Investec Group (OTCPK:IVTJF) This autumn 2024 Earnings Convention Name Could 23, 2024 4:00 AM ET

Firm Members

Fani Titi – Group CEO

Nishlan Samujh – Group Finance Director, CFO

Ruth Leas – CEO and Government Director, Investec Financial institution plc

Cumesh Moodliar – new CEO, South African enterprise

Convention Name Members

Alex Bowers – Berenberg

Fani Titi

Okay. Good morning. Now we have a reasonably thrilling presentation immediately. So I suggest that we begin. I might like first to welcome our colleagues in London.

At this time, the A crew will current from London. I’ve in London, becoming a member of the presentation later immediately, Nishlan Samujh, our Group Finance Director. He’ll undergo a little bit of element of the Group efficiency, after which we may have Ruth Leas give us a bit extra of colour on our U.Okay. enterprise. As you may see on this outcome, we have seen important progress in income and actually spectacular efficiency from our U.Okay. enterprise and Ruth might be adopted by Cumesh Moodliar, our new Chief Government of our South African enterprise. Once more, that enterprise has carried out fairly impressively in a really troublesome market. So excited to be joined by this A crew coming in from London.

So I am going to go straight into the presentation. As you all know, this yr marks 50 years of our existence as a enterprise. In 1974 in a single small workplace right here in Johannesburg, 18 individuals gated and determined to begin what would develop into the Investec of immediately. 50 years later, we’re in 11 international locations. In actual fact, we have been in additional 5, six years in the past, and we’ve got 7,500 colleagues around the globe. And, in actual fact, as we report immediately, you will note that we are going to be reporting revenues of over £2 billion. For a bit start-up within the southern tip of Africa, that basically is a formidable match to realize over the time.

In 1986, we listed in — on the Johannesburg Inventory Change, and in 2002, and I nonetheless bear in mind the tears in Stephen’s eyes after we acquired permission to record in London in 2002. And between that point and now, we’ve got spanned very massive companies which are world-class and worldwide in scale.

I am going to discuss Ninety One, which we demerged a couple of years in the past. And in doing so, we launched important worth to our shareholders, roughly £780 million. Lately, we deconsolidated Burstone, once more, a very high-quality international-type enterprise. Very lately, we bolstered our place throughout the U.Okay. market with the very strategically thrilling mixture of Investec Wealth & Funding U.Okay.

and Rathbones. That transaction introduced in regards to the U.Okay.’s largest DFM with over £108 billion — round £100 billion of belongings below administration and administration. And that basically strengthens our place going ahead throughout the U.Okay. market.

Clearly, if you get to a second like 50 years of existence and also you have a good time it, we’ve got to once more say how grateful we’re to our founders for founding this most unbelievable enterprise that’s Investec. And we additionally wish to admire everybody who has been part of Investec, our colleagues, our shoppers, so on and so forth.

The magic of Zebra and out of the odd wouldn’t have been doable, however for the contribution of everybody that has been right here at Investec that has made a contribution. In 2018, as you realize, we had a elementary change within the enterprise in that the enterprise transitioned from the founders. I do know there have been dangers at the moment about whether or not we might maintain the enterprise. The transition was easy. Whereas the founders are gone, our dedication to our shoppers, our dedication to our entrepreneurial tradition, our dedication to taking part in a constructive function in society stays undiminished. And following on the transition in 2019, we regarded to assessment the enterprise as a complete and to chart a path ahead that may result in higher sustainability for the enterprise.

And, in actual fact, that may lead us to reaching the returns on capital that we require. As a consequence of that, we demerged IAM now known as Ninety One. In actual fact, final night time, Hendrik despatched me a congratulatory message that was actually a beautiful of him to do round this set of outcomes. And following on that, as you realize, we’ve got executed a share buyback that has returned roughly ZAR 7 billion to our shareholders. Later within the presentation, I’ll contact on among the achievements we’ve got made in opposition to the commitments we made in 2019 in Cape City.

We now stand after 50 years at a degree the place we’re effectively positioned to execute a method for sustainable progress over the subsequent coming years. We stand right here with humility, but with confidence in our individuals and in our shoppers. We will justifiably be proud, however as I say, stay humble.

Shifting on to the subsequent slide. I will have a high-level view of the numbers. As you may see on this slide, the momentum in earnings as represented by earnings per share, adjusted earnings per share has continued. However that is actually a consequence of what we do for our shoppers. We do not chase income for the sake of income. We chase service to our shoppers. And as a consequence, we’re profitable. So I am grateful to all our colleagues for serving our shoppers as they’ve during the last yr.

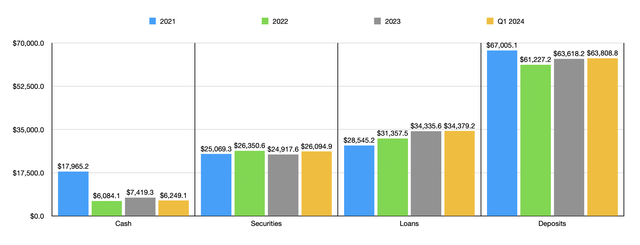

There additionally has been very pleasing progress within the elementary drivers of our enterprise. These are core loans and advances, and you may see the expansion over — between 2020 and now. And you may see within the funds below administration, equally, very pleasing progress. And you may see in deposits that we’ve got seen important progress. As we go ahead, we’ll proceed to redouble our efforts to get a deposit franchise that’s deeper, notably in non-wholesale deposit taking. That’s actually vital for our technique as we go ahead.

Once more, after we began off in 2019, we stated we needed to realize returns above our price of capital. And I am actually happy that we are actually on the prime finish of our beforehand guided ROE vary. Why are we so persistent about getting the likes, the returns which are as excessive as we do? We accomplish that as a result of larger returns permit us to serve our shoppers higher. They permit us to reinvest within the enterprise.

They permit us to spend money on our individuals, larger returns additionally permit us to play a extra significant function in society. And actually, they permit us to reward those that have given us capital, relaxation their capital behind us. So we reward our shareholders by means of distribution. So I am actually happy that we may get this stage of return, 14.6% return in kilos. This return has been diluted by the consequences of the mix with Rathbones.

I feel there is a 60 foundation level or so dilution, that means that the undiluted return or the return pre, the mix would have been 15.2%, a tremendous return for a pound-denominated enterprise.

If we go into the subsequent slide, Nishlan will go into the numbers fairly intimately, so I will not spend a lot time on this. I am going to simply spotlight two or three numbers. The expansion in adjusted earnings per share of 13.4% in opposition to the backdrop of uncertainty within the markets, unstable markets, excessive rates of interest, strain on shoppers, we predict it is a creditable efficiency. For our South African shareholders, the rise in rands is 30.8%, a very incredible efficiency from our enterprise. The associated fee self-discipline that we dedicated to in 2019 continues.

As you may see, the cost-to-income ratio stays effectively inside goal. We proceed to handle the enterprise fairly conservatively with respect to threat consciousness and threat administration, and I’ve spoken clearly in regards to the return on fairness. With these enhancements, we’re at a degree the place we’ve got introduced a recalibration upwards of our targets by 200 foundation factors at a Group stage, a major acknowledgment and testomony of the progress that has been made. I additionally want to level out the rise of 11.2% in web asset worth. Our enterprise has an important capability to generate capital and that you simply see in that quantity that’s there.

Simply trying on the geographic image. Once more, as I stated earlier, Ruth and Cumesh will undergo the detailed numbers. In every of those geographies, we’ve got scale, we’ve got relevance, and we’re seeing momentum in every little thing that issues. Should you take a look at the underlying mortgage books in dwelling foreign money, spectacular progress given the setting, deposits, important progress in dwelling foreign money, given the setting and, in fact, funds below administration.

Within the U.Okay., we report the funds below administration from Rathbones, our associates there. And, in fact, in South Africa, the web inflows on this interval have been completely incredible, because of the crew in IW&I Worldwide.

And if you happen to take a look at the U.Okay., you take a look at an ROTE of 15.7%, actually on the larger finish of what companies like us produce within the U.Okay. Within the U.Okay., we focus on ROTE as a result of that market stories ROTE by way of efficiency; and a couple of, the combo of our enterprise with Rathbones — put up Rathbones is such that it is smart for us to report ROTE. We’ll proceed, clearly, to publish ROE for our U.Okay. enterprise. In South Africa, we’re happy to report the 17.3% ROE for our enterprise in kilos, not rands. In rands, clearly, that efficiency is rather more important.

In closing on this first part, we proceed to run our enterprise with an important dedication in the direction of sustainability and particularly, web 0. We have made our commitments by way of fossil gasoline publicity. And you may see on the backside of this slide, the commitments we’ve got made, we proceed to trace fairly positively in opposition to these commitments.

