boykpc/iStock through Getty Photos

Introduction

Clarkson PLC (OTCPK:CKNHF) is a UK-based firm energetic within the delivery business, producing the vast majority of its income and revenue from shipbroking providers. Transport nonetheless is a significant manner for items to be transported everywhere in the world and in accordance to current estimates, about 85% of the worldwide commerce is carried on ships. Yearly, about 1.6 tonnes per capita are shipped by vessels, so being an essential shipbroker ought to mean you can at the very least develop with the market in case your prospects are pleased with the providers you present. I don’t count on the whole quantity of products which can be shipped to lower anytime quickly

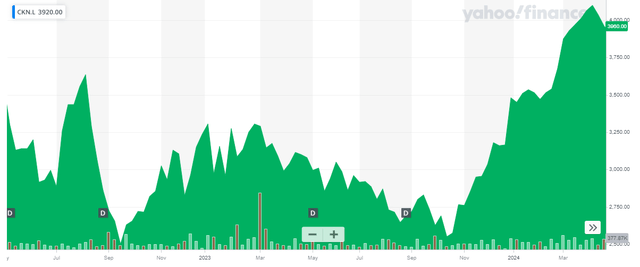

Yahoo Finance

Clarkson is buying and selling with CKN on the London Inventory Trade and with a median every day quantity of 66,000 shares per day, it clearly is probably the most liquid itemizing. As Clarkson reviews its monetary outcomes in GBP, I’ll use the GBP as base foreign money all through this text.

The corporate’s enterprise mannequin and the way it’s thriving throughout these unstable durations

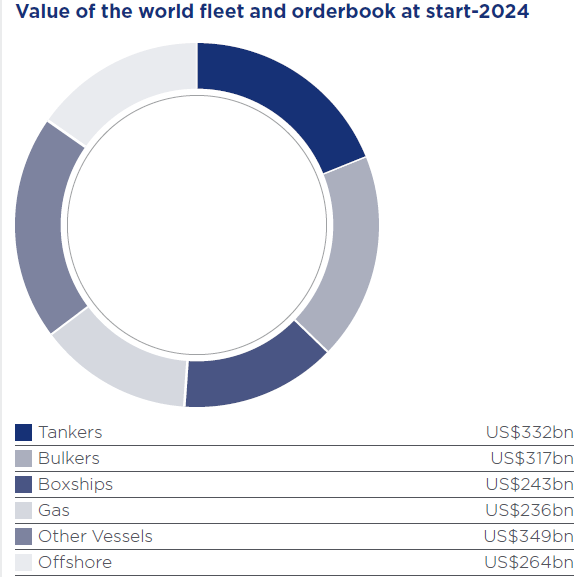

In the beginning of this 12 months, the whole worth of the world fleet and the orderbooks got here in at roughly $1.7T and as you possibly can see beneath, it’s fairly evenly divided amongst completely different classes.

Clarkson Investor Relations

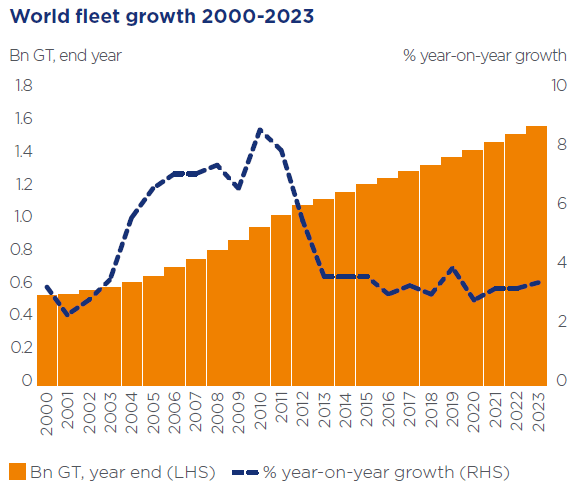

And because the world commerce volumes continued to develop up to now few a long time, the world fleet grew with it. Proven beneath is the common YoY development of the world fleet (expressed in capability, so not within the quantity of vessels). Prior to now decade, the fleet development has been comparatively regular at round 2-3%.

