JHVEPhoto

Funding thesis

The shares of Reinsurance Group of America, Integrated (NYSE:RGA) dipped 14.12% on Friday, August 2, 2024 and Monday, August 5. Some may think about {that a} warning of hassle forward.

RGA 1-month value chart (Looking for Alpha)

Nevertheless, I see it as a possibility to purchase a powerful inventory at a reduced value, and doubtless for a restricted time.

I’ve a one-year value goal that’s almost 19% above the present value and have rated it a Sturdy Purchase. What’s extra, the Quant system offers it considered one of its uncommon Sturdy Buys as nicely.

In regards to the firm

Once I talked about insurance coverage (I used to write down and publish an insurance coverage firm e-newsletter), mates would typically ask if insurance coverage firms needed to insure themselves too.

I might clarify that they do, and that they purchase their insurance policies from reinsurance firms. That is what this firm, which calls itself RGA in common communications, does, with a twist.

In contrast to most different reinsurers, RGA handles solely life and well being dangers. It doesn’t cowl property insurance coverage, which might expose it to hurricanes, tornadoes, and a number of different dangers.

Nonetheless, life and well being exposures is usually a problem, too. For instance, RGA wrote in its 10-Okay for 2023 (launched February 26, 2024) that “A rise within the variety of future COVID-19 instances or a future epidemic or pandemic might once more elevate mortality charges in sure jurisdictions and populations and trigger extra disruptions in worldwide and U.S. economies and monetary markets, which might severely influence our enterprise, outcomes of operations and monetary situation.”

The agency additionally gives Monetary Options, described on its web site as “Our understanding of every consumer’s particular capital and funding wants, in addition to intensive data of native markets and international greatest practices, uniquely positions RGA to search out options that enhance capital effectivity and promote long-term stability and progress.”

Traditionally, the corporate originated out of a reinsurance association by Basic American Life Insurance coverage Firm in 1973. It was integrated beneath its present identify in 1993 and made its preliminary public providing in the identical yr. Based on its web site, it has had a “higher than 17% compound annual progress charge for whole property” between its IPO and December 31, 2021.

RGA segments its operations geographically, and most of its working revenue is earned outdoors the U.S. These segments are U.S. and Latin America; Canada; Europe; Center East, and Africa; and Asia Pacific. It additionally has a section known as Company and Different.

On the shut on August 8, it traded at $201.21 and had a market cap of $13.01 billion.

Competitors and aggressive benefits

RGA famous within the 10-Okay that new enterprise within the business may be very value aggressive. Nevertheless, it added, “firms that constantly win enterprise are financially robust, present versatile phrases and situations, have a optimistic repute, ship glorious service, and reveal execution certainty and a long-term dedication to the enterprise underwritten.”

To place that one other manner, insurers might want low costs, however they know that additionally they have to reinsure with companies which might be financially strong and extra. Typically an inexpensive value will not be a discount.

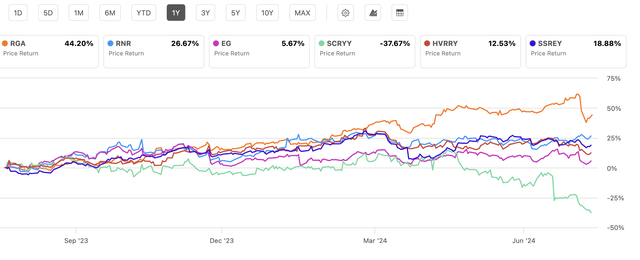

RGA competes not solely with different reinsurers, but in addition with conventional insurers, non-public fairness companies, and different monetary companies firms. Looking for Alpha lists the next as friends and/or rivals: RenaissanceRe Holdings Ltd. (RNR), SCOR SE (OTCPK:SCRYY), Hannover Rück SE (OTCPK:HVRRY), and Swiss Re AG (OTCPK:SSREY).

As the next chart reveals, RGA’s value returns have been outperforming the competitors over the previous 4 months:

RGA Worth Returns chart (Looking for Alpha )

Aggressive benefits

The corporate claims on its web site that it’s the solely international reinsurance firm to focus totally on life and well being. That ought to give it a few benefits. First, by specializing it develops higher experience in these fields. Second, it additionally offers it extra expertise in score complicated dangers.