Over the past variety of months, we’ve got been refining our sustainable finance framework, and we’ve got elevated and we’re driving actions throughout the Group in making an attempt to contribute extra by way of sustainable finance. And, in fact, as a financial institution, we’ve got shoppers, we’ve got suppliers, and we’ve got taken a task of advocacy to work in partnership to help our suppliers and our shoppers as we commit ourselves to a quicker tempo of decarbonization. So nice income reported, however a good better dedication to creating positive that we are able to run a enterprise that’s sustainable.

I am now going handy over the presentation to Ruth Leas to provide us a bit extra depth and colour on our U.Okay. enterprise. Ruth, over to you. Or is it Nishlan? I am sorry.

Nishlan Samujh

Fani, sorry to disappoint you.

Fani Titi

Sorry, Nish. I am so excited to listen to Ruth that I skipped you. It will give us evaluation of…

Nishlan Samujh

Or colour coated tie.

Fani Titi

Thanks, Nish. Over to you, sorry.

Nishlan Samujh

Anyway. Thanks, Fani.

It is actually nice to be in our workplace in London. In actual fact, we’re a bit pressured in regards to the noise upstairs as a result of this constructing has been ready for Rathbones to return in. However let me simply offer you among the backdrop. When Fani talks a few troublesome financial backdrop, you may see that by way of each the inflationary pressures that it stay fairly cussed within the system, however albeit that we’ve got seen some good indicators that it is now coming below management.

Financial progress in each South Africa and the U.Okay. markets remaining challenged, however once more, constructive indicators that we’re seeing some momentum come into the system as we glance ahead. Challenges reminiscent of the price of dwelling, nonetheless a actuality within the markets that we function in, given the inflationary backdrop. However once more, we’re transferring ahead in time.

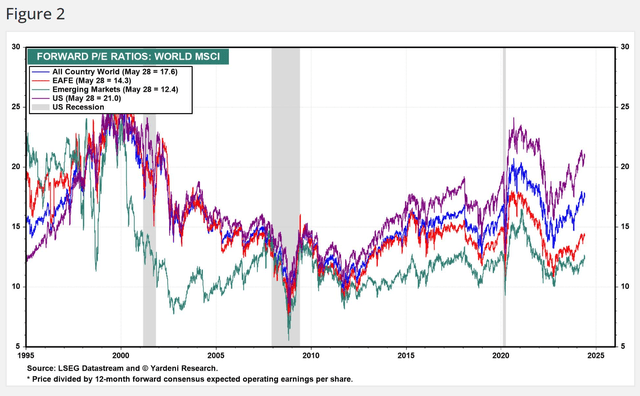

By way of markets, we have seen unstable markets throughout. And you may see this with the JSE closing round about 2.1% decrease than it is closed in March ’23 — at March ’24. However on the identical time, the common motion by way of valuations was truly 4.75% — 4.7% forward of the prior yr, related volatility seen within the FTSE, albeit in a constructive route. The rand trade price has continued to weaken. We’re in an election interval, and we’re a few week to go to the formalities of these elections. And yesterday, we discovered that the 4th of July has that means on this market. That is — from a rand perspective, a 9.2% lower within the total rand worth does have an effect.

And you will note that we have had truly constructive momentum by way of progress of our mortgage books and deposit books, however in sterling phrases, much more muted. And equally, from an earnings assertion perspective, for a enterprise that operates inside a cost-to-income ratio of 53% to weakening rand, clearly, has a adverse affect on the underside line with the rand weakening by about 14.8% over the interval.

World rates of interest, I feel the excellent news is that, we have seen a peak in world charges round in regards to the third quarter of 2023. The important thing query is, when do charges begin coming down? And I feel relying on the information that you simply learn the information, it is someday in 2024. I feel it is at all times good to only mirror on the speed environments in each geographies. Clearly, that lengthy interval of very, very subdued charges following the worldwide monetary disaster.

That interval is now over and the price of cash is de facto into the system. And we noticed fairly a speedy improve during the last monetary yr. And I feel noting that we have additionally seen it from a mean perspective. So, for instance, the U.Okay. base price on common at 2.3% within the prior yr and 5% within the present yr, and South Africa at 9.4% and 11.7% within the present yr.

As we glance ahead, clearly, that momentum will cease. I feel if you take a look at our outcomes, loads has gone on in these outcomes. And it is for that reason that we have ready a professional forma set of earnings statements so that you simply truly can examine on a like-for-like foundation.

Simply to provide you some insights into that, we’re extraordinarily excited in regards to the platform that is been created with a mix of Wealth & Funding with Rathbones, a platform that has now reported AUM of £107.6 billion on the finish of March and a platform that also has a whole lot of execution in entrance of it to ship the worth. Equally for Investec and Rathbones itself. Now, previous to the top of September, we mirrored our enterprise, Wealth & Funding U.Okay. by way of being consolidated. And put up that interval, we mirror an affiliate in Rathbones.

Burstone, I feel you noticed set of outcomes being launched simply the opposite day. And the internalization of the property administration firms to that platform has actually on condition that the completeness that’s required. Once more, we consolidated this automobile, and now we stock it at honest worth by means of revenue and loss. The distribution of Ninety One occurred pretty early on within the prior yr, however clearly has some affect by way of comparability after which the execution of the buyback.

So if you take a look at issues like the web curiosity earnings in South Africa, while we report progress, to some extent, that progress is subdued due to the execution of the buybacks, but you see the constructive momentum on the backside line.

By way of earnings drivers, FUM up by 14.2% in impartial foreign money with web gross discretionary flows of about ZAR 16.6 billion within the present interval, once more, underpinning a powerful base. Internet core loans and advances rising by 6.1% in impartial foreign money and our deposits rising by 4.4% in impartial foreign money, notably in our retail deposit base. The diversification of the guide, I would go away that to each Ruth and to Cumesh to unpack as they undergo the geographic element.

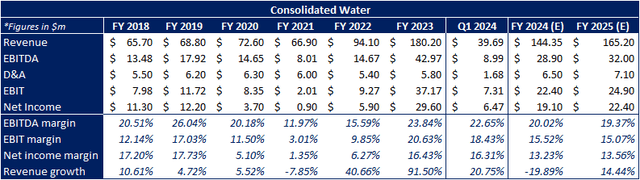

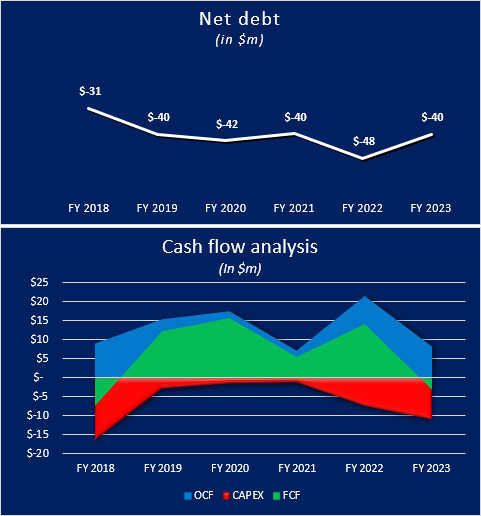

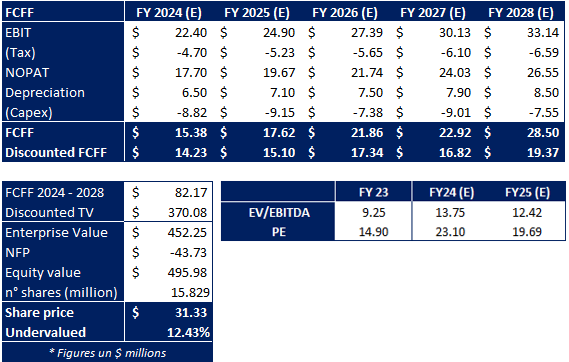

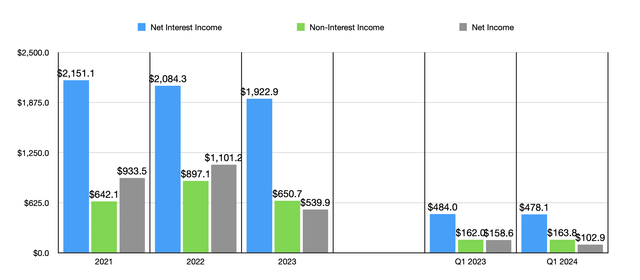

Now, if we take a look at the Group outcomes, let’s begin with web curiosity earnings. I feel once more, we have seen a progress of about 5.6%. Observe that some strategic motion has had affect, however we have seen constructive momentum given the backdrop of guide progress in each geographies, in addition to larger common rates of interest over the interval.

