Galeanu Mihai

Thesis

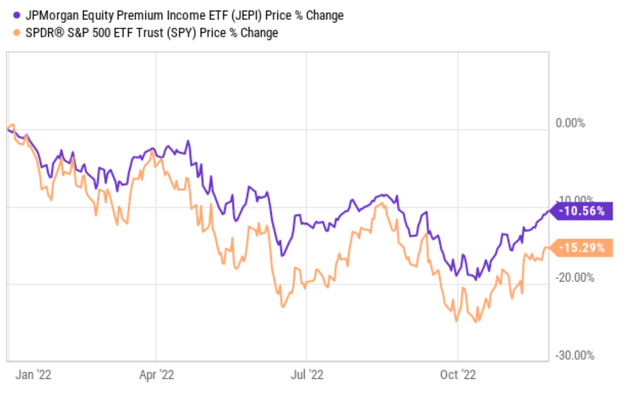

Over the previous 12 months or two, I wrote a number of articles to alert readers about dangers related to the JPMorgan Fairness Premium Revenue ETF (NYSEARCA:JEPI). Once I printed my first article on it again in June 2021, the fund was buying and selling at $61. The fund suffered a couple of 10% worth correction since then however pays a mouthwatering dividend yield of 10%+ as of this writing. Moreover, on a relative foundation, as proven within the following chart, JEPI outperformed the general fairness market by a superb margin. The SPDR S&P 500 Belief ETF (NYSEARCA:SPY) suffered a complete lack of greater than 15% YTD. In consequence, JEPI led the general market approximated by SPY by about 10%.

The above mixture of 10%+ yield and outperformance (even solely in relative phrases) could draw the curiosity of many potential traders. Thus, the logical query is whether or not its outperformance (both relative or absolute) can proceed.

Within the the rest of this text, I’ll argue that the reply is not possible for a number of causes. JEPI’s lead within the brief historical past since its inception was primarily because of the rotation to worth shares and in addition using choices throughout massive market corrections. And if we broaden the historic context a bit, we are going to see such a mix is in direction of its finish. And furthermore, underneath “regular” circumstances (i.e., different market situations), its equal mutual fund the JPMorgan Fairness Premium Revenue Fund Class AA (JEPAX) fund, offers extra historic knowledge and exhibits a special image.

Supply: Searching for Alpha.

JEPI and SPY: Fundamental data

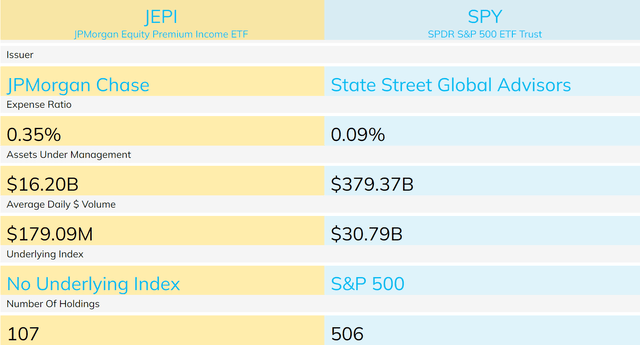

Each JEPI and SPY are listed with the S&P 500 index because the benchmark. Each maintain large-cap shares. SPY’s median market cap is $170.9 billion and JEPI’s is $103.5 billion. As a result of indexing technique and deal with massive caps, lots of their holdings additionally overlap (and we are going to element this later).

Now, the variations. JEPI is actively managed, and SPY is passively listed. In consequence, JPEI’s expense ratio of 0.35% is about 4x increased than the 0.09% charged by SPY.

JEPI makes use of a proprietary technique to hunt a mix of capital appreciation potential, excessive earnings, and low volatility. The technique to realize such a lofty mixture lies in A) the choice of each overvalued and undervalued shares, and B) using choice overlays on these shares. As detailed within the fund description (barely edited with the emphases added by me), the JPEI fund:

Seeks to generate excessive earnings by means of a mix of promoting choices and investing in U.S. massive cap shares.

Constructs a diversified, low volatility fairness portfolio by means of proprietary analysis designed to establish overvalued and undervalued shares with enticing danger/return traits.

