tumsasedgars

(This text was co-produced with Hoya Capital Actual Property)

Introduction

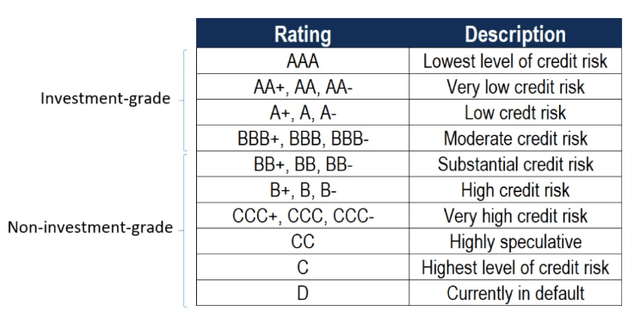

Traders like high-yield, or junk bonds for the revenue they generate, hopefully understanding they arrive with extra threat of default. These bonds will probably be rated BB or decrease by Commonplace & Poor’s and Ba or decrease by Moody’s. Utilizing the S&P rankings, the following chart offers readers an thought of the chance for every score degree.

corporatefinanceinstitute.com

Till you get all the way down to CCC, bond default charges are low, although there’s a bounce when getting into “junk” standing.

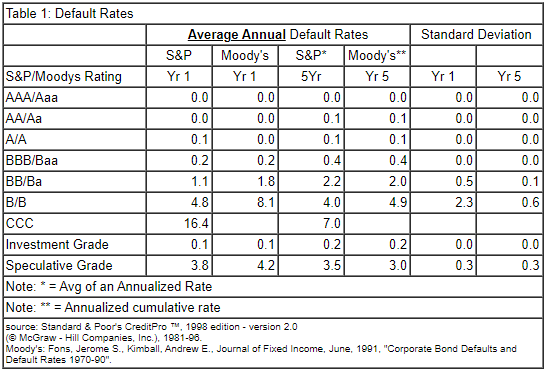

efalken.com

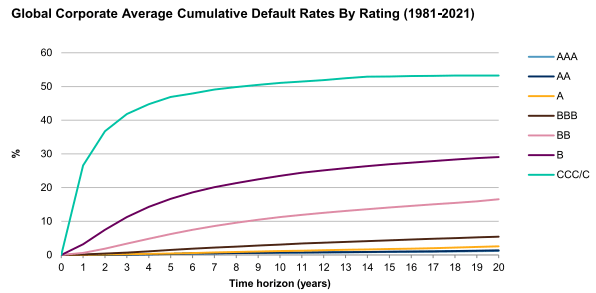

The subsequent chart reveals defaults by score and the way the speed modifications because the bonds age.

maalot.co.il/Publications

This text opinions and compares two comparable Excessive-Yield ETFs from iShares:

- iShares BB Rated Company Bond ETF (NYSEARCA:HYBB)

- iShares iBoxx $ Excessive Yield Company Bond ETF (NYSEARCA:HYG)

With comparable outcomes over HYBB’s quick life, my desire is HYBB for its a lot decrease expense ratio. Investor in HYG may think about tax-loss swap. I give each a Maintain score presently.

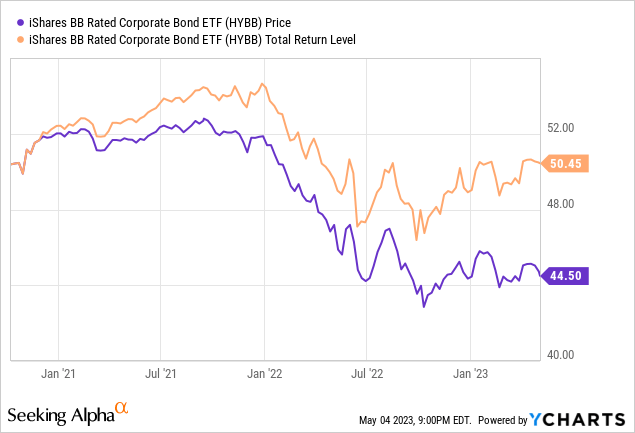

iShares BB Rated Company Bond ETF evaluate

Looking for Alpha describes this ETF as:

The fund invests in fixed-rate, US greenback denominated, company bonds issued by industrials, utility and monetary firms and with maturity to a couple of 12 months. It invests in excessive yield securities which might be rated as between BB+ and BB- by S&P and Fitch and Ba1 and Ba3 by Moody’s. The fund seeks to copy the efficiency of the ICE BofAML BB US Excessive Yield Constrained Index. HYBB simply began in October, 2020.

