ninitta

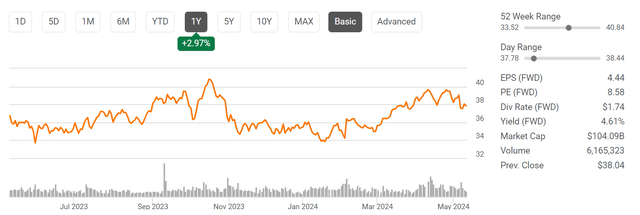

BP inventory’s excessive yield and low P/E

BP‘s (NYSE:NYSE:BP) inventory worth has largely been transferring sideways just lately. As seen within the chart beneath, its worth elevated solely about 3% within the final 12 months, whereas the S&P 500 loved one of many greatest years with greater than 20% achieve. There are definitely good causes for such lag, and I’ll contact on a number of of them later. Regardless of some revenue headwinds, BP has been enhancing its funds. As such, the purpose of this text is to argue that the mixture of worth stagnation and enchancment in its financials has created a large value-price hole and a extremely uneven return/threat profile.

In search of Alpha

As a mirrored image of this mix, BP now encompasses a dividend yield shut to five% (4.61% to be actual) and solely an FWD P/E of 8.58x as you may see from the chart above. Each time I see such a mixture of excessive yield and low P/E, my experiences have taught me to instantly test on the next two potential pitfalls:

- The hazard of a dividend minimize within the close to future.

- The hazard of shopping for a terminally stagnating enterprise at an affordable worth.

In BP’s case, I see neither hazard as to be detailed within the the rest of this text.

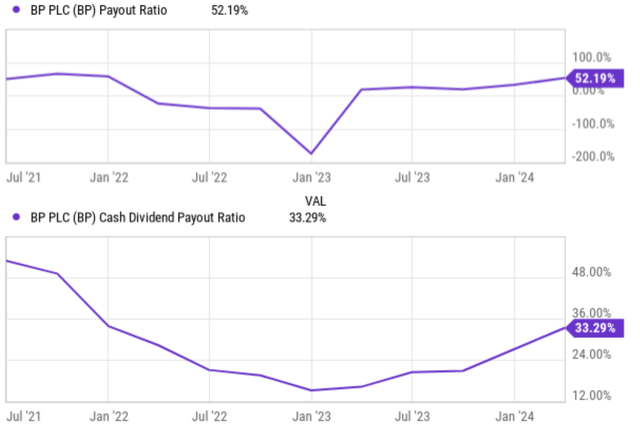

BP inventory’s Dividend security and share repurchases

Let’s study the hazard of an imminent dividend minimize first. The subsequent determine reveals BP’s EPS payout ratio (high panel) and money dividend payout ratio (backside panel) in recent times. As seen, the EPS payout ratio is about 52%, fairly secure in each absolute phrases (i.e., it is just about ½ of the earnings) or relative phrases (i.e., relative to its historic observe report or sector averages). When it comes to the money payout ratio, the image is even stronger. As seen, the EPS payout ratio is simply 33% at present.

Wanting forward, I anticipate BP’s shareholder-friendly insurance policies to proceed. Given the present secure ranges of payout ratios, I anticipate the other of a dividend minimize – I anticipate loads of room for the annual dividend distribution to extend within the subsequent few years.

In search of Alpha

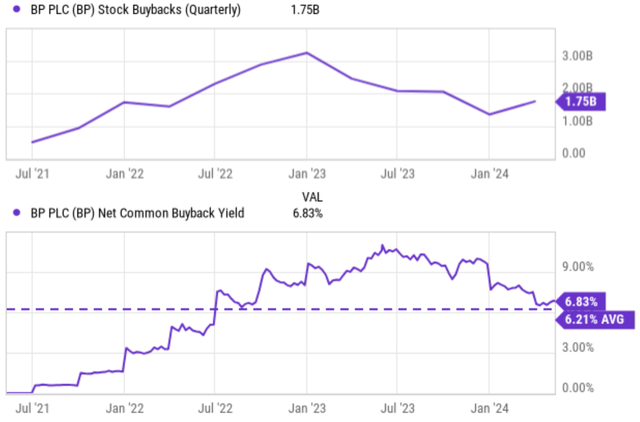

As one other demonstration of its dividend security (and in addition one other demonstration of its beneficiant shareholder-friendly insurance policies), BP has been shopping for again shares at an honest clip. And it has just lately elevated the repurchase authorization via the primary half of this 12 months.

As seen within the high panel of the chart beneath, BP has been allocating a large quantity of capital towards share repurchases in recent times. The quarter buyback peaked at over $3B early this 12 months and totaled $1.75B previously quarter. To raised contextualize the magnitude of such buybacks, the underside panel reveals its internet frequent buyback yield. As seen, the buyback yield peaked at over 10% just lately, averaged about 6.21% previously 5 years, and at present sits round 6.83%. These numbers are even greater than its already beneficiant money dividends.