Seeks to ship a major portion of the returns related to the S&P 500 Index with much less volatility, along with month-to-month earnings.

Supply: ETF.com

JEPI vs. SPY: Nearer examination of holdings

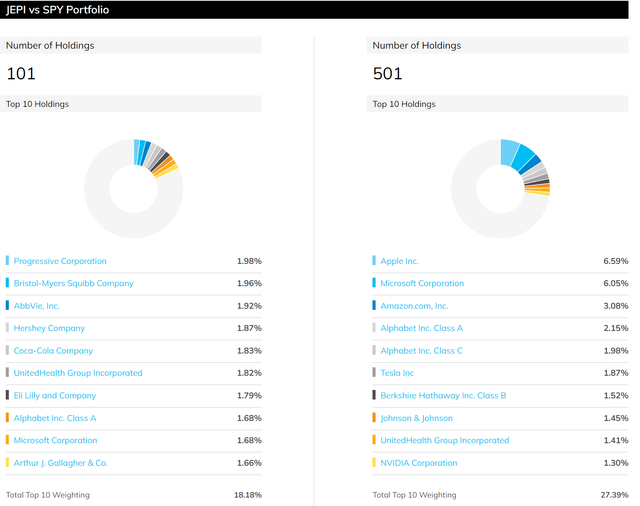

As simply talked about, each JEPI and SPY are centered on the large-cap house. Since they draw from the identical pool of shares, they overlap fairly a bit even amongst their high 10 holdings as seen from the chart beneath. You see UnitedHealth Group Inc (UNH), Microsoft Corp (MSFT), and Alphabet Inc (GOOGL) (GOOG) in each funds.

Though there are massive variations of their holdings too. First, SPY holds your complete large-cap house (with ~500 shares), however JEPI holds a subset of the large-cap house (with ~100 shares chosen by its proprietary analysis aforementioned). Therefore, JEPI contains a extra concentrated portfolio. Second, JPEI’s choice technique is extra geared towards worth, whereas SPY is listed by market cap. As detailed in JEPI’s fund description (barely edited with emphases added by me),

The fund advisers make use of a 3-step course of that mixes analysis, valuation and inventory choice. The analysis permits the adviser to rank corporations in line with what it believes to be their relative worth… The Fund buys and sells … utilizing the analysis and valuation rankings as a foundation. On the whole, the adviser selects securities which can be recognized as enticing and considers promoting them once they seem much less enticing.

Therefore, in a nutshell, JEPI is extra value-oriented whereas SPY is listed by market cap. And the basic variations of their indexing methods will be simply seen from their high 10 holdings beneath. As seen, JEPI holds extra shares within the conventional worth sectors resembling well being care (e.g., UNH, BMY, and ABBV) and shopper staples (resembling Hershey (HSY) and KO). Furthermore, JEPI holds these shares at a better focus than SPY. Within the meantime, it holds extra growth- and tech-oriented shares resembling MSFT and GOOGL at a decrease focus than SPY. For terribly costly shares like Tesla (TSLA) and Nvidia (NVDA), JEPI avoids them fully.

Supply: ETF.com

Therefore, as talked about above, the lead of JEPI over SPY within the 1 or 2 years was largely because of the substantial correction of the tech and progress sector, which harm SPY greater than JEPI. And if the lead is to proceed sooner or later, then we might want to assume that the worth sectors will hold outperforming progress and know-how shares. Nevertheless, this assumption doesn’t appear to be a sound one at the moment given the present situations.

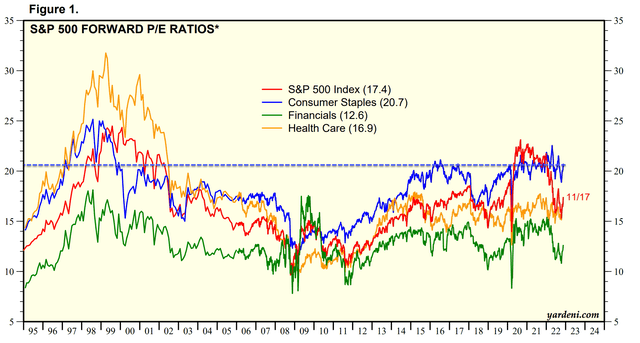

As you may see from the next chart, the S&P 500 index was priced at a big valuation premium in comparison with different sectors throughout 2021 and 2022 with a PE near 24x. Such a PE is sort of 1.6x increased than healthcare (about 15x PE at the moment) and about 10% above shopper staples (about 22x at the moment). Then the correction got here and harm the S&P 500 greater than these worth sectors. To wit, SPY’s present PE is just 17.4x, primarily on par with healthcare’s 16.9x. And it’s considerably beneath shopper staples, which stands at 20.7x PE, a file degree since ~2000.

