Thomas De Wever/iStock Editorial by way of Getty Photographs

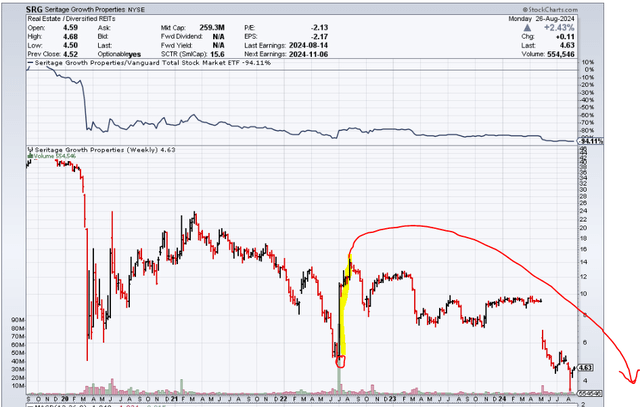

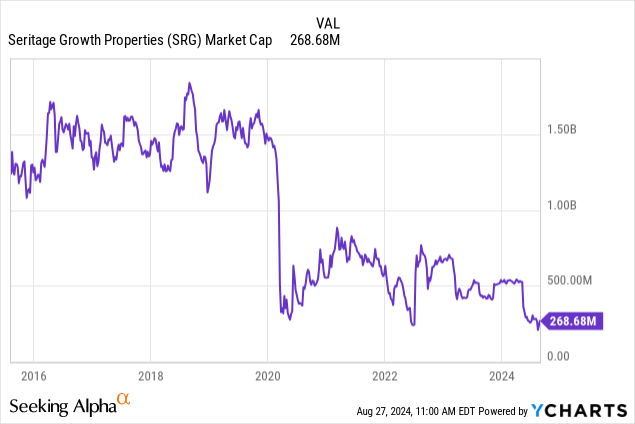

That isn’t the bullish headline traders have been in search of, nevertheless it’s the very best we will do right here. The Seritage Development Properties (NYSE:SRG) saga is coming to a becoming finish after 9 years within the public markets. The preliminary technique was to redevelop properties and promote them. After over $1 billion in capex, financed by promoting all their star properties, SRG lastly realized that burning money to maintain the home heat will not be extremely cost-effective. In order that they went within the different path. Liquidation mode. You may see how the inventory went vertical on the information from $5 to over $14 in 2022.

StockCharts

In fact, time, tide, and juiced-up actual property markets await no man. They missed the window of unloading these Class B properties and that complete achieve after which some, has been worn out.

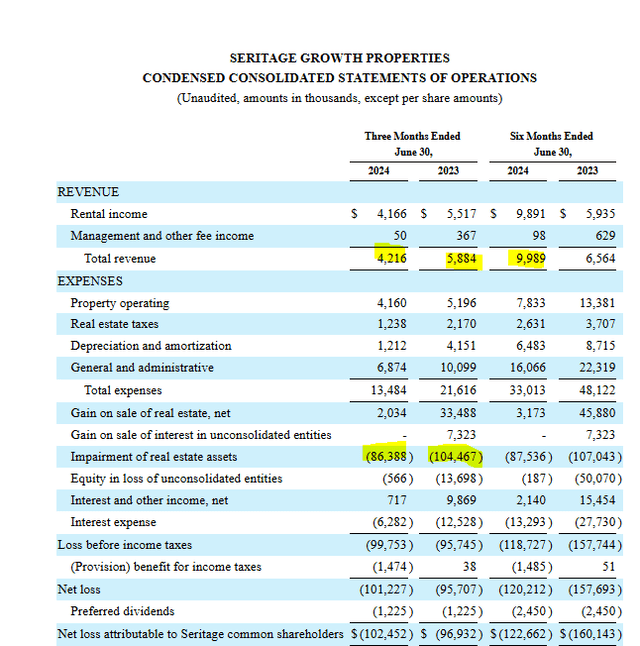

Q2-2024

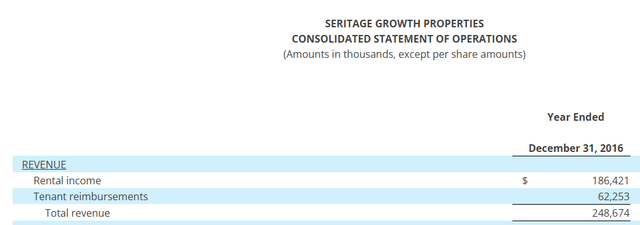

SRG delayed the discharge of its Q2-2024 financials by a bit as they found out what their impairment loss would really be for the quarter. In fact the spotlight right here was the $4.2 million quarterly income run price. Certain, they’ve offered belongings to get down right here, however it’s nonetheless a mirrored image of how terrible a play this has been. For comparability, SRG began off close to $250 million in annual revenues in 2016.

