Copa Holdings, S.A. (NYSE:CPA) Q1 2023 Earnings Convention Name Could 11, 2023 11:00 AM ET

Firm Members

Daniel Tapia – Director-Investor Relations

Pedro Heilbron – Chief Government Officer

Jose Montero – Chief Monetary Officer

Convention Name Members

Stephen Trent – Citi

Savi Syth – Raymond James

Guilherme Mendes – JPMorgan

Michael Linenberg – Deutsche Financial institution

Bruno Amorim – Goldman Sachs

Helane Becker – Cowen

Daniel McKenzie – Seaport International

Alberto Valerio – UBS

Rogerio Araujo – Financial institution of America

Josh Milberg – Morgan Stanley

Operator

Women and gents, thanks for standing by. Welcome to Copa Holdings First Quarter Earnings Name. In the course of the presentation, all individuals will likely be in a listen-only mode. Afterwards, we’ll conduct a question-and-answer session. [Operator Instructions] As a reminder this name is being webcast and recorded on Could 11, 2023.

Now I’ll flip the convention name over to Daniel Tapia, Director of Investor Relations. Sir it’s possible you’ll now start.

Daniel Tapia

Thanks, Felicia, and welcome everybody to our first quarter earnings name. Becoming a member of us in the present day are Pedro Heilbron, CEO of Copa Holdings and Jose Montero, our CFO.

First, Pedro will begin by going over our first quarter highlights, adopted by Jose who will talk about our monetary outcomes. Instantly after we’ll open the decision for questions from analysts. Copa Holdings monetary stories have been ready in accordance with Worldwide Monetary Reporting Requirements. In in the present day’s name, we’ll talk about non-IFRS monetary measures. A reconciliation of the non-IFRS to IFRS monetary measures will be present in our earnings launch which has been posted on the corporate’s web site, copaair.com.

Our dialogue in the present day will even include forward-looking statements, not restricted to historic information that mirror the corporate’s present beliefs, expectations and/or intentions concerning future occasions and outcomes. These forward-looking statements contain dangers and uncertainties that would trigger precise outcomes to differ materially and are based mostly on assumptions topic to alter. Many of those are mentioned in our annual report filed with the SEC.

Now, I would like to show the decision over to our CEO, Mr. Pedro Heilbron.

Pedro Heilbron

Thanks, Daniel. Good morning to all, and thanks for taking part in our first quarter earnings name. Earlier than we start, I wish to prolong my honest gratitude to all our co-workers for his or her dedication to the corporate. Their steady efforts and dedication have stored Copa on the forefront of Latin American aviation. To them as all the time my highest regards and admiration.

At the moment, we’re happy to report robust outcomes for the primary quarter and a stable outlook for the yr. Regardless of the continued excessive gasoline costs within the quarter, we had been in a position to ship an working margin of 22.3%. These outcomes had been primarily pushed by a strong demand surroundings within the area which led to an improved load issue in addition to a rise in passenger yields through the quarter.

Among the many foremost highlights for the quarter, passenger site visitors grew 7.1% in comparison with the identical interval in 2019 outpacing our capability development of two.8%. This resulted in an 86.8% load issue, a 3.5 share level enhance in comparison with Q1 2019. Passenger yields got here in at $0.146 or 20% larger than the primary quarter of 2019. Whereas cargo income was 52% larger, leading to unit revenues or RASM of $0.131, a 25.5% enhance in comparison with the primary quarter of 2019.

On the fee facet, our unit price excluding gasoline got here in at $0.062 or 2.1% larger in comparison with Q1 2019. Consequently our working margin got here in at 22.3% 5.5 share factors larger than within the first quarter of 2019. On the operational entrance Copa earnings delivered an on-time efficiency of 92.2% and a completion issue of 99.9%, as soon as once more amongst the easiest on the planet.

I wish to take this chance to precise my recognition for greater than 7,00Zero coworkers who day in and day trip ship a world-class journey expertise to our prospects. Their contributions are key to our success.

Turning now to our fleet. We acquired two 737 MAX 9 plane through the quarter and we anticipate to obtain 10 extra MAX 9 through the the rest of the yr to finish 2023 with a complete fleet of 109 plane. Almost about our community as we talked about in our final name, we plan to start out new service to the cities of Manta in Ecuador and Baltimore and Austin within the US beginning this summer season. With these additions, we’ll serve 80 locations in 32 nations in North, Central, South America and the Caribbean, as we proceed to strengthen and solidifying our place as essentially the most full and handy hub in Latin America.

Lastly almost about Wingo, Wingo continues its regional growth with the announcement of three new home Colombia routes from Bogota to Barranquilla, Pereda and Bucaramanga and one worldwide seasonal service from Cali in Colombia to Aruba. With these additions, Wingo will function 34 routes with service to 21 cities in 10 nations.

