Spencer Platt/Getty Photos Information

iQIYI (NASDAQ:IQ) is an internet video platform and one of many largest video-viewing websites on the planet. Its web site resembles that of YouTube, permitting customers to add movies. As well as, the websites supply streaming of films and dramas. Its outstanding monetization mannequin contains membership companies, internet marketing companies, and content material distribution. Most of IQ’s income comes from memberships, accounting for over 50% of all income in Q3. At present, IQ inventory trades at $6, which I believe is undervalued contemplating their quick development and earnings. I’ve a PT of $10 for IQ, although there could also be some hiccups within the quick run.

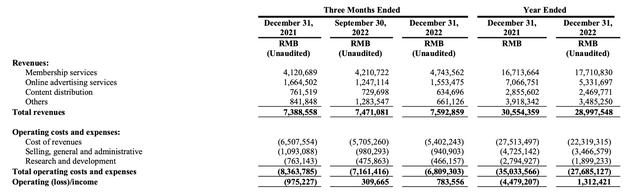

Earnings Outcomes:

In This autumn 2022, IQ reported $1.1 billion in income, a rise of three% YoY. That is fairly good contemplating related corporations corresponding to Netflix (NFLX) generated 1.9% YoY development over the identical interval. This additionally marks the second quarter IQ delivered optimistic working money flows.

Membership subscriptions elevated by 15% YoY, nevertheless, this was as a result of firm releasing quite a few premium contents within the quarter, driving a subscriber improve of 13 million over the quarter. It’s probably this quarter was an exception, and the expansion is anticipated to decelerate as the corporate can not preserve excessive numbers of premium content material.

Different types of income have slowed down, with promoting down 7% YoY, content material distribution down 17%, and others down 21%. These had been as a result of market and difficult macroeconomic environments in China.

On the brilliant aspect, IQ was in a position to improve its margins by chopping bills on content material spending, lowering 19% YoY whereas maintaining a robust content material library.

IQ Earnings (iQIYI)

For fiscal 12 months 2022, iQIYI generated $4.2 billion in income, which was a 5% lower in comparison with 2021. General, quarter Four was a formidable turnaround for the corporate, after dealing with disappointing ends in the primary Three quarters.

Shifting Content material Technique:

Over 2022, IQ produced a traditionally excessive variety of authentic content material. In 2022, over 50% of the dramas had been authentic, in comparison with 20% in 2018. Based on CEO Mr. Yu Gong.

“The success of the quarter was pushed by our authentic blockbusters. Wanting ahead, we’ll proceed to deal with our authentic content material technique to ship high-quality development, and to create extra worth for our stakeholders.”

The technique has proved profitable as IQ persistently produced blockbuster exhibits and memberships will increase at speedy charges. As well as, authentic exhibits enable IQ to have tighter price optimization, as they will handle each step of the method. I anticipate margins to proceed rising as IQ shifts its content material technique.

IQ authentic dramas (iQIYI)

As well as, the video streaming (SVoD) market income is anticipated to extend at a CAGR of 10.14% in China. As a frontrunner of SVoD, IQ has a lot of room for income development.

Predictions:

For my part, the wall road estimates for IQ’s Q1 earnings, set to launch on Could 16, are barely excessive. Analysts’ income expectations elevated 5.3% QoQ, and elevated earnings expectations by 41%. I believe IQ will miss income expectations, since a big a part of their income development this quarter was attributed to blockbuster exhibits. With a barely weaker content material library this quarter, I don’t suppose IQ can match income expectations, as a majority of their revenues are from subscriptions.

Alternatively, I anticipate a snug earnings beat. In This autumn, IQ’s EPS was 0.98, beating expectations by 93%. Thus, I anticipate them to beat the anticipated EPS of 0.72 by snug margins. You will need to acknowledge IQ’s margins and earnings largely rely upon its income, because the prices are comparatively mounted irrespective of the income.

Regardless that I believe IQ will underperform, I anticipate them to supply robust steerage on account of higher cost-efficiency and improved earnings from different sources of income.

Valuation:

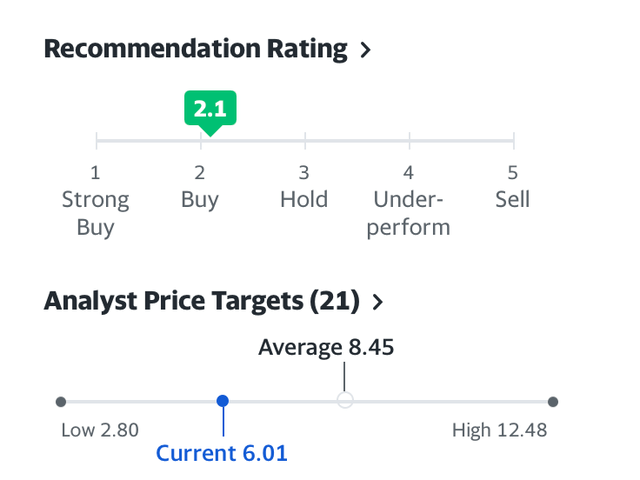

The inventory for IQ presently trades at round $6, and traded at as little as $2 again in October 2022. Based on Yahoo Finance, the PT is $8.45, giving it a 40% upside.

Yahoo Finance

As for my very own valuation, I’ll examine IQ with related corporations. IQ presently has a P/S ratio of round 1.34. Bilibili (BILI), an identical video sharing and streaming platform additionally common China, has a P/S ratio of two.39. Netflix has a P/S ratio of 4.46. Thus, I believe iQIYI is extremely undervalued, and will have an upside of 65%, or $10.

Dangers:

As a lot as IQ boasts about its potential to generate income in quite a few alternative ways, reality of the matter is that the corporate continues to be member dependent. Final quarter, 62.5% of its income had been from membership companies. Whereas this mannequin of enterprise is sustainable, as proved by Netflix’s constant income development over time, it does make the corporate over-reliant on blockbuster exhibits for income development. IQ has proved themselves to have the ability to produce high-quality exhibits, nevertheless, they nonetheless lack the resume to show to me of their consistency over lengthy intervals of time.

Moreover, though I get pleasure from their aggressive chopping of manufacturing prices whereas maintaining excessive worth content material, it is also a double-edged sword that may stab again. Netflix over time have persistently elevated manufacturing prices in worry of decreasing content material high quality and buyer satisfaction. Whereas cash doesn’t translate to high quality within the movie trade, it makes the margin of error quite a bit smaller when on a tighter price range.

An essential metrics to look at this quarter on the earnings report is potential methods for reviving different sources of income. All sources of income moreover subscription has fallen significantly due to the “difficult macroeconomic surroundings” (IQ’s earnings report). If these different sources of income, corresponding to promoting, makes a return, it is going to lower iQIYI’s reliance on the efficiency of membership subscriptions. Nonetheless, contemplating the corporate’s undervaluation and the optimistic outlook for the SVoD market in China, IQ stays an intriguing funding alternative with vital potential for development.

Conclusion:

IQ delivered a really robust 4th quarter efficiency and proved their new contents to be each prime quality and cost-effective. Whereas the corporate could have some troubles with income development within the quick run due to a barely weaker content material library, the pricing of the inventory is simply too engaging to not go in. All in all, I’d fee IQ a should purchase.