SRG 2016 Annual Report

With good hindsight, they in all probability ought to have omitted the “progress” of their identify. However again to the matter at hand. SRG confirmed one other giant impairment and this was pretty vital in mild of its residual market cap of near 1 / 4 billion.

SRG Q2-2024

The delay within the launch probably stemmed from the truth that the lease aid requests got here within the second quarter itself.

Throughout the three months ended June 30, 2024, we agreed to promote one asset that was under ebook worth ensuing within the recognition of impairment losses of $0.6 million, which is included in impairment of actual property belongings throughout the consolidated statements of operations. Moreover, through the three months ended June 30, 2024, the Firm acknowledged an impairment cost of $85.eight million on its improvement property in Aventura, FL as a consequence of negotiations for lease aid with current tenants that started through the second quarter of 2024 which triggered the necessity for an impairment evaluation pursuant to ASC 360, Property, Plant and Gear. Throughout the six months ended June 30, 2024, we recorded impairment losses of $87.5 million primarily as a consequence of modifications in low cost charges and residual cap charges between June 2023 and June 2024.

As a consequence of growing improvement and building prices, deteriorating market circumstances and, in sure circumstances excluding Aventura, agreeing to promote under carrying worth, the Firm acknowledged $104.5 million and $107.Zero million of impairment losses through the three and 6 months ended June 30, 2023.

Supply: SRG Q2-2024

Outlook

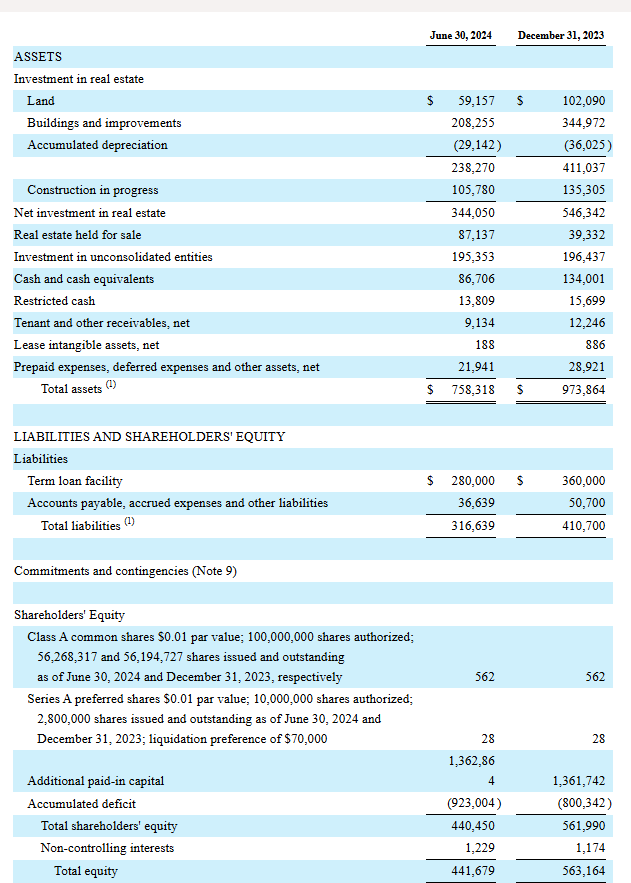

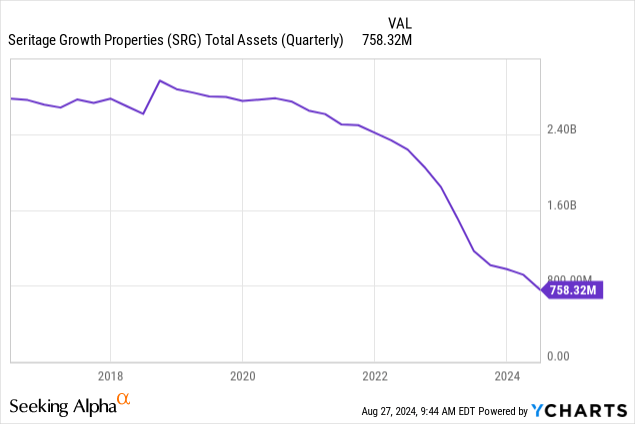

No matter how administration spins it, impairments within the case of REITs below US GAAP must be a pink flag. The rationale is that the web ebook worth is closely depreciated with GAAP accounting. If that lowered web ebook worth must be written down additional, meaning issues have gone awfully dangerous. One relative exception right here is for newly constructed belongings like Aventura. There may be usually little or no depreciation booked. However the truth that tenants are asking for lease aid, can not probably be an indication of a “premier property”. SRG’s ebook of belongings can also be pretty depleted right here. Assuming you’re taking complete belongings ($758 million) and complete fairness ($440 million) at face worth, one mustn’t count on blowout returns on the present market cap of $260 million.

SRG Q2-2024

Moreover, one should needless to say we bought right here after the liquidation of quite a lot of belongings.