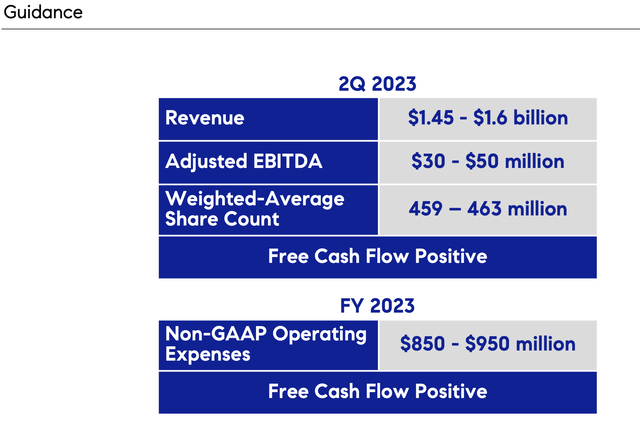

Now, turning to our expectations for 2023. As you noticed in our earnings launch, we elevated our working margin steerage to a spread of 22% to 24%, primarily pushed by the present stable demand surroundings within the area in addition to a decrease gasoline curve for the rest of the yr. As all the time, Jose will present extra element concerning the complete yr’s outlook.

To summarize, we’re off to an excellent begin in 2023 and anticipate to maintain seeing a wholesome demand surroundings all year long. We proceed rising and strengthening our community essentially the most full and handy hub for intra-Latin America journey. And as all the time, our workforce continues to ship world-leading operational outcomes whereas sustaining our price low.

Lastly, we’re as assured as ever in our enterprise mannequin. We proceed to ship stable margins and aggressive unit prices whereas providing an important product for our passengers, making us the very best positioned airline in our area to persistently ship industry-leading outcomes.

Now, I will flip it over to Jose, who will go over our monetary leads to extra element.

Jose Montero

Thanks, Pedro. Good morning, everybody. Thanks for being with us in the present day. I would like to hitch Pedro in acknowledging our nice workforce for all their efforts to ship a world-class service to our passengers.

I’ll begin by going over our first quarter outcomes. We reported a internet revenue for the quarter of $121.5 million or $3.07 per share. Excluding particular objects, internet revenue got here in at $157.Eight million or $3.99 per share. First quarter particular objects are comprised of an unrealized mark-to-market lack of $37.9 million associated to an appreciation within the worth of the corporate’s convertible notes and a $1.7 million unrealized mark-to-market achieve associated to adjustments within the worth of monetary investments.

We reported a quarterly working revenue of $193.2 million and an working margin of 22.3%. Capability got here in at $6.6 billion obtainable seat miles or roughly 3% larger than in Q1 2019. Load issue got here in at 86.8% for the quarter, a 3.5 share level enhance in comparison with the identical interval in 2019 whereas passenger yields elevated 20% to $0.146. Consequently, unit revenues got here in at $0.131 or 25.5% larger than within the first quarter of 2019.

Pushed by larger jet gasoline costs, unit prices or CASM elevated 17.2% versus Q1 2019 to $0.102. And our CASM excluding gasoline got here in at $0.062, a 2.1% enhance versus Q1 2019, primarily pushed by extra engine upkeep prices, adjustments in supplemental hire provisions associated to plane utilization in addition to extra lease engine prices, plus a rise in our gross sales and distribution prices as a perform of upper gross sales through the interval.

I will spend a while now discussing our stability sheet and liquidity. As of the tip of Q1, we had belongings of near $4.9 billion. And when it comes to money quick and long-term investments, we ended the quarter with $1.2 billion, which represents 36% of our final 12 months’ revenues. So our debt, we ended the quarter with $1.7 billion in debt and lease liabilities and achieved a internet debt-to-EBITDA ratio of 0.6 instances. 80% of our plane debt is mounted and I am completely satisfied to report that our blended price of plane debt for the quarter, got here in at an annualized fee of three%.

Turning now to our fleet. In the course of the first quarter, we acquired two Boeing 737 MAX 9s to finish the quarter with a complete of 99 plane in comparison with 102 plane in our fleet on the finish of 2019. With these additions, our complete fleet is now comprised of 68 737-800, 22 737 MAX 9s and 9 737-700s.

These figures embody one 737-800 freighter and the 9 737-800s operated by Wingo. Two-thirds of our fleet continues to be comprised of owned plane and one-third of our plane are on their working leases. In the course of the the rest of 2023, we anticipate to obtain 10 extra plane, all Boeing 737 MAX 9s to finish the yr with a complete fleet of 109 plane.

Lastly, I am happy to tell you that this previous month of March, our Board of Administrators accredited a quarterly dividend of $0.82 per share, topic to Board ratification every quarter, which reinstates our dividend payout of 40% of prior yr’s adjusted internet earnings. We made our first quarterly fee through the month of April and the second fee can be on June 15 to all shareholders of document as of Could 31.

As to our outlook, based mostly on the energy of the present demand surroundings, we are able to present the next steerage for full yr 2023. We anticipate to extend our capability in ASMs versus 2022 inside a spread of 12% to 13%. We now anticipate an working margin throughout the vary of 22% to 24%.

We’re basing our outlook on the next assumptions: load issue of roughly 85%, unit revenues throughout the vary of $0.125, CASM ex gasoline to be within the vary of $0.061. And at last, we’re anticipating an all-in gasoline value of $2.85 per gallon.

Thanks. And with that, we’ll open the decision to some questions.

Query-and-Reply Session

Operator

Thanks. [Operator Instructions] The primary query comes from the road of Stephen Trent from Citi. Stephen, please go forward.

