OceanFishing/iStock through Getty Photographs

Introduction

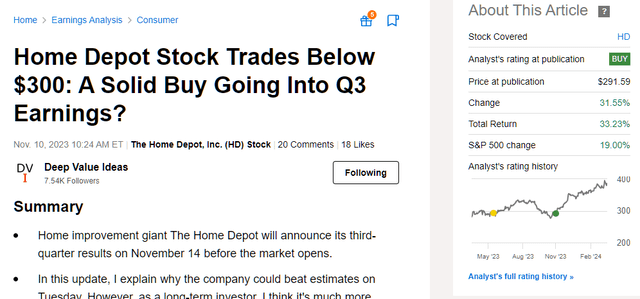

Shares of The Residence Depot, Inc. (NYSE:HD) – the world’s largest residence enchancment retailer by web gross sales – have been on a spectacular bull run since bottoming in October 2023. I cowl the corporate kind of repeatedly right here on Looking for Alpha, most just lately in November after I wrote my first bullish be aware on HD inventory.

HD inventory has gained greater than 30% in simply over 4 months (Determine 1), outperforming the AI-hype-driven S&P 500 by a whopping 14%. However do not get me mistaken – though I upgraded HD inventory to “purchase” in November, I used to be under no circumstances anticipating such a efficiency. I at all times stay humble, so the sharp rise within the share value makes me slightly uneasy.

Determine 1: Screenshot from the Nov. 10 article on HD inventory (Looking for Alpha)

Within the meantime, HD’s administration introduced outcomes for fiscal 2023 and the annual report (10-Ok) was printed. Yesterday, it was introduced that Residence Depot intends to amass specialty distributor SRS Distribution in a transaction valued at $18.25 billion, additional strengthening the main residence enchancment firm’s addressable market within the skilled buyer house.

For these causes, I believe it is a good time to sit down again, digest the information and reassess. On this replace, I share my views on the acquisition of SRS Distribution from an operational and monetary perspective. I additionally focus on the impression on The Residence Depot’s stability sheet, particularly contemplating the continued and partly debt-funded share repurchases. Lastly, I take a recent have a look at the valuation of HD inventory utilizing a multi-faceted strategy and discover the query of whether or not the inventory continues to be a maintain or whether or not it’s already time to lock in income.

SRS Distribution: A Good, Not To Say Logical Match – However An Costly One

One of many essential causes I like The Residence Depot is its sturdy dedication to skilled clients – who now in all probability account for greater than 50% of the house enchancment large’s gross sales. This rising section dampens money circulate and earnings volatility, largely on account of sturdy buyer stickiness (loyalty and time-saving packages, trusted worth proposition). Conversely, the skilled section is much less vulnerable to the cyclical demand for discretionary objects, which had been in excessive demand from DIY clients in the course of the pandemic however at the moment are exhibiting weaker demand given excessive inflation and considerably extra cautious clients.

As well as, the shopping for traits {of professional} clients and the unique advantages HD provides them lead, for my part, to comparatively greater profitability (economies of scale) in addition to up-selling alternatives. Its essential competitor, Lowe’s Firms, Inc. (LOW) – which I additionally cowl right here on Looking for Alpha – is pursuing the identical technique, however is at an earlier stage on this regard.

On this sense, the deliberate acquisition of SRS Distribution is a transparent signal of The Residence Depot’s dedication to stay the chief within the skilled section. Whereas Lowe’s can be a serious participant within the U.S. residence enchancment market, I believe HD has an edge on account of its higher scale, bigger measurement and higher credit standing (A2 vs. Baa1), which permits it to develop extra simply via acquisitions. I’ll focus on the impression of the SRS Distribution acquisition on Residence Depot’s stability sheet within the following part.

In response to HD administration, the acquisition will improve the entire addressable market by $50 billion or 5% in relative phrases (slide 8, SRS acquisition presentation). Extra importantly, the acquisition will improve and strengthen HD’s providing, notably within the roofing section, SRS’s core competency. Landscaping and swimming pool verticals are newer segments by which SRS gained a foothold in 2019 and 2021 respectively (slide 5, SRS acquisition presentation).