Within the 10-Okay, it mentioned its strengths are in its underwriting, data of mortality developments, environment friendly dealing with of transactions, and customer support.

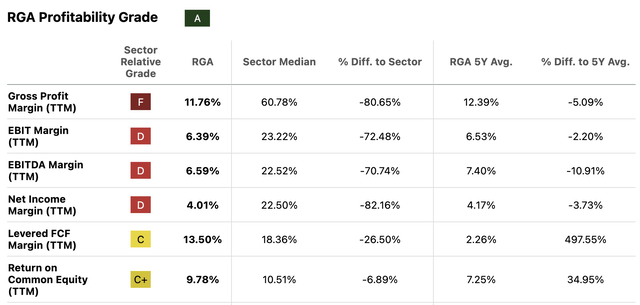

When reviewing its margins, although, RGA doesn’t look dominating in any respect. That is an excerpt from its Profitability web page at Looking for Alpha (comparisons with the Monetary sector):

RGA margins chart (Looking for Alpha )

The place does it get the A grade, then? It receives an A+ for money from operations and money per share, whereas internet revenue per worker will get an A grade (all information TTM).

Feedback: Regardless of the low grades for gross, EBITDA, and internet margins, it has maintained traders’ belief, so I consider it has at the least a slim moat.

Most up-to-date monetary report

RGA launched its second-quarter 2024 earnings report on August 1, and its highlights included:

- Consolidated internet premiums totaled $3.9 billion, which was 17.5% higher than the identical interval final yr. Overseas foreign money results lowered the overall by $33 million, and it had a $282 million acquire from a single premium pension threat switch.

- Funding revenue elevated 10.9%, helped partly by the next common funding yield (4.65% versus 4.42% final yr).

- Internet revenue accessible to shareholders was $203 million or $3.03 per share, in comparison with $205 million or $3.05 per share in the identical quarter final yr.

- Adjusted working revenue was $365 million or $5.48 per diluted share, up from final yr’s Q2 outcomes of $297 million and $4.40.

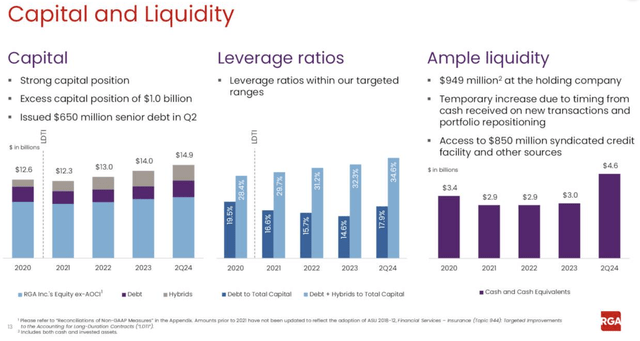

The next slide, from its Q2 investor presentation, reveals it continues to be nicely funded, sustaining its leverage ratio, and rising its liquidity:

RGA capital and liquidity slide (investor presentation)

The variety of frequent shares excellent got here down from 66.212 million final yr to 65.824 million this yr.

Feedback: Excluding the pension threat switch acquire, Q2-2024 was usually in step with earlier outcomes. And consistency is an effective factor in an insurance coverage inventory, albeit traders would undoubtedly prefer to have seen internet revenue and earnings per share develop together with income.

RGA’s dividend

On the identical time that it introduced its Q2 outcomes, the agency additionally introduced a 4.7% enhance in its quarterly dividend, to $0.89 from $0.85. It’s payable August 27 to shareholders of file on August 13.

The yield is at present 1.80%, based mostly on the August Eight closing value of $201.21, and is nicely above the common S&P 500 dividend yield of 1.32%.

It has elevated the dividend yearly for the previous 15 years, and over the previous 5 years it has averaged 8.83% per yr. And the dividend security grade is A-minus.

It doesn’t report shopping for again any shares in Q2.

