NORRIE3699/iStock by way of Getty Pictures

Curtiss-Wright Company (NYSE:CW) expects double digit FCF progress for the yr 2023. I’m optimistic concerning the spectacular M&A method, the diversification of the actions, and market expectations. In my opinion, additional new long-term contractual relationships signed by Curtiss-Wright will probably drive buyers’ pursuits, which can draw the eye of extra buyers. I did determine dangers from dependency on authorities businesses and maybe lack of technological innovation, nevertheless I consider that the inventory value might commerce at a better value mark.

Curtiss-Wright: Diversified Actions And Important Worldwide Publicity

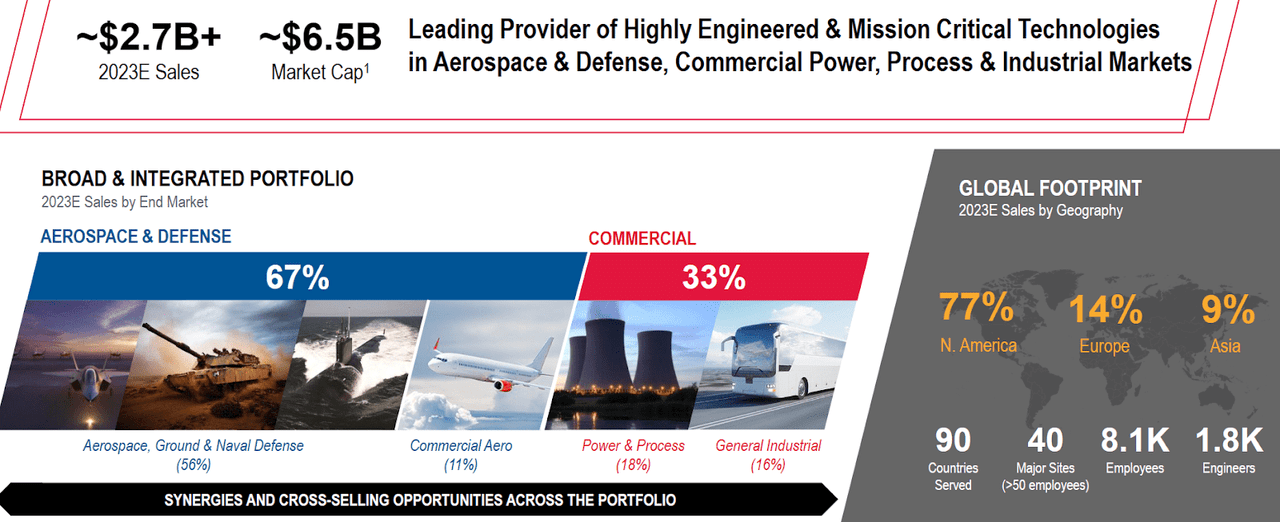

Curtiss-Wright is a global enterprise that gives its clients with extremely engineered options, merchandise, and associated companies. The purchasers belong primarily to the sphere of the aerospace and protection trade in addition to different markets with advanced technological wants. At current, the corporate is devoting vitality to reaching portfolio diversification that permits it to adapt to financial cycles.

Supply: Investor Presentation

The presence of the corporate is decided by making strategic choices to protect and enhance the corporate’s place out there in addition to to maintain recognition for its trajectory. Curtiss-Wright was a part of some essential improvements in numerous industries, resembling nonetheless being with the identify of Wright Brothers of the primary manned flight in historical past, having a presence within the improvement of the primary nuclear warship, and collaborating within the building of the primary energy plant of its variety in the US.

With these precedents and a present second characterised by the change in enterprise views given by technological improvement and innovation, the corporate has its forces to attain extremely efficient and protected merchandise for very particular niches in addition to to proceed the industrial relationship with the unique producers of the aerospace and energy technology industries.

The corporate’s operations are divided into three enterprise segments: aerospace and industrial, protection electronics, and energy and nuclear energy. For this, it has a number of manufacturing services in the US and a few services within the worldwide subject in Mexico, Canada, and the UK.

The primary of those segments has, as its essential purchasers, corporations from the aerospace commerce and in some circumstances from the protection trade. Among the many merchandise we will discover particular gadgets and gadgets for driving airplanes in addition to digital merchandise resembling sensors, regulators, automators of flight situations, and technological surfaces.