As for the impression on HD’s P&L assertion, I would not say SRS could have a lot of a right away impression. Contemplating that HD, with an enterprise worth (EV) of at the moment $425 billion, is planning to amass SRS in a $18.25 billion, that is already evident from this ratio. SRS income in 2023 was roughly $10 billion, so the acquisition will improve HD’s top-line by 6.5% (primarily based on HD’s common web gross sales from 2021 to 2023). The impression on EBITDA is considerably decrease at solely round 4.3% as a result of comparatively low working margin of SRS. This in flip implies that the elimination of redundancies is anticipated to end in a modest margin growth within the SRS section. Nevertheless, it ought to be borne in thoughts that SRS apparently solely makes use of a single ERP system, which it would in all probability retain even after the consolidation.

Therefore, and since SRS will proceed to function largely independently, I might not anticipate an excessive amount of from the consolidation by way of profitability. I believe it’s really cheap to anticipate a small detrimental impression on HD’s working margin earlier than synergies are realized, however doubtless not more than 30 foundation factors.

So the most important profit – moreover a extra holistic expertise for its skilled clients, which ought to additional enhance retention and bolster development – are cross-selling and upselling alternatives, in addition to considerably improved distribution capabilities. SRS has greater than 760 branches throughout 47 states, which is a really important addition to the two,015 shops HD operates within the U.S. (p. 24, fiscal 2023 10-Ok).

All in all, I believe it’s honest to conclude that SRS is an effective, to not say logical, match for The Residence Depot, which will definitely assist to additional strengthen the corporate’s already main place within the skilled section. In fact, the acquisition continues to be topic to regulatory approvals, however it’s cheap to anticipate that the deal is finalized by the top of 2024 or early 2025.

Lastly, by way of valuation, it’s honest to say that HD was undoubtedly not cut price searching with an implied EBITDA a number of of 16-17 and a gross sales a number of of 1.8. It is usually attention-grabbing to notice that the personal fairness agency Leonard Inexperienced & Companions (LGP) purchased SRS Distribution from Berkshire Companions LLC in 2018 for an implied enterprise worth of over $Three billion. So it’s clear that HD is buying SRS immediately at a a lot greater a number of – if we assume, for instance, that SRS had gross sales of $6.5 billion in 2018 and development of 9% p.a. (= $10 billion gross sales in 2023), the gross sales a number of of the LGP transaction would have been round 0.5 – or barely greater than 1 / 4 of the pending deal’s valuation. And even when we assume – which is hardly real looking – that SRS grew by 15% yearly over the past six years, the implied gross sales a number of would nonetheless be solely 0.6 ($5.Zero billion implied gross sales in 2018).

How Is Residence Depot’s Steadiness Sheet Impacted By The Acquisition And Ongoing Large Share Repurchases?

The Residence Depot is understood for purchasing again important quantities of its personal inventory yr after yr, and generally the corporate is accused of “monetary engineering”. Granted, shopping for again shares and decreasing the variety of shares excellent within the course of has a useful impact on earnings per share development. However that is really factor, for my part, so long as the shares are in fact purchased again at an applicable valuation and the corporate’s natural development stays intact.

Determine 2 exhibits the evolution of HD’s diluted weighted-average shares excellent over the past 20 years and the contribution of buybacks to EPS development in share factors. Over this era, HD has repurchased practically 55% of its diluted shares excellent in 2004, growing earnings per share by 121%. In different phrases, with out buybacks, fiscal 2023 earnings could be lower than half of what they really had been. Buybacks had been very pronounced earlier than the Nice Recession and have slowed to a 2-3% contribution to EPS development lately. Given HD’s very sturdy – largely double-digit – EPS development throughout this era, I discover the “monetary engineering” speculation tough to assist.

