jimfeng/E+ through Getty Pictures

Sekisui to Purchase M.D.C. Holdings

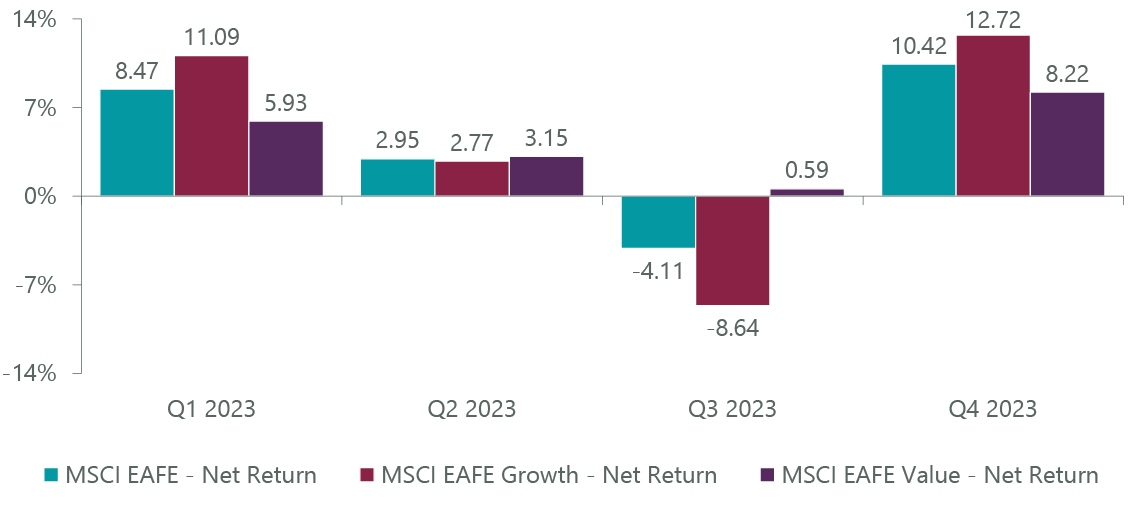

Shares of M.D.C. Holdings (NYSE:MDC) have been a powerful performer over the previous yr, and shareholders acquired one other enhance Thursday, due to an acquisition that sparked an 18% rally. Beneath the phrases of the deal, Sekisui (OTCPK:SKHSY) pays $63 per share in money. Shares are already inside 0.5% of that worth. Given I view a deal as prone to shut however no superior provides prone to materialize, I’d promote shares and lock within the revenue.

