mikkelwilliam

Writer’s Notice: This text was printed to iREIT on Alpha in Mid-Might of 2023.

Expensive subscribers,

Safehold (NYSE:SAFE) is an fascinating REIT. We very not too long ago had an replace article by Brad Thomas concerning the firm, which you will discover right here. He showcased his numerous returns over totally different durations of time – constructive from 2018, destructive since 2021, and considerably constructive, although underperforming, since April of 2023.

My very own final piece on SAFE was printed again in October of final yr. I’ve a modest place within the enterprise, and I am going to clarify to you right here why I am shopping for extra – some comparable causes to Brad, but in addition another concerns.

Let’s get going.

SAFE stays fantastically secure – here is why and why I am at a “BUY”

SAFE is not the simplest REIT to know and requires some in-depth studying earlier than you understand what to anticipate and what the corporate does.

It is a “Land lease REIT”. Not lots of them on the market, however that is what Safehold does and the enterprise it is in. SAFE is New York-based, it is externally managed (extra on that later), and comes with an fascinating enterprise thought. It is the one public floor lease firm obtainable presently, and it focuses strictly on investment-grade floor lease firms, so as to improve its security and handle solely an institutional quality-level portfolio.

So what precisely is a Land-lease REIT?

The corporate acquires, manages, and capitalizes on floor leases. On this enterprise thought, the tenants personal their buildings, however not the land that the constructing is constructed upon. The lease entails undeveloped business land that in flip is leased to tenants, given the precise to develop the property during the lease.

A superb instance of an organization that makes use of floor leases is Macy’s (M). The corporate’s buildings are owned by Macy’s, together with issues like parking, however the tenant nonetheless pays lease on the land.

Structurally and organizationally, a floor lease is similar to every other type of lease. The tenant makes month-to-month lease funds. With a floor lease REIT like Safehold, the leases are internet leases, which signifies that tenants assume duty for taxes, insurance coverage, and CapEx/OpEx during the lease.

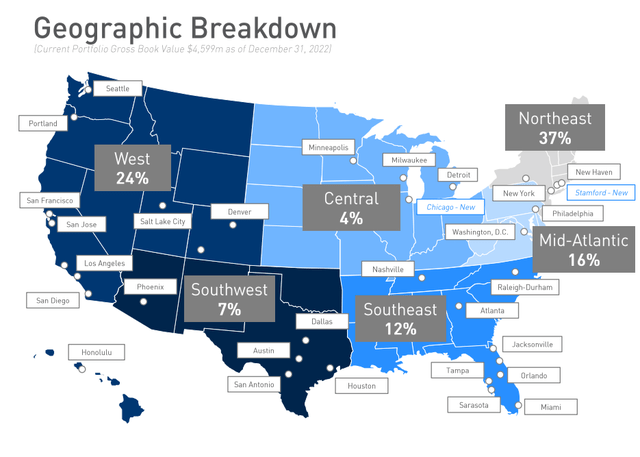

It would not take a lot explaining past this as to why that is a pretty enterprise mannequin. The corporate, in contrast to many different REITs in places of work, residences, or different segments, additionally would not maintain any huge overexposure to anyone space.

SAFE IR (SAFE IR)

The enhancements that could possibly be made contain extra publicity to sunbelt and central – however apart from that, that is a pretty mannequin.

The enchantment of the mannequin for the tenant is that it would not require the corporate leasing the land to place up huge quantities of capital for the land itself. As a result of these leases include very lengthy leasing phrases – not unusual to see over 50 years right here – it allows firms to primarily optimize their capital combine by not having to make use of vital quantities of its personal capital or debt to develop – whereas the homeowners of the lands, the REIT, get vital and long-term security from recurring lease checks. They get a long time’ value of earnings safety and may ultimately, often means off sooner or later, gather a lump sum fee for the property.

The tenant may also get entry to land that they in any other case would don’t have any entry to. That is why the mannequin is utilized by retail tenants comparable to Macy’s, but in addition McDonald’s (MCD) and Starbucks (SBUX).

I am going extra into the varied lease sorts and why landlords need unsubordinated versus subordinated leases from their tenants. However that’s how floor leases work, and why they’re engaging. And Safehold has been rising massively.

Over the previous few quarters, Safehold has been managing fairly properly. The quarterly outcomes ought to be taken with a justifiable share of salt, as a result of present prices of the incoming merger with iStar, inc.

There appear to be two methods to view this play. One facet, the extra bearish facet, views SAFE as uncovered to what are primarily Workplace-type properties in an actual property bubble/atmosphere that’s not conducive to places of work, as we have seen from the valuations for Workplace REITs. They are saying regardless of the corporate declining considerably in value, this firm shouldn’t be going wherever close to an upside, and the corporate’s elevated publicity to floating-rate debt together with its merger makes the whole play an unappetizing potential.

