tianyu wu/E+ through Getty Photos

RPM Worldwide (NYSE:RPM) has lately fallen from its excessive amid latest pullbacks within the housing market. With a latest underperformance within the building provides section of their core enterprise, strategic acquisitions and integration of purchases will promote robust progress and presumably offset drops in gross sales.

Enterprise Overview

RPM Worldwide Inc. is a multinational firm based mostly in the US that makes a speciality of the manufacturing and sale of specialty coatings, sealants, and constructing supplies. RPM operates by way of its subsidiaries and presents a broad vary of services and products to a wide range of industries, together with building, automotive, marine, and industrial.

The corporate was based in 1947 and is headquartered in Medina, Ohio. RPM’s enterprise operations are divided into three segments: the commercial section, the specialty section, and the patron section. The economic section focuses on the manufacturing of high-performance coatings, sealants, and adhesives for the building and industrial markets. The specialty section focuses on the manufacturing of business cleaners, restoration providers, and specialty chemical substances. The buyer section focuses on the manufacturing of client merchandise equivalent to paint, coatings, and caulks for the DIY {and professional} markets.

RPM has a world presence with operations in over 150 international locations and greater than 15,000 workers worldwide. The corporate has a robust dedication to sustainability and has carried out varied initiatives to scale back its environmental impression, equivalent to utilizing renewable power sources, lowering waste and emissions, and selling sustainable practices all through its provide chain.

Investor Relations Web site

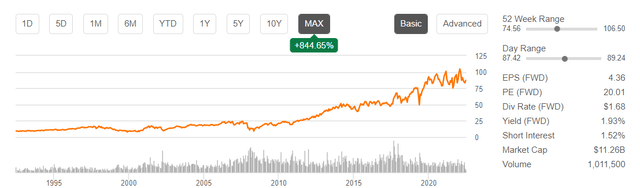

With a market capitalization of $11.7 billion, a rising ROIC of 11.62%, a 52-week excessive of $106.50, and a low of $74.56, a worth of $88.35 with a 21.44 P/E shows easy progress potential could also be obtainable at a major markdown.

RPM additionally pays a wholesome dividend of 1.88% representing a secure payout ratio of 39.33% giving them ample room in FCF to execute their CapEx plans to create connections inside their working mannequin and innovate upon merchandise. The corporate has additionally purchased again a small variety of shares which I consider is optimistic as RPM is reaching worth territory and buying such shares might create worth for shareholders and put extra FCF to make use of.

Searching for Alpha

With Q2 2023 outcomes exceeding expectations on EPS with a 0.04% beat ($1.10 in comparison with $1.10) however a 1.14% miss on income ($3.46 billion in comparison with $3.53 billion), RPM is demonstrating combined outcomes which is likely to be on account of macroeconomic headwinds, particularly a attainable housing slowdown which impacts their core enterprise mannequin. Nonetheless, RSG nonetheless achieved a 9.3% progress in web gross sales YOY displaying that even with a tough quarter, the corporate continues to excel inside its business and use its excessive ROIC to compound its progress. Even with such headwinds, the corporate expects to develop at low single-digit values displaying slight resilience in robust occasions.

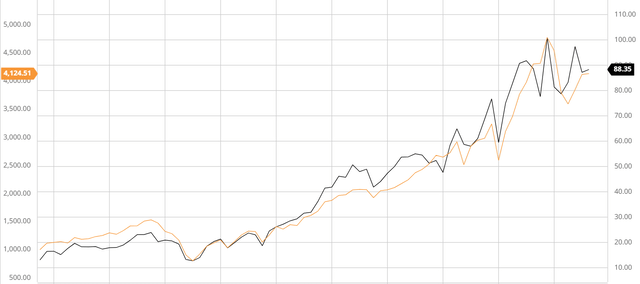

In-Line Efficiency with the Broader Market

RPM’s steady reinvestment of FCFs into its core enterprise mannequin together with its robust ROIC has allowed the corporate to compound its progress and obtain recurring revenues. This allowed RPM to take care of an in-line efficiency with the S&P 500 even throughout occasions when housing is a section that skilled a pullback.

RPM Efficiency to S&P (Created by creator utilizing Bar Charts)

Offsetting the Housing Pullback By Progress in Building Provide Section

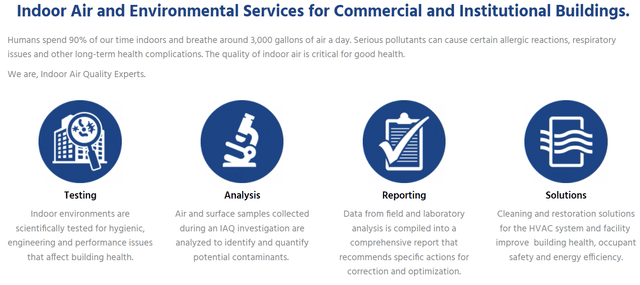

Over the past 30 years, RPM Worldwide has revamped 175 acquisitions with 60 being within the final decade. RPM has made eight acquisitions in 2022 with many being to additional combine their core enterprise mannequin and likewise develop to new geographies and enhance their model recognition and status throughout the globe. One key acquisition in 2022 that RPM Worldwide made was Pure Air Management Providers, Inc. Such a purchase order allowed RPM to develop its vertical integration in the case of its constructing provides section as they’re now in a position to set up and examine HVAC techniques. Such acquisitions are all a part of RPM’s plan to grow to be a one-stop store for purchasers creating nice worth for his or her different segments.