Even having lengthy industrial relationships with main corporations within the industrial sector, this section is extremely depending on the situations of the economic system typically, as a result of consumption of the inhabitants destined for this trade, and the wants of corporations to overview or develop their fleets in addition to to hold out investments on this regard.

The protection electronics section is especially oriented to the US protection trade and to a lesser extent to the aerospace commerce. Merchandise embrace in-flight communication applied sciences, extremely advanced built-in programs, devices for check flights, and stabilizers amongst others. The circulation of operations on this section is extremely linked to authorities choices relating to funding or wants within the aerospace trade. On this sense, Curtiss-Wright has managed to take care of relations and agreements with sure establishments that permit it to take care of an lively presence in some platforms with particular functions, resembling land or air automobile platforms, or each nuclear and non-nuclear submarines. Previously 10 years, the corporate has actively participated in additional than 320 platforms, collaborating in additional than 3,000 improvement or tools applications. Gross sales are sometimes carried out by means of contractual obligations with authorities entities versus the widespread gross sales channels by means of which their prior section earnings are earned.

Lastly, the nuclear and non-nuclear vitality technology section markets primarily with the naval protection trade and the vitality market. The corporate manufactures, develops, and sells generators, high-density engines, valves, and associated companies in ship restore. It additionally provides built-in modulation or air flow programs in addition to application-specific technological developments on particular merchandise.

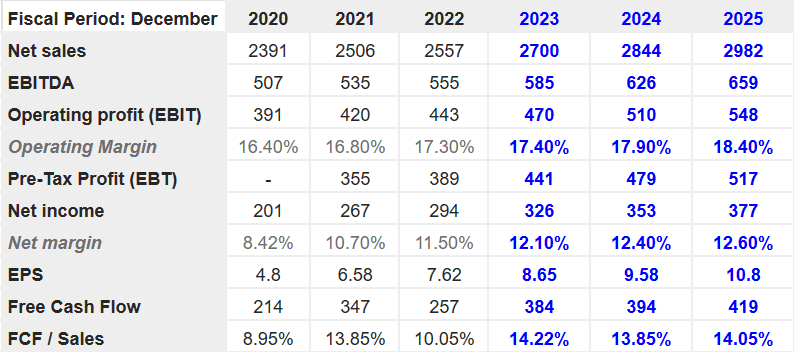

Stability Sheet

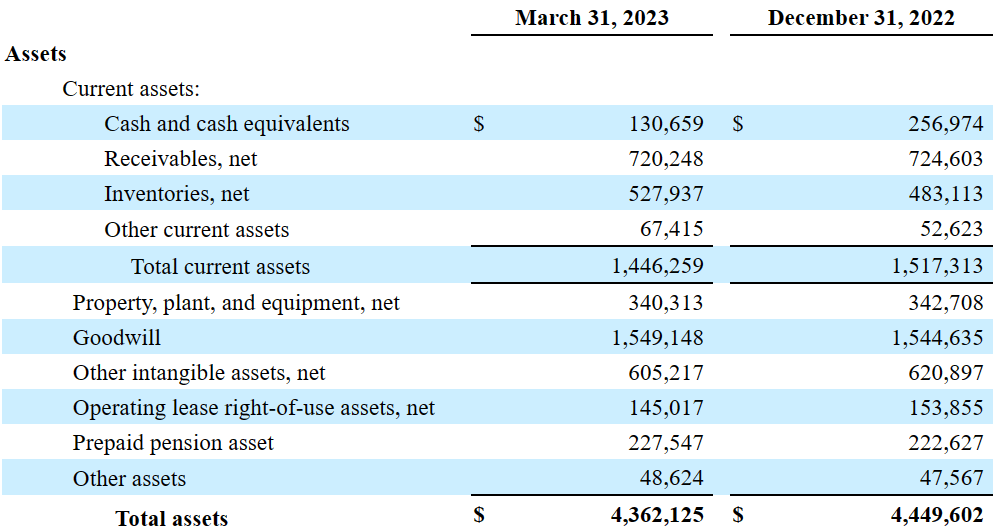

The final quarterly report included a small discount within the complete quantity of property and liabilities pushed by reductions in money, working lease-right of use property, and accounts receivable. The listing of liabilities additionally decreased resulting from reductions in deferred income, deferred tax liabilities, and accrued bills. I don’t assume that the evolution of the stability sheet can be appreciated by buyers.