Looking for Alpha

Rationale for the Deal

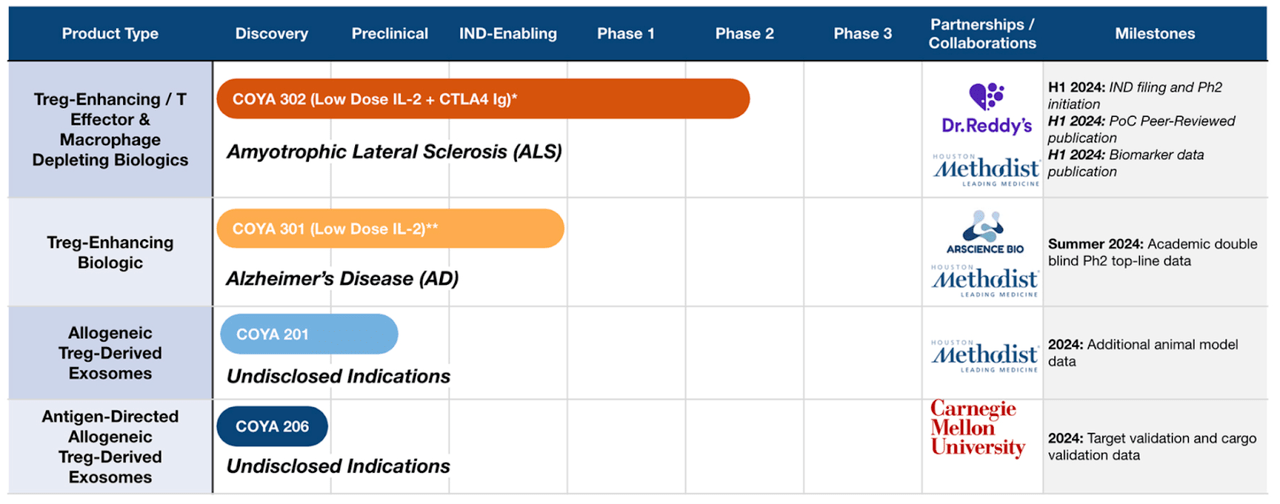

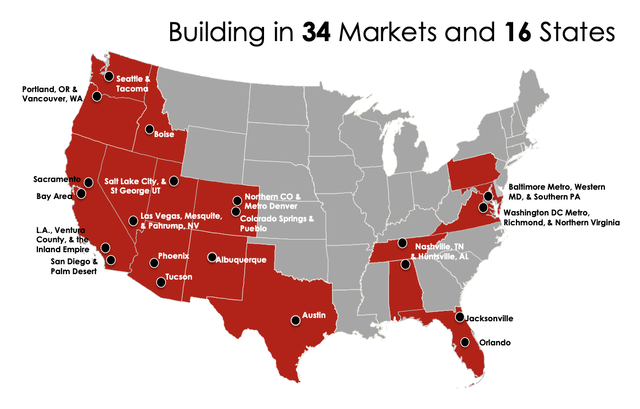

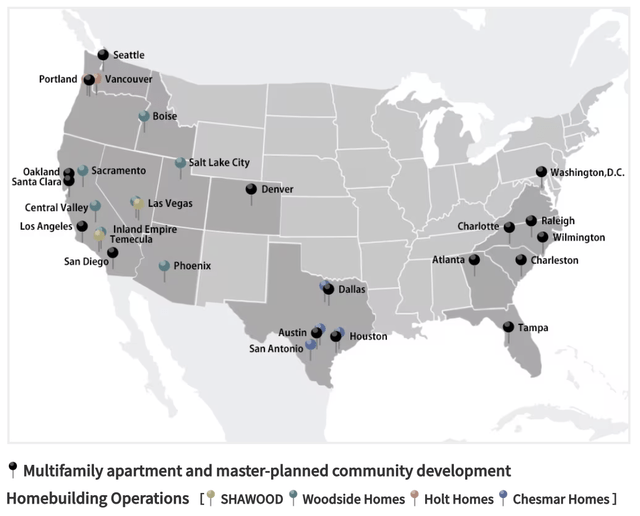

M.D.C. Holdings is a mid-sized US homebuilder with a deal with first-time homebuyers given its common promoting worth of about $550okay as of the third quarter. Over the previous yr, MDC has delivered practically 8,400 properties, and it has 235 energetic subdivisions. As you’ll be able to see under, MDC operates primarily throughout the Western United States, with further publicity within the Solar Belt.

MDC

The deal logic is evident after we have a look at Sekisui’s US enterprise as a result of it operates throughout a really related footprint, equally specializing in the center and lower-end of the brand new housing market within the US.

Sekisui

With MDC, Sekisui is working in markets it already is aware of, and this elevated scale ought to assist the corporate discover synergies to scale back prices and help margins. Whereas Sekisui is primarily a Japanese builder, it has sought enlargement within the US to diversify income. This buy will assist Sekisui obtain its aim of constructing 10,000 properties in the US by 2025.

Sekisui in June 2022 introduced an acquisition of Chesmar, which constructed simply over 2,000 properties. That added to its Woodside and Holt Group manufacturers, which collectively construct over 3,000 properties, giving the corporate about 5,000 items of capability. With the ~8,400 items from MDC, the corporate will vault previous its 10okay unit aim. MDC was the 11th largest US homebuilder by volumes, and collectively they need to be in regards to the 5th.

