tadamichi

The S&P 500 (SP500) has executed fairly effectively within the first quarter of 2024 (Q1 2024), up by 9.7% on the time of writing. By extension, its reproduction fund, the SPDR S&P 500 ETF Belief (NYSEARCA:SPY) is additionally forward. There are two the reason why this pattern is especially fascinating:

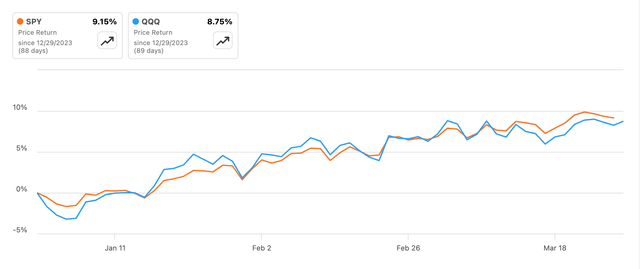

- The rise barely outstrips the Nasdaq tracker fund Invesco QQQ Belief ETF (QQQ) up to now this 12 months. This can be a flip in pattern from final 12 months when QQQ noticed a rise of 54% in contrast with 24% for SPY. The SPY’s lead is trivial at current (see chart beneath) however on the very least it signifies that it has caught up with QQQ.

- The rise is much more important contemplating that it comes at a time when the US financial system is anticipated to see a slowdown, whilst inflation cools off and curiosity charges are anticipated to begin coming off later within the 12 months. The truth is, my projections for the S&P 500 indicated that on common, the determine can be 0.75% beneath the common variety of 2023 primarily based on the index’s relationship with US GDP.

Worth Returns, YTD (Supply: Searching for Alpha)

Why SPY continues to rise

This raises the query as to why SPY continues to inch up, particularly as this is not only a point-to-point enhance. The common enhance in SPY in Q1 2024 is at 16.3% in comparison with the full-year common for 2023, which is even larger than the period-end enhance of 9.2%.

In different phrases, the rise is a much more constant enhance than can be instructed by an end-of-period comparability. That is defined by the efficiency and potential of its high 10 holdings in addition to a supportive macroeconomic context.

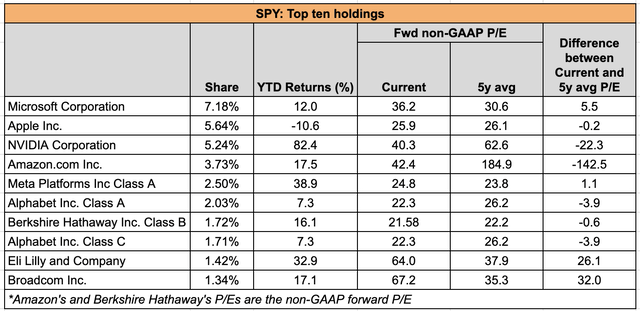

Continued robust efficiency by high holdings

A have a look at the belief’s high 10 holdings reveals that they’ve seen an excellent greater YTD weighted common enhance of 23%, pushed considerably by NVIDIA (NVDA) (see desk beneath). Additional, save Apple (AAPL) all of them have continued to rise YTD. Prescription drugs biggie Eli Lilly (LLY) and Broadcom (AVGO) are significantly notable on this regard, with double-digit will increase regardless that they’re buying and selling a lot larger than their five-year common ahead GAAP price-to-earnings (P/E) ratios. The truth is, the superior efficiency of LLY and Berkshire Hathaway (BRK.B) explains the small edge SPY has over QQQ at current.

Supply: Searching for Alpha, Writer’s Estimates

Additional, six of the ten holdings at the moment are buying and selling beneath their five-year averages to various levels. Amazon (AMZN) which is buying and selling on the lowest relative valuation has an upside even primarily based on a deeper basic evaluation.

