SOPA Photos/LightRocket through Getty Photos

Shopify (NYSE:SHOP) inventory’s premium price ticket comes with a set of presumptions about its future earnings outcomes that might be overly optimistic primarily based on my evaluation. I feel good outcomes from the agency are possible over the long run, however on account of uncertainty round earnings methods within the short-to-medium time period, my ranking is a Maintain somewhat than a Purchase.

2024 Operations & This autumn Outcomes

Shopify has positioned itself as a number one international e-commerce firm, facilitating important digital retail infrastructure over a number of channels. It supplies a full vary of instruments to begin and scale a retail enterprise, engineering for velocity, safety, and customization. Shopify is a trusted platform for greater than 175 corporations.

Shopify’s acquisition of Deliverr and its enhancement of the Shopify Success Community reveals a trajectory towards increasing velocity and effectivity throughout its channels. It gives retailers end-to-end logistics administration, together with quick supply and environment friendly returns. Deliverr’s know-how built-in into Shopify is anticipated to make the platform an all-in-one resolution for e-commerce administration.

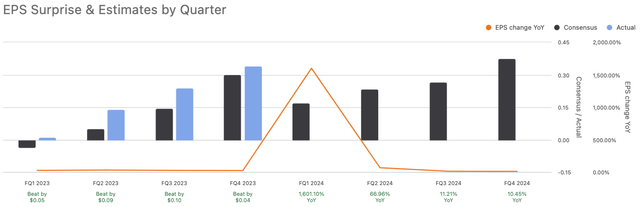

This autumn earnings beat expectations by $0.04, persevering with an earnings-beat streak for the whole monetary 12 months:

In search of Alpha

Our GMV progress accelerated in This autumn and for all of 2023, which powered Shopify’s robust monetary outcomes. In This autumn we delivered year-over-year income progress of 24%, which represents 30% progress when adjusting for the sale of our logistics companies, and achieved an working earnings margin of 13% and a free money movement margin of 21% – Jeff Hoffmeister, Chief Monetary Officer of Shopify.

Notably, the corporate outlined a spread of AI-powered additions to its product and repair portfolio. These embody Shopify Magic for service-wide effectivity, Sidekick commerce assistant, and an AI procuring assistant.

Full-year monetary highlights included 20% progress in Gross Merchandise Quantity, 26% progress in whole income, and a free money movement margin of 13% in comparison with -3% in 2022.

Profitability Considerations & Additional Financials

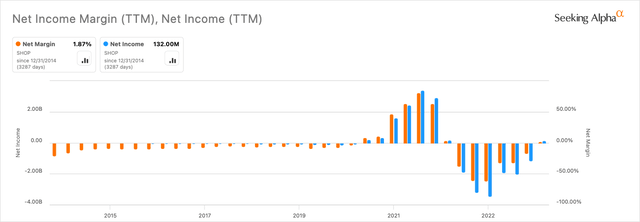

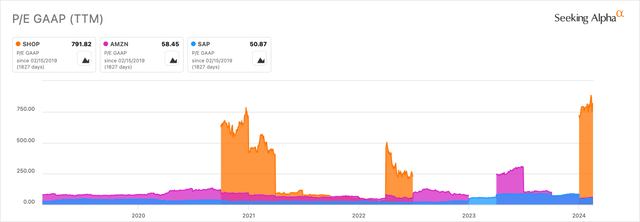

Shopify has had a unstable previous few years by way of earnings and web earnings margin, which is essentially why the share worth has been up so considerably in 2021 after which fell to extra cheap ranges circa 2022.

Writer, Utilizing In search of Alpha

In search of Alpha

In 2020, Shopify achieved profitability for the primary time. Throughout each 2020 and 2021, it skilled important progress, pushed by the surge in e-commerce from the pandemic on the time. This led to progress in service provider subscriptions and enhancements in Shopify’s Service provider Options. Shopify’s 2021 income grew considerably in comparison with 2020, with greater gross merchandise quantity and will increase in Subscription and Service provider Options income.

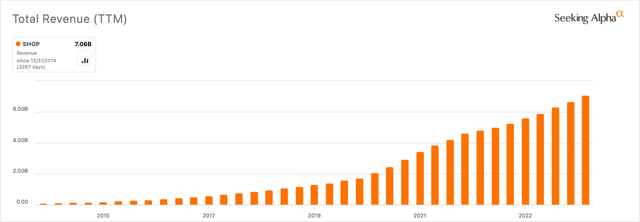

Writer, Utilizing In search of Alpha

Word from the chart above that Shopify’s income has not stopped rising. Shopify’s progress in Gross Merchandise Quantity and whole income continued in 2022, however at a extra reasonable tempo; this was a results of reversion to considerably normalized post-pandemic commerce habits. Nonetheless, its working loss was pushed by excessive compensation prices on account of a brand new construction and extra staff, in addition to its acquisition of Deliverr.

