Pixelimage

Bain Capital Specialty Finance Inc. (NYSE:BCSF) is a well-managed BDC with substantial extra dividend protection that would translate into a big extra money return potential in 2024.

The BDC raised its dividend twice final 12 months and although the funding portfolio is shrinking, attributable to increased repayments and headwinds to originations in a high-rate atmosphere, Bain Capital Specialty Finance’s internet funding earnings is greater than adequate to permit for a drastic dividend elevate this 12 months.

With a 11% low cost to internet asset worth additionally obtainable to passive earnings traders, BCSF additionally affords some re-rating potential on prime of a lined 11.4% yield.

My Score Historical past

Bain Capital Specialty Finance improved its dividend pay-out metrics final 12 months, partially due to its publicity to floating-rate loans which produced increased internet funding earnings for the BDC in 2023.

This was the explanation for me to change my inventory classification to Purchase. Taking into consideration that Bain Capital Specialty Finance continued to shine within the fourth quarter with its dividend protection, I feel that BCSF has appreciable potential at hand a lot of dividend raises to shareholders in 2024.

Portfolio Overview

Bain Capital Specialty Finance suffered from headwinds to originations in 2023 which have been introduced on the BDC by the central financial institution which raised short-term rates of interest aggressively within the first half of 2023.

As a consequence, Bain Capital Specialty Finance’s skilled a decline in new funding fundings and better repayments, resulting in a decline within the firm’s portfolio worth all through 2023.

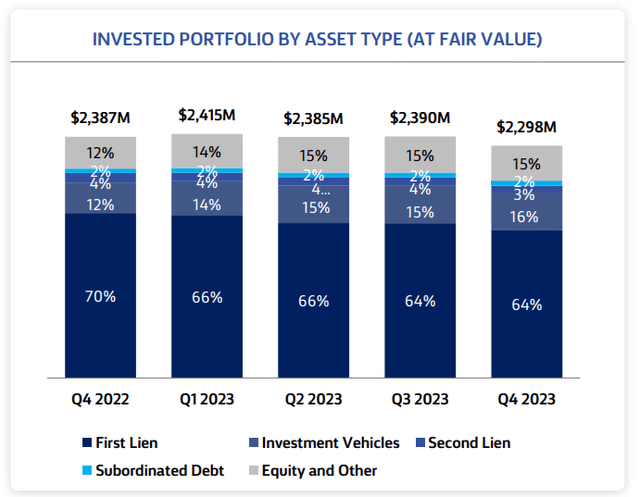

As of December 31, 2023, Bain Capital Specialty Finance’s mortgage portfolio had a complete honest worth of $2.Three billion, which was down 3.7% YoY. The portfolio consisted predominantly of First and Second Liens which collectively accounted for 80% of Bain Capital Specialty Finance’s mortgage investments.

The BDC additionally retained a big funding allocation to Fairness investments, amounting to 15% of all investments, as a method to boost its whole returns.

Invested Portfolio By Asset Sort (Bain Capital Specialty Finance)

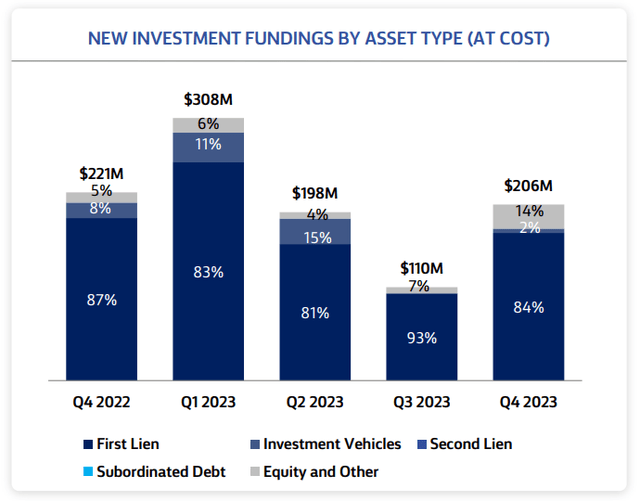

Bain Capital Specialty Finance did a complete of $822 million in new funding fundings in 2023 of which a whopping $691 million associated to the First Lien funding class. Gross sales and repayments totaled $924 million which leads us to a internet decline in funding exercise of $103 million in 2023.

These tendencies might change a bit in 2024, nevertheless, because the central financial institution is considering short-term rate of interest reductions if inflation cools down.

New Funding Fundings By Asset Sort (Bain Capital Specialty Finance)

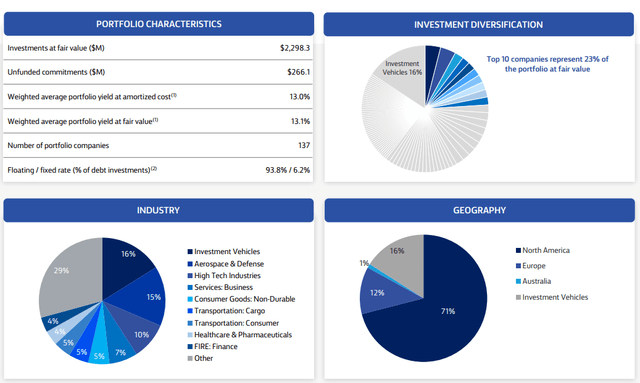

Bain Capital Specialty Finance’s portfolio is robustly diversified, not solely by way of business, but in addition by way of geography, with investments being made exterior of america to be able to enhance the BDC’s diversification profile. The current portfolio setup produced a 13.1% yield at honest worth and the portfolio is usually oriented in direction of floating-rate loans (93.8%).