I feel by way of web curiosity margin, plc reporting web curiosity margin of about 3.1% and South Africa round about 2.8%. Noninterest income progress was encouraging on this interval, actually being underpinned by the truth that we’ve got grown our shopper bases, and we have continued to see some exercise, notably a return to a few of our M&A and company exercise within the markets.

Our ECL cost on the earnings assertion, it is a bit decrease from £81 million to £79 million, however it’s a little larger by way of core loans and advances, and we printed a credit score loss ratio of about 28 foundation factors. That is reflective of a web restoration of about Four foundation factors in South Africa and a credit score loss ratio of 58 foundation factors within the plc.

And taking a look at working prices. Working prices are up 3.2%, however actually flat if you happen to acknowledge the truth that we’ve got supplied round about £30 million for what we presently estimate is the full price related to the motorcar finance industry-wide assessment that has been undertaken.

This slide is only a reflection on the truth that if you take a look at our cost-to-income ratio, we’ve got a run price by way of IT spend that’s constructed into that — into the associated fee/earnings ratio throughout each South Africa and the U.Okay. We have continued to successfully mould our IT spend to deal with each enterprise funding, in addition to the run price, clearly, defending the enterprise, so areas reminiscent of cybersecurity and coping with AI, each as a enterprise incorporating new expertise and in addition coping with the threats that come by means of these new channels are all integrated into the run price that we mirror with total IT spend at simply over £200-odd million within the present interval.

Now bringing the image into totality, South Africa rising by 13% within the present interval. So working revenue for the Group rising by 8% and on a pre-impairment foundation, rising by 7.1% to £963.6 million for the mixed Group. The U.Okay. enterprise are reporting a progress of 21%. If we deal with among the pink strains, in South Africa, the banking enterprise truly grew by 10% in rand phrases, down 5% — 4% — sorry, sure, 5% in sterling phrases. However once more, a whole lot of the strategic actions, notably the buybacks additionally influencing that consequence.

The world enterprise in South Africa, rising working revenue by 30% on this interval, supported by good inflows, in addition to constructive momentum on the worldwide technique. Group investments in each South Africa and the U.Okay. impacted by strategic actions over the interval. The Specialist Financial institution within the U.Okay. reporting progress of 34% over the interval. And once more, Ruth will unpack that element.

Wealth & Funding reporting a 10% drop in contribution to Group profitability is as anticipated. It is about six months into the execution of the Rathbones mixture. It is nonetheless very early days. However once more, the enterprise has reported round a few run price of £10.6 million of synergies which were achieved on this interval and a dedication to truly getting the enterprise to an working margin near 30% by 2026.

Now, as we’ve got dedicated again in 2019, Group investments turns into much less related by way of the general contribution. However this space printing an ROE contribution of 4.9% within the interval.

The important thing funding has been Ninety One, which generates by way of dividend flows to the Group and ROE of near 20%. Our funding in The Bud Group, we stopped fairness accounting a few yr in the past. So subdued returns from that portfolio, however we proceed to appreciate the belongings relative to its carrying worth total. And the Burstone Group, we do honest worth. So there’s a little bit of volatility within the valuation, however underpinned by underlying dividend flows that come by means of.

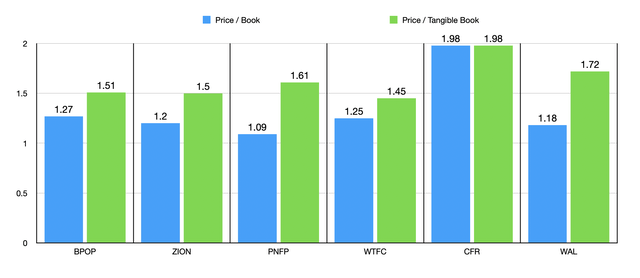

Now, bringing the image collectively by way of ROE, the Group printed an ROE of 14.6% within the interval. I feel what’s price noting is, you see that the common fairness for U.Okay. and different at about £2.7 billion. That includes a achieve of round about £358 million as we stock the brand new funding in Rathbones at a market value primarily based on the 30th of September deal that was executed. In order that does bloat capital a bit.

And to some extent, there’s a drag of about 1% within the U.Okay. and different phase, and that might be round about 2% subsequent yr. And in South Africa, round about 1.2% subsequent yr as we’ve got the total yr impact of the rise in capital. So however that, you continue to see a powerful print of ROE at 14.6% and return on tangible fairness at 16.5% for the mixed group.

By way of web asset worth, you see web asset worth rising from 507p to 564p. And that is actually underpinned by profitability, web of dividend move and however the adverse motion by way of the rand, once more, a really robust print. Now we have elected to mirror the intangibles that it is integrated within the Rathbones carrying worth as half as intangible as a result of that is the idea on which you’d mirror it on a consolidated foundation, so to maintain that constant.

And there is about 77p that’s actually the differential between what could be a pre-intangible worth. By way of capital and liquidity, total money and close to money remaining defensive at £16.Four billion for the Group.

Leverage ratios in each South Africa and within the plc remaining robust. Capital ratios, I feel, simply to remind ourselves that in South Africa, we report below AIRB. And we’ve got a focused vary of 11.5% to 12.5% for that individual steadiness sheet, once more, printing robust capital ratios. The discount from the prior yr actually the buyback processes and among the execution of strategic actions. And from a plc perspective, reporting below standardized a CET1 ratio of 12.4%, once more, effectively positioned to assist progress in that market.

So I feel now, Ruth, it is your flip.

Ruth Leas

Thanks, Nish. Good morning. Welcome, all people, to our London workplaces and really welcome — heat welcome to everybody in Johannesburg as effectively. I will be giving a high-level overview of the efficiency of Investec plc, beginning with our strategic positioning after which transfer into some element across the efficiency of our Specialist Financial institution. And lastly, specializing in the place we’re investing for progress and our progress alternatives going ahead.

Only a reminder or actually a recap of what we spoke about again at our interim leads to November is that, we’ve got created an area for ourselves the place we’ve got a novel breadth of capabilities within the mid-market, in U.Okay. and Europe and within the different geographies during which we function.

So we’ve got very important opponents in every of the actions during which we interact. However there may be not one single competitor within the U.Okay. house who brings a breadth of capabilities and diversified actions that we do throughout lending, advisory, hedging, transactional banking and deposits.

And as Fani talked about earlier, the entrepreneurial method of Investec actually seeded by our founders 50 years in the past and rising strongly and delivering by means of our distinctive shopper service care in all markets during which we function and leveraging our related shopper ecosystems. That is one thing we have labored very arduous at in the previous couple of years is really placing the shopper on the heart of every little thing we do.

It actually is one Investec, one management crew, and we have created ourselves round shopper teams, non-public shoppers, non-public firms, non-public fairness and listed firms, all performing actions within the company and funding banking house and the non-public banking house collectively. So we’re assembly each the non-public wants and the enterprise wants of our shoppers and, on the identical time, constructing scale and relevance in every little thing that we do. We proceed to have a comparatively small market share within the markets during which we function, which provides us an amazing runway for progress, and you have seen that progress actually selecting up considerably over the previous few years.

Calling out sure of the figures for Investec plc, our income up 15.8% in opposition to the prior yr at £1.188 billion and return on tangible fairness of 15.7%. Our cost-to-income ratio has diminished from 56.7% to 54.4%, with prices at £645.Three million and I am going to unpack that for you in additional element as I’m going by means of the remainder of the slides. The credit score loss ratio of 58 foundation factors according to the steerage we gave on the November outcomes, and adjusted working revenue up 20.6% at £455.5 million.

To level out the final line on the backside of the slide, pre-provision adjusted working revenue elevated 21.8% to £541.6 million, and we’re notably proud to be over that £500 million mark or £0.5 billion at this level in our journey. Simply to contextualize for you the place Specialist Banking matches in inside this.

Should you take a look at the second line on this desk right here, you will note that Specialist Banking elevated 33.9% from £303.Four million at March ’23 to £406.2 million at March ’24, and I am going to take you thru the element of what is behind producing that improve in profitability.

Trying first at mortgage progress. Internet core loans grew by 6.4% to £16.6 billion. Underlying that, our company lending, which is diversified throughout a number of areas, together with power and infrastructure finance, direct lending, asset finance, aviation finance, actual property finance, et cetera, grew at 8.6%, and our excessive web price mortgage lending reported progress of 4.3%. Clearly, the mortgage market has seen diminished demand industry-wide as rates of interest have elevated. And what we have additionally seen is that, redemptions are excessive, notably for a shopper base like ours the place we cope with excessive web price people who’ve sought to pay down their mortgages early when rates of interest are excessive.