Progress prospects

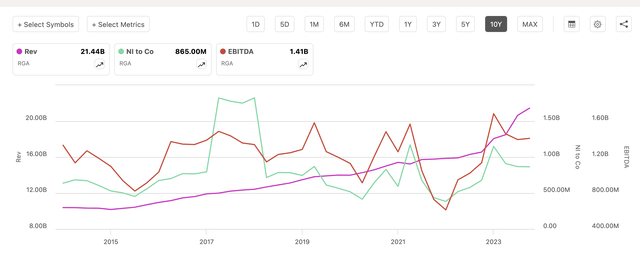

Let’s start with an outline of how RGA has fared over the previous decade:

RGA income, EBITDA, internet revenue chart (Looking for Alpha )

Clearly, income has grown steadily through the years, whereas internet revenue and EBITDA have been extremely risky and comparatively flat. EBITDA and internet revenue most not too long ago peaked in Q3-2023, dropped in This autumn-2023 and Q1-2024 earlier than leveling out in Q2 this yr.

The query, then, is the place internet revenue and earnings will go subsequent. Will they drop additional, keep flat, or will they develop once more?

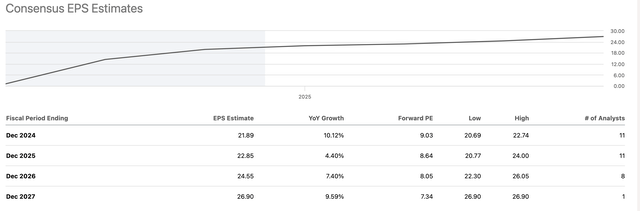

The 11 Wall Avenue analysts following RGA anticipate a double-digit increase in earnings this yr, adopted by extra modest progress in 2025 and 2026 after which an almost double-digit enhance in 2027:

RGA EPS estimates desk (Looking for Alpha )

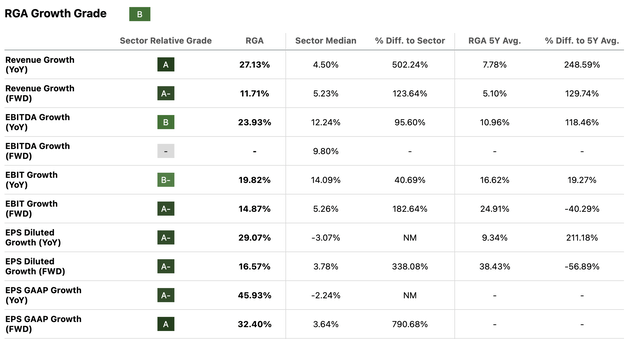

RGA additionally has a progress historical past, as proven on this excerpt from its Progress web page at Looking for Alpha:

RGA progress grades desk (Looking for Alpha )

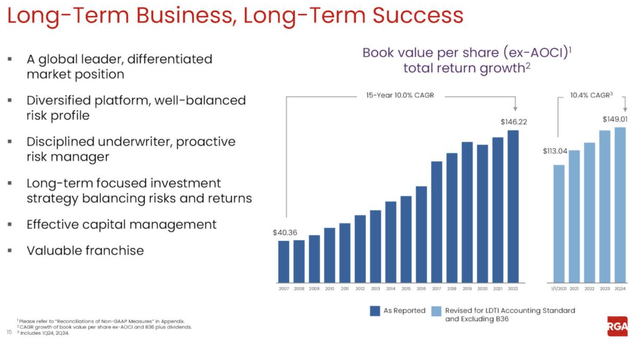

Right here’s one other, and longer, firm perspective on its historical past of progress:

RGA Progress chart (investor presentation)

Feedback: I’ve no motive to consider RGA won’t proceed rising because it has previously. Most significantly, bottom-line outcomes ought to transfer forward steadily.

