bjdlzx

(Be aware: Baytex Power is a Canadian firm that studies in Canadian {dollars} except in any other case famous.)

Baytex Power Corp. (NYSE:BTE) reported a robust second quarter. The promised outcomes that the final article spoke of are starting to be realized, and possibly extra. Administration talked about (many instances) through the convention name, that they’re getting a 500% return from the Clearwater wells, and that these wells are outperforming. If you’ll have outperformance, that’s positively the place to have it. Earlier than the acquisition, administration said they had been proud of 10,000 BOED (Clearwater manufacturing) which is actually heavy oil with not a lot else. Now, administration additionally talked about within the convention name they had been now producing as a lot as 20,000 BOED of that very worthwhile heavy oil. Even for a big firm like Baytex Power, the money will roll in with these improbable returns.

Earnings

A lot of the per-share manufacturing enchancment is as a result of Ranger Oil acquisition. That acquisition added numerous badly wanted mild oil manufacturing.

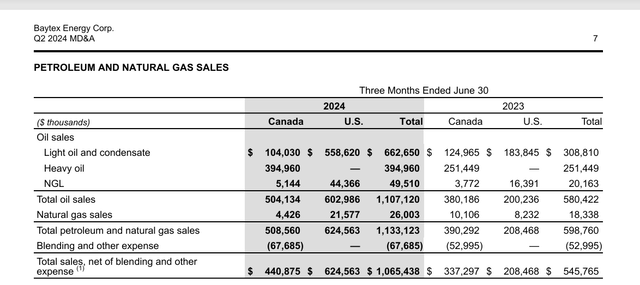

Baytex Power Gross sales Breakdown By Nation (Baytex Power Second Quarter Monetary Statements)

That is necessary, as a result of administration reported that forex modifications resulted in no enchancment within the debt steadiness. However the US gross sales are from the low-cost Eagle Ford and are very worthwhile. There may be subsequently each likelihood that the United States-based debt is being paid with the United States-based earnings. Due to this fact, whatever the accounting studies, the 2 ought to lead to an offset.

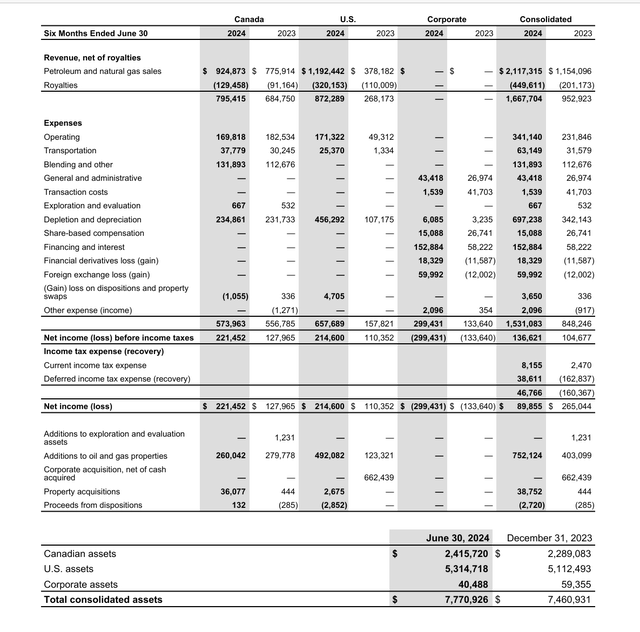

Baytex Power Earnings Assertion By Nation (Baytex Power Second Quarter Monetary Statements)

As could be seen by the total quarter proven above, that massive depreciation quantity proven for the quarter goes to guard numerous money circulate that can be utilized to pay debt. The relative property by nation likewise present that the operations are actually primarily in the US. So, the forex beneficial properties and losses will not be prone to have an effect on the debt state of affairs fairly as a lot because the accounting studies would have you ever consider.

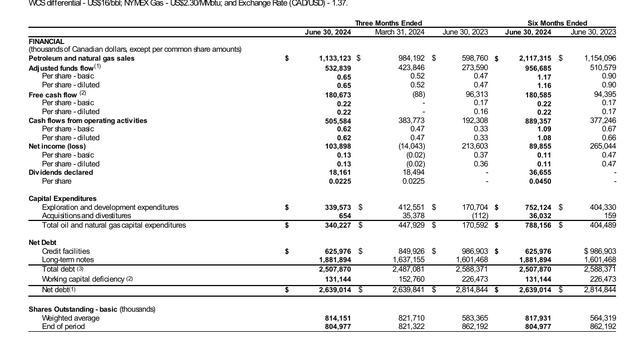

Baytex Power Second Quarter 2024 Earnings Abstract (Baytex Power Second Quarter Earnings Press Launch)

In the meantime, earnings per share and funds circulate from working actions are climbing sharply because the acquisition and associated optimization prices fade. The addition of 100% Eagle Ford manufacturing was a really worthwhile (and low price) addition to earnings. It put this firm within the place of posting some very important per share beneficial properties in comparison with a lot of the business.