Nonetheless, we’ve got achieved progress of 4.3% and the pipeline is constructing very properly. We have additionally seen excessive redemptions in our company lending areas. So truly, to remain nonetheless is an achievement. And we have truly been capable of develop relative to market, and that may be a sign or a operate of us persevering with to realize market share. We, in fact, haven’t diminished our underwriting requirements and are behaving much more selectively than we’ve got previously with rates of interest on the stage at which they’ve risen to.

Nonetheless, we’ve got been capable of develop strongly at total mortgage progress of 6.4%. Our buyer deposits additionally rising strongly to eight.7% to a complete of £20.Eight billion. A reminder that we’re considerably retail funded available in the market. Now we have seen progress in variety of shoppers in our deposit — our retail deposit channels of the order of about 17% to 18% of latest shoppers in these deposit channels.

We proceed to take care of very diversified funding channels and at all times cautious round our liquidity. It is vital to have a look at our diversified income streams. As a management crew, that is what we have been very a lot centered on, which is steady, repeatable, recurring earnings streams, which we consider finally leads to a powerful a number of.

You may see right here that web curiosity earnings grew by 13.2%. That is primarily based on the bigger books that we’ve got constructed over the previous couple of years, our diversified lending books and, in fact, larger rates of interest, and it additionally stems from our cautious positioning from a liquidity and money perspective, the place we at all times run a really lengthy money place.

If we take a look at noninterest income, you may see that, that elevated 36.5% predominantly from our capital-light actions. We’re very happy to see that we’ve got had larger web charge and fee earnings, a part of this off the again of our elevated lending exercise. We have additionally seen elevated exercise relative to final yr in our plc advisory actions and in addition referring to our first-time consolidation of Capitalmind.

Final yr, we took a majority stake in Capitalmind, M&A actions in Europe, giving us an on-the-ground presence throughout selective international locations in Europe, and we’re happy to see this consolidated into our outcomes immediately. So total, if you take a look at the charge earnings line, we’re seeing a rise relative to final yr.

And we have seen a constructive contribution from buying and selling earnings from buyer move. There was much less volatility in FX markets making that space of the enterprise difficult, however we’ve got seen good flows by way of our treasury, threat options, hedging actions and in addition constructive contributions from the conservative threat administration of our considerably diminished monetary merchandise guide.

Trying on the cost-to-income ratio. This has diminished from March ’23 at 60.4% to 55.6%, you may see that total working prices have elevated by 9.3%, reflecting a rise in variable remuneration according to our efficiency.

And this additionally features a £30 million provision from the industry-wide FCA motor finance assessment. If we exclude this provision, and we exclude the first-time consolidation of the price of Capitalmind, our fastened prices grew solely 2.9%, effectively under the common U.Okay. inflation price, and we are able to see that we proceed to train price self-discipline and are continuously trying to improve our efficiencies by way of our supply.

I am going to simply spend a minute or two on the motor finance provision. We began our enterprise within the motor finance {industry} across the center of 2015. In early 2016, the guide was solely £11 million. We’re speaking about 1% of market share. So a really small market share in a really extremely banked {industry} and extremely banked market, a really small participant. And this publicity grew to round £555 million in March ’21. The interval of the assessment is till January 2021, in fact, we consider we have been according to all laws and authorized necessities as much as this date. Nonetheless, we really feel that it’s prudent to take a provision.

We’re ready to take action given the comparatively brief interval we have been engaged on this market. Now we have correct knowledge throughout this full interval. We have utilized various assumptions, varied eventualities to provide you with this determine, which can cowl each litigation prices, operational prices, authorized prices and in addition some estimation of potential redress.

We acknowledge very clearly that there’s important uncertainty round this estimation, and we might want to wait to see the result of the assessment later this yr to see the place the FCA lands on it. And, in fact, welcome the assessment additionally within the context of total shopper obligation the place we really feel at all times strongly round defending the pursuits of our customers.

Trying on the credit score loss ratio, we guided on the November interim outcomes that we anticipate to see the credit score loss ratio in the same space to what we noticed within the first half. And that is according to our steerage. We have come by means of at 58 foundation factors, which is up from March ’23 at 37 foundation factors. What we’re seeing is, selective or idiosyncratic stresses throughout the guide in varied areas, however no proof of pattern deterioration and the general credit score high quality of the books stays robust. It’s regular to anticipate a rise within the stage of defaults after you will have seen important will increase of rates of interest in a really brief house of time. And as you may see from the next slide, we really feel very effectively coated by way of our protection ranges in opposition to these defaults.

Keep in mind that Investec undertakes solely secured lending. There isn’t any bare lending undertaken right here, and we’re very centered as a enterprise, at all times on collateral and loss given default. So we have to look into that after we take a look at our protection ranges and see that they’re prudently supplied.

Nishlan spoke to Investec Wealth & Funding, which, as everyone knows, mixed with Rathbones in the direction of the top of final yr. We’re very happy with how our strategic partnership goes collectively primarily between our non-public shopper enterprise and Rathbones and that partnership continues to develop from energy to energy with various referrals from non-public shopper space of Investec by means of to Rathbones and in addition engaged on referrals again from Rathbones to Investec. We stay up for delivering important worth creation by means of the extraction of synergies in that enterprise, which might be undertaken by Rathbones.

And you’ll have seen in Rathbones latest reporting to 31 March ’24 that they’ve reported run price synergies to this point of £10.6 million. It’s early days within the levels of that transaction. So most significantly and excitingly, the place are we investing for progress? You may see from the enterprise and from the supply that we’re firmly on the entrance foot and delivering for progress and centered on progress. And that is in opposition to a really difficult macroeconomic backdrop. I haven’t got to inform everybody within the room how arduous it has been to function in opposition to a backdrop of very sluggish financial progress and uncertainty, each geopolitical uncertainty and, in fact, political uncertainty, which has gone on for a really very long time right here within the U.Okay.

So we do welcome the knowledge or some stage of certainty that we are going to get put up the 4th of July with the transfer ahead there. In order we sit immediately, taking a look at inflation printing at 2.3%, we really feel that’s truly a really constructive print at that stage of inflation at this level and it actually appears that the subsequent transfer in rates of interest is downwards. We actually are trying ahead to that as a result of we consider that, that can carry a constructive enchancment in sentiment, even when it is solely a 25 foundation level transfer downwards, we anticipate that ranges of exercise ought to improve round that after which additional allow us to extend our market share of our very established, diversified shopper franchises.

I defined originally, our distinctive positioning and our distinctive breadth of mid-market capabilities, and as defined earlier, a big runway to develop. We have been capable of develop in opposition to a backdrop of sluggish progress. So having wind in our sails from GDP progress within the U.Okay., in Europe, within the U.S., the Channel Islands and in India, some extra wind in our gross sales from progress will definitely allow us to develop very strongly organically.

We proceed to deal with our progress in Continental Europe. We have been effectively established in that a part of the world for a while, round 40% to 50% of our direct lending and fund options exercise already takes place in Europe, and we’ve got had a enterprise in Eire for over 20 years, presently endeavor FX and varied hedging fashion transactions.

We have lately employed some individuals on the bottom in, or are hiring individuals within the floor within the Netherlands to proceed that stage of exercise. And, in fact, Capitalmind, with its presence and advisory exercise on the continent, will allow us to take ahead our confirmed observe document working selectively in Europe.

We proceed to deal with our different funding funds. We have talked about various occasions that we’re capable of generate extra threat than we are able to tackle steadiness sheet. We distribute a really great amount of threat yearly.

That’s partly due to our threat diversification technique of protecting our books effectively diversified, but in addition our shoppers develop stronger and greater fairly shortly, which results in a cut-off date that we won’t service them at a really a lot bigger stake. And we might be very all for bringing in exterior capital into what’s a really engaging market house of personal credit score, which we have been working in very efficiently for a few years.

Now we have massive groups in these companies. Now we have the expertise of, not solely choosing the credit score, but in addition working by means of varied cycles and with the ability to restructure and rejuvenate alternatives and exposures by means of the cycle. So we proceed to deal with that. These are lengthy germination companies, however thrilling occasions forward in that house.

After which lastly, as talked about earlier, centered on being one of many main discretionary wealth managers within the U.Okay. and really a lot centered on the improved shopper proposition of each Investec and Rathbones as we go ahead.

I might now prefer to name on Cumesh to proceed.

Cumesh Moodliar

Good morning, everybody.