Stephen Trent

Good morning gents and thanks very a lot for taking my questions. I used to be questioning sort of on a high-level foundation in the event you might talk about the alternatives associated to the renewed strategic alliance with United Airways from August 2021 and what you could be seeing when it comes to the potential for a joint enterprise settlement perhaps revisiting that down the road. Thanks very a lot.

Pedro Heilbron

Sure. Hello, Stephen, it is Pedro. As you already know, we’ve got a really robust alliance with United that goes all the best way again to the continental date. And on high of that we’re, in fact, a part of Star Alliance. So, we really feel that with our robust United relationship plus Star Alliance, we cowl what’s of most profit to Copa when it comes to the place we fly the areas the place we fly the place we’re energetic and the earnings that we needs to be an alliance with.

We even have that letter of intent or no matter it is referred to as with — between Avianca United and Copa for a JBA joint enterprise settlement. And I feel that has not been applied. The pandemic was in between. And truthfully, I do not actually know if that is going to be applied or it might simply be allowed to run out. I feel it most likely has over a yr for that call to be made. However once more, what I am making an attempt to say is that we’ve got the alliances we want and that add essentially the most worth to Copa.

Stephen Trent

Tremendous I actually recognize that. And simply my one follow-up I consider you talked up to now in regards to the LEAP engines driving sort of a one-time comparatively smallish CASM Ex headwind into this yr? And any high-level view on whether or not that is going to ease as we transfer by way of 2024?

Pedro Heilbron

Sure, I will let Jose reply.

Jose Montero

Sure, Stephen, let me simply say that sure there are some, I might say, short-term headwinds associated to the LEAP engine. Many of the prices that we have seen to date this yr are related to quick store visits that a number of the engines require to as a part of campaigns which might be being carried out within the worldwide fleet of the LEAP.

We’re seeing an enchancment within the efficiency of the engine. And we’re comparatively superior within the majority of those campaigns. And so going ahead in the remainder of 2023 we anticipate to have a lesser variety of engines going into a store and/or with a number of the fixes which might be required. And so that truly flows into our $0.061 CASM steerage that we’ve got for the complete yr vis-à-vis the CASM Ex steerage that we had issued again in February.

Stephen Trent

Tremendous useful gents. Thanks for the time and looking out ahead to seeing you on Tuesday.

Jose Montero

Thanks, Stephen. Identical right here.

Operator

One second for the following query. 1The subsequent query comes from the road of Savi Syth of Raymond James. Savi, please go forward.

Savi Syth

Thanks. Good morning everybody. I used to be curious you often a reasonably conservative workforce in forecasting and the sort of income outlook enchancment is fairly significant. Simply curious what tendencies you are seeing that sort of offers you confidence essentially on to sort of take these numbers up.

Jose Montero

Sure Savi. Hi there, I will begin and perhaps Pedro you possibly can soar in to enhance. I might say that the very first thing is that Q1 actually had a really, very strong demand surroundings. So I feel that is a portion of the rise that we had made to our unit income steerage. After which secondly, I might say, that from our visibility that what we’ve got for the approaching months particularly the second quarter the demand surroundings continues to be comparatively strong. In order that’s additionally embedded in there.

After which we’re cognizant that our visibility is restricted for the rest of the yr. So I feel that that is — there’s some seasonality as effectively that we put into the steerage. And naturally we’re cognizant as effectively that there is numerous capability coming into market. There’s numerous — gasoline can also be an merchandise that we’re paying shut consideration to and the motion in gasoline. So we’re — I feel we’re — I feel we are able to say that we’re assured within the 12.5%, nevertheless it’s principally associated I might say to Q1 and to the visibility that we’ve got into the primary half of the yr.

Pedro Heilbron

And the one factor I might add Savi is that our steerage despite the fact that it has been improved as you all talked about nonetheless places us at a decrease RASM for the second half of 2023 in comparison with the second half of 2022. And that is due to the decreased gasoline curve and the extra capability coming into our markets. So we’re nonetheless projecting decrease RASM within the second half of the yr.

Savi Syth

That is useful. And alongside these strains for my second query, I’m wondering in the event you might speak a bit bit about, what you are seeing on the enterprise demand standpoint. It appeared prefer it was a sluggish progress over the previous few quarters. Have you ever seen any enchancment there?

Pedro Heilbron

There’s nonetheless some enchancment, however issues have modified a minimum of in our a part of the world because the pandemic. So leisure is our strongest phase now. Is just not as a lot as half, nevertheless it’s within the 40% of our break up between leisure VFR enterprise and enterprise has come up considerably, it is like within the mid-20s, perhaps a bit bit lower than that p.c when it comes to that very same break up, however slight enchancment in the previous few quarters, nothing very important.

Savi Syth

Excellent. Thanks.

Pedro Heilbron

Thanks, Savi.

Operator

One second for our subsequent query. The following query comes from the road of Guilherme Mendes from J.P. Morgan. Guilherme, please go forward.

Guilherme Mendes

Good morning, Pedro, Jose, Daniel. Thanks for taking my questions and congrats on the gorgeous robust outcomes. First query only a follow-up on the assumptions behind the steerage. I feel it is clear on the CASM entrance, however simply questioning, when it comes to the capability addition versus small discount.