Pure Air Management Providers Segments (RPM Investor Relations)

This acquisition together with others can even protect gross sales even when the housing pullback continues. With declines within the building section, RPM is utilizing its robust FCF to buy corporations in weak spot and combine them into their general enterprise to spice up the struggling building section and generate compounded progress for the long run.

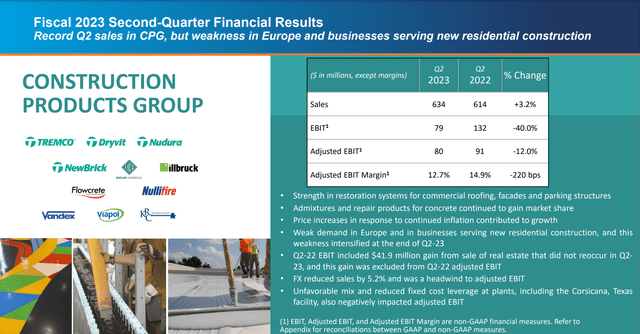

Building Merchandise Efficiency (Investor Presentation)

Analyst Consensus

Analyst consensus charges RPM Worldwide as a “purchase” as it’s reaching worth territory. With a median 1Y upside of 10.84% at $97.93, it demonstrates that analysts additionally notice the expansion potential RPM has within the long-run.

Buying and selling View

Valuation

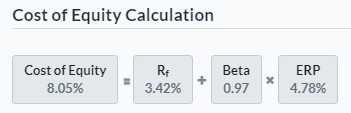

Earlier than creating my assumptions and calculating my DCF, I’ll calculate the Price of Fairness and WACC for RPM Worldwide utilizing the Capital Asset Pricing Mannequin. Factoring in a risk-free price of three.42%, I used to be in a position to conclude that the Price of Fairness was 8.05% as displayed beneath.

Price of Fairness Calculation (Created by creator utilizing Alpha Unfold)

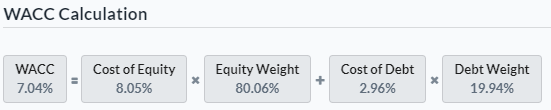

Assuming this Price of Fairness worth, I used to be in a position to calculate the WACC to be 7.04% as proven beneath, which is beneath the business common of 11.39%.

WACC Calculation (Created by creator utilizing Alpha Unfold)

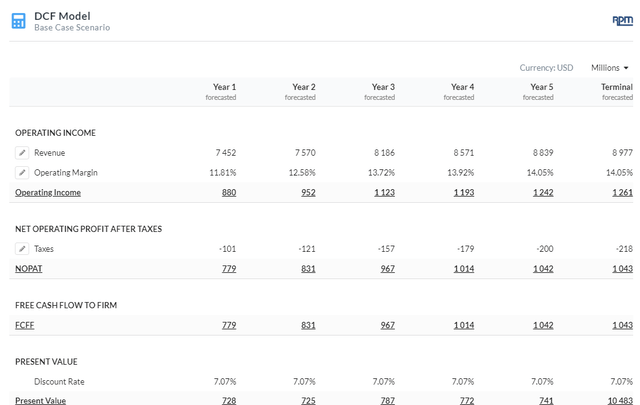

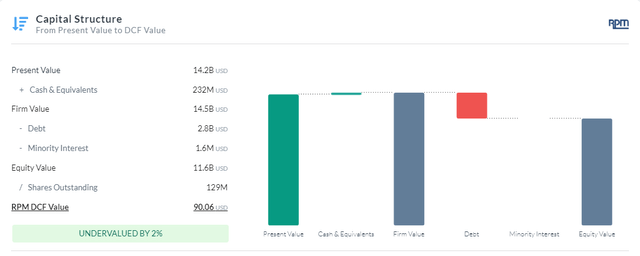

After performing a Agency Mannequin DCF evaluation utilizing FCFF, I’ve decided that RPM Worldwide is presently undervalued by 2% with a good worth of roughly $90.06. To reach at this conclusion, I utilized a reduction price of seven.04% over a 5-year interval. Moreover, I estimated a low-single-digit progress price for income past 2023 as a result of firm’s growth into new markets and elevated income in current ones. I additionally predicted that RPM Worldwide will proceed to enhance its operations by buying extra environment friendly property, leading to a gradual enhance in working margin over time, as proven in my DCF evaluation.

DCF Assumptions (created by creator utilizing Alpha Unfold)

RPM Capital Construction (Created by creator utilizing Alpha Unfold)

Dangers

Potential Macroeconomic Headwinds: RPM Worldwide might face a decline in income as a result of potential recession within the subsequent 12 months, because the housing market presumably continues to say no. With such a decline, there could be a lower in building initiatives and subsequently housing upgrades which RPM gives. This development could also be exacerbated by excessive inflation and rising charges, which might weaken purchaser energy.

Integration and Expansionary Points: The corporate has set excessive expectations for itself to proceed its profitable technique of creating robust acquisitions, which have led to improved efficiency lately. Nonetheless, if the corporate slows down on acquisitions on account of few choices and focuses on innovating current segments utilizing FCF, it might expertise stagnant progress for a number of years.

Conclusion

To summarize, RPM Worldwide is a robust firm with nice prospects for progress in current segments and new geographic areas as nicely. With a wholesome dividend and slight share buybacks together with a barely undervalued worth, a purchase ranking most accurately fits the inventory as I feel it’ll yield long-term success.