Actually a privilege to current these outcomes immediately. I rise up right here immediately representing shut to five,000 of my South African colleagues. And in addition, in some ways, I rise up right here representing my predecessor, Richard Wainwright. I take a look at these outcomes and the yr to March ’24 actually signify important effort below Richard’s stewardship within the SA enterprise and total within the Group as a complete.

So Richard, simply an acknowledgment of the function that you have performed and in addition equally the expansion mindset that Richard has embedded in our enterprise within the Group in South Africa and I feel additionally internationally.

And on that observe, additionally simply speaking about a few of our outgoing DLC members, I might additionally simply wish to acknowledge the function that Ciaran Whelan performed within the — in main the Rathbones mixture for us. So I feel for us, standing up right here — for Ruth and myself standing up right here and speaking to those outcomes, we signify the efforts and enter and powerful work of many, lots of our colleagues throughout each geographies.

If I flip to the South African enterprise now, I feel we’ve got a really mature franchise throughout two core shopper segments, company and personal shoppers. In saying that although, what we’ve got continued to do is take a look at new alternatives, new segments to function in and apply other ways to proceed to develop our presence within the South African market.

Equally, throughout our Wealth & Funding enterprise, our efforts to proceed to develop our enterprise in nation, but in addition to proceed to internationalize our presence in assist of our home shoppers aspirations is a key a part of that progress technique. If I discuss to the Specialist Banking enterprise throughout each our company enterprise, our funding financial institution and our non-public financial institution enterprise, a key focus has been shopper acquisition.

And however a really troublesome macroeconomic setting in South Africa, I feel Ruth alluded to among the broader world macroeconomic components like low GDP progress, excessive rate of interest setting. I feel South Africa has additionally been beset by different macroeconomic challenges, notably across the power disaster, round transport and logistics and various different components.

As you all know, we’re lower than per week away or simply over per week away — below per week away from an election, and — which can hopefully settle and create a better stage of confidence going ahead. In order we enter this era, the important thing a part of our technique has been to place in place foundational progress platforms throughout all of our companies.

I am going to chat to the numbers in better element. Nishlan has coated a good bit of the element. I feel at a high-level, simply trying on the income numbers and speaking to our income, and I am speaking in South African rands, it is a bit extra snug when your foreign money is depreciated by near 15% to stay in your home foreign money.

So, in any other case, it simply turns into very troublesome to a geographical comparability. So I feel from a income perspective, simply what’s actually been constructive is income 7.1% forward of — 7.7% forward of prior yr. Our working prices have ticked up barely at 8.3% forward of the prior yr, which has had a slight affect on our cost-to-income ratio at 53%. Simply allowing for that these numbers are reflective of the total South African enterprise, and I’ll drill into the element of each the financial institution and wealth companies a bit additional into this presentation.

The credit score loss ratio truly at minus Four foundation factors, displays important recoveries we have had within the yr below assessment. On a gross foundation, our credit score loss ratio could be at 9 foundation factors. So I feel you continue to have a really constructive consequence given the robust macroeconomic setting, and I feel reveals a stage of conservatism throughout the enterprise and the best way we have managed our lending books over this era.

Adjusted working revenue at ZAR 10.1 billion is 12.5% forward of the prior yr. And in addition, I feel for the primary time, we have truly damaged by means of the ZAR 10 billion barrier. So I feel just like Ruth when she spoke about going by means of the £500 million mark, additionally a constructive progress from our South African enterprise. ROE for us, I feel, has actually been a key, key issue for us to contemplating the yr below assessment at 17.3%. I’ll discuss to additional element on that.

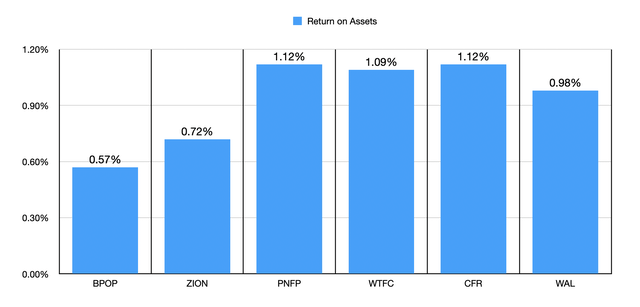

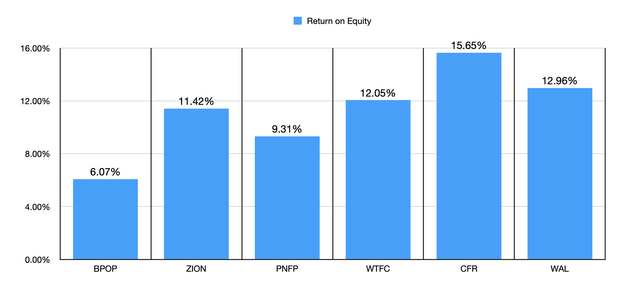

And I feel what’s vital to notice has been the constructive affect of the share buyback and the way that is impacted our ROE. And equally, trying to the underlying franchises within the SA enterprise, we take a look at the Specialist Financial institution having an ROE of 19.2%. We will go into some additional element on the underlying companies throughout the Specialist Financial institution franchises, and you may see that the ROEs of these companies have been performing very, very effectively and possibly according to peer group and considerably above in some areas. So a constructive consequence in lots of respects for the enterprise.

And if we take the pre-provision adjusted working revenue has elevated by 7.2% to ZAR 9.9 billion. Taking a look at a breakdown throughout our varied enterprise items. I feel simply highlighting our Wealth & Funding enterprise, which has proven improve in working revenue of 29.6%.

Definitely, a few of that has been off the again of the foreign money depreciation on condition that over 65% of the belongings below administration are domiciled in arduous foreign money. However that one of many — and I feel Nishlan’s alluded to it additionally in his replace was the constructive belongings below administration inflows of discretionary belongings of slightly below ZAR 17 billion.

So displaying persevering with progress in that market and persevering with shopper acquisition and in addition the leverage and profit we’re now beginning to obtain from our non-public shopper technique throughout the Group. So I feel a major uptick for us. Equally, trying on the Specialist Banking enterprise, 9.8%, up from the prior yr at ZAR 9.5 billion.

Group investments at ZAR 63 million after which Group prices at ZAR 353 million. So I feel only a key think about speaking to among the progress throughout the enterprise could be taking a look at core mortgage progress. And whole core mortgage progress of 5.7% to ZAR 343.7 billion. If I can simply give some extra colour to that, I feel progress in our company lending enterprise, however the robust macroeconomic setting has been pretty constructive or constructive at 6.7%. Non-public shopper mortgage guide has grown at about 5.6%. What’s been very attention-grabbing in that personal shopper mortgage guide progress has been the expansion in our mortgage guide of simply over 7.6%.

So I feel what’s key for me is taking a look at our guide progress is saying the extent of diversification coming by means of the underlying guide progress, which talks to among the progress methods beginning to pay dividends and in addition units up the enterprise, we consider, on the precise platform for a go-forward view. Equally, on deposits, up 0.4%. However the quantity for me to actually spotlight, and I feel, which is essential for us, is the rise in non-wholesale deposits by 14.1%. In order that’s our retail deposit guide. And once more, speaking to rising diversification throughout our enterprise, each on the mortgage guide aspect after which on the deposit guide aspect.

As we take a look at the persevering with momentum from our shopper franchises, I imply, simply trying throughout our varied earnings strains throughout deal and different charges, funding and affiliate earnings, a few the components that we take a look at as additionally web curiosity earnings elevated by 9.2% pushed by larger common incomes of curiosity on belongings and equally, elevated rate of interest setting.

The noninterest income declined by 1.4%. And a few of that is on the again of low exercise ranges that you have seen throughout among the franchises. We have nonetheless seen a constructive contribution from funding earnings, notably from our company and institutional financial institution in South Africa. Buying and selling earnings from the steadiness sheet administration displays nonrepeat from a previous interval, market-to-market losses in respect of that. This has actually offset additionally by a lower in buying and selling earnings from buyer move because of decrease rate of interest spinoff buying and selling quantity.

So, once more, a operate of the place the market is and the place we might see an uptick, hopefully, if the macroeconomic setting improves within the coming interval. One of many key points has clearly additionally been how we handle our cost-to-income ratio. And if you happen to take a look at it on the Specialist Banking stage at effectively below 50%, at 48.4%, however barely up on prior yr, which was 47.8%. This has largely been pushed by elevated personnel prices and in addition further regulatory prices. The variable remuneration has additionally elevated according to efficiency inside varied areas of our enterprise. So, once more, we’re nonetheless — an merchandise that we might proceed to handle very rigorously, however effectively inside our goal vary.