Simply questioning if it is associated to any potential bottlenecks on the provision facet of the {industry} and on the remainder steerage pondering that most likely it implies a stronger yield for the yr regardless of of decrease gasoline price as effectively, so in the event you might please simply additional clarify the way you’re seeing demand surroundings going ahead?

Pedro Heilbron

Sure. I will begin…

Guilherme Mendes

After which, the second query. Sorry go forward.

Pedro Heilbron

Yeah. I will begin after which, I will let Jose add. So when it comes to capability effectively Copa itself is receiving 12 plane within the yr. In order that’s fairly a bit some capability. After which, our friends in Latin America are getting again to pre-pandemic ranges which weren’t the case in 2022, however would be the case to any extent further the remainder of 2023.

So all of that collectively plus there are different airways particularly OCCs that are rising sooner than pre-pandemic. So once we add all of that up it is a appreciable variety of extra seats in our area. Demand is there in fact, so we’re assured on the demand and we’re assured that there is sufficient demand however extra capability plus decrease gasoline often it tends to lead to decrease unit revenues.

Jose Montero

Yeah, Guilherme when it comes to the capability motion that we made when it comes to our full yr steerage it’s yeah, associated to the most recent forecast that we’ve got when it comes to plane deliveries for the yr. So that is what we’ve got when it comes to our greatest information as of now when it comes to new craft deliveries.

Guilherme Mendes

Very clear. Thanks. And the second query is when it comes to the capital allocation. And naturally the dividends already out. You’ve gotten the buyback open as effectively. So pondering that leverage stays under one-time internet debt to EBITDA in the event you see room or perhaps a rare fee or a extra aggressive buyback? Thanks.

Jose Montero

All proper. Guilherme, I’ve to say that we reinstituted our dividend. The Board accredited that again in March. And it is 40% of our prior yr’s adjusted internet earnings. And so we’re I feel completely satisfied I feel with that stage. I might say that our buyback program as you noticed continued to be energetic throughout this yr through the first a part of the yr.

And I feel that there is a few necessary factors to make. Primary is that, we’ve got a large variety of investments coming in associated to plane for development of our enterprise. So I feel that a part of this capital that we’ve got is geared in the direction of development of Copa itself. And quantity two, we’ve got to transform and we additionally should — need to have numerous flexibility when it comes to the administration of that legal responsibility.

Guilherme Mendes

Very clear. Thanks. Have an important day.

Jose Montero

Thanks.

Pedro Heilbron

Thanks, Guilherme.

Operator

One second for our subsequent query. The following query comes from the road of Michael Linenberg from Deutsche Financial institution. Michael, please go forward.

Michael Linenberg

Hey. Good morning everybody. And that was nice forecast. A pair right here, one, the transfer so as to add extra home service in Colombia by Wingo was that in response to the suspension of Avelo and Extremely? Is it a tactical transfer?

Is it a harbinger of perhaps getting larger within the home Colombia? And is there a possibility so that you can perhaps get a number of the slots that may probably be launched because of consolidation and rationalization within the Colombian market? That is my first query. Thanks.

Pedro Heilbron

Okay. So a couple of issues there Michael. One is that Wingo is just not actually a big participant in home Colombia. Wingo has 9 planes as we all know it is 9 737-800. And this capability shift has to do with one thing that is been creating over the past variety of months, which is a extra energy within the home market than in a number of the worldwide routes which have seen much more capability. So it is tactical. It is tactical. It is restricted.

Sure the shutdown of sure airways has a optimistic impact, however truly advantages far more the opposite airways, the opposite incumbents in Colombia. Wingo once more is just not important and it by no means actually competed that a lot head on with the airways. They’re not flying. So not a big impact, however there’s a little bit higher energy within the home and that is why they cut back — what Wingo has completed is lowered frequencies in a number of the worldwide markets that we’re not doing as effectively and redeploy them within the home market that’s doing higher. So once more tactical.

Michael Linenberg

Something on the booked Bogota slots that probably turn out to be obtainable, are you in line to attempt to seize a few of these to your use?

Pedro Heilbron

Proper. So, though, there are not any plans to develop the Wingo fleet in an aggressive means, we are usually disciplined and Wingo proceed making the most of alternatives and never simply taking a bunch of plane. So Wingo will stay disciplined and opportunistic, however the Bogota slots are essential, as a result of it was very troublesome for Wingo, it is rather troublesome for Wingo to publish a complicated schedule and fly on the proper time on the peak instances when most passengers need to fly, as a result of to date the slots in Bogota has been dominated by a single provider. And so hopefully that is going to alter and make Bogota, which is like the one one of many only a few slot restricted airports in our continent, it’s going to make it extra aggressive and it might enable Wingo and others to supply service on the time passengers need to fly. So we see that as a optimistic improvement.

Michael Linenberg

Okay, nice. After which that is simply one other form of community query, Pedro. One of many issues that we noticed popping out of COVID is we noticed numerous the massive international hubs initially solely profit from the restoration of native site visitors. And I feel as issues have began to activate, we’re seeing much more what we name sixth freedom site visitors, third and fourth freedom connections, which is one thing that you just concentrate on. And so once you take a look at the commentary out of say a Turkish or an Emirates or a Cathay Pacific, you are actually beginning to see that profit.