As of March 31, 2023, the corporate reported money and money equivalents value $130 million, accounts receivables of $720 million, inventories value $527 million, and complete present property of about $1.446 billion. Additionally, with property, plant, and tools of $340 million, goodwill near $1.549 billion, and pay as you go pension asset of $227 million, complete property stand at $4.362 billion.

Supply: 10-Q

Additionally, with accounts payable of about $207 million, accrued bills value $153 million, and deferred income of $234 million, complete present liabilities stood at $672 million. The stability sheet additionally included long-term debt of $1.229 billion, accrued pension and different postretirement profit prices of $58 million, and long-term working lease liabilities near $124 million. Whole liabilities can be near $2.307 billion.

Supply: 10-Q

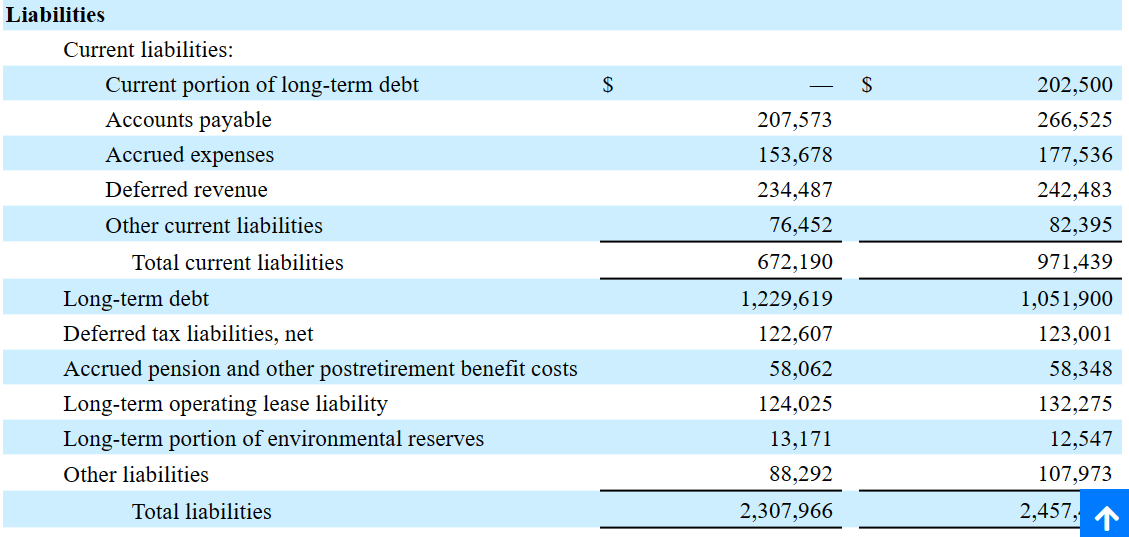

Market Expectations

I consider that readers will probably be desirous about taking a look on the expectations of different analysts. On this case, I feel that the expectations are helpful as they embrace web gross sales progress, working revenue progress, and web earnings progress.

Market expectations embrace 2025 web gross sales near $2.982 billion, 2025 EBITDA of $659 million, working revenue of $548 million, and working margin of about 18.4%. 2025 web earnings would stand at $377 million, with an EPS of $10.Eight million, 2025 FCF of $419 million, and FCF/gross sales of 14%.

Supply: Marketscreener.com

My Monetary Mannequin

Beneath the assumptions in my monetary mannequin, I assumed that income progress and FCF margin stability would probably come from diversification of its product portfolio in addition to the long-term contractual relationship Curtiss-Wright maintains with its clients.

