drnadig

File Throughput With Extra Quantity To Come

Six months in the past, I upgraded Western Midstream Companions (NYSE:WES) from Purchase to Robust Purchase. The partnership models had lastly damaged over $30 in a convincing method after a protracted sideways stretch in the $20s.

Western Midstream additionally guided for a big distribution improve in February, to $0.875 quarterly from $0.575 beforehand. This may deliver the calendar 12 months 2024 payout to $3.20. At the moment, I acknowledged the one factor conserving WES from having a double-digit yield can be a rise within the unit value. It rapidly appreciated to over $42 in mid-July earlier than pulling again some within the general market correction.

Looking for Alpha

This huge distribution hike confirmed confidence in continued development, which WES demonstrated within the second quarter. The partnership as soon as once more hit throughput information in key basins. WES additionally introduced a number of agreements to present agency processing capability to its upstream prospects, setting the stage for continued quantity development.

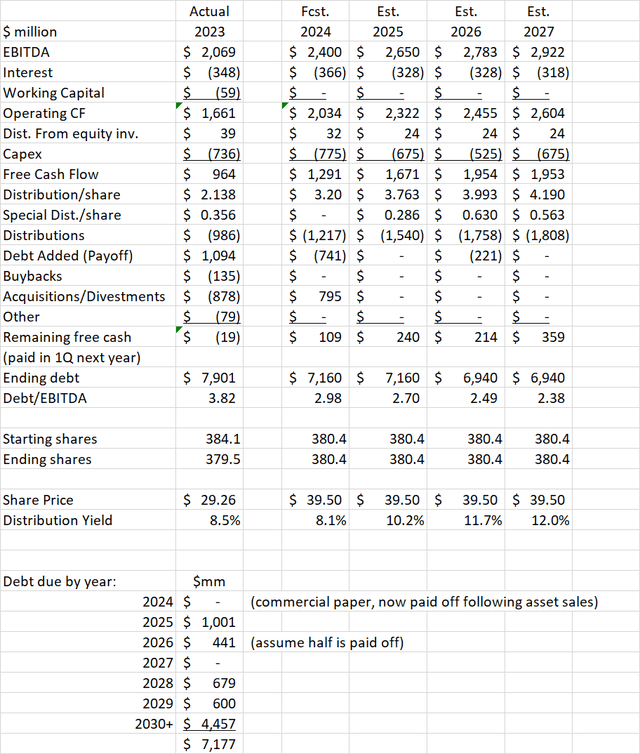

These offers underpin the EBITDA and free money circulation projections I made in my final article. The important thing enchancment in my forecast is that WES has continued to enhance its steadiness sheet. The partnership paid off the short-term debt issued to finish the Meritage Midstream acquisition within the Powder River basin of Wyoming. In addition they purchased again long-term debt opportunistically under par within the open market. With the rise within the unit value, this has been a greater use of capital than inventory buybacks. It additionally will increase the possibilities of getting debt/EBITDA leverage under 3.Zero by the tip of 2024, organising the partnership to declare a particular distribution in 1Q 2025. WES does probably not must delever additional, permitting for stronger particular distributions in later years as properly.

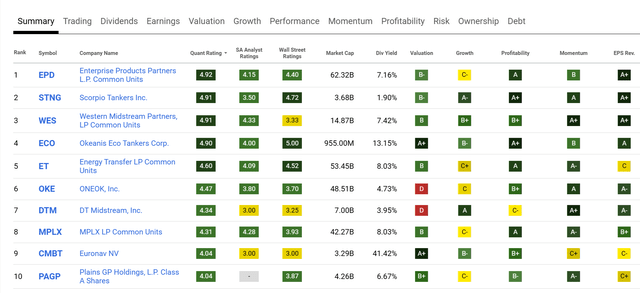

Whereas the yield based mostly on the 2024 payout has fallen to eight.1% based mostly on the upper $39.50 unit value, WES ought to be capable to improve the common distribution in keeping with EBITDA development going ahead. I see the yield based mostly on present value once more exceeding 10% in 2025. I’m shifting the score again to Purchase because of the latest quick improve in unit value, however WES stays among the many greatest investments within the midstream area.

Sources Of Progress

For these newer to the partnership, WES engages in gathering and processing of pure gasoline, NGLs, crude oil, and produced water primarily in two basins, the Delaware in West Texas and the DJ in Colorado. The partnership has additionally turn out to be the most important midstream supplier within the Powder River basin following the Meritage deal. In addition they function smaller methods in southwest Wyoming, Utah, and South Texas. Lastly, WES has non-operated stakes in some long-distance pipelines. They bought out of some non-operated stakes in pipelines and gasoline gathering methods in different areas to pay attention of their core geography.

