hapabapa

My Thesis Replace

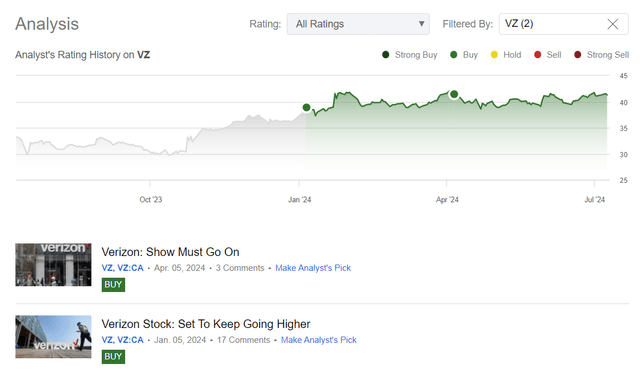

I began overlaying Verizon Communications Inc. (NYSE:VZ) inventory in January 2024 and up to date it in April stating that VZ inventory had a 20% nominal upside potential, not together with the very excessive 6% dividend yield. Basically, the inventory has gone nowhere since I began overlaying it, and it has underperformed the foremost broader market indices such because the S&P 500 (SPX) (SP500) – identical to most different worth shares on the market generally.

In search of Alpha, Oakoff’s protection of VZ

Regardless of the comparatively weak efficiency, I am glad that VZ hasn’t been offered off lately. I feel that VZ will nonetheless have the chance to understand its progress potential sooner or later, which I affirm in the present day based mostly on my up to date evaluation.

My Reasoning

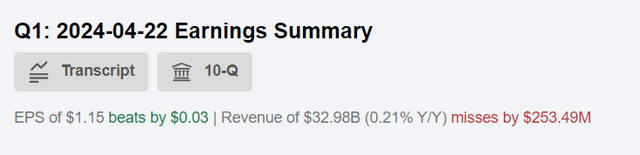

Verizon’s Q1 2024 consolidated income was principally flat at nearly $33 billion attributable to a steadiness between the expansion in wi-fi service income, which elevated by 1.3% YoY, and a decline in wi-fi gear income (-7% YoY). The slight enhance in wi-fi service income was pushed by current worth hikes, greater adoption of premium plans, and progress from the corporate’s mounted wi-fi entry (FWA) initiatives, in response to the press launch notes. Regardless of decrease COGS for each segments, greater SG&A and D&A bills led to a rise in consolidated OPEX, so VZ’s unadjusted Q1 EBIT determine fell barely by 0.84% YoY. Nevertheless, Verizon’s consolidated adjusted EBITDA elevated by 1.4% from the earlier 12 months, reaching $12.07 billion. This led to a slight enchancment within the EBITDA margin, which widened by 40 foundation factors to 36.6%. Sadly, VZ’s adjusted diluted Q1 EPS fell by 4.2% YoY to $1.15, primarily attributable to greater curiosity bills; anyway, it was sufficient to beat comparatively modest Wall Avenue EPS expectations for the quarter (although the identical cannot be stated about income expectations):

In search of Alpha, VZ

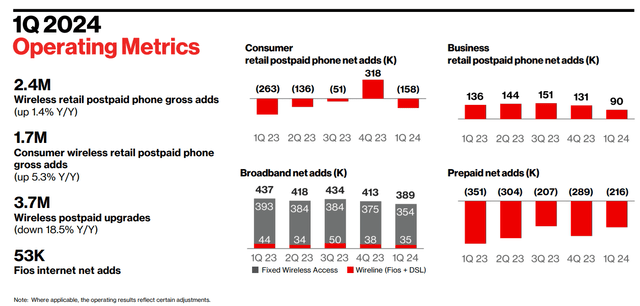

Verizon added >Three million broadband subscribers in simply the final 2 years, which appears good to me; by the tip of Q1 2024, VZ had served 11.1 broadband subscribers. As Verizon solely has ~1.1 million subscribers from the ACP program, the administration has estimated that this program might be eradicated and its impact on EBITDA can be minimal; such a response qualitatively distinguishes VZ from different small-cap gamers like SurgePays (SURG). I anticipate the federal government to relaunch the ACP program in some type or one other, which could even develop Verizon’s EBITDA going ahead. Within the meantime, Verizon’s current knowledge on key working metrics appears greater than stable to me if we take the stagnant state of the telecom trade as a complete as a benchmark.