Clarkson Investor Relations

Nearly all of Clarkson’s income is generated within the shipbroking division, which contributed about 517M GBP in income in 2023, a rise of roughly 4% in comparison with the 496M GBP in 2022. The pre-tax revenue in that section elevated at a barely decrease tempo, however nonetheless confirmed a 3% improve. And simply to be clear, promoting and shopping for ships for shoppers is only a small portion of Clarkson’s brokerage providers as the corporate is concerned in all points of delivery, together with brokering new constitution agreements between lessors and lessees.

Whereas I’m primarily within the firm’s shipbroking division, it additionally has just a few smaller different divisions just like the financing group which helps securing challenge finance and structured asset finance offers. The help division represents slightly below 10% of the income and focuses on stevedoring and as an example customs clearance paperwork. The division with the best margins is its analysis division: on a income of 21.9M GBP it reported an 8.4M GBP pre-tax revenue for a margin of just about 40%.

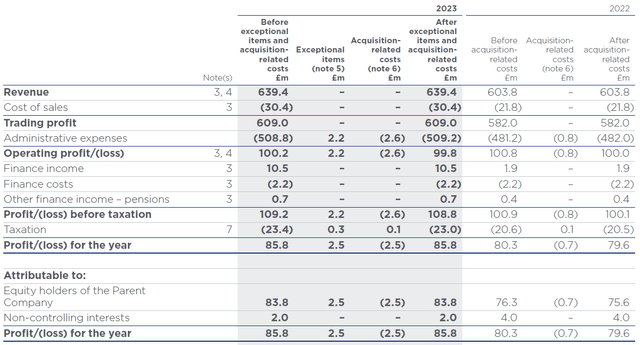

The whole income in 2023 got here in at roughly 639M GBP, a rise of simply over 5% whereas the price of gross sales elevated by 40% however as you possibly can see beneath, most of Clarkson’s working bills are booked as an administrative expense, which elevated by slightly below 6%. This meant the working revenue remained nearly unchanged at round 100M GBP.

Clarkson Investor Relations

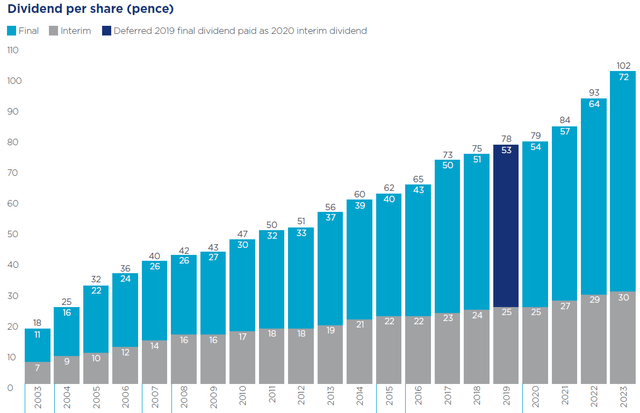

The upper rates of interest on the monetary markets additionally had a optimistic impression on Clarkson’s earnings profile because it reported a web finance revenue of 8.3M GBP in comparison with a web finance expense of 0.3M GBP. This helped Clarkson to publish a 108.8M GBP pre-tax revenue and an 85.8M web revenue, of which 83.8M GBP was attributable to the frequent shareholders of Clarkson. This represented an EPS of 275 pence per share. This allowed Clarkson to hike the dividend to 102 pence for the complete monetary 12 months, which suggests that previously 20 years Clarkson has elevated the dividend each single 12 months.