On the opposite facet, extra a constructive notice, say (and level out) that SAFE lacks the fairness threat of managing actual property – it is a capital supplier with none precise property obligations, making the comparability to an Workplace-type firm or REIT fully moot. Whereas the leases it holds could possibly be stated to be beforehand particular to places of work, it would not dictate that places of work must be constructed there.

Moreover, any debt threat must be put within the context of its maturities – and these are among the longest within the business, at a debt-to-book fairness of beneath 2x and a complete debt to Fairness market cap of beneath 2.5x. The common maturities listed here are over 22 years, and no maturities coming due till 2026.

So, as is considerably typical with me, I say that the pessimist is simply too pessimistic, and the unbridled optimism is simply too optimistic. The reality is, as I see it, someplace in between.

Over the previous couple of quarters, SAFE earnings have been beneath the forecasted price. 1Q got here in at ~80% decrease YoY, however after all, this was largely because of merger prices, which we will internet out. Apart from these, the earnings decline was largely a product of accelerating publicity to floating charges and debt load.

Anybody investing in SAFE wants to concentrate on what occurs when financing prices change because of rate of interest adjustments, no matter lengthy maturities, both because of float publicity or because of refis. That is sure to supply some downward stress in earnings, each GAAP and FFO, that might see the corporate go even decrease right here.

Whereas I will not declare that I foresaw the precise nature of this again 1-2 years in the past once I acquired my eyes opened to SAFE, I did see the danger in rates of interest, and this triggered me to remain out of the inventory till it fell beneath $26/share. The bubble we noticed in 2020-2022, which ended when SAFE fell from grace and from a share value of over $60/share was by no means one thing I noticed as sustainable.

Nonetheless, claiming in the identical vein that the corporate’s present debt combine/composition is untenable and can trigger a downfall goes too far. The argument is being made as a result of near-billion in debt that SAFE has placed on an unsecured revolver – not sometimes the ability you’d need to use for that quantity as a result of rate of interest value of such an answer. These current strikes have left the corporate a bit cash-strapped and with rates of interest going up. We’re seeing notes at over 5%, and yet one more $100M revolver at LIBOR + 1.5%, which is important on this atmosphere. LIBOR was properly beneath 3% a yr in the past, and the corporate’s curiosity funds are actually over 6% on common for that barely north of $1B.

If a criticism could be levied on the analysts following SAFE and their forecasts from march-April 2022, is that they anticipated rates of interest to remain the identical, and fully didn’t forecast this huge delta in debt-related funds.

The present rate of interest atmosphere additionally signifies that something the corporate tries to do on the debt combine/finance facet goes to be influenced by present market circumstances. There aren’t any “good” or “straightforward” hedges to get out of this case, comparable to floating to fastened swaps or some refinancings. The dangers financiers take will come at a price, and that leaves me with the next expectation for earnings for the subsequent few years – that they will not be massively rising.

On the identical time, the bearish facet takes far too destructive a view and infrequently forgets what the corporate has truly achieved – and the way it operates – such because the essential variations in its principal security.

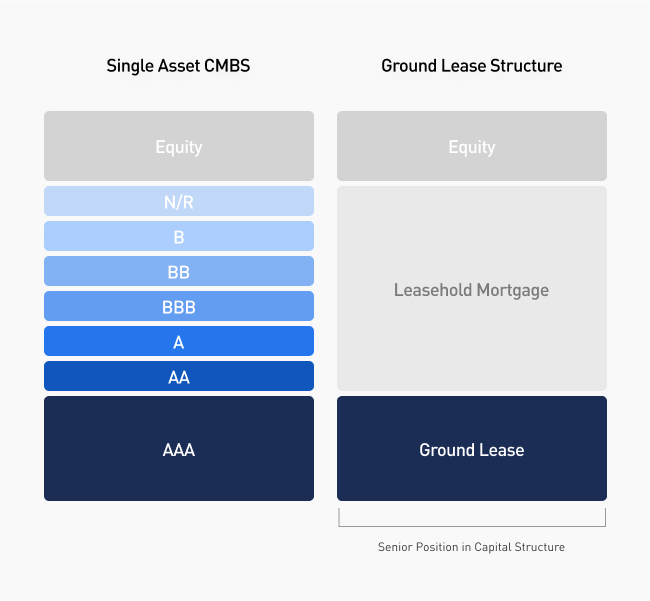

Safehold IR (Safehold IR)

The corporate’s working mannequin entails an AAA-like place within the capital construction, nearly immune from the forms of dangers you see in single-asset CMBS. Even with contractual inflation captures, the corporate’s inflation-adjusted yield is over 6% at 3% long-term inflation.

Bears additionally neglect, or underestimate (in our opinion) the worth of the CARET construction and the worth it provides – each when it comes to monetization and different considerations. For these unfamiliar with it, the CARET program is an innovation when it comes to making an attempt to worth future cap appreciation, with CARET unit reflecting unrealized capital appreciation the corporate expects to obtain as soon as leases terminate or expire.

