Sanofi, Inpex (OTCPK:IPXHF) and Commonplace Chartered (OTCPK:SCBFF).

Through the quarter, along with the transactions talked about above, the Technique initiated a brand new place in Gerresheimer (OTCPK:GRRMF) within the well being care sector.

Sean Bogda, CFA, Managing Director, Portfolio Supervisor

Grace Su, Managing Director, Portfolio Supervisor

Jean Yu, CFA, PhD, Managing Director, Portfolio Supervisor

|

Previous efficiency isn’t any assure of future outcomes. Copyright © 2023 ClearBridge Investments. All opinions and information included on this commentary are as of the publication date and are topic to vary. The opinions and views expressed herein are of the writer and will differ from different portfolio managers or the agency as a complete, and aren’t supposed to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This data shouldn’t be used as the only real foundation to make any funding choice. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this data can’t be assured. Neither ClearBridge Investments, LLC nor its data suppliers are accountable for any damages or losses arising from any use of this data. Efficiency supply: Inner. Benchmark supply: Morgan Stanley Capital Worldwide. Neither ClearBridge Investments, LLC nor its data suppliers are accountable for any damages or losses arising from any use of this data. Efficiency is preliminary and topic to vary. Neither MSCI nor another celebration concerned in or associated to compiling, computing or creating the MSCI information makes any categorical or implied warranties or representations with respect to such information (or the outcomes to be obtained by the use thereof), and all such events hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or health for a specific goal with respect to any of such information. With out limiting any of the foregoing, in no occasion shall MSCI, any of its associates or any third celebration concerned in or associated to compiling, computing or creating the information have any legal responsibility for any direct, oblique, particular, punitive, consequential or another damages (together with misplaced income) even when notified of the potential for such damages. No additional distribution or dissemination of the MSCI information is permitted with out MSCI’s categorical written consent. Additional distribution is prohibited. |

Authentic Submit

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.