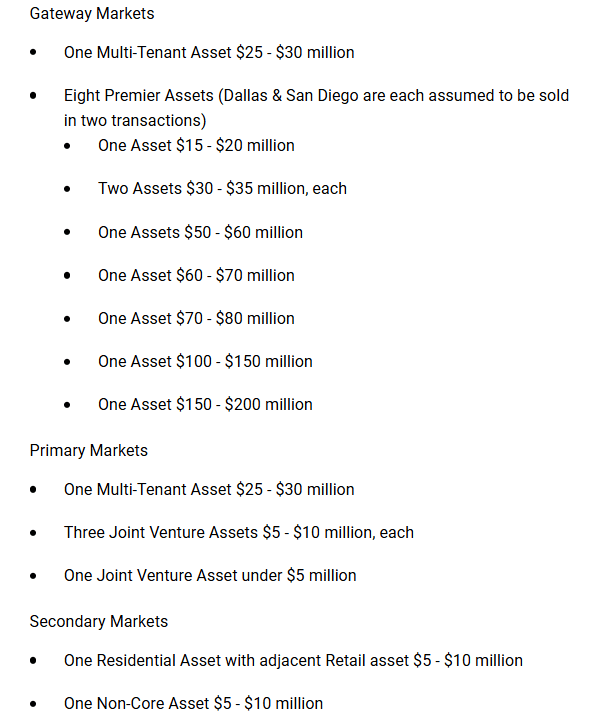

This quarter we noticed $40 million extra in asset gross sales and the corporate confirmed that it has 5 belongings advancing via the gross sales course of which ought to fetch it about $138.6 million. Excluding these belongings, now we have the next.

SRG Q2-2024

At this level, there must be a reasonably excessive diploma of certainty in these values. However for sensible functions, we are going to assume the low finish of every of those numbers. That works out to about $550 million. Including up the $140 million in anticipated asset gross sales which aren’t included right here, your complete exit worth turns into about $690 million. The corporate additionally has about $130 million of present belongings which incorporates about $100 million of money and restricted money. So at current, we will assume {that a} liquidation would fetch not less than $820 million. SRG has $316 million in complete liabilities. We also needs to assume that the money burn price of about $15 million 1 / 4 for 7 quarters. The burn price ought to drop over time as curiosity expense falls, however to be conservative we will run with $15 million during. Lastly, we have to subtract the popular shares out of the equation. Seritage Development Properties 7% CUM PFD SR A (NYSE:SRG.PR.A) have a par worth of $70 million.

Verdict

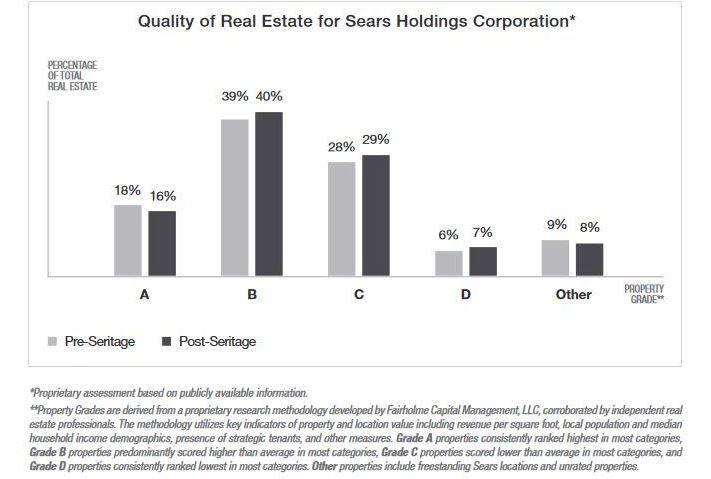

$330 million is what’s left after every part is offered off by the top of 2025 and all money owed are paid. Who may have predicted that for a corporation that got here into existence with a $3.5 billion enterprise worth? Really, Bruce Berkowitz (the largest bull on all issues Sears) advised everybody how poor the asset base was again in 2017 (see right here for an interview). He confirmed the cut up of belongings left contained in the now-defunct Sears Holding Company and SRG.

Bruce Berkowitz

Funnily, traders insisted on valuing this far above A-rated malls for many of its historical past. They have been too enamored with the truth that Warren Buffett owned some fairness so that they gave a tough cross to the information. At this level although, the chances of getting greater than the present market capitalization is pretty excessive.

So that is like shopping for a greenback for effectively, 80 cents. That is like getting to look at 4 Nickelback concert events without spending a dime. The nice half is that you would be able to make that return profile with even much less danger. The only approach could be to purchase the inventory and promote the $5.00 coated name for 60 cents for April 2025. Alternatively, you may promote the $5.00 coated name for $1.00 for January 2026. This reduces your web money outlay considerably and improves your buffer. We are literally placing a purchase right here at $4.60, and we’d provoke the commerce for our portfolio.

Please notice that this isn’t monetary recommendation. It might appear to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of an expert who is aware of their goals and constraints.