And I feel additionally symbolic of the truth that in sure areas of our enterprise, we have continued to develop headcount the place we see progress alternative. And we have additionally equally proceed to speculate on that.

I feel I’ve unpacked the credit score loss ratio intimately earlier. So I am going to transfer on to only our subsequent slide, which actually covers our ECL provisions. And just like Ruth, majority of our lending mirrored right here is collateralized lending. And we have seen a slight enchancment in Stage 3. So I feel, once more, total, a constructive pattern for us in lots of respects. And an easing rate of interest setting will clearly hopefully enhance all of these particular metrics.

If I flip to our Wealth & Funding enterprise, which I touched on earlier. One of many key information for us has additionally been to see how the enterprise has strategically grown. So outdoors of simply speaking to absolutely the numbers right here, the deal with the internationalization of the enterprise. The important thing alternative that the crew recognized in Switzerland and the way we construct that platform to assist excessive web price of Africans and in addition different worldwide shoppers and a continued deal with, not simply internationalization for our shoppers, but in addition including various different value-added companies like tax and fiduciary companies, all of which may assist our total shopper base and deepen entrenchment.

The funds below administration within the interval elevated by 15.2% to only over ZAR 500 billion. And equally, we have seen adjusted working revenue up by 29.6%. So I feel if we take a look at the general efficiency of that franchise and put up a Rathbones mixture, you are seeing this as nonetheless a major progress on for our enterprise and in addition a major capital-light income stream for our Group. So a constructive consequence from that engagement. And in addition, what we’ve got seen is various different strategic steps taken by our Wealth & Funding enterprise, which we’ll replace in additional element on later.

If I can flip to among the progress alternatives. And simply to actually discuss to — and never simply an bettering macroeconomic setting, however the place can we consider we have a chance to develop our specialist providing and into the segments that we consider we are able to deal with.

So I feel below Richard’s watch, we had began a really important drive to extend non-public banking shopper, core buyer acquisition in our Non-public Banking enterprise. Within the yr below assessment, our core shopper acquisition grew by slightly below — web core shoppers in non-public banking grew by slightly below 9%. We’ll proceed to scale that. And because the financial system improves, we consider that these numbers would additionally enhance considerably.

I’ve already touched on the persevering with and evolving deepening of our worldwide proposition for our SA shoppers and what we’re referring to now as our SA worldwide shoppers, which can even assist a broader Investec ecosystem throughout each SA, U.Okay., Channel Islands, Mauritius and Switzerland. So the total ecosystem of Investec coming collectively for these internationalizing shoppers from an SA perspective.

The third side has been — and I feel Fani alluded to that in his opening was about deepening and rising our enterprise banking proposition, which is de facto specializing in our mid-market phase and the chance to develop what we’re doing inside that house. We have already internally taken various important steps to focus on our groups in a extra integrating approach throughout our — all of our varied banking areas in SA.

So each the company institutional financial institution, the funding financial institution and the non-public financial institution and ensuring that we’ve got integrating groups specializing in the mid-market phase with our enterprise banking proposition being the golden thread that hangs collectively inside that phase. Equally, we have regarded on the potential alternative in that house, and we consider that we are able to develop our share of pockets over the approaching time period.

As we glance to among the structural challenges in South Africa, what we have additionally seen has been the numerous alternative to develop and proceed to develop the work of our power and infrastructure finance crew and the power for us to assist many purchasers for — in respect of their renewable power and infrastructure wants. Already, our crew has important deal move and are taking part in a task, not simply in South Africa, but in addition throughout the broader continent.

And I feel that is in all probability additionally a chance to speak to us taking a look at how we might take a look at rising our Remainder of Africa technique, according to our present technique, and we have already put in place sure key metrics to have a look at how we may develop our world markets presence, our commerce finance and our power and infrastructure finance groups into that. We do consider there is a important alternative in the remainder of the continent. And it is extra about how can we take a whole lot of our present franchise worth into these areas with the same threat self-discipline and mindset.

Thanks. I am going to now hand over to Fani in Johannesburg for Q&A. Thanks, Fani.

Fani Titi

Thanks, Cumesh.

Nonetheless have some closing immediately earlier than Q&A. I am positive you may see why I am enthusiastic about this crew that we’ve got. I believed Nishlan was good in providing you with a broad view of the entire group. I believed the granularity and texture that Ruth may give in regards to the U.Okay.

enterprise and our distinctive positioning there was vital. And Henry tells me that Cumesh is really easy and cozy, on condition that that is his first presentation, you may see in a market that may be very mature how we’re attacking that marketplace for progress as we go ahead. So a incredible A crew, clearly, getting tempted to have them current the subsequent outcomes on their very own.

Simply taking it dwelling, I had referred to the Capital Markets Day in 2019. And I am simply going to wrap it up fairly shortly. We will see that during the last 5 years or so, we’ve got seen important progress in earnings.

As we go ahead, the emphasis is sustaining — is on sustaining efficiency. And you may see during the last three years, that has been the case, and we’re fairly excited that our interplay with shoppers continues to be very deep, as you heard from each Ruth and Cumesh.

We additionally had indicated that we are going to be very a lot minded to handle our prices and have the self-discipline to take action as we undergo, and you have seen among the actions we’ve got taken. As we go ahead, I am actually relaxed in regards to the skill of the enterprise to handle prices. I do know some individuals had stated, why have not you been extra aggressive in your cost-to-income targets?

We wish to make investments, and we even have the aptitude and the observe document, I feel, in managing our prices. You may see these prices remaining nearly fixed from 2020 to now from £1.18 billion to £1.120 billion. I imply, good price management total.

We have talked in each markets about how we take into consideration threat administration and the way there is a larger diploma of threat consciousness and possession. And you may see that in your impairment expertise over time. We’re on the prime of the cycle of excessive rates of interest.

From right here, we might anticipate that there could be a bit of normalization. And in every of the markets, we’re snug with our threat administration expertise as such. So the standard of our asset guide actually appears incredible.

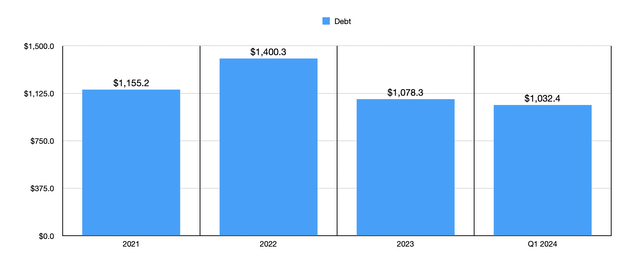

We additionally talked 5 years in the past in regards to the capital allocation self-discipline. One of many components of it was that we might return capital to shareholders that’s in extra of our necessities. We had checked out a specific stage of mortgage progress, each within the U.Okay. and SA, however we additionally had stated we’ll limit the issuing of shares that shareholders have been involved about by way of dilution. So you may see in your weighted common variety of shares excellent, you will note that we have been at 946 million.

In 2020, we are actually at 848.Eight million. And that may be a consequence, clearly, of the buyback on the one hand. And on the opposite, the truth that we aren’t issuing shares into the market. And we have talked in regards to the ROE enhancements over the interval because of a powerful capital technology that we see within the enterprise.

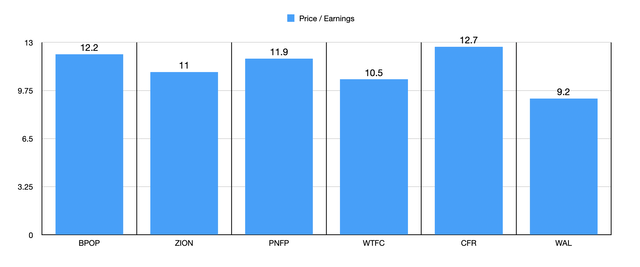

This enchancment over time on the again of serious strategic execution has led us to revise our goal upwards. Earlier than I discuss that revision, Nishlan has spoken in regards to the dilatory impact on our ROEs of the Rathbones transaction, on condition that there was an uptick in our capital of about 380. In order that results in a dilution on our targets of 1%. So we had an unique goal of 12% to 16% of ROE — on ROE on the Group stage, adjusted technically only for the mix of Rathbones, that adjusts to 11% to 15%. And off that base, we’re happy to substantiate that we are going to be concentrating on returns between 13% and 17% in ROE phrases and in ROTE phrases between 14% and 18%.

Once more, I repeat that the U.Okay. and the U.S. market report efficiency largely on ROTE. So we’ll deal with that a bit bit. And our U.Okay. enterprise might be reported that option to examine it simpler with our U.Okay. colleagues, however we’ll proceed to publish ROE for the U.Okay.