And I feel once I take a look at Copa and I take a look at capability coming on-line by a few of your opponents the place I feel you actually outshine the competitors is the entire connections that you just fly in metropolis pairs that no person else serves. And I think that perhaps that wasn’t seeing as a lot service within the earlier a part of the restoration interval and that is beginning to activate now and people are markets which might be uniquely served by Copa. Is that proper? Is that one thing a pattern that you have been seeing in your markets or perhaps your connecting markets turned on from day one?

Pedro Heilbron

Nicely, we have seen energy all through our markets and all through our community. And we’re staying true to our imaginative and prescient and to our enterprise mannequin. So popping out of the pandemic, we went again to doing what we have all the time completed in a really centered and disciplined means. And that demand has been there from the start I might say, nevertheless it’s clearly stronger now and it continues to develop. It is holding up. And there is extra capability from different airways and from ourselves coming in, however the entire market has improved. And sure I feel you are proper. Now we have one thing distinctive about our community and we hope to proceed creating it.

Michael Linenberg

Okay. Nicely, nice. Nice outcomes, and thanks for answering my questions.

Operator

One second for the following query. The following query comes from the road of Bruno Amorim from GS. Bruno, please go forward.

Bruno Amorim

Sure. Thanks for taking my questions. So I would like to listen to from you if potential what’s your imaginative and prescient for the following few years when it comes to the aggressive dynamics and the anticipated profitability for the enterprise. After all, adjusting for eventual volatility in macro situations, which could occur. My level right here being that in the event you look within the 2010 to 2014 cycle margins had been round 20%. I am speaking about EBIT margin then between 2015 and 2019 margins hovering round 15%.

So in the event you had been to guess for the following few years are we extra in the kind of market that we noticed between 2016 and 2019, or is it potential to maintain margins round 20% despite the fact that you aren’t rising as a lot as again that cycle 2014 when the area was rising. However finally after the pandemic, you may see structurally much less competitors simply making an attempt to determine, what would be the new regular going ahead and it might be nice to listen to your ideas round that. Thanks

Pedro Heilbron

Okay. So we’ve got supplied steerage for 2023 solely, not from — not for the years after that. And I would love to not speculate a lot in regards to the future. However I ought to say, that we spend numerous time engaged on bettering each side of the corporate, what we have all the time completed and make Copa extra aggressive, as we go and as we develop. We see proper now, what we are able to see now is a sturdy demand surroundings. We see a superb future for our enterprise mannequin, centered on one hub of the Americas in Panama, and we see many alternatives to extend the connectivity and add new cities, and we’ll proceed working in the direction of a cost-competitive, on-time passenger-friendly, with an environment friendly and productive and motivated workforce.

So that is what we do. That is, what we’ll proceed to do. And it looks like the surroundings for such an airline to thrive, in our a part of the world, is there and it could be getting higher. So that is what we’re engaged on. There’s all the time competitors, in fact. Hopefully, there’s room for those which have additionally a enterprise mannequin, that is smart for them and that is lifelike with the dimensions of the market. So so long as it is — there’s that stability, I feel we’ll be fantastic. And in any case, we hope to all the time be able to do higher than the opposite. In order that’s our focus. However past 2023, I feel we’ve got to attend a couple of extra earnings calls.

Bruno Amorim

T

hanks, nice. Thanks. And that’s nice perspective. If I’ll only a very fast follow-up then. After the capability you anticipate to return again, through the yr as you talked about, will you be in the identical place when it comes to overlaps and competitors total vis-à-vis, the pre-pandemic situation kind of competitors? Are you able to touch upon the aggressive panorama after this capability, that you just anticipate to return again is in place?

Pedro Heilbron

Nicely, I feel — I imply the competitors is fairly, public. So, we most likely sort of have the identical info, however competitors has change. It is not — I might say, it isn’t lower than earlier than. If something, it is extra it is extra, dynamic perhaps extra aggressive, nevertheless it’s altering the sense that it is gone extra in the direction of the low-cost, facet of the spectrum. And in that sense, we’re like one of many few remaining full-service airways in our a part of the world. And there is some — there is a area for that. However there’s numerous competitors and we compete with all, and we attempt to be as aggressive as anybody particularly, since we have talked a couple of bigger p.c of passengers now are leisure than pre-pandemic.

Bruno Amorim

Excellent. Thanks very a lot.

Pedro Heilbron

Thanks, Bruno.

Operator

[Operator Instructions] The following query comes from the road of Helane Becker of Cowen. Helane, please go forward.

Helane Becker

Thanks, operator. Hello, guys. Thanks for the time. So that you guys are coming as much as New York subsequent month and holding your Investor Day. After we take into consideration issues you possibly can say, have you considered the main focus of that and what you possibly can replace us on? I do not need to run forward of it, however I am sort of questioning what to look ahead to?

Pedro Heilbron

Nicely, hopefully, a superb meal and a superb Q&A session. However as you already know, Helane our story does not change a lot from yr to yr. We all the time stick with just about the identical enterprise mannequin, which as I used to be mentioning, earlier than we tried to all the time enhance and make higher. And hopefully we’ll speak about that about what are we engaged on what are we specializing in, what we’re making higher, what’s working, what may want adjustments, however by no means large surprises. We are likely to have like a means of doing issues and so long as does not have to be modified, we simply look to enhance it. So I might say, anticipate extra of the identical and perhaps — effectively Jose, go forward.

