DonsESLAdventure/iStock Editorial by way of Getty Photos

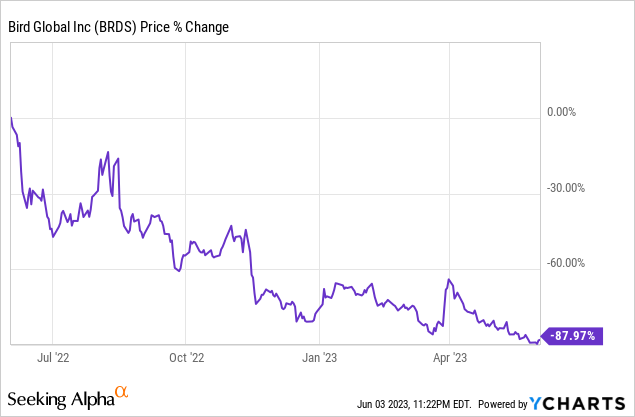

Chicken World’s (NYSE:BRDS) go-public story has turn into a traditional story of how SPACs turned the harbinger of wealth destruction in opposition to initially buoyant expectations of progress. The Los Angeles-based firm is down by 88% over the past 12 months and has fallen 54% in 2023 alone. The decline has been relentless, led by an unprofitable enterprise that has turn into solely at odds with the present market risk-off sentiment. Bears, who type the 12% brief curiosity, have a Chapter 11 submitting in view as Chicken faces a dearth of liquidity and consecutive quarters of excessive money burn that has left it with a few quarters of money runway as of the top of its fiscal 2023 first quarter. To be clear right here, Chicken is hurtling in direction of a chapter submitting and its frequent shares needs to be averted.

While Chicken simply initiated a 25-for-1 reverse inventory break up to keep up compliance with NYSE minimal itemizing guidelines, the corporate has been hit with one other non-compliance discover with its present market cap at $30 million being beneath the requirement for a $50 million market cap. This varieties a core danger for present shareholders as a reverse inventory break up doesn’t enhance market cap so the one near-term treatment to regain compliance would both be a basic led rally or a broader inventory market rally that the corporate’s commons are in a position to take part in. With the market pricing in a roughly 75% likelihood of the FOMC pausing charge hikes at their June 14th assembly, Chicken may very well be handed an eleventh-hour salvo in opposition to its shares being moved to over-the-counter buying and selling.

Price Cuts Are Aggressive However Do not Go Far Sufficient

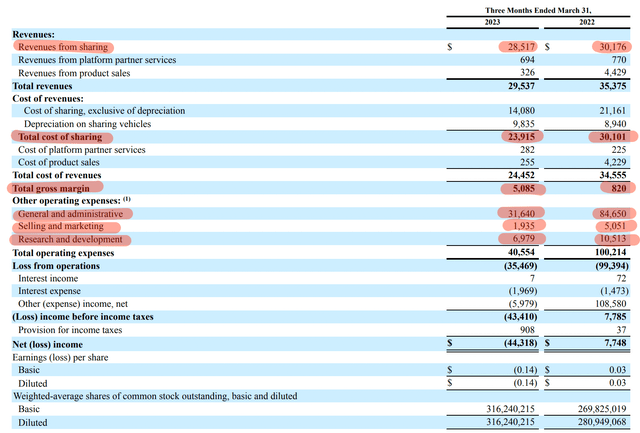

Chicken’s fiscal 2023 first-quarter earnings noticed income are available in at $29.5 million, a 16.5% decline over its year-ago comp and a miss by $33.95 million on consensus estimates. There was a drop in income throughout all their income phase with revenues from sharing seeing a $1.66 million drop year-over-year and with product gross sales collapsing by 92.6% over the identical timeframe following the corporate’s choice to exit their retail enterprise final 12 months. This exit positively impacted gross revenue margins which got here in at $5 million throughout the first quarter, up from simply $820,000 within the year-ago comp. Critically, while Chicken was in a position to understand a 20.5% discount in the price of sharing versus the 16.5% decline in sharing income, the exit from their retail enterprise did the heavy lifting for gross revenue margins coming in at 17.2% throughout the first quarter.

Chicken World Fiscal 2023 First Quarter 10-Q

Chicken has been aggressive in reducing again its operational price base. Basic and administrative bills fell to $31.6 million from $84.6 million within the year-ago interval with the corporate additionally decreasing its promoting and advertising bills by 61.7% and reducing again on R&D by $3.5 million throughout the first quarter versus the year-ago comp. These mixed initiatives noticed complete working bills fall by round 60% to $40.55 million from $100.2 million. Nevertheless, it was not sufficient with internet loss coming in at $44.Three million throughout the first quarter, round 150% of income and 148% of the corporate’s present market cap.

Requiem For A Very 21st Century Mode Of Transport

A Chapter 11 submitting is a comparatively easy affair and is without doubt one of the choices out there to firms whose liabilities and obligations are in extra of what their enterprise can meet. Chicken’s money burn from operations got here in at $21.7 million throughout the first quarter, down from $42.6 million within the year-ago comp however nonetheless at an extreme and unsustainable stage. For some context, the corporate’s money and equivalents together with restricted money on the finish of the primary quarter stood at $18.Three million.

Critically, Chicken’s money place in opposition to its present money burn profile leaves the corporate with a brief money runway. In fact, the scenario is fluid and Chicken remains to be taking aggressive steps to scale back its money burn so future quarters ought to see a decreased charge of outflows. Bears also needs to watch out with Chicken guiding for constructive free money flows by the top of fiscal 2023 with a goal of decreasing its general working bills to a ceiling of $100 million by means of 2023, down from $290.2 million in 2022. The corporate’s administration can be bullish and bought round 1.5 million shares in Could, highlighting what they thought was a mismatch between the corporate’s present valuation and their constructive free money stream steering. On a full-year foundation, Chicken now thinks it will probably generate constructive free money stream within the vary of $5 million to $10 million.

Nevertheless, I might be skeptical about investing based mostly on this steering. Turning the present money burn to constructive money flows will probably be troublesome in opposition to a tepid money place. Shares are to be averted with a complete debt place of $110.eight million as of the top of the quarter being a excessive mountain to climb for an organization nonetheless dropping such massive sums even after aggressive price cuts.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.