iantfoto

Public Storage (NYSE:PSA) is among the hottest REITs on this planet, and it’s simple to grasp why:

- Particular person traders see their self-storage properties everywhere, giving them a way of familiarity with their actual property.

- It has a really sturdy stability sheet, which is a transparent benefit in as we speak’s surroundings.

- Self storage properties have traditionally generated persistently excessive returns in all market environments, together with even recessions.

- The REIT has a really giant scale with a $50 billion market and a list on the S&P500 (SPY), decreasing dangers.

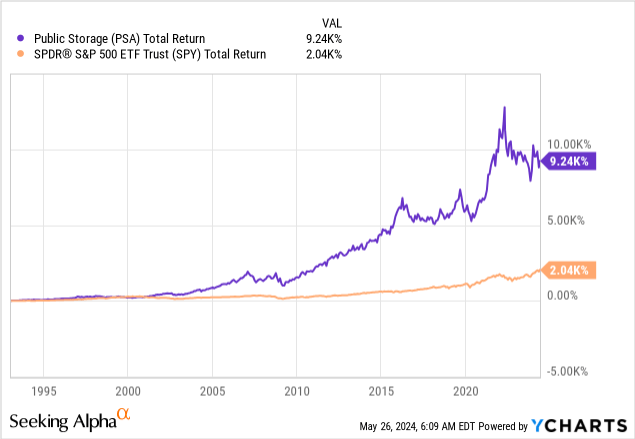

- PSA has a multi-decade monitor report of regular dividend development, and it has additionally massively outperformed the remainder of the REIT market:

Public Storage

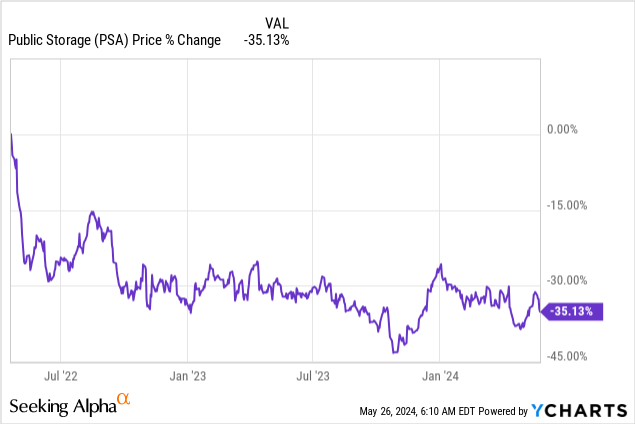

However this sturdy repute didn’t protect PSA from the REIT bear market that started in 2022. It took down each REIT, together with even one of the best of them.

Because of this, PSA is down 35% for the reason that starting of 2022, and that is regardless of rising its money circulate by 25% since then. This primarily implies that its valuation has been reduce in half:

Is now time to purchase its inventory whereas it’s discounted?

Or must you promote earlier than it drops even additional?

I’m typically very bullish on REITs (VNQ) and this may occasionally lead you to suppose that I’d be a purchaser right here, however I’m not and listed here are three the explanation why:

Motive #1: Vital oversupply danger

The pandemic led to a growth in demand for self-storage house due to 4 key causes:

- Abruptly individuals wanted to create space for a house workplace

- Older generations handed away and left quite a lot of stuff behind

- Folks purchased quite a lot of new toys for the outside

- Lastly, lots of people moved round from one metropolis to a different.

Furthermore, this growth in demand occurred at a time when little or no new provide was being constructed, and in consequence, the market was severely undersupplied, permitting PSA to considerably hike its rents and develop its occupancy charges.

However this then attracted quite a lot of builders within the self-storage house, and now the corporate is going through the precise reverse surroundings.

The demand is normalizing because the world progressively returns to regular, with more and more many individuals returning to the workplace, promoting their toys, and shifting lower than they did in prior years.

On the similar time, an enormous wave of latest provide is hitting the market, placing it in a state of oversupply.

Because of this, PSA’s similar property NOI dropped by 1.5% within the first quarter, and that is after struggling in 2023 already. Its occupancy additionally dropped by one other 0.8% to 92.1%.

And sadly for PSA, this difficult surroundings will probably final for some time longer as a result of there’s a lot provide coming in, and that COVID-fueled demand wasn’t all sustainable:

Public Storage

Its administration factors to issues getting higher in 2025 and 2026, and they’re most likely proper.

However I concern that if we go right into a recession, the demand may not be fairly as recession-resistant because it was prior to now as a result of the rents of self-storage are as we speak far larger. In earlier recessions, it was simpler to easily ignore the storage expense as a result of it was a smaller proportion of your revenue, however following the large hire hikes of the pandemic, extra individuals will most likely cease their leases as they appear to chop down on spending.

Lastly, over the long term, I’ve one other concern about self-storage house, notably within the USA.

In the present day, there’s 10x extra space for storing within the US than within the UK and 40x greater than in continental Europe. I imagine that a few of this huge distinction may be defined by cultural and geographic causes.

However I do suppose that shopper spending within the US will progressively transfer increasingly from shopping for “issues” to purchasing “experiences” as an alternative. Europeans do not buy as many toys, however they spend extra on experiences, and I see American individuals moving into that very same course.

The “expertise economic system” is rising quickly, I do not see this ending, and it’s a long-term headwind for self-storage amenities. Not solely that, however the “sharing economic system” can also be rising quickly, and additionally it is a headwind for self storage amenities. Instance: for those who can simply hire an RV and the price of that’s cheap, you might be much less probably to purchase one for your self.

Motive #2: Too massive for its personal good

I’ve beforehand defined that scale has benefits. It results in decrease bills, higher entry to capital, and decrease danger.

However previous a sure level, economies of scale flip into diseconomies of scale, and I’ve usually used Realty Earnings (O) for instance for this.

Its development fee has slowed down as a result of it’s a lot more durable to develop from a $50 billion base than from a $5 billion base. New acquisitions do not transfer the needle as a lot anymore, and it’s good to purchase an enormous quantity of latest properties simply to maintain the ball rolling. You then lose flexibility, agility, and bargaining energy with property sellers, main you to probably decrease your underwriting standards and pay greater than you’ll have in any other case.

Nicely… PSA is simply as massive as Realty Earnings and due to this fact, I feel that its measurement is more likely to decelerate its development sooner or later as nicely. I’d relatively personal a a lot smaller self storage REIT.

Motive #3: Higher alternatives elsewhere, together with in its peer group

PSA’s valuation has dropped significantly for the reason that starting of 2022.

Even then, it’s as we speak priced at 17x FFO, which doesn’t strike me as “low-cost” when contemplating that it’s going through some extreme headwinds and that its money circulate is declining.

There are many REITs which are priced at decrease multiples and are literally rising their money circulate. To provide you an instance, Huge Yellow Group (OTCPK:BYLOF / BYG) is the chief within the UK, and it’s priced at 16.5x, regardless of having fun with much better long-term development prospects.

Subsequently, I’ve a tough time justifying an funding into PSA.

Positive, it’s not priced at a “bubbly” valuation anymore prefer it was in 2021, however that doesn’t make it low-cost as we speak. I nonetheless count on it to do comparatively nicely over the long term, however I simply suppose that another REITs will do lots higher and for that reason, I’ve no real interest in proudly owning PSA presently.