Determine 2: The Residence Depot, Inc. (HD): Diluted weighted-average shares excellent and contribution of share buybacks to EPS development over the past 20 years (personal work, primarily based on firm filings)

Nevertheless, contemplating that HD generates between $14 and $16 billion in free money circulate yearly (after adjusting for stock-based compensation and dealing capital actions, Determine 3) and pays out about half of that to its shareholders within the type of dividends, it is simple to see that not less than a few of these buybacks had been funded by debt. However what seems like a nasty factor could make good sense from a monetary perspective so long as the debt is affordable – which has undoubtedly been the case for a few years. A big firm with large scale and predictable money circulate like The Residence Depot is completely able to borrowing briefly to purchase again inventory, however in fact that may’t go on without end.

Determine 3: The Residence Depot, Inc. (HD): Free money circulate over the past 20 years, after adjusting for stock-based compensation and smoothing working capital actions with a three-year rolling common (personal work, primarily based on firm filings)

On this context, I believe it’s value noting that HD administration has vowed to pause share buybacks till the SRS acquisition – which can add $12.5 billion of debt (excluding working leases) – is digested. This announcement was one of many causes behind the current affirmation of HD’s A2 senior unsecured score by Moody’s.

A have a look at the maturity profile of Residence Depot’s debt (Determine 4) – which in fact doesn’t but embody the impression of the SRS acquisition – is kind of reassuring, regardless of the huge and partially debt-funded share buybacks. HD at the moment pays a really favorable weighted-average rate of interest of three.64% on its long-term debt, and maturities – whereas considerably right-skewed – seem very manageable. With a free money circulate after dividends of about $25 billion over three years, it is simple to see that HD might theoretically pay down debt because it matures off the stability sheet. There may be $14.Four billion of debt coming due over the subsequent six years, and assuming administration needs to pay down SRS debt over that interval as nicely, HD would wish to put aside about $27 billion of free money circulate to pay down debt. If the financial setting proves fairly secure over this era, this can be a very real looking expectation and HD might even proceed improve its dividend additional and resume share buybacks after three to 4 years.

Determine 4: The Residence Depot, Inc. (HD): Lengthy-term debt maturity profile and weighted-average rates of interest, as of fiscal 2023 year-end (personal work, primarily based on firm filings)

In fact, it’s not sensible for HD to repay all of the debt that may come due within the subsequent few years – particularly if rates of interest fall once more. Nevertheless, I discover it very reassuring that HD’s debt – even after the acquisition of SRS Distribution – stays manageable, even when the financial setting weakens considerably going ahead.

At Nearly $400 – Is It Time To Promote HD Inventory?

Earlier than concluding this replace, I want to briefly focus on the valuation of HD inventory. In spite of everything, a return of greater than 30% in simply over 4 months simply does not appear realistically sustainable – maybe HD inventory has merely gotten forward of itself? Once I printed my final article, HD shares had been buying and selling just below $300, and I assumed this was a fairly good value with a long-term mindset, however undoubtedly no steal.

At practically $400, in fact, issues look very totally different. Determine 5 illustrates varied valuation multiples and compares them to their ten-year common. Contemplating that HD inventory has benefited massively from the low rate of interest setting and the actual property growth, I might argue that the ten-year common valuation will not be essentially a conservative comparability. But regardless of this already pretty optimistic backdrop, HD inventory is at the moment buying and selling at a couple of 20% premium, relying on which valuation metric you have a look at. Specifically with HD’s already massive market share within the U.S. in thoughts, the excessive price-to-earnings-growth (PEG) ratio specifically makes me a bit uneasy.

Determine 5: The Residence Depot, Inc. (HD): Multiples-based valuation of HD inventory and comparability to ten-year common multiples (personal work)

Approaching the valuation from a money circulate perspective, I carried out a reduced money circulate (DCF) sensitivity evaluation. The outcomes are proven in Determine 6 and ought to be interpreted as follows. An investor who buys HD inventory immediately and is content material with a value of fairness of 8% expects the corporate to develop its free money circulate by 4.0% yearly in perpetuity. This does not appear overly unrealistic, however given HD’s already very massive measurement and the infamous sensitivity of DCF fashions with respective to the terminal worth, a phrase of warning is nonetheless warranted. Now, one might argue that an 8% value of fairness is just too low an anticipated return, provided that the long-term risk-free charge (as measured by 30-year Treasuries) is at the moment 4.3%. Personally, I believe 8% is appropriate on this case as I discover it arduous to think about HD shedding its main standing, which ought to enable it to take care of wholesome earnings and subsequently dividend development.