Supply: seekingalpha.com HYBB

HYBB has $239m in AUM and prices buyers 25bps in charges. The TTM Yield is 5.9%.

Index evaluate

ICE defines this index as:

ICE BofA US Company BB Index, a subset of the ICE BofA US Excessive Yield Grasp II Index monitoring the efficiency of US greenback denominated beneath funding grade rated company debt publicly issued within the US home market. This subset consists of all securities with a given funding grade score BB.

Supply: indices.theice.com

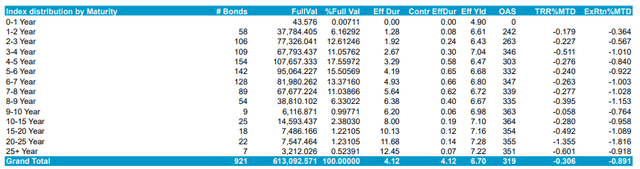

They offered some tables with fundamental information included, of which I picked this one to point out. Because the identify implies, all of the bonds are price BB.

indices.theice.com

HYBB holdings evaluate

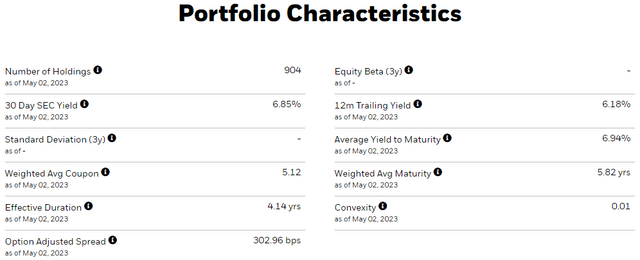

iShares offers some fundamental portfolio traits.

ishares.com

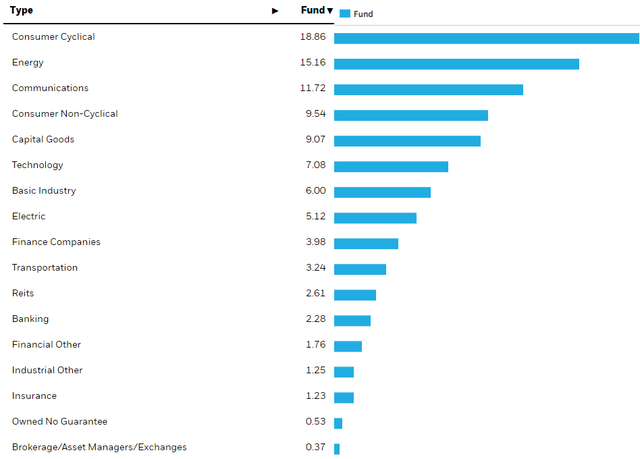

ishares.com HYBB sectors

Whereas the Prime Three sectors comprise 45% of the publicity, there’s a good unfold throughout the opposite sectors. On this time, the small allocation to banks is a plus.

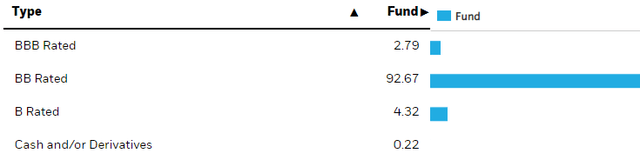

I think the non-BB-rated bonds have been such when issued, some are actually higher, some worse.

ishares.com HYBB rankings

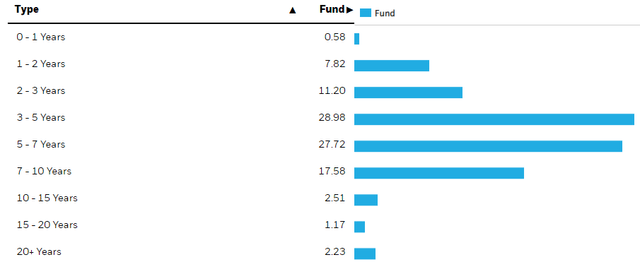

Over 50% of the holdings mature with the 3-7 12 months window, with the portfolio’s WAM at 5.82 years.

ishares.com HYBB maturities

Earlier than 2025, 3.55% of the portfolio matures. These bonds carry a WAC of 5.16%.

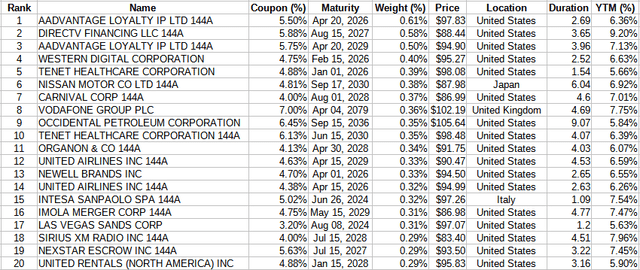

Prime 20 holdings

ishatres.com HYBB holdings; compiled by Creator

With over 900 holdings, these bonds are solely 7.4% of the portfolio. The underside half come to a respectful 30% of the portfolio’s weight. All bonds are dominated within the USD, so there isn’t any forex threat.

