TexBr

Canadian intermediate oil producer Gran Tierra Vitality (NYSE:GTE)(TSX:GTE:CA) continues to be weighed down by the unsure outlook for oil and heighted geopolitical danger in Colombia the place its operations are positioned. The plans of Colombia’s first leftist president Gustavo Petro, himself a former guerilla, to stop awarding new hydrocarbon exploration contracts and ban hydraulic fracturing in Colombia are weighing closely on vitality firms working within the nation. Gran Tierra is a hotly adopted excessive danger excessive return small-cap oil inventory which has gained round 1% since I final wrote on the driller after it had accomplished its 10-for-1 reverse break up and rated it as a robust purchase. The driller skilled a deep sell-off after saying disappointing first quarter 2023 numbers on the again of a pointy improve in geopolitical danger. Whereas the market perceives it to be a high-risk funding, newest occasions and information assist the funding case outlined in my earlier articles.

Operational replace

An essential growth for buyers in Gran Tierra to notice is the driller’s rising skill to constantly develop oil manufacturing. Prior to now, the corporate earned a status for overpromising and beneath delivering when it got here to petroleum manufacturing volumes. The shortcoming to ship the budgeted manufacturing volumes has weighed closely on Gran Tierra’s share worth. There are indicators that the driller is able to constantly boosting manufacturing, notably because it ramps up the tempo of operations on the Acordinero and Costayaco Blocks onshore Colombia.

Certainly, for the reason that 2020 pandemic Gran Tierra has been constantly rising manufacturing with the most recent numbers supporting that development. First quarter 2023 manufacturing grew 8% in comparison with a yr earlier to a median of 31,611 barrels per day, whereas second quarter 2023 rose 6% month over month and a notable 10% yr over yr to 33,600 barrels each day. This was the best petroleum manufacturing reported by Gran Tierra for the reason that second quarter 2019 when the driller pumped 35,340 barrels per day.

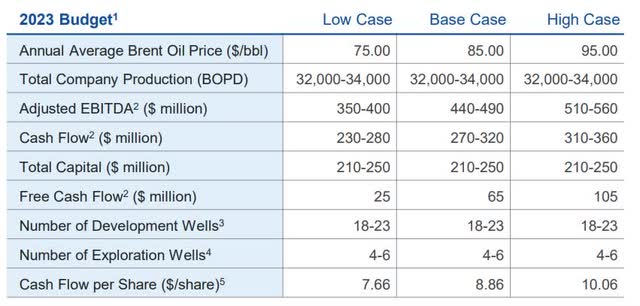

Gran Tierra’s push to ramp-up manufacturing is progressing effectively with common output for the final 2 weeks of Could 2023 reaching a median of 36,800 barrels per day. Yr to this point 2023 common manufacturing, for the interval of January 1, 2023, to Could 28, 2023, was 32,400 barrels per day which is throughout the annual forecast vary of 32,000 to 34,000 barrels per day, as per the chart under.

Gran Tierra 2023 Funds (Gran Tierra Vitality June 2023 Company Presentation)

Supply: Gran Tierra Vitality June 2023 Company Presentation.

This strong manufacturing is a promising growth which if maintained will act as a strong catalyst to spice up Gran Tierra’s share worth. The corporate drilled 19 wells, break up between 12 manufacturing wells and seven water injection wells, between January 1, 2023, and Could 30, 2023. These signify nearly all of the 18 to 23 wells deliberate for the yr, which means that any monetary pressures won’t impression Gran Tierra’s drilling program and deliberate manufacturing volumes. These newest numbers spotlight that Gran Tierra will meet and even doubtlessly beat its forecast 2023 common annual manufacturing of 32,000 to 34,000 barrels per day. These developments actually bode effectively for the corporate’s annual income, EBITDA, money circulation and internet revenue.

The important thing concern at the moment is the muted outlook for oil costs, which stay tender even after Saudi Arabia vowed to slash one other a million barrels each day off its oil manufacturing. Gran Tierra wants Brent to common $85 per barrel to attain its base case 2023 funds. Each day, that seems much less and fewer probably with Brent presently buying and selling at $75 per barrel and solely averaging $80.45 for the yr to this point, on the time of writing. The present poor outlook for oil which is being impacted by fears of a recession and weaker than anticipated financial knowledge in China is weighing on Gran Tierra’s efficiency and monetary outlook.

Monetary replace

Primarily based on present Brent costs and a softer forecast with the U.S. EIA predicting that the worldwide benchmark will common $79.54 per barrel for 2023 Gran Tierra will probably solely obtain the low case forecast the place it wants a median worth of $75 a barrel. It will considerably impression Gran Tierra’s monetary place at a time when it’s struggling to construct free money circulation and cut back looming debt maturities. In line with the driller’s 2023 funds it is going to solely generate $25 million in annual free money circulation if Brent fails to rally and common $75 per barrel for the yr.

It is a worrying growth due to the corporate’s debt profile with $272 million of excellent notes maturing in 2025, because the chart exhibits.

Gran Tierra Debt Profile (Gran Tierra Vitality Company Presentation June 2023)

Supply: Gran Tierra Vitality June 2023 Company Presentation.

The $272 million in excellent notes, which falls due in February 2025, will transfer to present liabilities throughout early 2024 putting larger stress on Gran Tierra’s already considerably fragile steadiness sheet. If Gran Tierra generates 2023 free money circulation of $25 million which is then added to $105.6 million of money, on the finish first quarter 2023, it will likely be inadequate to fulfill that obligation even after accounting for $20 million of stock and $13.6 million of accounts receivable. This means that the driller might want to refinance that obligation by taking up further debt, probably at much less favorable phrases, including to the corporate’s monetary burden. That’s clearly weighing on Gran Tierra’s market worth.