Our cost-to-income ratio, that is by means of the cycle. We anticipate that to be lower than 57%. We have been at about 54% or so this yr. In order that cost-to-income ratio is for by means of the cycle, and we’re snug that the self-discipline is there. So I do know some individuals have commented on that as a possible space of concern.

On the credit score loss ratio, we’ve got expanded a bit bit our credit score loss ratios to a spread of 20 bps. So we now may have a credit score loss ratio goal vary of between 25 bps to 45 bps. In SA, given Cumesh’s presentation, we’re trying, as I stated, at 15 to 25 bps. Within the U.Okay., given the positioning of that enterprise within the mid-market, we’re taking a look at a spread of 30 to 50 bps. As Ruth talked about for the close to time period, we clearly will provide you with a way of what we anticipate.

Now we have lifted our dividend payout ratio from 30% to 50% to 35% to 50%. So the work completed during the last 5 years has been substantial. The advantages are taking part in for all to see. Extra importantly, we’ve got a base from which we are able to develop the enterprise sustainably over the long run. Our obligation is to serve our shoppers and to play a significant and impactful function in society, and we’re dedicated according to our goal of making enduring work to do the identical.

Trying close to time period on the monetary yr 2025, March 2025, we clearly acknowledge that there stays a major stage of volatility available in the market and uncertainty. Now we have an election subsequent week right here. Now we have an election within the U.Okay. in July, July 4. Now we have an election within the U.S. in November, and there is a rolling election in India already.

So there is a stage of uncertainty and geopolitically, we’ve got the challenges that we’ve got. Regardless of that difficult setting, as I stated, once I regarded on the 50 years, we stay assured in our place as a enterprise. Now we have deep franchises. We stay assured within the entrepreneurial tradition that drives and binds our individuals. And we’ve got very distinctive positions in every of the markets that we function.

I hope you bought a way of the place we might be on the lookout for progress in SA. You will have a way equally the place we’ll be on the lookout for progress within the U.Okay. and Europe. So primarily based on our positioning, regardless of the troublesome backdrop, we anticipate income momentum to be supported — to proceed supported largely by guide progress. You will have seen the expansion in our books, and that historic progress will clearly profit us as we go ahead.

We anticipate charges to begin to reasonable within the present yr. That moderation we might anticipate to be fairly muted. The expectations, clearly, within the U.Okay. might be totally different to expectations. In SA, we predict SA might be slower than the U.Okay., simply given the truth that our inflation continues to be a lot larger than the midpoint of the vary of 4.5%.

Our governor want to see inflation charges there and decrease. So given these expectations, we see a muted affect on our web curiosity earnings, however clearly, there might be an affect.

And on condition that setting, the place we proceed to accumulate shoppers, the place we see a stage of exercise, given in South Africa, the excessive stage of — the high-quality of our non-public shoppers and the bigger corporates that we serve and in addition given the truth that post-election, hopefully, there is not a major instability round financial coverage. We see in the meanwhile that there seems to be a consensus that you will have an consequence, if you happen to take a look at the newest polls for the ANC of round 45 and probably a steady, both ANC authorities or on their very own or coalition authorities. So when you’ve got that sense of stability, we predict there could be some pickup in financial exercise. We have seen enchancment in power.

The power availability issue lately has been at about 70%, which is sort of vital. Some individuals suppose which may be some chicanery round elections, however I do belief the Chairman of that Board of Eskom and the Chief Government, we have seen some turnaround round Transnet. Once more, the participation and collaboration between enterprise and authorities appears to be yielding some constructive momentum.

Within the U.Okay., our place is so distinctive. And our market shares are so small and the breadth of companies is so spectacular that we predict even in a barely more durable setting, we are able to do higher. As Ruth indicated, if charges begin to come down, even when it is solely 25 bps, that feeds into confidence and sentiment.

And in that setting, we might anticipate that our Group ROE ought to come out at about 14%. And Ruth needed me to elucidate that circa means it may very well be barely up or barely down. So I am going to give Ruth a 1% vary, 0.5% every approach. That is for you, okay? ROTE of circa 16%.

For the South African enterprise, we’re taking a look at an ROE of 18.5%. And that is in kilos, by the best way, as a result of we report in pound. So an exceptional achievement if we are able to attain it. Within the U.Okay., we’re taking a look at return on tangible fairness of circa 14%. Our cost-to-income ratio below 57%.

As I stated, I am not anxious about our skill to proceed to handle prices. So I would not anticipate any important deterioration in our cost-to-income ratio. Credit score loss ratio to be throughout the goal. Our enterprise is effectively positioned. We’re an optimistic bunch, the 7,500 individuals of Investec.

Now we have a tradition that appears for alternative even in a troublesome setting. So we glance ahead with a level of confidence, and we’ve got the pleasure and the satisfaction of the final 50 years, however we stay cognizant that the market is hard. There may be competitors on the market, however we’ll again this crew to do effectively on this setting. I liked the crew that we’ve got in London. As I say, I am tempted to have them current on their very own.

On that observe, I will ask for questions. I apologize, the presentation has been fairly lengthy. I actually believed it was vital so that you can hear from each Ruth and Cumesh as they go into the element of their companies.

Query-and-Reply Session

A – Fani Titi

Questions. The place can we begin? Will we begin in Johannesburg or elsewhere?

Unidentified Firm Consultant

We’ll begin within the U.Okay.

Fani Titi

We’re beginning in London. I’ve to apologize. I can see you are eager to ask. Any questions within the U.Okay.?

Unidentified Firm Consultant

Sure, we’ve got a query, Fani. Please go forward.

Alex Bowers

That is Alex Bowers from Berenberg. I simply have three questions, if I’ll. Simply firstly, on NII. Is there any up to date steerage by way of sensitivity to price, Ruth, each in form of the U.Okay. and South Africa? So second query on the FCA motor finance assessment.

You talked about you anticipate an consequence on the finish of this yr. What is the form of course of between every now and then to get us then what are the form of key milestones alongside the best way? After which lastly, simply on the Rathbones deal, I do know it is nonetheless early levels, however by way of synergies between Rathbones and the non-public financial institution within the U.Okay., what are the form of belongings you’re beginning to consider in that space? Thanks.

Fani Titi

Alex, I am going to offer you one probability you’re taking three, proper? So I will ask my crew there within the U.Okay. to deal with these questions. The NII steerage, we have printed a guide the place we give sensitivity for every of the areas, however I am going to ask Nishlan to only cowl that briefly. And Nishlan, you may discuss Rathbones.

Ruth sits on the Board of Rathbones. So we choose for her to not reply any questions referring to Rathbones. So Nishlan will take that query. I do not bear in mind the third query, however I am positive the crew will bear in mind.

Nishlan Samujh

You may want to only remind me of the second and third query. However let’s simply cope with the rates of interest. Rate of interest sensitivity for the U.Okay. at round about 25 foundation level motion is between £7 million to £Eight million. From a South African perspective, I am taking a look at Wealthy and I am taking a look at Cumesh each have their heads down. So we’ll take a flyer for that quantity round about ZAR 50 million for 25 foundation factors.

Alex, if you happen to do not thoughts, simply remind us of the second and third?

Alex Bowers

Certain. Simply on second was on motor finance. So the FCA assessment is ongoing. I feel you anticipate an consequence within the yr by way of, I assume, the method between every now and then what’s anticipated to occur?

Nishlan Samujh

Nicely, clearly, it is not — we have to comply with the unfold by way of the FCA’s course of. I feel there are a while strains related to that. There’s a whole lot of work occurring round getting the information, attending to a stage that I feel is suitable. We have used the entire pointers that is accessible. We have used the entire knowledge factors that we are able to get our arms on.

I feel what was crucial from Ruth’s dialog is de facto the scale of guide by way of the assessment interval that we referred to. So we’re fairly assured by way of our measurement. However I do not suppose we may give you rather more element round that.

Alex Bowers

After which the final one was simply in regards to the Rathbones merger and form of potential synergy concepts between the non-public financial institution and Investec and Rathbones.

Nishlan Samujh

I feel the entire synergy concepts stay constant to what was mentioned on the time of the execution of the transaction. So the primary that we spoke about was bringing your complete enterprise onto a banking platform, and that basically enhances the treasury administration. And you’ve got seen a few of that execution already come by means of by way of the achieved £10.6 million. The opposite is the platform and to an extent, the transition of Investec Wealth & Funding on to the Rathbones platform itself. After which the third is, clearly, to do with the shopper swimming pools on each ends of the companies, and that can come over time.

Now, I feel what’s secret’s that, if you take a look at Rathbones’ March and December buying and selling replace, they’ve dedicated to getting in the direction of an working margin in the direction of 30%.