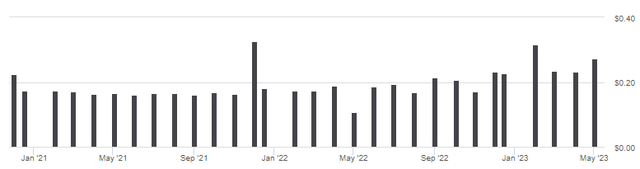

HYBB distribution evaluate

seekingalpha.com HYBB DVDs

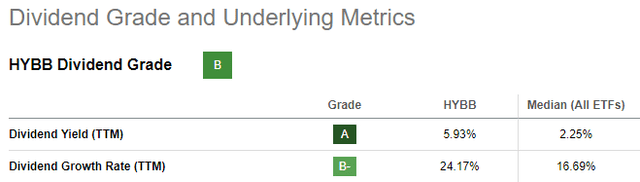

Whereas latest payouts are up, the change isn’t constant. Even with its restricted historical past, Looking for Alpha offers this a “B” grade.

seekingalpha.com HYBB scorecard

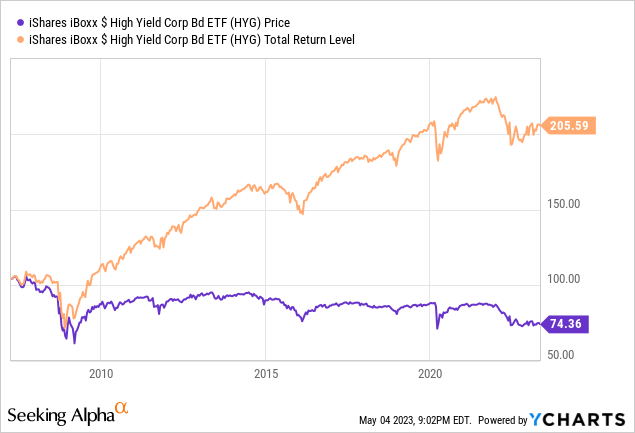

iShares iBoxx $ Excessive Yield Company Bond ETF evaluate

Looking for Alpha describes this ETF as:

The fund invests in mounted revenue markets of world developed area. It invests in U.S. dollar-denominated excessive yield company bonds with a maturity of at the least one 12 months and fewer than 15 years and a sub-investment grade score from Fitch, Moody’s or S&P. The fund seeks to trace the efficiency of the Markit iBoxx USD Liquid Excessive Yield Index. HYG began in 2007.

Supply: seekingalpha.com HYG

HYG has $15.2b in AUM and comes with a a lot larger price: 48bps. The TTM Yield is 5.5%.

Index evaluate

The index supervisor offers this description of their index.

The Markit iBoxx USD Liquid Excessive Yield Index consists of liquid USD excessive yield bonds, chosen to supply a balanced illustration of the USD excessive yield company bond universe. The indices are an integral a part of the worldwide Markit iBoxx index households, which give {the marketplace} with correct and goal indices by which to evaluate the efficiency of bond markets and investments. The index is market-value weighted with an issuer cap of three%.

Supply: cdn.ihsmarkit.com

For extra particulars on the index guidelines, readers can use this hyperlink.

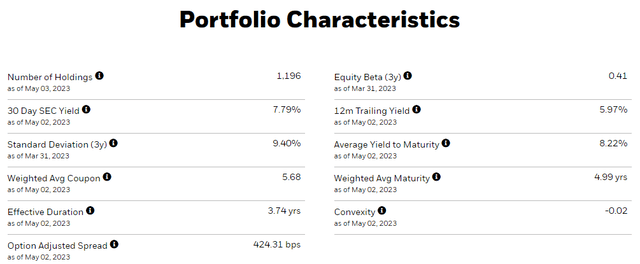

HYG holdings evaluate

Right here, iShares offers this information factors.

ishares.com

Most of those traits are larger for HYG than HYBB.

