courtneyk

Proper now, there’s a whole lot of doom and gloom round the true property business. Rate of interest hikes aren’t having the meant affect on residence costs – due to the sharp spike in rates of interest, would-be sellers are hanging onto their properties for longer so as to retain a low rate of interest, retaining stock low and transactions muted.

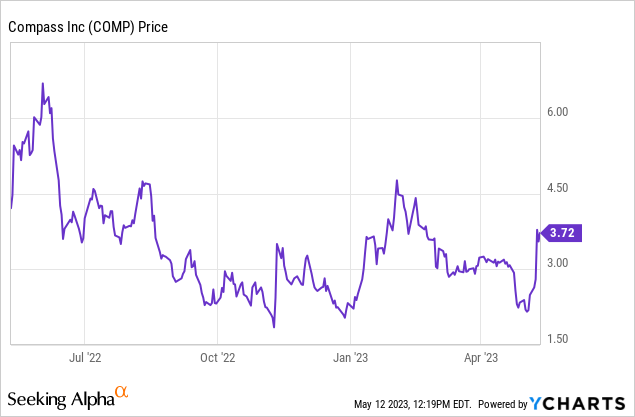

This, in fact, has damage brokers like Compass (NYSE:COMP) – however as regular, the markets have taken extra of a short-term method in sending Compass inventory down sharply from COVID-era ranges. In actuality, this main nationwide brokerage is making the most of the turndown to rationalize its expense base, inspire its highest-performing brokers, and develop the endurance of its model.

Compass’ current Q1 earnings print caught traders abruptly after a string of unhealthy information. Not solely is the corporate anticipating income declines to reasonable in Q2, however the firm additionally re-affirmed its dedication to being FCF constructive for the yr. The inventory jumped up greater than 30% in response.

In my opinion, there’s a whole lot of promise in Compass shares for the steadiness of the yr. Compass is lastly proving to the markets that though it is dealing with great macro and business strain, it is probably faring loads higher than lots of its competing brokerages – as evidenced by its skill to cull losses whereas additionally gaining market share. I stay bullish on Compass, and I might remind traders that the true property business has at all times been cyclical (even when we’ve not seen these sort of shocks since 2008-2009) – however the work that Compass is doing now, particularly on shoring up its profitability, will echo long gone when the recession is over.

Right here is my full long-term bull case on Compass:

- Inside just a few years, Compass has grow to be a dominant brokerage – Compass’ market share of U.S. actual property transactions is rising quickly to ~5%. Already deeply embedded into main coastal markets, Compass is extra lately pushing into new workplace alternatives within the Midwest. There’s nonetheless room for additional growth. Even after the brand new market exercise this yr, Compass remains to be penetrated into lower than half of the U.S. inhabitants.

- Tertiary income alternatives – Just lately, Compass has been opening the door to new monetization alternatives, together with beginning its personal title firm. This positioning helps Compass derive extra pockets share from actual property transactions as an entire. Compass has commented that connect charges on these tertiary companies are rising. Compass estimates its U.S. TAM is $240 billion, of which solely $95 billion and the remaining is coming from adjoining companies.

- Robust branding – Compass constructed a model round being a full-service, high-quality actual property brokerage, very related in model and profile to opponents like Berkshire Hathaway HomeServices or Sotheby’s. This provides the corporate a really sturdy distinguisher towards different tech-first rivals like Redfin.

- Scalable platform – Compass’ major prices lie within the R&D spending to ship its expertise platform for Compass brokers, in addition to the gross sales and advertising prices of promoting its model to homebuyers/sellers and potential new brokers. These prices are scalable: as Compass’ scale grows, and as agent productiveness grows (the common Compass agent generates 19% extra gross sales within the second yr), Compass will have the ability to enhance its profitability margins, which we’ve got already seen within the firm’s newest outcomes.

To me, the post-earnings rally in Compass is just the start in right-sizing the inventory’s valuation to its correct value. It is value noting as effectively that Compass has a comparatively sturdy steadiness sheet with $364 million of money (towards roughly ~$250 million of debt) to assist the corporate navigate by way of this recession – which, on high of an expectation to be FCF constructive, offers the corporate loads of endurance. Keep lengthy right here.

Q1 forward of expectations; and ahead outlook is significantly better than feared

This is the advantage of investing in beaten-down firms: often, expectations are fairly low, and exceeding low expectations can result in large upward gyrations in inventory worth.