And that is by September 2026, which actually incorporates the anticipated time strains round synergistic outcomes. I feel the constructive observe that got here by means of in March is that, the constructing that Rathbones has been launched. And if you happen to right here earlier on, you’d have heard among the work occurring upstairs. Thanks.

Fani Titi

I can affirm that Nishlan was proper to the rate of interest sensitivity in SA for a 25 bps transfer is ZAR 51 million. I feel he stated ZAR 50 million. So I feel that is about proper.

Thanks Nish. Any additional questions within the U.Okay.?

Unidentified Firm Consultant

No additional questions, Fani.

Fani Titi

We’ll come to SA.

Unidentified Analyst

Good morning. Thanks, Fani and crew. Simply two questions, please. Relating to the up to date ROE goal vary, then the steerage for 2025, you are guiding to be inside that vary. Are you able to give us a way of how you progress up that vary? Is it largely about earnings progress, contemplating the CET1 ratios in the meanwhile? Do you see alternative to return extra capital as effectively? After which are you able to give us an replace on the outlook for income progress within the U.Okay. as effectively, please? Possibly simply unpacking among the areas the place you see momentum, and I assume, the expansion within the non-public shopper enterprise as effectively, please?

Fani Titi

Okay. I am going to ask Ruth afterward to speak to how we see income progress throughout the U.Okay. setting. I feel as we take a look at these targets from a South African perspective, we generate capital forward of our utilization, given the place the setting is. We have indicated that we’ve got a capital ratio of about 13.6% or so, total steerage round CET1 is 11.5% to 12.5%.

We want to see how the setting unfolds over the subsequent six to 12 months put up the election. To the extent that we can’t develop our belongings at a a lot quicker price as a result of the setting is constrained, financial and political coverage stays unsupportive of enterprise. Clearly, at a degree, we should assessment the surplus capital that we generate. So it is not a tomorrow consideration, however it’s a consideration we’ll make within the close to future. From a U.Okay. perspective, we’re rising at a reasonably quick price.

Clearly, on this explicit interval with charges as excessive as they’ve been, the expansion has not been as we’ve got had it during the last two or so years. I might anticipate that enterprise to proceed to generate capital, however to reinvest within the enterprise. So I would not see essentially extra capital popping out of that resulting in us returning capital from that base. Clearly, we return capital by means of dividends and the U.Okay. financial institution participates within the dividends that we do declare. Much more progress we see inside that setting, in South Africa, it’ll depend upon what occurs economically over the subsequent yr or so.

Ruth, do you simply wish to cowl the way you see income progress over the subsequent 12 months or so?

Ruth Leas

Sure, positive. Thanks for the query. If we glance again at income progress this yr, I might say that it has been robust, however blended. Sure areas have grown very strongly. Others have simply maintained the place they have been eventually yr.

We noticed robust progress in power and infrastructure finance, notably within the U.S., but in addition in our U.Okay. enterprise, we have seen progress in our aviation enterprise. We have seen progress in asset finance. We have additionally seen our lending books in direct lending and fund options sustain with the place they’re at, though they have been a really excessive stage of redemptions. So we — it is in opposition to a really low progress backdrop.

So with charges coming down and better exercise ranges, we do anticipate lending exercise to extend as we go ahead. Additionally, on the non-public shopper aspect, as I stated earlier, we noticed mortgage progress of solely 4% final yr, which is a slower run price than we have seen in prior years, however a lot quicker than market, and we see these pipelines constructing very strongly as we go right into a decreasing price setting.

One factor that has been fairly elusive has been IPOs, and we’d anticipate as exercise ranges improve, we must always see better chance of charges approaching each the plc advisory aspect and M&A advisory aspect and positively from a U.Okay. perspective, are very a lot trying ahead to the times when IPOs might be again. It looks as if with the best way the capital buildings are, with debt being so costly, that it must be the time for fairness once more. And positively, we have seen curiosity coming into the U.Okay. house or actually the London market trying very, very low-cost and investor curiosity coming in.

Fani Titi

Thanks [Bonnie]. We have clearly spoken about revenues from a Banking perspective. From a wealth perspective, we might anticipate that over the subsequent 12 months, Paul Stockton and his crew will be capable of make the progress that they’ve signaled to the market with respect to synergies.

So we stay up for that. To the extent that rates of interest come down, market-facing companies, asset administration companies, wealth administration companies probably may do higher, notably if sentiment and confidence amongst non-public shopper improves in South Africa, we proceed to serve the excessive finish of the market. And as Cumesh indicated, we’re internationalizing our providing.

There might be much more deal with what we are able to do by means of Switzerland. And I am positive you will have seen additionally that, that enterprise has struck a distribution-type relationship to simplify it in Latin America. In order that enterprise is de facto fairly positively taking a look at avenues for additional progress. So each from a banking perspective and from a wealth perspective, we stay inspired that there are pockets of progress that we are able to execute on.

Thanks. Any additional questions in Johannesburg? Sure, please.

Unidentified Analyst

Barry, there is a mic coming to you. Good day, my identify is Barry. I want to know you’ve got acquired Wealth & Funding and Rathbones, neither of that are completely wholly owned, and now they are going on the identical platform. Are you — do you propose to mix them? Or how do you allocate prospects per firm, per admin?

Fani Titi

Simply to be very clear, we personal 100% of Investec Wealth & Funding South Africa, which is now — we now name Wealth & Funding Worldwide. Rathbones is a U.Okay. home fund supervisor, discretionary fund supervisor. So for the U.Okay., shoppers that come out of the U.Okay. will go into Rathbones.

In order that’s fairly clear. Outdoors of the U.Okay. market, we’ve got a method to develop internationally, and we’ll try this particularly by means of the Swiss platform. That is why I discussed the Swiss platform. So the choices are fairly straightforward, and there might be a set of shoppers that pre the transaction, South African shoppers that can proceed to be managed in partnership with Rathbones. So we have thought fairly clearly in regards to the alternative.

We predict in a U.Okay. context, given among the modifications in guidelines round pension funds that the chance for a participant like Rathbones clearly the biggest in its phase, will be capable of develop for our individuals. That platform offers us a chance for progress the place we are able to improve functionality throughout the U.Okay. setting. So we’re fairly excited in regards to the U.Okay.

home alternative. Outdoors of that, our enterprise has grown notably strongly. You noticed a few 30% improve in income. You noticed in W&I Worldwide. You noticed £16 billion of inflows, discretionary inflows.

So we’re fairly enthusiastic about that wealth alternative.

Unidentified Analyst

Subsequent query. Your share buybacks, do you propose to proceed? I have not learn the doc. And if that’s the case, are you biased to purchasing extra South Africa or extra shopping for the U.Okay. listed?

Fani Titi

We have largely come to the top of the ZAR 7 billion program. I feel the quantity that we reported final time was about ZAR 6.Eight billion or so. So we have about ZAR 200 million or so to go. As I answered the earlier query, the buildup of extra capital, we’ll assessment over time. So within the close to time period, we aren’t trying to launch any important buyback program. However as I stated, we do generate extra capital inside a South African setting.

Any additional questions in Johannesburg? Do you will have something from the…

Unidentified Firm Consultant

Sure. Have one thing from the webcast? That is from Threat Insights. We price Investec on ESG, and we have seen that your Scope Three emissions as a proportion of whole emissions is sort of low. We have seen this sample with different listed firms in SA as effectively. Usually, Scope Three accounts for greater than 80% of whole emissions. Is there a plan to competitively place Investec by measuring Scope Three extra successfully?

Fani Titi

We clearly have completed as a lot work as we are able to do on this space. One of many areas of progress is in standardizing knowledge that if you take a look at Investec and Normal Financial institution and Barclays otherwise you take a look at JPMorgan, that the information you see is credible and comparable. So various requirements are being developed, and so they’re changing into extra acceptable requirements. For example, we use PCAF in sure cases. And if you get to Scope 3, there have been various developments in knowledge integrity.

So till we’ve got a stage of — larger confidence in knowledge integrity, the work we do will at all times be work in progress. And we do report fairly extensively our emissions. However sure, this space requires much more improvement within the high quality of the information, not only for Investec, however industry-wide and globally, however we stay dedicated to doing our greatest by way of decarbonization. Is that it?

Unidentified Firm Consultant

That is it. No extra questions.

Fani Titi

Okay. I feel we have come to the top of the presentation. Thanks to your attendance. We’ll discuss to you once more in six months, and wishing you effectively for many who might be going to elections subsequent week. And for our U.Okay. colleagues, wishing you summer season. Thanks very a lot.