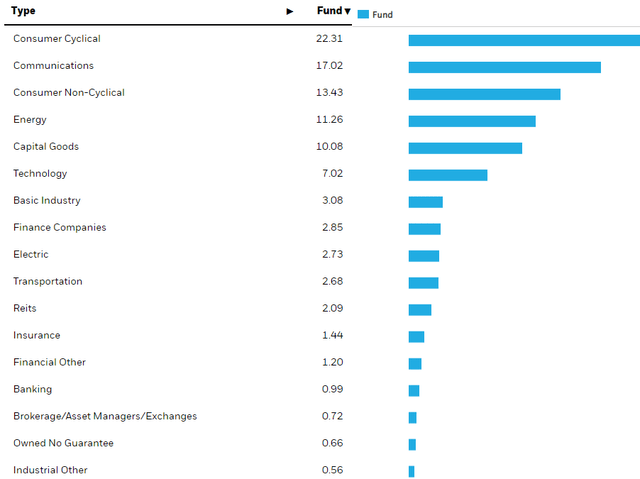

ishares.com HYG sectors

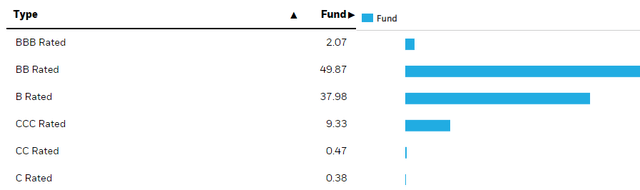

Whereas the highest sectors parallels HYBB, HYG has over 50% within the prime Three sectors, and 5 with weights over 10%. With out the BB-rated mandate, HYG has a big allocation beneath that one.

ishares.com rankings

This helps account for HYG having a better yield and portfolio WAC. HYG reveals the same maturity schedule as does HYBB, with over 63% within the 3-7 12 months window.

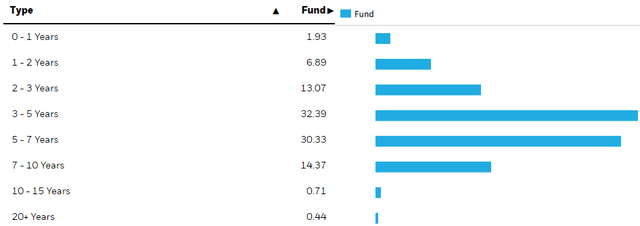

ishares.com HYG maturities

For HYG, 3.1% of the portfolio matures earlier than 2025, with a WAC of 5.63%.

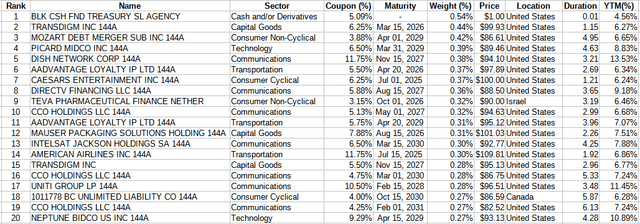

Prime 20 holdings

ishares.com HYG holdings; compiled by Creator

Even with 1200 holdings, these holdings are over 7% of the portfolio. For HYG, the underside half account for 71% of the portfolio; leveling the impact of every bond’s impression to the ETF.

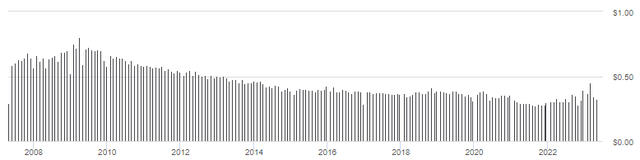

HYG distribution evaluate

seekingalpha.com HYG DVDs

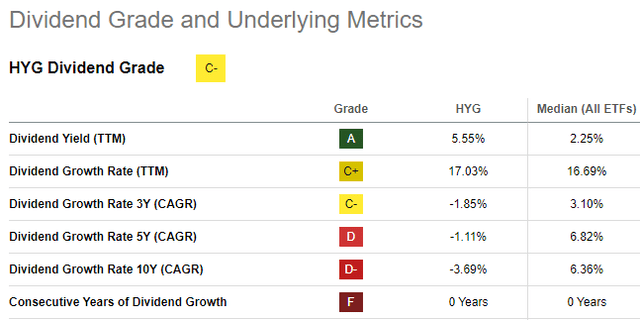

As anticipated, payouts transfer, with a delay, together with the change in rates of interest, although not completely as latest payouts are literally down from 2022. HYG scores solely a “C-” from Looking for Alpha on this ETF issue.

seekingalpha.com HYG scorecard

Evaluating ETFs

Utilizing varied websites, I collected these mounted revenue information factors on every ETF.

| Issue | HYBB | HYG |

| Efficient Length (yrs) | 2.05 | 3.74 |

| Efficient Maturity (yrs) | 5.97 | 4.99 |

| Portfolio score | BB | B- |

| Weighted Common Coupon | 5.18% | 5.72% |

| Common YTM | 6.94% | 8.22% |

| Weighted Common Value | $92.52 | $90.88 |

| P.c in BB rated | 93% | 57% |

| P.c in B rated | 5% | 39% |

The large distinction is HYG’s holds a a lot larger degree in b-rated bonds than HYBB, which focuses on BB-rated bonds. With an extended length, HYG ought to do higher as soon as rates of interest begin falling.

