tadamichi

By Christopher Gannatti, CFA

After the worldwide monetary disaster of 2008/09, U.S. equities – significantly growth-oriented U.S. equities – went on a run. For an prolonged interval in 2022, it began wanting like the expansion rally was over and the worth cycle had begun.

Durations of progress or worth outperformance and underperformance are likely to unfold over years. It could be uncommon for traders to have a look at long-term charts and see fast shifts in worth/progress management. If historical past is a information, we are able to consider two logical eventualities now unfolding:

- State of affairs 1: 2022 was a blip and the expansion rally is basically simply persevering with. The world’s largest tech corporations are pushing markets larger and worth is relegated to underperformance.

- State of affairs 2: The primary half of 2023 is the blip and the worth rotation that many traders caught onto in 2022 will choose again up after this shorter interval of progress outperformance.

On this piece, we concentrate on those that consider that the worth rotation is coming again, that’s, State of affairs 2. We famous in a previous weblog submit that one thing ‘bizarre’ is going on within the relationship between the S&P 500 and S&P 500 Worth indexes, and we lengthen a few of that evaluation right here.

Analytical Framework: Funds & Indexes

Inside this piece, we reference:

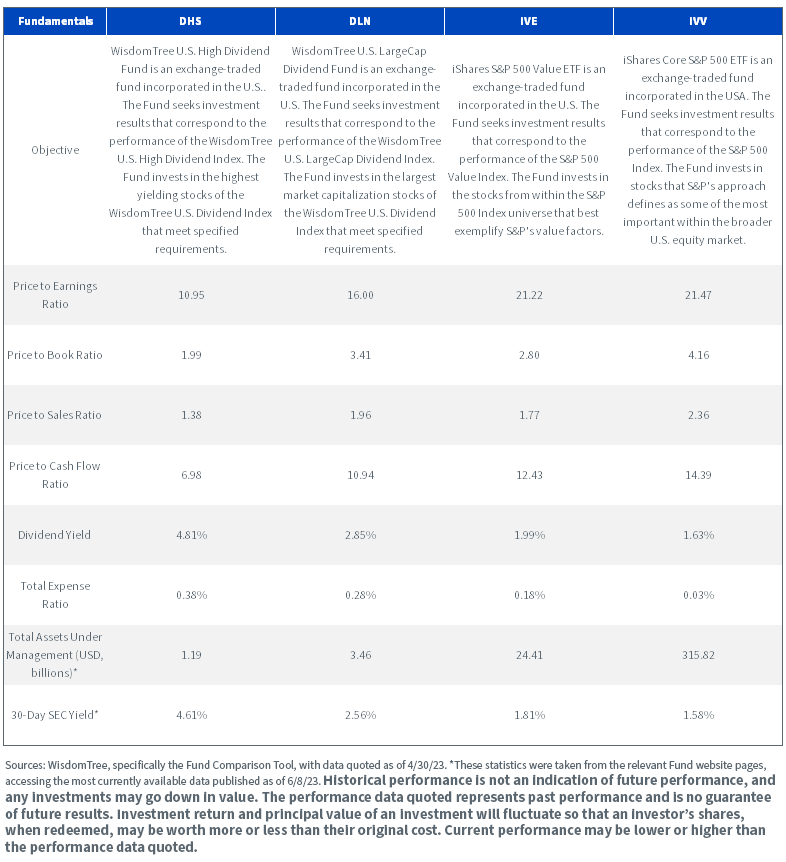

- iShares Core S&P 500 ETF (IVV), which tracks the returns, after charges and bills, of the S&P 500 Index.

- iShares S&P 500 Worth ETF (IVE), which tracks the returns, after charges and bills, of the S&P 500 Worth Index.

- WisdomTree U.S. LargeCap Dividend Fund (DLN), which tracks the returns, after charges and bills, of the WisdomTree U.S. LargeCap Dividend Index

- WisdomTree U.S. Excessive Dividend Fund (DHS), which monitor the returns, after charges and bills, of the WisdomTree U.S. Excessive Dividend Index.

The important dialogue relates IVE, DLN and DHS – all methods having various levels of value-type publicity – again to IVV by way of efficiency and valuation.

As we noticed in a previous submit, if Microsoft (MSFT) is the highest holding of the S&P 500 Worth Index by a major margin (and in addition of IVE), it has implications for the relative reductions and ‘true’ worth tilt – which might be within the eye of the ‘beholder’ or index methodology.

The Setup: Efficiency within the First Half of 2023

First, we present the year-to-date efficiency in 2023.