Who would need to purchase these, it’s possible you’ll ask?

Clearly, loads of educated traders, on condition that 3% have been bought to institutional traders, comparable to sovereign wealth funds and household places of work that are identified to spend money on long-term stable progress and security potential. These holders are entitled to take part in any proceeds above the fee foundation as soon as property are bought.

The maybe largest “drawback” I see when it comes to threat is the focus of its land portfolio to Manhattan, which nonetheless makes up round 24% of the corporate’s gross guide worth or GBV. SAFE has been diversifying right here, however it nonetheless has lots of work to do so as to discover worth in areas that I’d contemplate to be “engaging” relative to considerably riskier west and east-coast areas.

Bears additionally characterize the corporate as an workplace landholder – that is false. 44% is Workplace, however multifamily is over 35%. This makes the corporate a diversified holder with a tilt towards Workplace.

The corporate’s sturdy fundamentals, together with its BBB+, give a very totally different image than among the bears telling us to not spend money on the corporate wish to convey. They’re additionally rated in a different way than a REIT, which can be not coated in among the bearish stories.

Let’s take a look at valuation.

Safehold – The valuation could be very tough

Every time somebody says “Properly, this firm cannot be measured historically“, I are likely to take about nineteen steps again.

Usually, I actually do not belief any enterprise that claims that so as to worth it “correctly”, you need to do X and Y.

Why? As a result of there are 100 engaging funding alternatives that don’t require us to take distinctive approaches to one thing so simple as a valuation for a enterprise.

So, perceive that once I say this firm is engaging and could be purchased, it comes with a sure threat profile that can be thought-about in a different way than your conventional firms – and by totally different, I imply increased in some methods.

With regards to SAFE, there’s some sound reasoning behind why it would want some variations when it comes to its metrics – and among the ones are talked about above. The corporate’s debt is sky-high – over 12.5x internet debt/EBITDA. However on the identical time, SAFE has no obligations to its properties within the type of CapEx. The idea is that when that extraordinarily long-maturity debt comes due in over 25-30 years, the compounding nature of its money flows could have finished wonders. It is not a improper assumption to have both.

In an effort to see the protection, you want solely take a look at what the corporate has finished already to enhance its metric. Again 5 years in the past, the payout was 90%+ of internet. That’s now lower than 35% of internet at a yield of virtually 5%.

Publish the merger, and given its difficult peer state of affairs (no different direct friends exist), evaluating this firm is maybe the toughest a part of this text and of wanting on the firm.

We are able to take a look at some analyst estimates. With regards to S&P World, estimates right here put the corporate at round $24-$25/share on common, however given the low protection, I are likely to ascribe this to a lack of knowledge of the corporate’s earnings potential and upside.

That’s not to say that I anticipate SAFE to return to $60/share or wherever near it, at the very least not within the close to time period. With the current internalization of its administration and the method is at present in, coupled with the near-zero years of precise publicly-traded historical past, I are likely to say that SAFE is tough to conservatively forecast expectations from – however a 13-16x P/FFO price, coming to a 2025E of round $29-$33/share appears the baseline minimal of what I’d anticipate from the corporate right here.

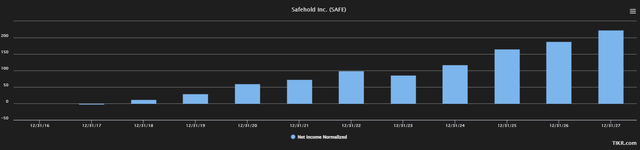

After I final wrote concerning the firm, we had been at lower than $26/share, which I considered as fairly engaging with a possible long-term upside within the triple digits. I nonetheless view this as being totally attainable. And I’m removed from alone on this. Right here is the anticipated internet earnings progress past the 2023E dip.

TIKR.com SAFE forecast (TIKR.com)

And you may see the identical developments in different measures – be it income, EBITDA, EBIT, EBT – supplier’s alternative, it is forecasted to rise. The curiosity expense I discussed, that is anticipated to remain at or concerning the degree it at present is, anticipating administration to type it out at or barely above the degrees we’re at present at, with rising bills as the corporate grows. (Supply: S&P World)

If this seems to be the case, then I consider this to be a catalyst for additional upside. Many analysts have very constructive targets for the enterprise – upwards of $50/share. If sure optimistic views materialize, that is totally attainable. However I are likely to view this with a wholesome dose of skepticism and would common it out to a PT of round $32/share, which might nonetheless be a double-digit upside from present ranges.

One other argument, and one well-covered in Brad’s current article, is insider data and CEO information.

Coupling all of this, I see a little bit of threat and maybe not as unerringly a powerful purchase as for another qualitative REITs on the market – however I undoubtedly see an upside to the corporate.

My place in SAFE is not huge – however it’s within the inexperienced, and I am open to increasing it right here.

I am at a “BUY”, and I give it a present PT of $32/share.

Questions? Let me know!