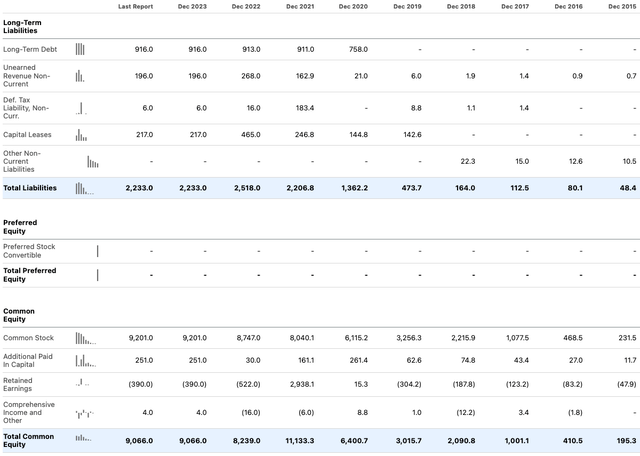

Shopify’s stability sheet must be famous for its distinctive stage of fairness in comparison with liabilities. Its equity-to-asset ratio at the moment is 0.8. Examine this with MercadoLibre (MELI), which has an equity-to-asset ratio of 0.17, or Etsy (ETSY), which has an equity-to-asset ratio of -0.25.

In search of Alpha

That is excellent news, and the monetary administration type might be additional elucidated by trying on the money movement assertion. Very minimal debt has been issued, with most financing a results of the issuance of frequent inventory:

In search of Alpha

Valuation Threat

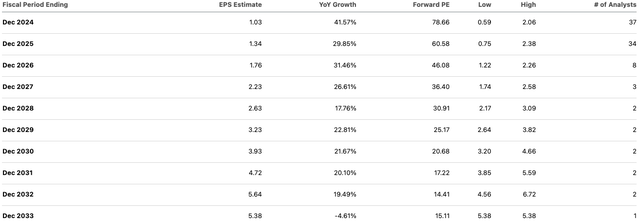

Let’s take a more in-depth have a look at Shopify’s valuation, beginning by understanding its ahead P/E GAAP ratio of 112.99, which is a 319.08% distinction from the sector median of 26.96. If I have a look at future earnings progress indicated by In search of Alpha’s aggregation of YoY progress analyst estimates, a 23% annual common EPS progress charge is forecasted over the subsequent decade:

In search of Alpha

I used this annual progress estimate in my DCF evaluation. I additionally began with December 2024’s EPS estimate of $1.03, and I added the tangible guide worth per share of $6.69. Utilizing a 4% terminal stage progress charge and a 10% low cost charge, my truthful worth got here to $56.45, a -44% margin of security in opposition to an $81.29 current inventory worth.

I feel that the worth of Shopify shares at the moment makes an funding within the firm comparatively speculative. Such a excessive price-to-earnings ratio assumes outsized long-term dominance over a few years. This optimistic consequence for the agency is feasible, however a actuality test could also be wanted. This appears to me to be a high-risk funding primarily based on its valuation alone that’s prone to expertise important volatility in its share worth till its profitability technique stabilizes.

Writer, Utilizing In search of Alpha

SMBs Market Threat

Shopify’s enterprise is very depending on small and medium-sized companies (SMBs). This creates a major be aware of warning that traders want to pay attention to. Whereas the pandemic was helpful for Shopify, it’s hardly assured that different macroeconomic points will not considerably impression e-commerce SMBs and trigger enterprise failures affecting Shopify’s income. SMBs are considerably extra fragile than bigger companies and are extra liable to draw back dangers from low-probability, high-impact occasions which might be unpredictable. Whereas most on-line market and e-commerce suppliers are on the mercy of this threat, it requires cautious due diligence in terms of deciding on a small or bigger capital allocation.

Conclusion

Shopify is overvalued; traders must be cautious if contemplating shopping for a stake now however might maintain it for long-term progress with expectations of periodical volatility in thoughts. The enterprise might stay a dominant chief in e-commerce for many years to come back, and its stability sheet presents positives. Nonetheless, as a result of speculative nature of the current valuation and earnings instabilities, my analyst ranking for the inventory is a Maintain.