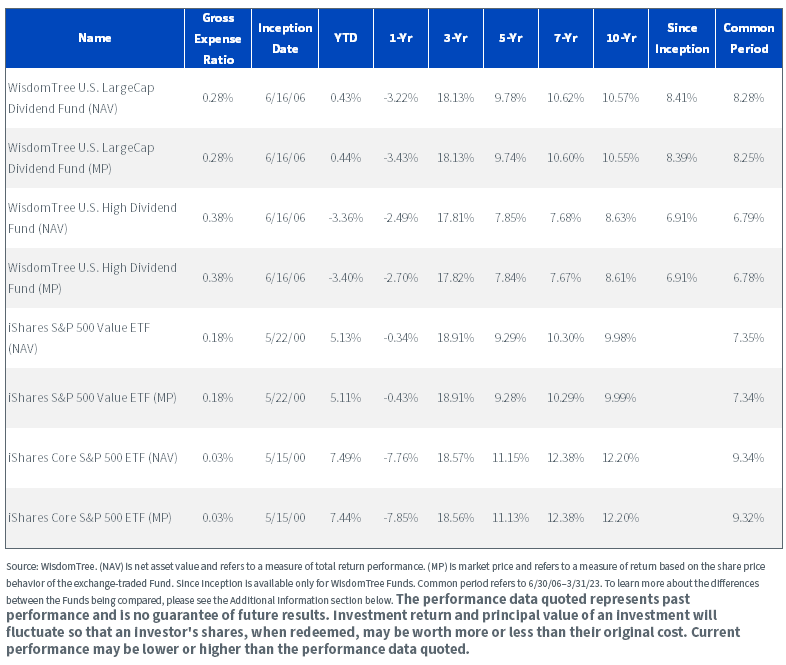

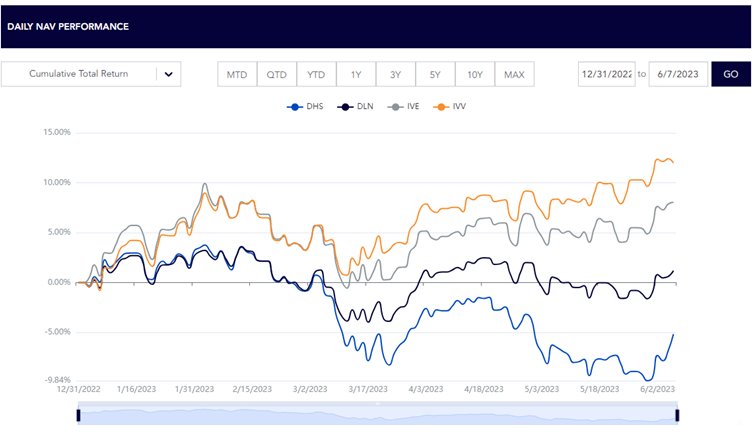

- IVV returned practically 12% – from a slender subset of huge, tech-oriented corporations that features Microsoft.

- IVE returned better than 8% over the identical interval, pushed by prime 10 exposures to Microsoft, Meta Platforms (META) and Amazon.com (AMZN). We additionally be aware that the tenth place in IVE was truly Netflix (NFLX), not an organization usually on the tip of a price investor’s tongue.

- DLN was up 1.18% over the interval, whereas DHS was down 5.17%.

- If a small subset of huge tech corporations goes to steer the U.S. fairness market, DLN could possibly catch Apple (AAPL) and Microsoft – payers of great dividends – however DHS is unlikely to catch the main tech ‘progress’ corporations, because of the nature of its Index focusing solely on larger yielding dividend-payers.

Determine 1a: Standardized Efficiency as of March 31, 2023

Determine 1b: Zooming in on Yr-to-Date 2023 Efficiency

‘Worth’ Is Often Outlined by Basic Metrics

The value-to-earnings (P/E) ratio is probably going essentially the most broadly adopted of the totally different metrics used to indicate whether or not a inventory, index or fund is dear or cheap.

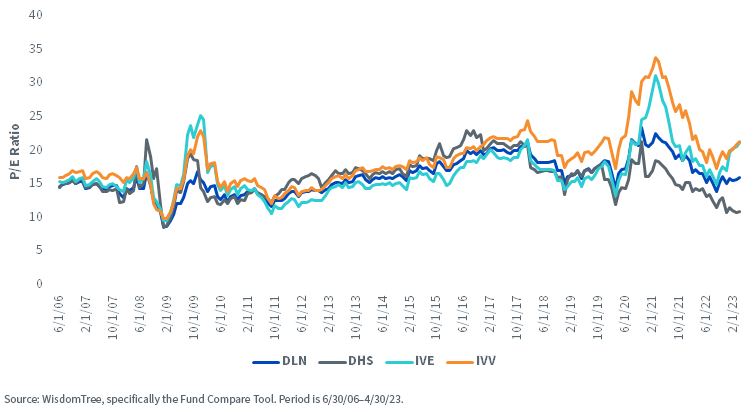

IVV, IVE, DLN and DHS all comprise massive, established, worthwhile corporations – for essentially the most half – so it’s acceptable to have a look at P/E multiples. Determine 2 exhibits:

- Not one of the methods is ‘costliest’ or ‘least costly’ on a P/E foundation for the total time sequence.

- From late-2021 to early-2022, DHS’s P/E ratio was fairly clearly declining, and it’s getting near single-digit territory at current.