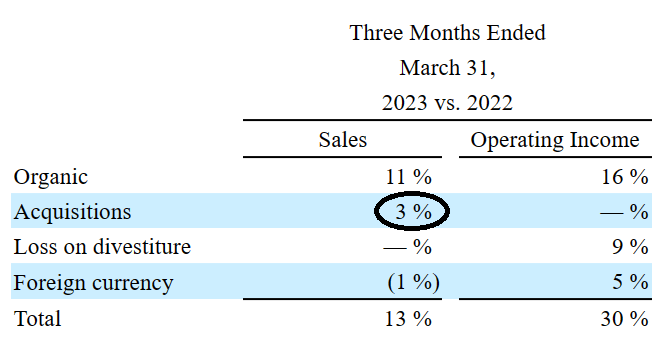

I additionally consider that shareholders will benefit from the progress within the brief time period pushed by each natural and inorganic gross sales and the acceleration of those by means of extra direct channels with its clients. Apart from, I assumed that the latest success in its working platform will probably permit allocation of great sources to analysis and improvement and maybe new future acquisitions. On this regard, I might draw the eye to the inorganic progress reported within the final quarterly report. The corporate appears to acquire inorganic web gross sales progress in most quarters.

Supply: 10-Q

In my opinion, if buyers consider that new money from sale of property will probably be coming to the stability sheet, they might purchase extra shares. Because of this, the price of capital could lower, which can have a optimistic influence on the inventory valuation. Within the final quarterly report, we noticed one sale of property in Germany.

In January 2022, the Company accomplished the sale of its industrial valve enterprise in Germany for gross money proceeds of $Three million. The Company recorded a lack of $5 million upon sale closing through the first quarter of 2022. Supply: 10-Q

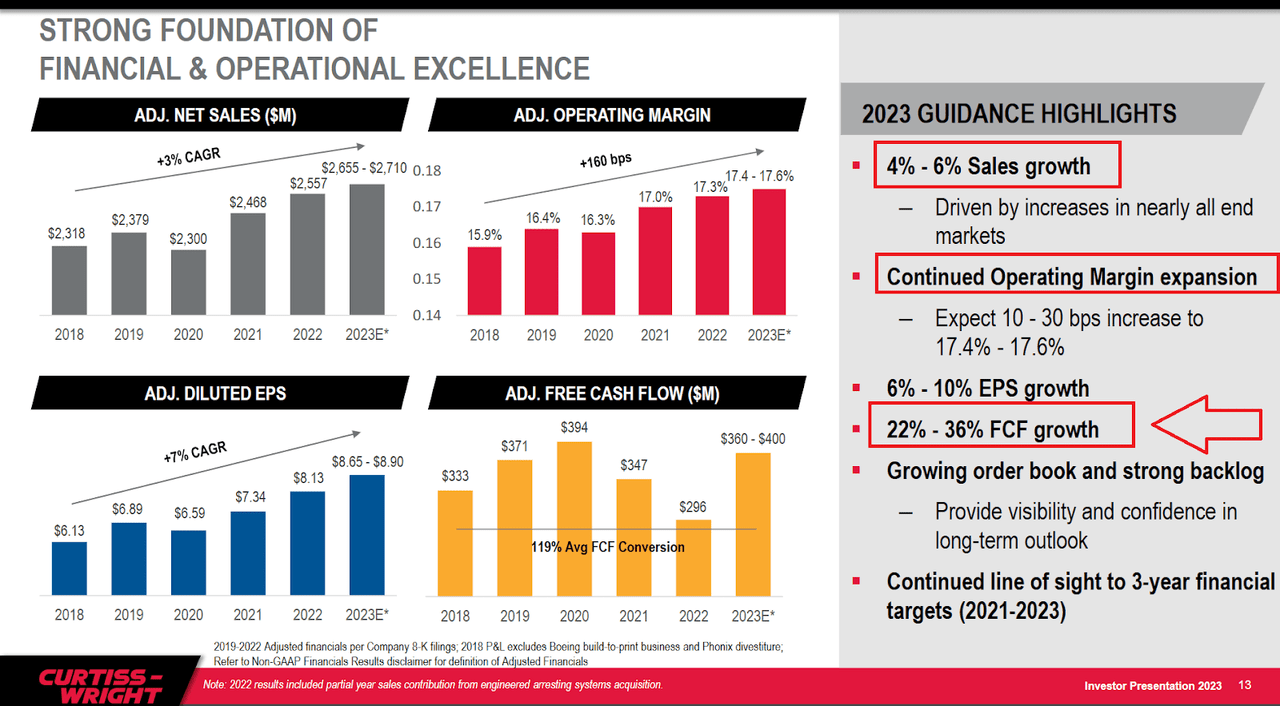

Beneath my DCF mannequin, I additionally assumed that future gross sales progress can be roughly near what the corporate reported in its 2023 steering. I’m referring to 4%-6% gross sales progress and 6%-10% EPS progress. It’s also value noting that administration believes that 22%-36% FCF progress may very well be achievable. In my opinion, additional order e-book progress and backlog progress would function the drivers of future enterprise growth.