Jose Montero

I might simply add, effectively to start with for sure issues Helane, we attempt to take someday at a time. So we’re making ready earnestly, for the earnings name after which perhaps subsequent week, we’ll begin engaged on the small print of the Investor Day. However I might say, a few issues so as to add to what Pedro talked about, primary is, that at our final Investor Day was right here in Panama again on the finish of 2019, earlier than the pandemic. So we’re cognizant that, it is necessary so that you can get face time with us.

And I feel a part of, what we’ve got in retailer can also be getting face time with members of administration which might be past us too. So, I feel that that is additionally an necessary a part of it. And simply merely, present an replace on a number of the initiatives that we had mentioned again three years in the past. So I feel that is sort of what we take into account.

Helane Becker

Okay. I’ve a final. After which my follow-up query is one thing I feel Jose, that you just talked about when it comes to capital allocation with respect to share repurchase and the convert which I feel is callable. Did I interpret your reply appropriately that both a kind of is up – is honest recreation that you’d purchase again to transform? If it made sense.

Jose Montero

Sure. I do not need to speculate. I do not need to get into essentially particulars of potential avenues that we’d pursue. However I might say that we at this stage need to keep flexibility when it comes to the choices that we’ve got. So I feel that the stability sheet could be very, very robust and we’ve got – we need to maintain options open to reduce the fee for us when it comes to the settlement of the convert. So – and sure, we’re additionally cognizant that the convert has a name choice in there and we – all options are on the desk proper now daily.

Helane Becker

Thanks.

Operator

One second for the following name or subsequent query. The following query comes from the road of Daniel McKenzie of Seaport International. Daniel, please go forward.

Daniel McKenzie

Hey, good morning, guys. Congratulations on the quarter and the outlook right here. Simply have a few questions. The primary actually ties to income from premium seating. And I am actually simply making an attempt to get a primary understanding on this a part of the story. So I suppose first, what p.c of the income is it in the present day versus what it was in 2019? After which simply associated to that how rapidly is that rising?

Pedro Heilbron

Sure. Okay. So let me begin after which I will let Jose, comply with up. So then – we do not share that particular info however what I can say is that premium demand and premium yields are above pre-pandemic ranges. So load elements are higher, yields are higher and premium seating profitability is healthier than pre-pandemic.

Jose Montero

Sure. Nicely, and in addition our paid load issue at enterprise class, which we do not disclose however we are able to say directionally that it’s larger in the present day than the place it was again in 2019 as effectively. So I feel that is one other knowledge level that is necessary.

Daniel McKenzie

Okay. After which I suppose a second query right here is only a query on the brand new distribution technique that you have talked about up to now, what p.c of the income is booked on Copa’s web site in the present day versus the GDSs? And the way does that evaluate to 2019? After which to what extent is that serving to you to seize some extra income say from upsell alternatives or bundling? After which tied to that how materials are the fee financial savings that you just’re seeing from this new technique?

Pedro Heilbron

Okay. I will begin and if I go away something out – so large, large image. Pre-pandemic, let’s imagine that one-third of our distribution was direct and two-thirds had been oblique so companies and the like. And in the present day we’re very near flipping these numbers the place two-thirds will likely be direct together with NDC connections and one-third goes to be conventional journey company GDS bookings. So we’re about to flip the numbers, the ratios, as I simply talked about. And that in fact comes with appreciable financial savings together with that we’re charging a surcharge for conventional GDS bookings, which make up for any price distinction. So I do not know if we’re sharing but any price saving numbers however once we add the income influence so the income…

Jose Montero

I imply I feel that to date – I imply this – to start with we’ve got to say that this began in Q3 of final yr. So it’s nonetheless an ongoing course of that we’ve got. However it’s from as an instance ROI perspective or a money perspective performing, I feel as anticipated or perhaps a bit bit higher. However as Pedro talked about, there is a portion of the profit right here that exhibits a factoring income due to the truth that we’ve got a payment that we cost for gross sales that aren’t carried out on NDC channels or on our personal direct channels.

Now going ahead, our expectation is that the precise prices – pure price of distribution ought to come down within the method that our direct channel, gross sales proceed rising. So we’ve got an expectation that that may come over the following a number of quarters. And that profit truly, that channel shift profit then is included within the steerage of $0.061 steerage a minimum of for the tip of this yr. However once more, there is a sort of a change of mannequin and so it will likely be with us for a few years to return.

Pedro Heilbron

And as necessary is the truth that now we’ve got a lot better management of our distribution and that is going to permit us to do extra issues sooner or later that may decrease prices and enhance revenues in fact.

Daniel McKenzie

Sure. That’s good. Thanks a lot you guys. Okay, then.

Pedro Heilbron

Thanks.

Operator

One second to your subsequent query. The following query comes from the road of Alberto Valerio of UBS. Alberto, please go forward.

Alberto Valerio

Hello, Pedro, Jose. Thanks for taking my questions and effectively completed for the outcomes. Sorry, for the repetitive yr that was superb the steerage that you just guys simply supplied to us for the yr. And I am questioning right here to seek out what was the distinction between the steerage that you just simply supplied in February — mid-February so 2.5 months later or two months later the steerage that you just guys are offering in the present day? So we’ve got talked in regards to the demand already that stronger you mentioned that additionally perhaps larger publicity to the excessive earnings class with these enterprise vacationers. Is there the rest like some publicity to areas or North America, South America some totally different debt or one thing totally different from the individuals skywalk of touring in the event you might give me some info on that may assist lots.