Supply: Yardeni.com

JEPI vs. SPY: How about using choices?

The usage of choices (within the type of ELNs, Fairness Linked Notes) will help generate excessive earnings, and the earnings will increase as market panic heightens – like what we simply skilled. In JEPI’s case, it employs as much as 20% of its complete belongings on choices. Nevertheless, the choice overlay will restrict the fund’s upside potential as detailed in its fund description (once more, edited with emphases added by me),

So as to generate earnings, the Fund could make investments as much as 20% of its internet belongings in ELNs… ELNs by which the Fund invests are by-product devices which can be specifically designed to mix the financial traits of the S&P 500 Index and written name choices in a single be aware type. The ELNs present recurring money stream to the Fund primarily based on the premiums from the decision… Investing in ELNs could scale back the Fund’s volatility as a result of the earnings from the ELNs would scale back potential losses incurred by the Fund’s fairness portfolio. Nevertheless, the ELN would additionally scale back the Fund’s capability to totally revenue from potential will increase within the worth of its fairness portfolio.

Attributable to JEPI’s brief historical past (it was launched solely in 2021), I’ll use the subsequent chart beneath to point out the roles of the choice overlay. The chart beneath makes use of JEPAX as a proxy to approximate JEPI. The JEPAX is a mutual fund that was launched in Sep 2018 with a method much like JEPI. Therefore, JEPAX offers ~Three years of information to see the function of the choice underneath a broader vary of market situations.

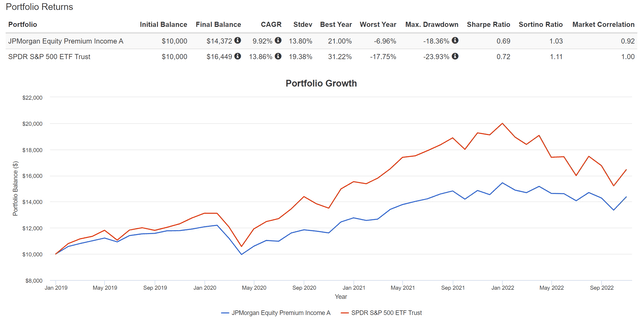

Now you may see that over an extended timeframe, JEPAX lagged SPY by a big margin. Over this time period, SPY supplied a good-looking return of 13.8% every year and a complete return of 64%. In distinction, JEPAX solely returned 9.9% per 12 months and 43% in complete. It lagged SPY by ~5% on a CAGR foundation and 21% on a cumulative complete foundation. And a key basic trigger is using choices that put a ceiling on the upside potential of a superb a part of its belongings.

Supply: PortfolioVisulizer.com

Dangers and closing ideas

To recap, in its brief historical past, JEPI offered traders with a sexy mixture of excessive dividend yield and relative outperformance. To wit, it led SPY by about 5% in complete return YTD and it at the moment offers a 10%+ yield. For potential traders drawn to the fund, the logical query is whether or not its outperformance (both relative or absolute) can proceed.

Sadly, my reply to the query is very seemingly. JEPI’s lead to this point was primarily because of the rotation from progress and tech shares to worth shares. The rotation is at an finish as a result of SPY’s present PE of 17.4x is on par with value-sector resembling well being care and much beneath shopper staples (20.7x). Moreover, JEPI’s choice overlay limits the upside potential in the long term as demonstrated within the case of JEPAX.

To shut, I’d counsel JEPI solely to traders who want present earnings in a easy fund. For many who don’t thoughts some DIY (not that a lot as detailed in my weblog article ), I see a extra dynamic method combining a core fund (resembling SPY) and some tactical holdings as a extra promising technique going ahead. Plus, you get to avoid wasting the 0.35% price charged by JEPI.