VZ’s IR supplies

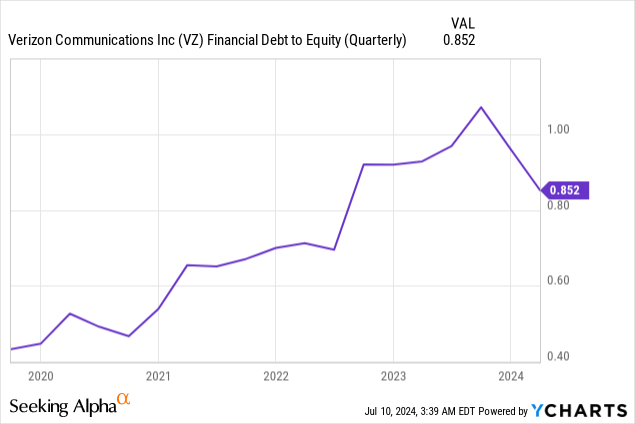

One cannot ignore the dialogue of free money movement. Though greater curiosity bills put some strain on money movement from operations, this metric amounted to $7.1 billion in Q1, which led to an FCF in Q1 2024 (+16% YoY, amounting to $2.7 billion). And it is not only a short-term FCF tailwind, as for the complete 12 months, Verizon expects money movement to develop steadily, much like what we noticed final 12 months. On the leverage aspect, we see that Verizon’s internet unsecured debt improved, standing at $126 billion – that is a $3.7 billion discount from final 12 months. The corporate additionally issued a $1 billion inexperienced bond to fund renewable power purchases. So the online debt to EBITDA is now standing at 2.6x in comparison with 2.7x final 12 months, which looks as if a minor change, however continues to be optimistic, particularly contemplating that the debt-to-equity has dipped beneath 1, in response to YCharts knowledge:

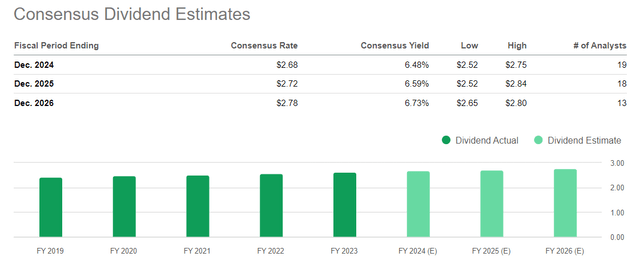

On this respect, I consider that In search of Alpha Quant’s evaluation of VZ’s dividend security ought to truly be greater than the present “C+” grade. With FCF stabilizing, Verizon’s dividend must be rather more sustainable. And even considering present dividend estimates, which can show to be too pessimistic when it comes to precise potential payouts, VZ will probably proceed to extend its dividends for no less than the subsequent few years. On the similar time, the implied dividend yield is more likely to stay persistently above 6.5% from 2025 onwards, which is rather a lot contemplating the possibly imminent turnaround within the Fed’s financial coverage.

In search of Alpha, VZ

I feel Verizon’s enterprise is more likely to stay secure and doubtlessly see income progress in the long run attributable to its fast roll-out of the C-band spectrum, which is significant for its 5G community and new mounted wi-fi entry providers. The corporate advantages from sturdy buyer loyalty, greater adoption of premium plans, and lowered churn in C-band markets. Nonetheless, Verizon has a historical past of main in next-gen wi-fi know-how, and its strategic strikes like exiting the risky Media enterprise put it in good stead for future stability and progress despite the fact that it faces competitors in opposition to T-Cell (TMUS) within the 5G market, in my opinion. Tracfone’s acquisition provides one other attainable alternative for increasing revenues, though it poses challenges as regards the pre-paid market.