Pedro Heilbron

So in a quite simple means — and I will let Jose if he wants so as to add something or be extra particular. In a quite simple means what Jose talked about earlier than we’ve got now visibility on the primary half of the yr and a decrease gasoline curve. So these two issues are the primary drivers to the improved working margin steerage.

Jose Montero

Sure. I might say that when it comes to regional efficiency, I might say that the majority of our areas are performing very effectively forward of what we had earlier than. And as Pedro talked about first half is performing effectively. And once you take a look at the working margin steerage we can’t overlook about gasoline as effectively. After we supplied our steerage again in February gasoline was at larger stage than the place it’s in the present day as effectively.

Alberto Valerio

We are able to say additionally that competitors is much less right here was up to now as a result of once we see gasoline drop up to now we see yields come down. And in line with the steerage that you just guys supplied you may be flat for this yr given which in the event you develop in double-digit now?

Pedro Heilbron

No not essentially. As I discussed earlier than our RASM steerage implies a decrease RASM for the second half of 2023 than the precise RASM we delivered for the second half of 2022 the yr earlier than. So we’re factoring in a decrease than 2022 RASM and that is the decrease gasoline curve and capability from opponents. However once more having the higher visibility for the primary half of the yr allowed us to regulate RASM upwards for the complete yr.

Alberto Valerio

Incredible, improbable. And my final one right here on the working capital. It got here a bit bit above what we had estimated for the quarter. Simply questioning whether or not it is one thing not recurring on this quarter on the working capital issues. Thanks once more for taking my query. Congrats on the consequence.

Jose Montero

I might say Alberto that we had — from ATO perspective I feel our single ATO is definitely down for the quarter. Gross sales are nonetheless forward. I feel there’s some objects there associated to some refunds of tickets and expire coupons et cetera. But it surely’s I feel there’s additionally seasonality in there as effectively. In order that’s the primary drivers there.

Alberto Valerio

Incredible. Thanks.

Jose Montero

Thanks.

Pedro Heilbron

Thanks.

Operator

One second for the following query. The following query comes from the road of Araujo Rogerio of Financial institution of America. Araujo, please go forward.

Rogerio Araujo

Sure. Really that is Rogerio Araujo. Thanks lots for the chance, Pedro, Jose and Daniel. I’ve one query. Final time we noticed margins near the place Copa delivering was previous to 2015. If I am not mistaken, Venezuela was doing nice on the time was truly pushing that margin upward considerably. On an apples-to-apples foundation is there a purpose to consider that Copa is definitely far more worthwhile now than at the moment. Let me put — in different phrases this query any purpose to consider that Copa structural margin is larger now than earlier than? In that case the place does it principally come from in your view? Thanks very a lot.

Pedro Heilbron

Sure. Thanks, Rogerio. As I discussed earlier than we’re all the time working in the direction of being a extra aggressive airline. And we by no means financial institution on robust revenues as a result of we all know there are cycles in our {industry}. What we financial institution on is having aggressive price and being extra environment friendly and extra productive. And we’re a way more environment friendly and productive airline than again then in 2013, 2014. The larger adjustments the place we’ve got a decrease CASM Ex and so we’re extra environment friendly in that sense. We have labored arduous to enhance our CASM ex. So we’ve got higher unit price which permits us to be extra worthwhile even with decrease yields.

And a part of that can also be having a more practical environment friendly fleet. Now we have a single fleet principally 737-800 and MAX 9, which have higher — a lot better working price than again then. And we have completed quite a lot of issues. It is going to most likely be a protracted record to be extra environment friendly. However for instance we do our personal C checks in-house. We did not do this again then. The distribution technique is yielding outcomes. And there is most likely, there’s a record of different of different initiatives. Now we have densified the fleet considerably and there is extra to return. So sure we’re far more aggressive and have higher unit prices and extra environment friendly that once we had been — what we had been again then in 2011, 2012, 2013 once we had an identical margin however perhaps revenues had been stronger.

Rogerio Araujo

Okay. Fairly clear. Congratulations for the very robust outcomes and all these price discount and effectivity up to now years.

Pedro Heilbron

Thanks very a lot, Rogério.

Operator

One second to your subsequent query. The following query comes from the road of Josh Milberg of Morgan Stanley. Josh, please go head.

Josh Milberg

Hey, Pedro, Jose good to speak to you guys and massive congrats on the outcomes. I had a few follow-ups and please forgive any repetitiveness on my facet. One is you touched on the difficulty of your — what your opponents are doing when it comes to bringing again capability however I used to be simply hoping you may remark a bit additional on that situation. How a lot it has been impacted by plane supply delays and in addition simply on the Avianca facet, in the event you’ve been seeing any influence from that airline shift in technique with respect to community or in every other sense that is the primary query.

After which the second query is in the event you might remark a bit bit additional in your fleet plan and what it might imply for capability development in 2024. I do know you mentioned earlier than that it is form of early days to be moving into subsequent yr. However I do know that you’ve got the 737-800s which might be scheduled to return off lease. I feel your plan exhibits you holding on to these. So any shade there can be nice.