Supply: Investor Presentation

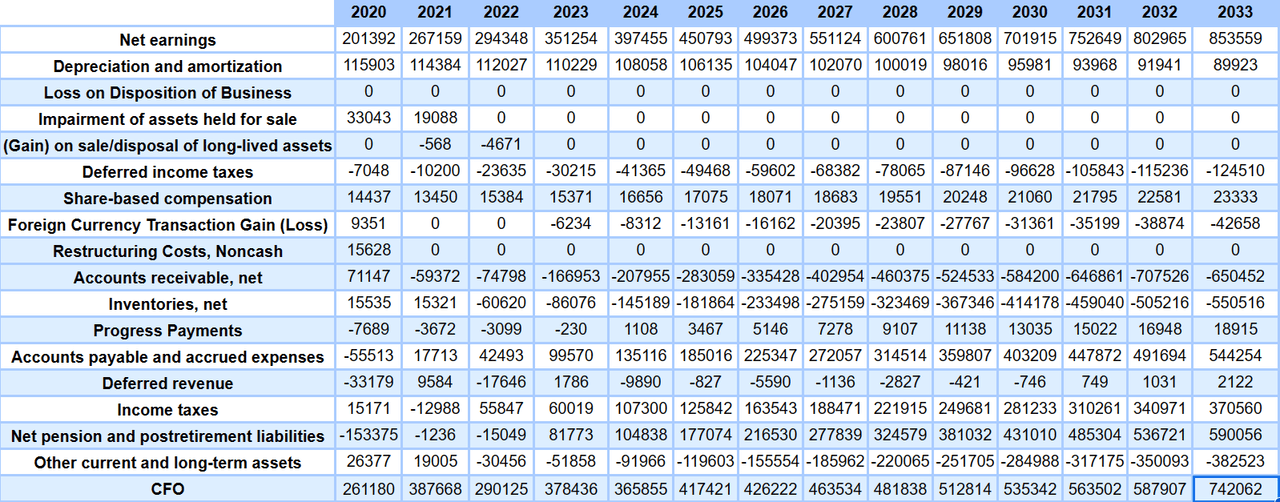

My monetary mannequin would come with web earnings progress, CFO progress, and FCF progress. I didn’t take into consideration the calculation of the FCF positive aspects from disposition of property, goodwill impairments, or restructuring prices.

2033 web earnings would stand at $853 million, with depreciation and amortization value $89 million, deferred earnings taxes of about -$125 million, and share-based compensation near $23 million.

Additionally, with 2033 adjustments in accounts receivable of about -$651 million, 2033 adjustments in inventories of -$551 million, adjustments in accounts payable and accrued bills near $544 million, and adjustments within the web pension and postretirement liabilities of about $590 million, 2033 CFO can be $742 million. If we assume 2033 capex of -$5 million, 2033 FCF can be $737 million.