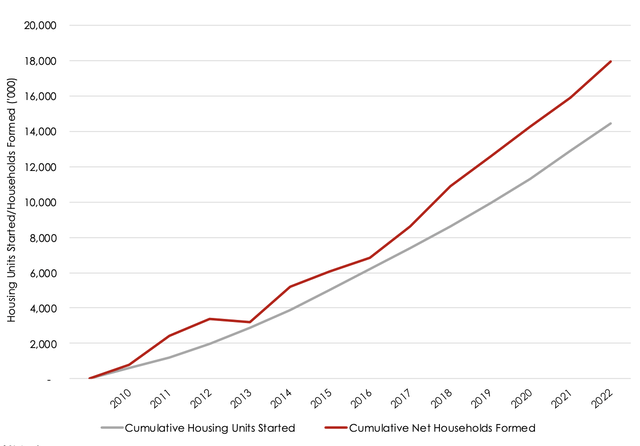

To be clear, Sekisui shouldn’t be diversifying for the sake of range; the US housing market may be very enticing, which is why I’ve rated many housing-related shares a purchase over the previous yr and a half. As I wrote about in 2022, the US housing market is deeply undersupplied due to low building ranges final decade, and I’ve estimated a ~Four million unit shortfall. MDC’s evaluation is analogous, at about 3.7 million items.

MDC

I imagine Sekisui doubtless agrees with this evaluation. Beneath-supplied markets give sellers extra pricing energy, which is why I’ve seen homebuilders favorably, anticipating this dynamic to maintain costs up and housing extra resilient to larger charges than many anticipated, which has largely performed out. With the Federal Reserve doubtlessly chopping charges, the market might face renewed demand, additional aiding builders.

Might the deal be blocked?

In M&A, there are two dangers: on the draw back, that the deal is blocked, or on the upside that one other suitor is available in and begins a bidding struggle. Starting with the draw back threat, with shares practically at $63, the market views completion as extremely doubtless. I agree with this.

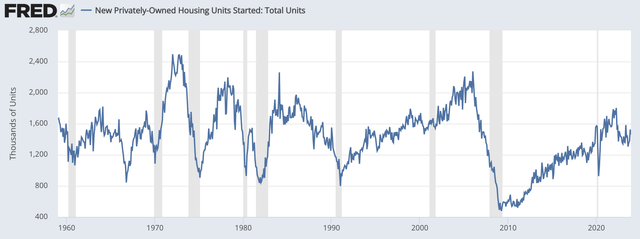

There actually has been elevated antitrust scrutiny – as Spirit Airways (SAVE) and JetBlue (JBLU) traders have realized not too long ago – of all offers over the previous few years. I see no antitrust points right here. The US housing market sees about 1.5 million properties constructed per yr. It is extremely fragmented with many native builders. Collectively, Sekisui and MDC may have solely about 1% market share. They continue to be a really small participant. With nonetheless Four builders bigger than them, and such a small market share, it’s troublesome to see any believable antitrust argument in my view.

St. Louis Federal Reserve

The opposite threat right here is that it is a overseas firm shopping for a US agency, which might create some further scrutiny. Nonetheless, Sekisui did shut its acquisition final yr with no concern, and I view that doubtless right here. Notably with Japan being an in depth US ally, I’d usually see no concern with overseas purchaser threat. Nonetheless, it will be remiss to not word that Nippon Metal’s proposed acquisition of US Metal (X) has grow to be politically controversial with some calling for a evaluation by CFIUS, the Committee on International Funding in the US.

This push does counsel elevated skepticism of overseas patrons of US belongings, even from less-controversial corporations like Japan. That stated, I don’t count on an identical response right here. MDC is far smaller and fewer of an “iconic/legacy” model as US Metal. Furthermore, as I’ve mentioned in write-ups of the metal sector, that trade has benefitted from a way more constantly protectionist spirit, throughout each side of the aisle. For example, President Biden has largely saved President Trump’s metal tariffs in place—a uncommon level of settlement.

Given MDC’s comparatively small dimension and the small mixed market share, I don’t see regulatory challenges for this deal from both an antitrust or overseas funding perspective. Additional, there will not be financing circumstances, and so Sekisui shouldn’t have any concern closing by 6/30/24, if not sooner.

Might one other bidder emerge?