The potential of those holdings can clarify why SPY has risen up to now in 2024 and why it may well rise going ahead as effectively. This upside may even mood the draw back to the shares that presently far exceed their five-year averages. It does should be mentioned although, that even those that look overvalued proper now, are rated as Purchase by each Searching for Alpha and Wall Avenue analysts.

What the macroeconomic prospects say

The macros have additionally supported SPY’s development in Q1 2024. The US financial system continued to see above-trend development of three.2% in This fall 2023. Furthermore, the full-year 2024 forecast has been upped to 2.4% from the sooner 1.7%. That is the distinction between above-trend and below-trend development, which is saying one thing. I’ve written concerning the financial system extra intimately in my latest article on QQQ, so I gained’t go over it once more.

However right here I do need to tie this dialogue again to the regression evaluation I did the final time for SP500, with GDP because the explanatory variable. Because it seems, in comparison with the 0.75% decline forecast the final time from this evaluation, an enter of two.4% development in 2024 signifies that the SP500 on common will stay principally the identical as in 2023. This in flip implies that even when the SP500 had been to drop to a mean stage of round 4,050 for the rest of the 12 months from the present stage of 5,203, it will nonetheless come out on the similar ranges as final 12 months.

The dangers to SP500

The query now could be, is the index more likely to fall that a lot within the 12 months? Or in any respect, for that matter? There are definitely dangers of a decline. Its present P/E is at 28.3x, which is larger than the previous 10-year common ratio of 24.7x. If the ratio had been to say no to its common stage this 12 months, the SP500 would drop by 13% from the present ranges to 4,552.

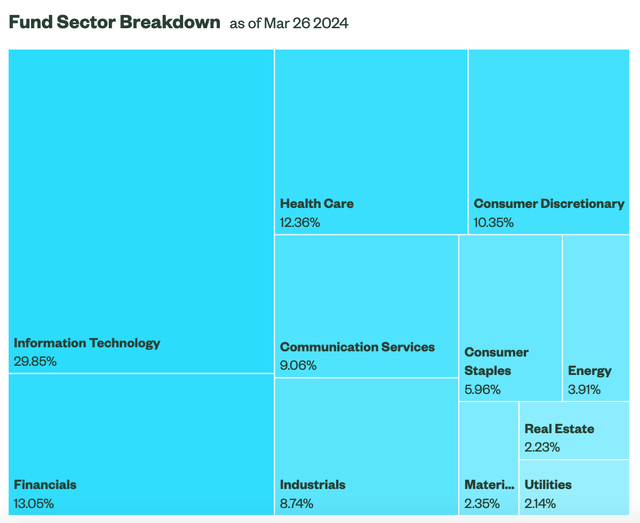

That is attainable if the financial system weakens from hereon, which might’t be dominated out. Going again to the forecasts for the US financial system, development is anticipated to be between 1.5-1.7% within the subsequent three quarters, which is underwhelming. This may affect the index and the fund, 30% of whose holdings are in macro-sensitive sectors like financials, industrials, actual property, power and supplies (see chart beneath).

Supply: State Avenue

That mentioned, there will be some assist from softening inflation and later within the 12 months, decrease rates of interest. Nonetheless, the mix of how these varied macro indicators play out will be essential in figuring out what’s subsequent for the S&P 500.

What subsequent?

In sum, whereas there’s an upside to SPY, there are additionally dangers forward. The continued momentum is spectacular, reflecting investor confidence. Its high 10 holdings additionally give good reason for optimism, with six of them buying and selling beneath their five-year common P/E.

However a possible slowing down of the financial system is a key threat to contemplate, nonetheless. Even when GDP development is comparatively wholesome within the US this 12 months, my evaluation signifies that there’s little upside to the index from 2023. This in flip implies that the fund worth can decline from present ranges. Even when it would not decline as a lot as indicated by the evaluation, there would nonetheless be a good correction if its P/E had been to fall to the historic common.

Contemplating how a lot it has risen already previously 12 months and up to now in 2024, this isn’t the time to take dangers with the index for short-term investing. For that reason, I’m retaining the Maintain ranking.