Supply: DCF Mannequin

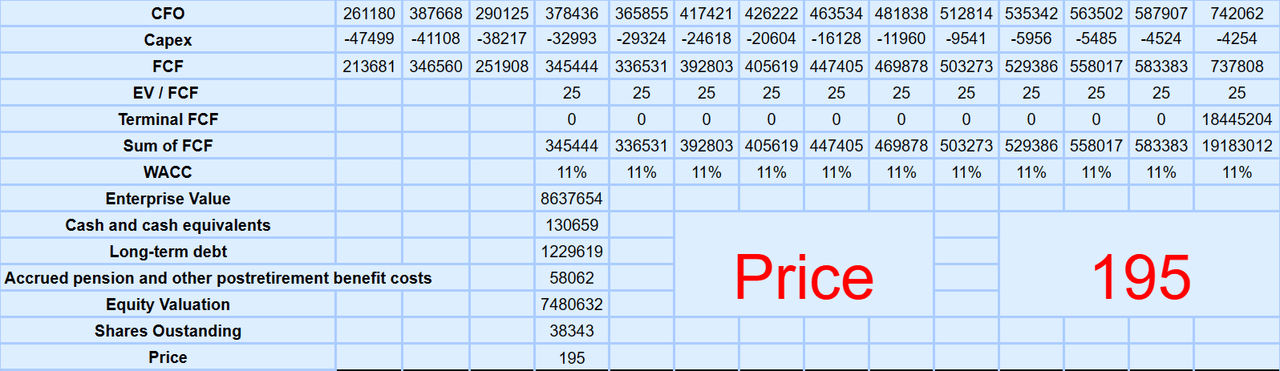

If we assume an EV/FCF near 25x and a WACC of 10.5%-11%, the enterprise worth would stand at $8.63755 billion. Apart from, if we add money and money equivalents value $130 million, and subtract long-term debt of about $1.229 billion and accrued pension and different postretirement profit prices near $58 million, the fairness valuation can be $7.4855 billion. Lastly, the truthful value can be near $195.55 per share.

Supply: DCF Mannequin

Rivals

Curtiss-Wright maintains industrial relations with state businesses, and a few of these contracts are secured in the long run. With that, the negotiation of different contracts generally consists of different corporations within the sector, which aren’t quite a few and keep nice entry to sources and infrastructure capability. Rivals with extra sources could have extra benefits than Curtiss-Wright when signing new contracts.

I additionally consider that the event of know-how for more and more particular merchandise opens the door for brand new corporations to take part with low situations within the markets. This additionally applies to the section for the aerospace trade. The corporate additionally lives with the eventual sufficiency that some corporations or businesses should cowl their very own manufacturing or restore demand.

Dangers

Along with the logical operational dangers that exist for Curtiss-Wright as a result of nature of its enterprise, we should spotlight that for all its segments, the flexibility to scale or develop gross sales and actions depends upon the success of its clients and their demand for progress. This issue, added to its nice dependence on gross sales with the US authorities businesses, is among the factors the place I feel it’s essential to cease to take a perspective of the actual progress capacities in direction of the longer term. Though the connection with these businesses undoubtedly supplies a constant channel of actions, it could possibly ultimately grow to be a limitation within the occasion that the corporate fails to conduct its investigations with the technological requirements of personal markets.

I might even be afraid that the shortcoming to take care of the technological commonplace and performance of its merchandise might have nice penalties with reference to future contract assignments and the attraction of latest purchasers. To this dependency on authorities businesses should be added the dependency on corporations within the industrial aerospace sector and, finally, the dependency on the event of this sector, which in flip is conditioned by the worldwide financial scenario.

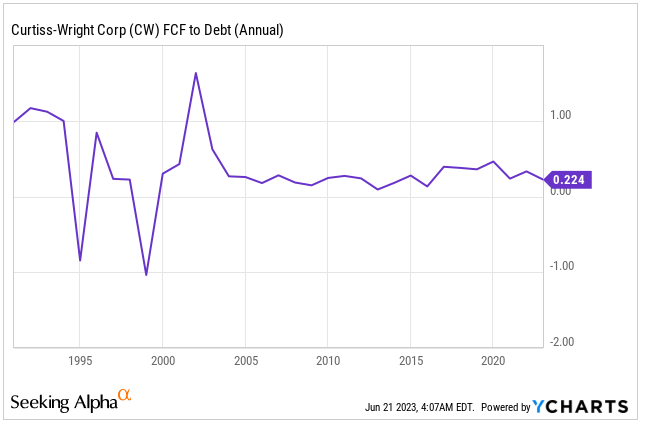

Contemplating the soundness of the industries through which Curtiss-Wright operates and its long run enterprise historical past, I’m not actually afraid of the dangers from the debt. With that, I feel that many buyers on the market can be a bit afraid of the full quantity of debt.

Supply: YCharts

My Takeaway

Curtiss-Wright presents nice credibility in its monitor document, sustaining top-of-the-line high quality and security requirements, and a sustained enterprise exercise that’s targeted right this moment on delivering quick returns to its shareholders. I consider that the latest sale of property within the final quarter, the spectacular steering given for 2023, new acquisitions, and FCF expectations can be sufficient to justify a place within the inventory. I see a number of dangers from competitors, dependency on authorities businesses, and lack of technological innovation. With that, I consider that Curtiss-Wright inventory might commerce at a better mark.