Valuation

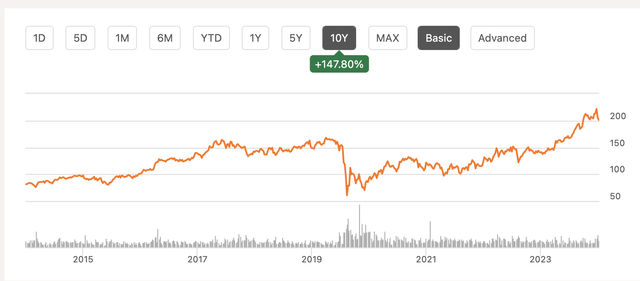

Over the previous 10 years, the RGA share value has risen quickly:

RGA 10-year value chart (Looking for Alpha)

On the suitable aspect of the chart, we see a dip, with the share value falling 7.48% on Friday, August 2. That’s the day after earnings had been launched. The value additionally fell on Monday, August 5, by one other 6.64%. The declines partially mirrored a income miss of $260 million; nonetheless earnings beat the estimates by $0.39.

August 2 was additionally the day the S&P 500 fell by 1.86% and on the next Monday it misplaced one other 2.91%. The mixture of the income miss and broader market selloff brought on RGA to take the hits it did.

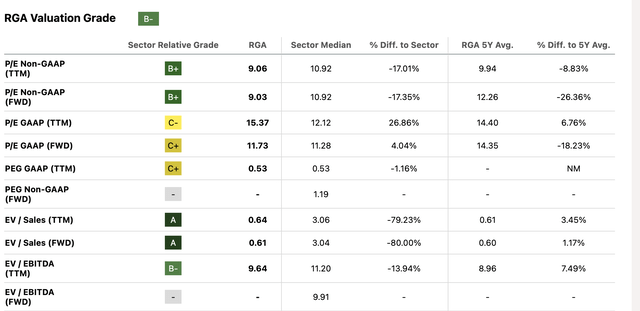

Regardless of the long-term, rising share value, the valuation metrics stay cheap, as proven on this excerpt from its Valuation web page at Looking for Alpha:

RGA valuation ratios desk (Looking for Alpha )

I might have anticipated the inventory value to observe earnings, however its earnings have been muted over a lot of the previous decade, as proven above.

Primarily based on these metrics, and particularly the current dip, I consider RGA is undervalued, that the pre-August 2 costs had been nearer to truthful worth than the present value, since each the RGA and S&P 500 have been recovering.

Wall Avenue analysts consider the corporate is due for an uptick in earnings this yr, as we noticed above. They anticipate this yr’s EPS to develop by 10.12% and subsequent yr’s to be one other 4.40% greater.

They’ve a one-year median value goal of $239.09, which represents an 18.83% enhance. Whether or not coincidentally or not, that’s roughly equal to the sum of an earnings enhance of 10.12% and common dividend enhance of 8.83% (for a complete of 18.95%).

I’ll use that as my one-year value goal as nicely, since it’s in step with the capital features and dividend progress. That deserves a Sturdy Purchase score; one different Looking for Alpha analyst has contributed a score, a Purchase, previously 90 days. The Quant system offers it a uncommon Sturdy Purchase score, as do six of the 11 Wall Avenue analysts. Three analysts gave it a Purchase score and two positioned Maintain rankings.

Danger components

Since RGA focuses on reinsurance for all times and well being insurers, it has the next publicity than different reinsurers to epidemics, pandemics, and different well being disasters. That’s mitigated, to a higher or lesser extent, by its lack of publicity to property and casualty dangers, and by advances in medication which might be prolonging lives.

Different threats to human longevity embrace pure disasters, conflict, and probably by local weather change. The corporate is unable to foretell the long-term implications of the latter.

It costs its merchandise on the belief that mortality, longevity, morbidity, and lapse charges are fairly predictable. It expects some fluctuations, however not sufficient to impair its underwriting. A scenario like that created by COVID-19 can problem these assumptions.

The corporate operates globally, which raises the specter of geopolitical threats, particularly in rising markets. It additionally means modifications in change charges can pull earnings up or down.

Every part the corporate does is in information, together with private information. Any failure of its info safety methods might severely harm its enterprise. Any breach that includes the lack of private or consumer information might severely diminish its repute (and finally, its viability).

Conclusion

Total, Reinsurance Group of America is a powerful and rising firm that ought to proceed to supply capital features and rising dividends for medium and long-term traders.

The current drops within the share value present these traders with an entry alternative, to get in at a discount value, and to get pleasure from greater dividend yields.

I consider RGA is at present undervalued and have a one-year value goal of $239.09, which earns it a Sturdy Purchase score.