Portfolio Overview (Bain Capital Specialty Finance)

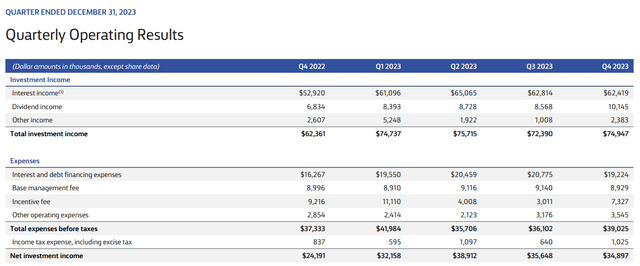

Bain Capital Specialty Finance’s excessive extra dividend protection is pushed by a considerable enhance within the BDC’s internet funding earnings, because of rising curiosity earnings. The BDC’s curiosity earnings skyrocketed 18% YoY to $62.Four million in 4Q-23 attributable to rate of interest tailwinds supplied by the central financial institution.

Bain Capital Specialty Finance’s internet funding earnings jumped 44% YoY to $34.9 million and the BDC makes greater than sufficient money to afford some beneficiant dividend raises in 2024.

Quarterly Working Outcomes (Bain Capital Specialty Finance)

Potential For Dividend Hikes In 2024

Bain Capital Specialty Finance raised its common dividend twice in 2023 and I see extra dividend hikes coming shareholders’ methods in 2024 because the BDC produces substantial dividend extra protection.

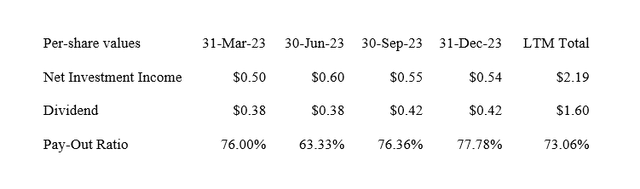

Bain Capital Specialty Finance earned $0.54 in internet funding earnings within the fourth quarter which compares to a dividend pay-out of $0.42 per share. This interprets right into a dividend pay-out ratio of 78% in 4Q-23 and a twelve months dividend pay-out ratio of 73%.

Bain Capital Specialty Finance introduced a $0.12 per share particular dividend in February, to be paid in equal quantities throughout 2024. In my opinion, passive earnings traders might see 1-2 extra hikes within the common dividend this 12 months additionally.

Dividend (Writer Created Desk Utilizing BDC Data)

Promoting For 0.90x NAV, Re-Score Potential

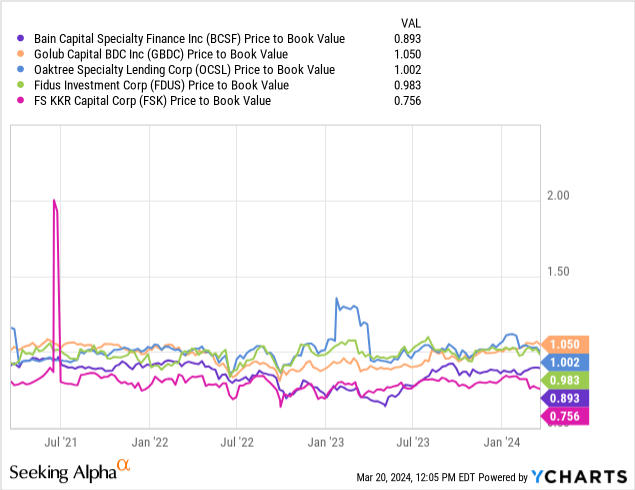

BCSF remains to be promoting for a 11% low cost to internet asset worth which I don’t view as deserved. Bain Capital Specialty Finance’s internet asset worth as of December 31, 2023 was $17.60, up $0.31 per share YoY.

The NAV of $17.60 represents my intrinsic worth estimate since BDCs should mark their loans at honest worth. With the dividend being this well-covered by internet funding earnings and the web asset worth rising, I feel BCSF has an excellent probability to re-rate to internet asset worth in 2024, notably if the BDC makes information with one other one or two dividend hikes.

With a 11.4% dividend yield presently supplied by the BDC’s inventory, I feel that passive earnings traders may doubtlessly have the ability to earn one other 10% on prime in capital appreciation.

Why The Funding Thesis Might Not Work Out

Bain Capital Specialty Finance is a floating-rate BDC and as such dependent in its internet funding earnings potential on the central financial institution. Current inflation numbers have made it very clear that inflation round 3% is right here to remain which is delaying a few of the price cuts that the market anticipated.

A faster-than-anticipated return to a extra ‘regular’ price atmosphere, as unbelievable because it appears proper now, would doubtless be detrimental to Bain Capital Specialty Finance’s internet funding earnings development in 2024.

My Conclusion

Bain Capital Specialty Finance is a well-diversified BDC that skilled sector-specific headwinds in 2023 as a result of central financial institution elevating rates of interest that weighed on the BDC’s origination exercise and led to a better diploma of mortgage repayments.

Nonetheless, Bain Capital Specialty Finance raised its common dividend twice in 2023 and the BDC has appreciable dividend development or particular dividend potential in 2024 because it maintains a moderately excessive diploma of extra dividend protection.

I feel that the 11.4% dividend yield right here is kind of secure and I might not be shocked to see two beneficiant dividend hikes in 2024 additionally.

Since BCSF remains to be promoting at a 11% low cost to internet asset worth, I feel passive earnings traders get to lock in an honest margin of security right here as properly. Purchase.