Clarkson Investor Relations

As Clarkson runs an asset-light enterprise, its money flows are very robust as properly. The corporate reported a complete working money stream of 155.3M GBP regardless of a 6.1M GBP funding within the working capital components. We also needs to deduct the 2M GBP in curiosity funds and 10.5M GBP in lease funds however add again the 10.3M GBP in acquired curiosity. A remaining adjustment is deducting the 0.8M GBP distinction between taxes owed and taxes paid.

Clarkson Investor Relations

This ends in an adjusted working money stream of 158.4M GBP. The whole capex was simply 10.8M GBP, leading to an underlying free money stream of roughly 147.5M GBP or 480 pence per share. Sounds nice, however take into account this contains simply over 58M GBP in bonus accruals, so the underlying normalized money stream is roughly 90M GBP or 293 pence per share.

Clarkson is working as a profit-sharing firm with enormous bonuses for its staff. This ensures everyone seems to be rewarded handsomely and retains the expertise throughout the firm. Final 12 months, the corporate expensed about 59M GBP in bonuses and a big portion of those bonuses have been settled in shares which Clarkson had to purchase on the open market.

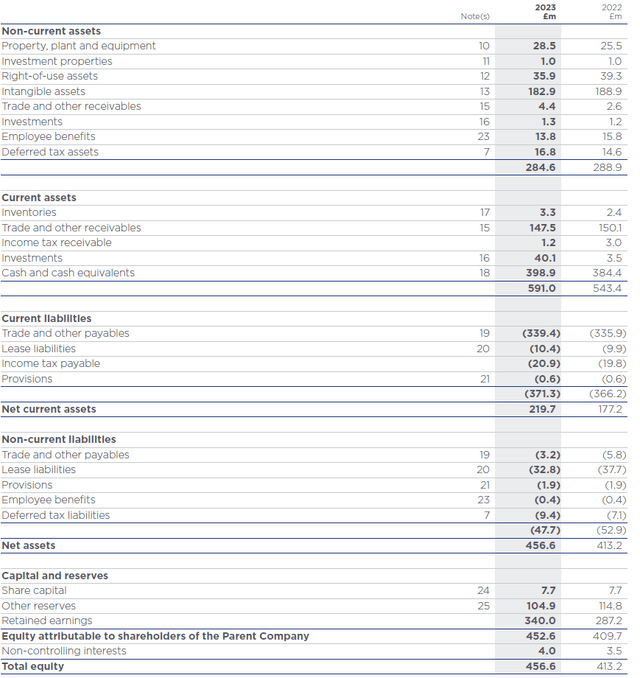

So whereas the steadiness sheet beneath reveals an enormous 399M GBP money place and no debt, the corporate’s web debt calculation does embrace the whole bonus accrual.

Clarkson Investor Relations

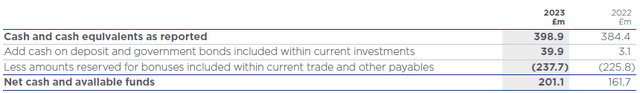

The picture beneath reveals the breakdown of the online money calculation, which got here in at 201.1M GBP. Divided over the present share rely of 30.7M shares excellent, the adjusted web money per share is roughly 655 pence.

Clarkson Investor Relations

Funding thesis

Clarkson’s monetary outcomes will proceed to fluctuate based mostly available on the market circumstances however contemplating the inventory is at the moment buying and selling at 3920 pence with 655 pence per share in web money (adjusted for bonus accruals), I actually don’t thoughts valuing the corporate at an enterprise worth of 1B GBP contemplating it generated about 90M GBP in adjusted money stream. The robust money place gives draw back safety.

In fact, there aren’t any ensures Clarkson can proceed to maintain its earnings profile on the present elevated stage, however because the world commerce volumes proceed to extend, shipbrokers like Clarkson will proceed to play an essential function in connecting vessel house owners with charterers.

I at the moment don’t have any place in Clarkson PLC, however I like its asset-light mannequin and its good fame within the shipbroking enterprise. I’ll attempt to choose up the inventory after it begins buying and selling ex-dividend later this week.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.