Determine 6: The Residence Depot, Inc. (HD): Discounted money circulate sensitivity evaluation (personal work)

Conclusion

The Residence Depot – the world’s largest residence enchancment retailer – yesterday introduced the acquisition of SRS Distribution, a pacesetter in roofing, landscaping, and pool verticals. For my part, the acquisition is a superb addition that may additional strengthen HD’s main place with skilled clients – one of many the explanation why I’m a really assured long-term shareholder of HD.

The choice to permit SRS Distribution to proceed to function largely independently is puzzling at first look, however signifies that the corporate has standing and is very trusted by its clients. Nevertheless, retaining the model whereas establishing cross-advertising and integration of the choices into one another’s loyalty and low cost packages ought to end in important development. When it comes to profitability, SRS Distribution is – unsurprisingly – considerably weaker than The Residence Depot. HD’s margins are subsequently prone to decline barely, not less than within the close to time period, however I believe some synergies could be realized although SRS will proceed to function largely independently. Provided that The Residence Depot’s gross sales will solely improve by round 6.5% after the consolidation of SRS, I might not overstate the impression on margins, which I estimate to be round 30 foundation factors within the quick time period.

The implied valuation of the transaction on the excessive facet for my part, particularly taking into account that SRS Distribution modified arms solely six years in the past at an implied gross sales a number of of in all probability nicely under 0.6x. Nevertheless, it is clearly unattainable to quantify the impression on HD’s development at this level, so I am going to give administration the good thing about the doubt, and I believe it might be an exaggeration to interpret the sharp valuation a number of growth as an indication of desperation to develop at any value.

With HD at the moment buying and selling at an enterprise worth of $425 billion, SRS is clearly a quite small fish to swallow. Nevertheless, it appears value noting that SRS has about $5.5 billion in debt (market worth) on its stability sheet, and together with the consideration to be paid, HD’s debt will improve by about $12.7 billion. That is definitely sizable, particularly given how aggressively HD has been shopping for again shares over the previous few years. Nevertheless, I believe HD’s debt stays very manageable even after the acquisition is accomplished (which is anticipated to be in late 2024 or early 2025).

The house enchancment large generates between $14 and $16 billion in free money circulate annually and returns round half of this to shareholders within the type of dividends. Buybacks are paused till the SRS takeover has been digested. It is a optimistic signal, which was additionally famous by the score company Moody’s in its newest affirmation of the A2 senior unsecured score. Assuming that the financial setting doesn’t deteriorate considerably, HD ought to have the ability to scale back leverage by round $7 billion per yr. For my part, the corporate can proceed to extend its dividend regardless of at the moment prioritizing deleveraging, and I anticipate it to renew share buybacks in a couple of years.

When it comes to valuation, the market-beating return of greater than 30% in simply over 4 months means that HD inventory has gotten forward of itself. To a sure extent, I believe that is true, and the multiples-based valuation primarily based, the comparability with ten-year common valuation multiples, and the DCF sensitivity evaluation affirm this. Nevertheless, we by no means know what the longer term holds and I do not assume the valuation of HD inventory is excessive sufficient to justify promoting the place now. In fact, tax concerns additionally performed a task in my decision-making course of, however I clearly now not take into account the inventory a purchase at this degree and therefore downgrade it to “maintain”.

Thanks very a lot for studying my newest article. Whether or not you agree or disagree with my conclusions, I at all times welcome your opinion and suggestions within the feedback under. And if there’s something I ought to enhance or develop on in future articles, drop me a line as nicely. As at all times, please take into account this text solely as a primary step in your due diligence.