Whereas I don’t see draw back from the $63 buy, with shares so near $63, there would doubtless have to be one other bidder to materialize to justify proudly owning shares. I don’t see this as doubtless. First, Larry Mizel and David Mandarich the founder/Chairman and CEO respectively have every agreed to vote in favor of this deal, giving 21% shareholder help already. With that key help, Sekisui ought to have a comparatively straightforward path getting the required majority help. Whereas this isn’t a founder-controlled firm, with that possession stake, MDC is closely “founder-influenced.” Presumably if it had one other get together to promote to, it will have, and so seem pleased to promote to Sekisui.

On high of this, MDC is getting a good worth on this transaction in my opinion. Within the firm’s third quarter, MDC earned $1.40 as income fell from $1.Four billion to $1.1 billion. Deliveries have been down 17.5% to 1,968. By means of 9 months, it has earned $3.73. Based mostly on This fall steerage of 18-19.5% gross margins on about 2,300 deliveries at a roughly secure gross sales worth of $550okay, MDC ought to earn about $5.25 this yr.

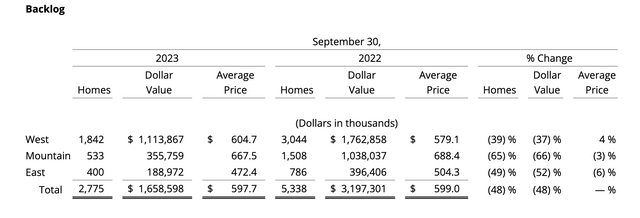

At this buy worth, MDC is promoting for 12x 2023 earnings and about 1.4x ebook worth (this was $44 in Q3 and certain ended the yr in This fall at ~$45). That could be a stable a number of. Now, at this worth, Sekisui instantly will get MDC’s added scale with 235 energetic communities. MDC additionally owns 17,800 tons with an extra 4,600 optioned. The corporate has a backlog of two,775 items, which whereas down by 48% from final yr, gives a stable base of income for 2024.

MDC

Importantly, MDC has seen bettering exercise currently. In Q3, there have been 1,695 in new orders, nicely up from 299 final yr with the West accounting for 60% of deliveries. Moreover, with constructing prices declining, gross margins improved by 280bp sequentially, although they’re anticipated to say no barely in This fall from the 19.7% in Q3. Sekisui doubtless sees room for margin enchancment because it combines operations and builds scale.

By shopping for MDC, Sekisui will get to tug ahead its US enlargement and add publicity to a secularly sturdy market. Moreover, MDC provides steadiness sheet energy because it has $1.Eight billion in money and securities vs simply $1.5 billion of debt, leaving it with a web money place.

12x earnings and 1.4x ebook worth is an efficient worth to promote at. For comparability, KB Dwelling (KBH), which I not too long ago downgraded to carry, is buying and selling just under 9x 2023 earnings and about 1.2x ebook worth. Now, it does carry about $1 billion in web debt, which doubtless suppresses its P/E vs MDC. Given the place KB trades, it will be troublesome for it to high the bid and nonetheless be accretive to its shareholders with out including important debt, which US homebuilders have been loath to do.

With most homebuilders buying and selling at ~10x earnings, they’re prone to proceed to direct their money movement to repurchasing extra of their very own shares than search M&A, significantly at this a number of. Certainly, some would possibly argue I used to be too cautious in shifting KBH to a maintain, given its decrease valuation. Usually although, publicly traded corporations commerce under M&A premium costs. Sekisui additionally had a singular rationale (scale up small US operations) that may justify its determination to pay a premium above potential stand-alone worth. As such, I’d not count on KBH to succeed in MDC’s a number of.

Concluding ideas

In the end, this has been an ideal yr for MDC holders. With this deal extremely prone to shut however no clear motive for shares to maneuver above $63, this commerce is now performed out. Assuming a ~Three month shut, traders have an annualized return of ~5%, assuming yet another dividend cost. For that yield, traders can personal a treasury invoice. With basically no premium to the risk-free rate of interest, markets are appropriately, in my opinion, assuming this deal is prone to be accomplished. As such, with no fairness threat premium left, I’d promote shares, lock in sturdy income, and look to allocate elsewhere.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.