In 2Q 2024, WES elevated pure gasoline volumes by 3% and liquids (crude and NGLs) by 6% sequentially (in comparison with 1Q 2024) at websites they function. Pure gasoline throughput was a file in each the Delaware and DJ Basins. Liquids throughput was additionally a file within the Delaware.

The WES business crew was busy throughout Q2 ending offers with prospects for extra agency processing capability. You will need to keep in mind that whereas Occidental (OXY) continues to be the overall companion of WES, they personal lower than a majority of the restricted partnership models and permit WES administration to function independently. A lot of the expansion in 2Q got here from third-party prospects exterior of Oxy. WES closed a number of offers on third-party quantity within the Delaware basin. They elevated volumes with Phillips 66 (PSX) within the DJ basin from 175 to 200 MMCFD. In addition they signed up extra agency quantity commitments on the Chipeta facility, situated within the Uinta basin of Jap Utah. These embrace an settlement with Williams Corporations (WMB) for as much as 110 MMCFD, and a cope with Kinder Morgan (KMI) for as much as 150 MMCFD.

Western Midstream Companions

The added volumes within the Delaware are anticipated to begin within the second half of 2024 and ramp up in 2025. WES has ready for these volumes by executing development initiatives in gasoline processing vegetation at North Loving and Mentone Prepare 3. This 550 MMCFD of recent capability (300 already on-line this 12 months and 250 in 2025), represents a few third of WES’s capability within the Delaware earlier than the Mentone Three startup. This helps a number of years of future development within the Delaware. The brand new offers within the Uinta and DJ basins may refill vegetation in these areas by 2026, nevertheless.

Earnings Mannequin Replace

I up to date the EBITDA projections from my final article solely barely. For 2024, I now count on WES to hit the highest finish of their EBITDA steerage, or $2.Four billion. Within the later years, EBITDA continues to develop, however I conservatively left the values roughly the identical as within the prior mannequin. That ends in 10% development in 2025 and 5% per 12 months development in 2026 and 2027. Curiosity expense is barely decrease as WES purchased again extra debt in 2Q. For capex, I’m nonetheless assuming the midpoint of firm steerage, or $775 million in 2024. I enable this to come back down in 2025 and 2026 as the large enlargement initiatives within the Delaware basin will probably be on-line by 2025. For 2027, I elevated my capex assumption from the final mannequin, as WES could look to broaden in Utah and Colorado if these services are full.

I proceed to count on WES to develop the common distribution every year in keeping with EBITDA development. With the credit standing now funding grade at BBB- and debt/EBITDA leverage under Three by the tip of 2024, I don’t see the corporate decreasing debt as a lot going ahead. I additionally assume no buybacks in 2027 with the potential improve in capex that 12 months. With these adjustments in capital return, I now count on WES to pay engaging particular distributions after Q1 of every of the subsequent Three years.

Writer Spreadsheet

Peer Comparability

Trying on the 54 shares within the Oil and Fuel Transportation and Storage trade, WES has moved as much as third place within the Looking for Alpha Quant Rankings. Observe that the highest Four are all in Robust Purchase territory, and solely 0.02 rankings factors separates #1 from #4. Two of those Four are smaller-cap tanker corporations, however WES has a detailed peer at #1 with Enterprise Merchandise Companions (EPD). With its higher dividend development and potential for particular distributions, WES appears to be like like a greater decide for income-focused buyers. WES can be a smaller cap than EPD or #5 on the listing, Power Switch (ET). I consider this results in WES getting extra ignored by Wall Road than its larger-cap friends, resulting in extra alternative for value strikes on optimistic surprises.

Looking for Alpha

Conclusion

Western Midstream Companions, LP had a productive first half of 2024, processing file volumes and dealing on initiatives to broaden capability in its key Delaware basin. The partnership additionally signed agreements within the Delaware and elsewhere to extend processing volumes beginning within the second half of this 12 months. These offers improve confidence that WES can ship EBITDA on the excessive finish of the vary in 2024 with additional development over at the very least the subsequent three years.

WES additionally continues to maintain its steadiness sheet in good situation. I now count on the partnership to hit its 3.Zero debt/EBITDA leverage goal in 2024, permitting a particular distribution to be paid in 2025. The decrease debt additionally permits for elevated particular distributions in 2026 and past.

The bottom distribution is the perfect factor about proudly owning WES, nevertheless. The partnership is paying out $3.20 in calendar 2024, or 8.1% yield on a share value of $39.50. In future years, distributions ought to develop in keeping with EBITDA, leading to yield on price outcomes of over 10% in 2025 and 12% in 2027 based mostly on the present value.

With the massive improve in unit value over the previous few months, I now fee WES a daily Purchase, however Looking for Alpha Quant Rankings nonetheless contemplate it a Robust Purchase and simply 0.01 rankings level from the highest of its trade. For revenue buyers, the distribution yield, development, and potential for specials make WES the perfect within the midstream.