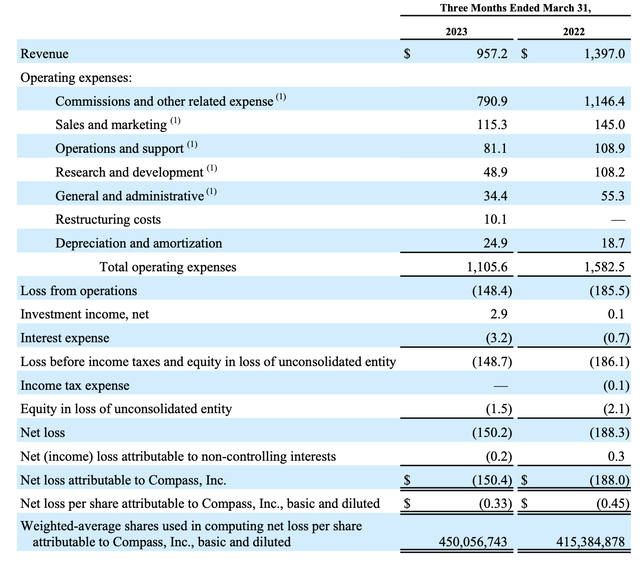

Check out Compass’ Q1 outcomes beneath:

Compass Q1 outcomes (Compass Q1 earnings deck)

Compass’ income declined -31% y/y to $957.2 million, a perform of a -24% y/y decline in complete transactions and a -32% y/y decline in complete transactional worth. This was, nonetheless, loads higher than feared, as Compass had guided to a decline of between -32% y/y and -39% y/y in Q1.

And amid the sharp income decline, the business did worse: as Compass reported that relative to This fall, it gained 17bps of market share to finish This fall at 4.5% nationwide market share.

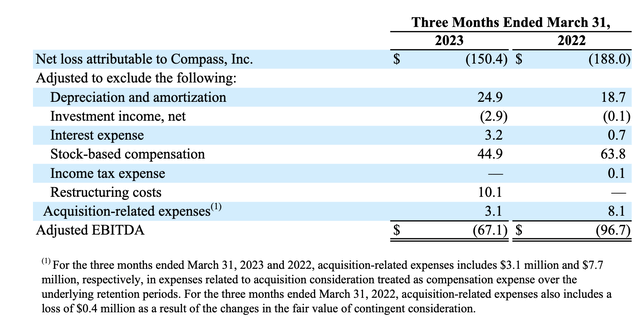

The larger story right here, nonetheless, is expense administration. Despite sharp income declines, Compass achieved adjusted EBITDA of -$67 million within the quarter, which is an enchancment of $30 million yr over yr:

Compass adjusted EBITDA (Compass Q1 earnings deck)

Expense administration is administration’s high aim, and CEO Robert Reffkin famous on the Q1 earnings name that these aren’t non permanent value cuts meant to salve over a brief recession, however everlasting structural adjustments:

Most significantly, the market efficiency in Q1 and what we already are seeing for Q2 provides to our confidence that we’ve got set the precise OpEx targets to generate constructive free money circulate in 2023.

I wish to emphasize two essential factors because it pertains to OpEx. First, if the market ought to worsen past 25% down, we’re ready to take further steps to reset OpEx ranges decrease. Bear in mind, the latest estimates for the yr from NAR, Fannie Mae and the MBA are for a decline within the vary of 12.6% right down to 22.5% down.

Quantity two, as I beforehand mentioned, we’re assured that we have set the precise OpEx goal vary of $850 million to $950 million. We have now taken everlasting actions not non permanent ones. We anticipate to remain inside this vary over the following two to 3 years. We might be simply at $900 million annualized by year-end.

And our administration staff is dedicated to actioning continued efficiencies with a aim of working in direction of the midpoints of our OpEx vary over the following couple of years, even because the market improves to extra normalized ranges. In consequence, when the market improves sooner or later we might be well-positioned for producing vital long-term earnings.”

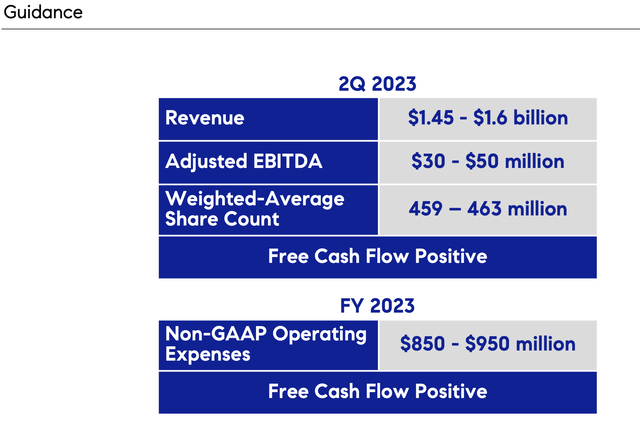

Compass’ outlook additionally supplies fairly a sturdy image of the rest of the yr. On a income foundation, the corporate’s $1.45-$1.60 billion steering implies the y/y declines moderating to a spread of -29% y/y to -21% y/y. Compass moreover expects adjusted EBITDA to show constructive in Q2:

Compass outlook (Compass Q1 earnings deck)

Moreover, Compass is anticipating each quarter for the rest of 2023 to generate constructive money circulate, which is an plain expression of energy amid sharp macro-driven business headwinds.

Key takeaways

Recessions are a take a look at for firms to reshape administration priorities and switch value constructions the other way up, and Compass is making the precise strikes to stabilize itself within the short-term whereas positioning for market share progress and profitability growth sooner or later. Maintain driving the upward momentum right here.