Lastly, keep in mind that repurchases are way more potent than money dividends in the long term, particularly made on the present low P/E multiples. There are a lot of the explanation why I want buybacks (and they’re all detailed in my different articles), right here I’ll quote the highest 1 issue: tax, an element that’s truly in our management (whereas most elements are finally out of our management in investing):

Inventory buybacks are far more tax-efficient for each the corporate and the shareholders. With a inventory buyback, shareholders do not understand any capital good points or losses till they really promote their shares. This enables them to defer paying taxes on any appreciation within the inventory worth. In distinction, with money dividends, first, they’re taxed twice. First, it’s taxed on the firm after which shareholders owe taxes once more as earnings as soon as they obtain the cash – no matter whether or not they reinvest the dividend or spend it.

In search of Alpha

BP inventory’s Development potential

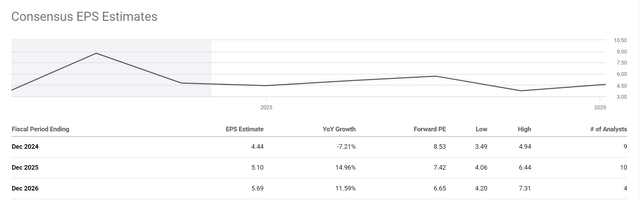

Now let me transfer on to look at the second potential hazard: the hazard of shopping for a completely stagnating firm at an affordable worth.

The chart beneath reveals the consensus EPS estimates for BP inventory within the subsequent Three years. As seen, total, analysts anticipate BP’s EPS to develop within the subsequent few years. The consensus estimates level to an EPS of $4.44 in fiscal 2024, representing a modest decline YOY. Then the market expects it to extend to $5.10 and $5.69 by the tip of fiscal 2025 and 2026, respectively. These numbers symbolize a year-over-year development of 14.96% in 2025 and 11.59% in 2026.

In search of Alpha

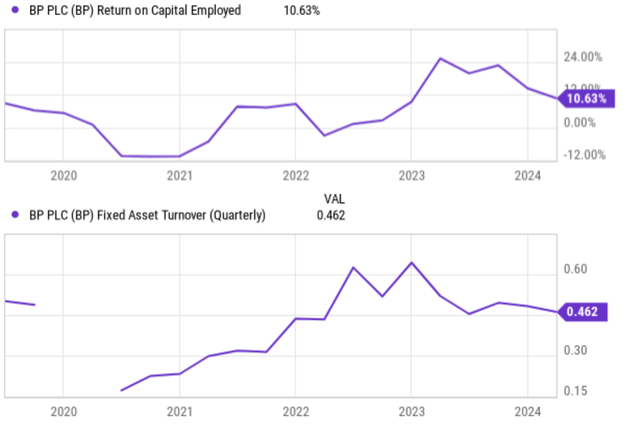

I definitely see good causes for the decline in FY 2024. BP has been dealing with some challenges in its manufacturing volumes these days. As you may see from the following chart beneath, its ROCE (return on capital employed) has dropped considerably from a latest peak of round 24% to the present degree of 10.6% solely. And a essential trigger for this drop is asset utilization, dropping from over 0.6x just a few quarters in the past to the present degree of 0.46x solely. There are just a few different ongoing headwinds to compound the problem. The present commodity costs are comparatively low in comparison with the typical costs in recent times. Increased labor prices and inflation additionally added to the revenue stress.

Wanting forward, I see these points as non permanent solely and anticipate a strong EPS rebound within the subsequent 1~2 years as consensus projected. Amongst all of the ROCE drivers, asset turnover is a knob that’s largely inside administration’s management. And based mostly on administration’s newest outlook, upstream manufacturing ranges are poised to enhance within the subsequent few quarters. Oil costs are in fact out of administration’s management. However my outlook for oil costs is sort of optimistic, as detailed in a latest article on Chevron (CVX). Lastly, the corporate has just a few different initiatives that may assist development in each the close to and long run. Its renewable operations are slowly increasing. The corporate’s different power pipeline is rising quarter over quarter, notably within the Americas and Asia Pacific area. Bolt-on acquisitions present one other development catalyst. For instance, BP just lately introduced the acquisition of an power provider in Germany.

In search of Alpha

Different dangers and closing ideas

When it comes to draw back dangers, BP faces largely the identical set of dangers frequent to grease shares. As aforementioned, the massive volatility in oil costs is an ever-present threat for oil shares. Geopolitical instability, financial fluctuations, and even shifts in client habits can set off oil worth swings that considerably affect profitability. Moreover, the worldwide push for cleaner power sources presents a long-term problem. BP has some initiatives on this space, however they’re all in an early stage in my opinion (for instance, BP is dedicated to reaching net-zero emissions by 2050). These initiatives and dedication to wash power might result in greater upfront prices within the quick time period.

All informed, my conclusion is that BP presents a compelling BUY alternative for value-oriented buyers below present circumstances. The inventory trades at a really low ahead P/E ratio and provides a lovely dividend yield. The corporate’s aggressive share buyback program additional enhances shareholder returns. The buybacks truly return way more capital to shareholders than its already-generous money dividend, particularly when adjusted for taxes. Whereas EPS development might face some headwinds within the close to time period, I anticipate a stable rebound within the coming 1~2 years. These positives far outweigh the potential dangers in my opinion, leading to a really skewed reward/threat revenue.