The necessary debt ratio got here in at 1.1. Mr. Market might not be impressed with the perceived lack of progress on the total debt quantity. However the forex beneficial properties in debt worth are prone to be offset by growing earnings in United States {dollars} to maintain the image in steadiness.

The entire state of affairs will get translated to Canadian {dollars}, which makes it difficult to determine what’s going on. Within the presentation, administration helps by mentioning the debt in United States {dollars}. However forex swings total are unlikely to be the difficulty that the market perceives it to be.

Manufacturing

In the meantime, administration reported total manufacturing progress. That got here, in fact, with the usual line about how they guided to manufacturing upkeep and beat that steerage by means of effectivity and, in fact, by means of technological advances.

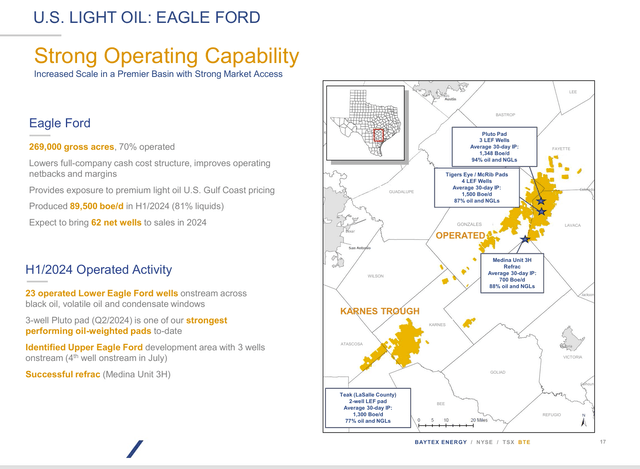

Eagle Ford

The Eagle Ford acreage has gone from not operated to principally operated with the acquisition. Since simply non-operated acreage is mostly discounted, this modification may lead to the next valuation.

Baytex Power Eagle Ford Acreage Progress (Baytex Power Newest July 2024, Company Presentation)

As a number of earlier articles identified, the partnership with Marathon (MRO) on the non-operated acreage is prone to pay massive dividends and lead to a sooner street to higher outcomes. In some methods, this might match the low-risk outcomes of a “bolt-on” acquisition due to that partnership. Already, administration is touting price financial savings and manufacturing charge enhancements.

The sunshine oil manufacturing is critical to this firm in that it helps the debt servicing throughout instances of weak pricing. The extremely worthwhile heavy oil manufacturing is a reduced product whose money circulate can disappear throughout downturns. Due to this fact, the advantages of this acquisition embrace the power to develop the very worthwhile heavy oil manufacturing, along with the same old advantages right here of improved operations and higher profitability. Shareholders win in two methods.

If this concept works as deliberate, shareholders can anticipate extra mild oil acquisitions in order that the heavy oil enterprise could be safely expanded.

Heavy Oil

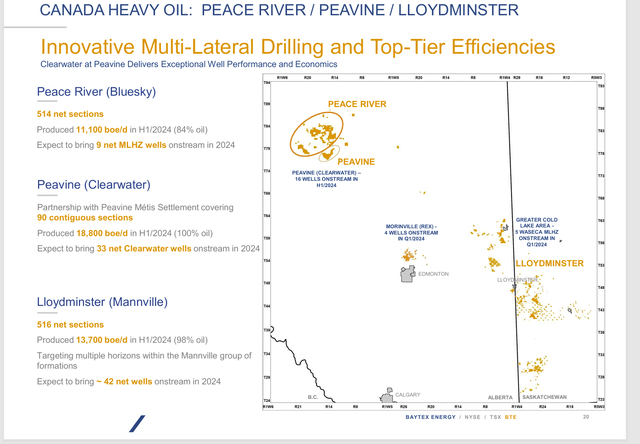

The Peavine-Clearwater group of leases are by far probably the most worthwhile within the present surroundings. All of that mild oil has the corporate drilling for greater than 500% returns, in all probability at high pace.