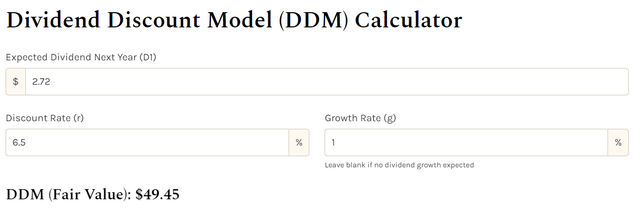

In my final article, I offered detailed calculations on the low cost charge I exploit to worth the corporate by the DDM mannequin. My calculations initially led me to a conclusion at a WACC of 6.36%. Nevertheless, I am now elevating this charge to six.50% as a result of the share of debt within the firm’s capital construction has barely declined. To account for the altering setting, I used StableBread’s dividend low cost mannequin template once more, inserting the FY2025 anticipated dividend payout quantity, the focused dividend progress charge of 1% (my fundamental assumption), and the WACC I discussed above. This leads to a worth goal of $49.45, which is nearly 22.3% greater than the inventory worth on the shut of buying and selling on July 10, 2024.

StableBread.com, DDM mannequin template, Oakoff’s notes

So I once more come to the conclusion, that given Verizon’s undervaluation, the soundness of its dividend, the anticipated enchancment in enterprise progress, and the rise in free money movement, the VZ inventory restoration momentum ought to proceed.

Dangers To My Thesis

Actually, the corporate’s key danger components haven’t modified considerably within the final three months.

Regardless of its 4G dominance and advances in 5G, Verizon nonetheless faces disruptive technological adjustments that pose a danger to its enterprise. I additionally ought to notice that the presence of extreme competitors might hinder administration’s plans to reaccelerate enterprise progress in an already oversaturated telecom market, as I warned my readers in my earlier VZ article. Ought to this be the case, my whole thesis can be incorrect.

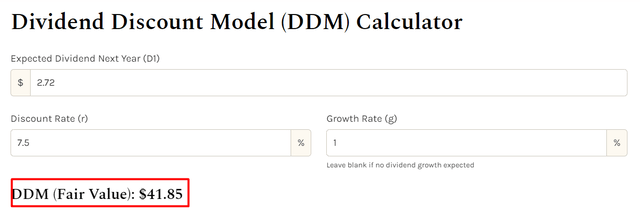

It is also value remembering the hazards related to legacy infrastructure, because the Wall Avenue Journal’s report on out of date copper cables exhibits. Though they haven’t been used for the reason that mid-20th century, there are nonetheless questions on their presence within the system that may result in legal responsibility claims, particularly these originating from earlier acquisitions. As well as, there’s a danger that I’ve made some errors whereas calculating the truthful worth of VZ share costs. For instance, if we use a reduction charge of 7-8%, all of the conclusions from my DDM will change meaningfully:

StableBread.com, DDM mannequin template, Oakoff’s notes

Concluding Ideas

Whereas Verizon just isn’t a risk-free dividend funding attributable to varied monetary and operational challenges, I feel it has a powerful probability of success given the optimistic progress prospects in a few of its end-markets and ongoing price optimization efforts. I positively like what I am seeing from the corporate’s newest financials – I hope Verizon continues to beat EPS estimates and deleveraging, making the dividend even safer.

Assuming free money movement will increase by the tip of 2024 in comparison with 2023, and company progress stays secure at 1-3% per 12 months from 2025 onwards, the at the moment estimated dividend yield of ~6.5% (in FY2025) ought to stay safe, for my part. With a present WACC of 6.5% and a projected dividend progress charge of 1% yearly, the inventory has over 22% upside potential, excluding the dividend yield. Due to this fact, I am reiterating my earlier “Purchase” score in the present day.

Good luck together with your investments!