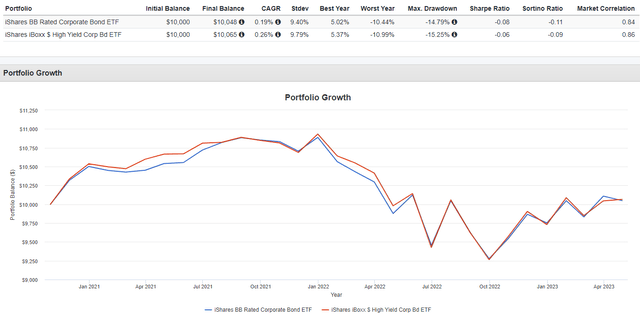

PortfolioVisualizer.com

Not one of the information offered by PortfolioVisualizer favors one ETF over the opposite. That goes for revenue offered to buyers additionally, with every ETF offering probably the most in an equal variety of years.

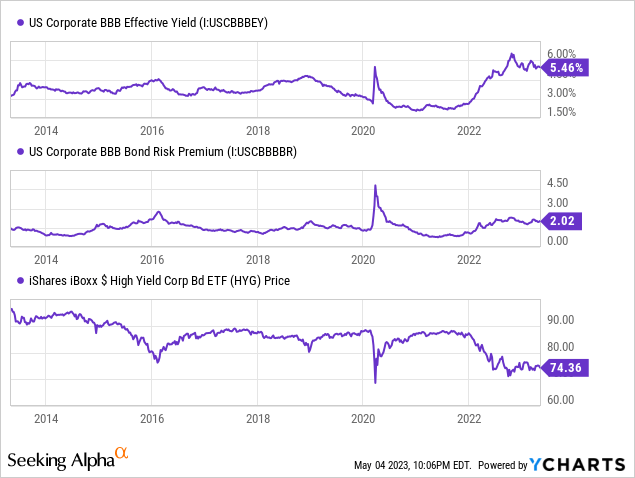

Portfolio technique

I did not not discover YCharts offering comparable information for “junk bonds” however would count on the essential actions to be comparable. BBB-rated bonds did finest when each their price and threat premium have been dropping. Whereas down from their latest peak, neither is close to latest lows.

This latest WSJ article listed 4 motive Excessive Yield bonds is perhaps value shopping for.

- Historic returns: Going again to 1987, the Financial institution of America US Excessive Yield Index, which tracks a basket of junk bonds, has by no means suffered two consecutive years of detrimental returns. That features the years of the worldwide monetary disaster of 2007 to 2009.

- More healthy debtors: The businesses issuing high-yield debt as of late are in higher form financially than they’ve been up to now, based on analysts. That’s partly as a result of many wobbly debtors have migrated away from issuing junk bonds to borrowing within the mortgage market.

- Underrated bonds: Lots of the remaining debtors within the junk-bond market are bigger firms with sturdy stability sheets and respectable financials. But their bonds proceed to be labeled as being at a better threat of default. That’s as a result of credit-rating companies have grow to be far more cautious about elevating their rankings, attributable to some classification errors made up to now.

- Financial system’s route: Many analysts imagine the financial system will sluggish or enter a gentle recession later this 12 months. If or when the financial system slumps, two issues will occur to vary the value of bonds. First, yields on 5-year Treasuries will begin falling and should hit 2% by mid-2024, down from 3.4% lately. Nevertheless, the good thing about falling authorities charges will probably be partially offset by will increase in junk credit score spreads of roughly half a proportion level by the tip of the 12 months.

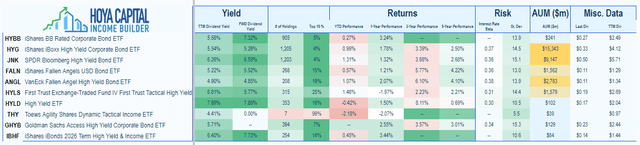

Whereas this text reviewed one new and one seasoned Excessive Yield ETF, listed below are some others that ought to included in any due diligence evaluation of this a part of the bond market. The subsequent tables consists of the 2 reviewed right here plus eight others.

hoya-capital-income-builder