- IVE’s P/E ratio has elevated considerably from late-2022. We all know that the S&P 500 Worth Index (tracked by IVE) went by a reconstitution that was answerable for getting corporations like Microsoft, Amazon.com, Meta Platforms, Salesforce (CRM), Cisco (CSCO) and Netflix into the highest 10 holdings. IVE’s P/E ratio is wanting similar to that of IVV, the Fund that tracks the return of the broader S&P 500 Index.

Key Query: If an investor is in search of worth, does it make sense to seek for it in a technique with the same P/E ratio to the broad benchmark?

Determine 2: Divergence in Worth-to-Earnings (P/E) Ratios amongst Worth-Oriented Funds

How Does the Current Evaluate to Historical past?

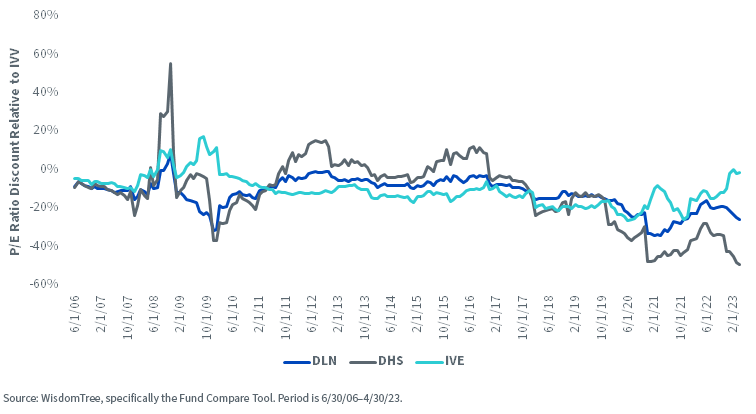

It isn’t usually {that a} worth index has a P/E ratio larger than the market – significantly with no recession that may lead to worth indexes having briefly depressed earnings.

Proper now, everyone seems to be ready for a recession that has but to materialize.

- In reality, the final time that IVV (S&P 500) and IVE (S&P 500 Worth) had the identical P/E ratio (or IVE was a bit larger), it was in the course of the international monetary disaster of 2008/09 – when earnings collapsed on the huge banks and cyclical shares.

- From late-2017 to late-2021, IVE’s P/E ratio was usually at a 20% low cost to the broad market. The common low cost since 2006 has been 10.5%.

- DHS is in large low cost territory: DHS’s P/E ratio is at a reduction of round 50% to IVV, for the primary time since its inception on June 16, 2006, roughly 17 years in the past. That is an excessive valuation low cost and maybe a chance.

- DLN’s P/E ratio is at an roughly 25% low cost to IVV, whereas its common low cost has been 12.1%.

Determine 3: Valuation Reductions throughout Numerous Worth Indexes

Conclusion: For Worth Publicity, Make Certain You Know What’s Beneath the Hood

The worth issue might battle if the financial system deteriorates and short-term earnings come below strain. Nonetheless, in our view, these in search of instruments to implement a price thesis ought to maintain IVE’s metaphorical ft to the fireplace, and acknowledge that an publicity like DHS appears to be very closely loaded towards shares at present out of favor, and is thus approaching that honored single-digit P/E that causes many worth traders to salivate.

Determine 4: Additional Data Supporting the Comparability of the Totally different Funds

Vital Dangers Associated to this Article

There are dangers related to investing, together with the doable lack of principal. Funds focusing their investments on sure sectors enhance their vulnerability to any single financial or regulatory growth. This will likely lead to better share worth volatility. Dividends should not assured, and an organization at present paying dividends could stop paying dividends at any time. Please learn every Funds’ prospectus for particular particulars relating to every Funds’ threat profile.

Christopher Gannatti, CFA, World Head of Analysis

Christopher Gannatti started at WisdomTree as a Analysis Analyst in December 2010, working straight with Jeremy Schwartz, CFA®, Director of Analysis. In January of 2014, he was promoted to Affiliate Director of Analysis the place he was accountable to steer totally different teams of analysts and strategists throughout the broader Analysis workforce at WisdomTree. In February of 2018, Christopher was promoted to Head of Analysis, Europe, the place he was based mostly out of WisdomTree’s London workplace and was answerable for the total WisdomTree analysis effort throughout the European market, in addition to supporting the UCITs platform globally. In November 2021, Christopher was promoted to World Head of Analysis, now answerable for quite a few communications on funding technique globally, significantly within the thematic fairness area. Christopher got here to WisdomTree from Lord Abbett, the place he labored for 4 and a half years as a Regional Advisor. He obtained his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern Faculty of Enterprise in 2010, and he obtained his bachelor’s diploma from Colgate College in Economics in 2006. Christopher is a holder of the Chartered Monetary Analyst Designation.

Authentic Publish

Editor’s Word: The abstract bullets for this text had been chosen by In search of Alpha editors.