Pedro Heilbron

Yeah, yeah. Thanks, Josh. So I will speak on fleet plan second however we’ve got — we speak fleet plan first as a result of we’ve got revealed 2024. So we’re getting 12 plane this yr and we have revealed that we’re getting Eight MAX eight subsequent yr however it might have been extra earlier than if not for Boeing delays. As we all know Boeing Airbus everybody has delayed. So the delays are between three and 4 months in some instances might be even longer for subsequent yr. So we’ve got revealed 8. We hope to get extra.

Hopefully, we are able to get greater than eight as soon as we get the most recent info from Boeing. We even have quite a lot of leases that come due and we’ll renew — we’ll attempt to renew as many as we have to. And all of it will depend on what number of deliveries we get from Boeing. So it is sort of like a financial institution on the dance of the belongings of the plane belongings. So we have to stability the lease expirations with the Boeing deliveries with the demand forecast. And proper now, all of it seems good truly. So we’re hopeful that we’ll get extra plane and demand will stay robust as it’s proper now. Now, if you wish to add something to fleet Jose?

Jose Montero

Yeah. I feel that is very full. By way of 2024 as Pedro talked about we’ve got proper now our plan is revealed in our Investor Relations web site together with the eight plane that Pedro talked about for 2024.

Pedro Heilbron

Proper. By way of opponents, I am unsure there’s far more to say, I do not like to provide them like free promoting or something like that. However you requested about Avianca. We in fact compete fairly a bit in opposition to Avianca. Now we have all the time competed with Avianca. Despite the fact that we’re additionally collectively in Star Alliance and we’ve got code sharing and frequent flyer reciprocity. So I might say it is a pleasant and wholesome competitors. And so they’re nonetheless rising their hub. They’re additionally flying continuous. They’ve modified their mannequin. In order that they have — they went by way of Chapter 11. So they’re a robust competitor little doubt. And does it present? Is it noticeable? After all, it’s. However we’re additionally rising and competing. So there is a stability there’s some form of a stability there as they develop and compete so can we. And when it comes to the remainder, effectively they’re just about again to pre-pandemic capability as we’re. So is LATAM and others that had been smaller again then are most likely above these ranges. So we’re in a dynamic market with robust demand and I feel it is what can be anticipated in any case.

Jose Montero

Thanks, Josh

Josh Milberg

Okay. Thanks very a lot. These had been nice responses. Have a pleasant day.

Pedro Heilbron

Thanks.

Operator

Please maintain for the following query. The following query comes from the road of Duane Pfennigwerth of Evercore ISI. Duane, please go forward.

Unidentified Analyst

Hey, good morning. That is Jake Gunning on for Duane. So simply to place a finer level on earlier questions on geographic demand energy. On a earlier name, you talked about level of sale for US versus native, might you speak about simply how that is trending now?

Pedro Heilbron

I do not know if it is — I do not assume it is modified a lot. We see energy in most of our areas and markets. Possibly South America is just not as robust comparatively talking because it was earlier than. So South America is just not as robust, however nonetheless optimistic, however that would change from one quarter to the opposite and US level of sale stays fairly robust despite the fact that the forex the US greenback has misplaced a bit little bit of worth nonetheless has numerous energy. And the economic system as we all know within the US remains to be robust. Despite the fact that efforts had been being made to sluggish it down it is resilient. So there’s nonetheless energy in US level of sale. So I do not assume something has modified that a lot from our earlier name.

Unidentified Analyst

Okay. After which on capability simply given demand energy and the capability constraints the place or how far more would you need to develop with out these constraints?

Pedro Heilbron

So our fleet plan I feel is an effective reflection of our development plan. We’re getting 12 MAX 9s this yr. Subsequent yr we’ve got revealed eight MAX Eight we’ll be getting. However as I discussed if we might get extra as a result of we had been purported to get extra. However resulting from delays, we’re not getting all of them in 2024 those we had been anticipating to get initially. So if we are able to get a couple of extra we’ll be very completely satisfied and we’re ready to listen to from Boeing perhaps that may occur. So that offers you an thought of our development which is within the double-digit vary.

Jose Montero

No, I used to be simply going to say Jake that I feel a great way to take a look at it and that is simply theoretical in fact, however take a look at the preliminary full yr steerage that we issued again in November had a 15% development. And in order that was — we might argue that our regional expectation of the place we would like it. So sure.

Unidentified Analyst

Okay. That make sense. Thanks and have a pleasant day.

Jose Montero

Thanks.

Pedro Heilbron

Thanks.

Operator

Thanks. I might now like to show the decision again over to Pedro Heilbron. Pedro, please go forward.

Pedro Heilbron

Sure, thanks very a lot. And so thanks all. This concludes our earnings name for the primary quarter of 2023. And so I will take additionally this chance to announce that we’ll have our Investor Day as I feel Helane talked about. It may be on June 22 in New York Metropolis. You ought to be getting the invites and every other particulars within the subsequent couple of days. So hope to see you then subsequent month and have an important day. Thanks as all the time to your assist.

Operator

Women and gents, thanks to your participation. That concludes the presentation. It’s possible you’ll disconnect and have a beautiful day.