kokouu

Enterprise Merchandise Q1 Evaluate

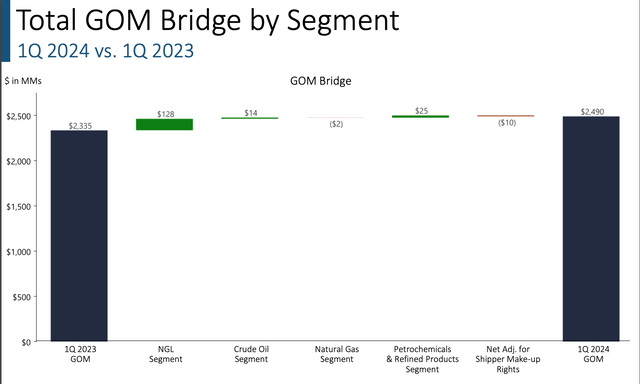

Enterprise Merchandise (NYSE:EPD) reported one other typical quarter this week. The corporate delivered $2.5 billion of adjusted EBITDA for the quarter. That made for $9.5 billion over the previous 12 months and a leverage ratio of 3x. The corporate expects to bounce round that leverage ratio plus or minus 25 foundation factors.

The corporate elevated the distribution to $0.515, a 5.1% enhance from final yr. That’s commensurate with the rise within the firm’s DCF (distributable money circulation).

I like to recommend anybody concerned with EPD inventory to overview Enterprise’s quarterly earnings presentation. It tells you many of the salient working outcomes for the corporate. I am going to undergo the essential slides right here.

At its coronary heart, EPD is a fee-based enterprise the place NGLs (pure fuel liquids) make up over half of the working margin. Subsequently, it is no shock that the majority of any development in working margin company-wide will come from the NGL phase

EPD Firm Gross Working Margin Bridge (EPD Q1 Presentation)

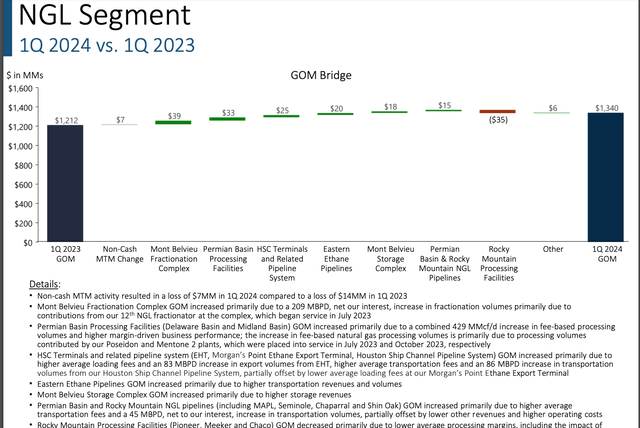

The excellent news is that the NGL phase is rising mainly throughout the board.

NGL Section Gross Working Margin Y/Y Bridge (EPD Q1 Presentation)

The soundness and steady development of those numbers are what present the funds that enable this firm to pay a run charge $2.06/unit distribution whereas nonetheless funding ~$3.5 billion of development capital and sustaining a bulletproof stability sheet. In contrast to many corporations going through maturity partitions of low price capital coming off, EPD has a 19-year weighted common lifetime of debt at a weighted common price of 4.7%.

Development of Export Capability

I do not assume many buyers admire how essential the US has turn into as an exporter within the world power markets. In line with the IEA, the US exported 3.62 million barrels of power liquids in 2013, comprised of crude oil, refined merchandise and pure fuel liquids. At the moment that quantity is 12.1 million barrels.

EPD performs an enormous function in these exports, particularly its NGL export infrastructure on the Gulf Coast, particularly the Houston Ship Channel. The corporate exports 2.33 million barrels per day or round 70 million barrels per 30 days of liquids. It was mentioned on the quarterly convention name that the corporate has initiatives to develop to 100 million barrels per 30 days.

For the reason that Houston Ship Channel is capability constrained, a method for the corporate to hit that 100 million objective is growth of SPOT (seaport oil terminal) 30 miles off the Brazoria County coast in Texas. SPOT simply acquired a deepwater port license in April. It will likely be linked to EPD’s oil pipeline community and have a VLCC (very giant crude provider) docking skill that can enable for two million barrels of loading capability per day.

The corporate is at the moment searching for contracts for SPOT earlier than making the FID (ultimate funding resolution), a course of it expects to finish by the top of this yr. As soon as SPOT is accomplished and operational, most if not the entire firm’s oil export capability that happens within the Houston Ship Channel might be moved to SPOT.

EPD Inventory Valuation

At simply over 9x EBITDA with a 12.2% free money circulation yield and a bit over 7.25% distribution yield, EPD models are basically high-yield bonds that develop 5% per yr. It is higher than a bond from a tax perspective although, because the distributions are largely return of capital, which makes the funds extremely engaging to people.

Conclusion

I really like EPD’s property and have monumental respect for administration. The models have had a pleasant run for the previous few quarters, however they’re nonetheless under their pre-Covid excessive regardless of super development of the property, the money flows, and discount in leverage. This firm is a core a part of my portfolio and I count on to be so for years.