Baytex Power Abstract Of Heavy Oil Enterprise (Baytex Power Newest July 2024, Company Presentation)

The Clearwater wells are at the moment breaking even at a considerably cheaper price than the remainder of the heavy oil manufacturing. Till the expertise breakthroughs enabled the Clearwater state of affairs, the heavy oil was truly the next breakeven proposition that was very worthwhile through the “good instances” and nonexistent throughout downturns as a result of excessive breakeven.

That made the corporate earnings extraordinarily risky, even in comparison with different upstream producers. The shortage of money circulate throughout downturns clearly turned a difficulty after 2015 when many pure heavy oil producers reported no earnings within the interval 2015-2020.

Clearwater has a lot decrease breakeven factors. Due to this fact, heavy oil manufacturing would possibly generate money circulate throughout cyclical downturns to assist with the debt. However proper now, that’s an untested concept. Therefore, each the sunshine oil and the heavy oil manufacturing must develop.

Debt

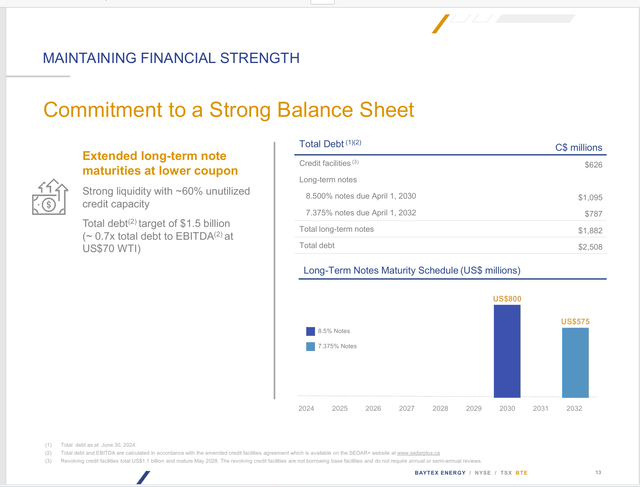

Administration is paying down debt. However the US greenback strengthened to the purpose that administration famous through the convention name, it fully offset any debt discount progress.

Baytex Power Debt Abstract (Baytex Power Newest July 2024, Company Presentation)

In the course of the convention name, administration additionally famous that free money circulate will likely be “backend loaded” which means that many of the projected free money circulate will arrive within the second half of the fiscal 12 months. Typically, this administration will repay that financial institution steadiness first. It is usually in United States {Dollars}, and so it will get revalued on the steadiness sheet.

On condition that the corporate simply made a significant acquisition, that ought to shock nobody that there have been numerous first half bills. However the market is fixated on the debt and certain didn’t like that the worth of the debt didn’t present enchancment as a result of forex points.

The bizarre nature of the earnings in United States {dollars} supporting the debt to largely (and possibly fully) erase any forex beneficial properties and losses considerations is prone to be a difficulty for this inventory.

Clearly, it could not be a difficulty for an Eagle Ford operator that’s United States primarily based and has Canadian operations, as a result of that’s more than likely simpler for traders to know.

However earnings and EBITDA used within the calculation ought to change proportionally to any debt worth modifications to maintain the debt ratio in line. Due to this fact, any debt ratio enhancements ought to survive forex fluctuations. How this goes with Mr. Market over the long term is anybody’s guess.

Abstract

The acquisition was uncommon in that it promised to profit the corporate in two methods. First, administration may use its partnership with Marathon to profit its Eagle Ford operations. Secondly, the very worthwhile mild oil money circulate may very well be used to develop the much more worthwhile heavy oil enterprise. Clearwater manufacturing seems to be on the verge of doubling, and the money circulate it produces is way out of line with the manufacturing quantities.

For probably the most half, the acquisition is on-track to assembly the promised advantages. There are some hitches, just like the forex swing results on the debt. However then once more, such issues occur and have unintended uncomfortable side effects. This may increasingly distract the market. However allow us to see what occurs as the corporate continues to make progress in lowering debt.

Dangers

Any upstream operator is topic to the volatility and low visibility of future commodity costs. Any extreme and sustained downturn can materially change the corporate’s outlook.

The expertise enhancements that enabled the Clearwater state of affairs are spreading to different heavy oil performs. The anticipated advantages of these performs could not materialize. Or alternatively, the practices may unfold to mild oil performs and trigger numerous overproduction, which might trigger a interval of low business profitability and an prolonged downturn (just like 2015-2020).

The lack of key personnel may set the corporate again.