Nonetheless, administration has completed an inexpensive job of decreasing debt and strengthening Gran Tierra’s steadiness sheet since oil costs crashed at first of the 2020 pandemic, which noticed the market worth the corporate for chapter. Lengthy-term debt on the finish of the primary quarter 2023 totaled $581.Four million in comparison with $786.6 million on the finish of the identical interval in 2020. The corporate is concentrated on decreasing its long-term debt repurchasing $Eight million of the 6.25% February 2025 notes in the course of the first quarter 2023. This not solely delivered a $1.1 million achieve for Gran Tierra but additionally diminished the driller’s financing prices. The regular discount of debt isn’t solely strengthening Gran Tierra’s steadiness sheet but additionally boosting the corporate’s internet asset worth and can finally result in a better valuation.

One other essential growth is the regular discount of Gran Tierra’s share depend. By the tip of the primary quarter 2023, the driller had 333,069,042 frequent shares excellent which is almost 10% decrease than the 368,898,619 frequent shares excellent on 31 December 2022. The variety of excellent shares was diminished to 33,306,904 after Gran Tierra accomplished a 10-for-1 reserves break up on Could 4, 2023. The driller continues to purchase again inventory and has bought 36 million shares between September 2022 and March 31, 2023. The regular buyback of excellent shares will even strengthen Gran Tierra’s monetary place and raise the corporate’s after-tax NAV per share.

Valuation replace

With none additional monetary knowledge being made accessible by Gran Tierra the valuation I calculated for the Could 6, 2023, article utilizing the next inputs stands:

- An after-tax internet current worth with a 10% low cost, generally known as an NPV-10, of $1.three billion for 1P reserves.

- An after-tax NPV-10 of $1.Eight billion for 2P reserves.

- A inventory depend of 333,069,000 excellent frequent shares, which after the 10-for 1-reverse break up modifications to 33,306,904 frequent shares;

- Lengthy-term debt of $581,391,000.

- Money and money equivalents of $105.7 million as per Gran Tierra’s first quarter 2023 outcomes.

Utilizing that data I made up my mind in my earlier Could 6, 2023, article that Gran Tierra had an after-tax 1P internet asset worth of $2.56 per share and $4.08 per share for its 2P after-tax NAV. After permitting for the 10-for-1 reverse break up accomplished on Could 4, 2023, these values are $$25.60 and $40.80 per share respectively. It’s price noting that Gran Tierra’s after-tax NPV10 was calculated utilizing a five-year forecast Brent worth of $80.56 per barrel. Simply as greater oil costs, in addition to discoveries, can result in a better NPV-10 softer costs will trigger the worth of Gran Tierra’s oil reserves to fall. Whereas the five-year common worth used to calculate the NPV-10 is barely greater than the EIA’s short-term 2023 forecast of $79.54 per barrel there may be each probability the Brent worth will exceed the five-year common used for Gran Tierra’s NPV-10.

On the idea of Gran Tierra’s after-tax 2P NAV of $40.80 per share, which is seven occasions the present share worth of $5.56 on the time of writing, the driller is closely undervalued providing a strong margin of security. The final time Gran Tierra traded at round or near that worth was in September 2018 when Brent was buying and selling at between $76 and $86 per barrel. Since then, the geopolitical dangers related to working in Colombia have intensified, particularly after the 2022 presidential election with former leftist guerilla Gustavo Petro rising victorious.

Nation particular danger replace

In my earlier articles I’ve mentioned these dangers and associated headwinds at size with the first hazards being:

- November 2022 tax hikes which elevated the efficient tax fee for oil firms working in Colombia from 36% to round 50%.

- Petro’s plan to finish awarding contracts for hydrocarbon exploration, though present agreements shall be revered and stay in drive, making the impression on Gran Tierra at the moment negligible.

- Petro’s plan to ban hydraulic fracturing, which is presently being thought-about by Congress and can probably be authorized, though Gran Tierra isn’t impacted as a result of the corporate doesn’t personal any unconventional acreage.

- Heightened safety danger attributable to ongoing battle between varied unlawful armed teams notably dissident factions of the Revolutionary Armed Forces of Colombia who didn’t settle for the 2016 peace settlement the Nationwide Liberation Military, generally known as the ELN, and largest organized crime group The Gulf Clan. Nonetheless, a ceasefire between the federal government and ELN was not too long ago declared.

- Rising tensions between Colombia’s public forces and the president which noticed the specter of a coup d’état made by the previous president of Colombia’s retired and reserve army forces affiliation ACORE.

- The outbreak of a political scandal in regards to the former ambassador to Venezuela and Petro’s chief of workers the place allegations of unlawful wiretaps, lie detector assessments and police coercion have emerged. In consequence, Colombia’s Congress has frozen any consideration of Petro’s proposed reforms inflicting the peso to soar, which probably will solely be non permanent.

Remaining ideas

The chaos and appreciable uncertainty which has emerged in Colombia in the course of the first yr of Petro’s presidency is weighing closely on vitality firms working within the nation. It’s these dangers that are feeding the market’s overblown notion of danger that’s weighing closely on Gran Tierra’s market worth. Because of the headwinds buffeting Gran Tierra the corporate stays considerably undervalued and its share worth will stay beneath strain for a while but. There are, nevertheless, constructive catalysts rising which can act as tailwinds. These embody greater oil costs due to Saudi Arabia’s manufacturing cuts and rising demand as we enter the summer time driving season. There are additionally indications that Petro could also be compelled to desert his plan to deliver hydrocarbon exploration in Colombia to an finish.