vice_and_virtue

Amplify Lithium & Battery Expertise ETF (“BATT”)

The Amplify Lithium & Battery Expertise ETF (NYSEARCA:BATT) (“BATT”) is a broad option to play the lithium-ion battery, electrical automobile (“EV”), and EV metals increase. Present valuation seems to be nice and the expansion outlook is excellent.

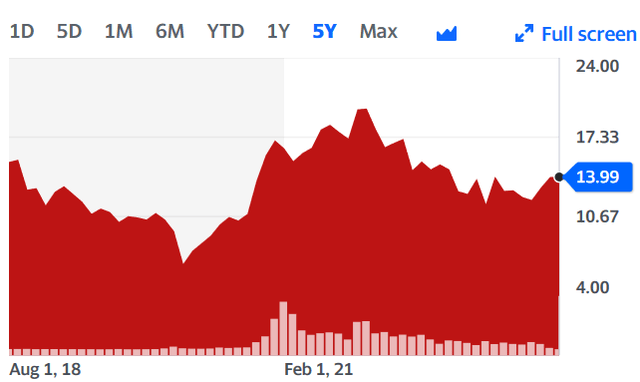

The BATT ETF value has moved sideways the previous 5 years regardless of bettering fundamentals

As proven on the chart under the BATT ETF has typically moved sideways or barely down over the previous 5 years, regardless of the EV and battery sector booming. This has largely been attributable to damaging sentiment ensuing within the BATT ETF’s PE ratio falling considerably. We give some extra causes for this within the conclusion.

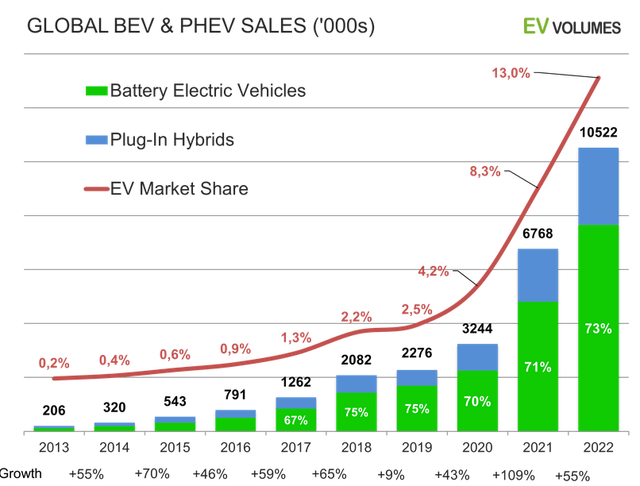

2018 world plugin electrical automobile gross sales ended at “over 2 million and market share at 2.1%”. 2023 gross sales are forecast by Development Investing to achieve 14.35m and 17.5% market share. That is roughly a 7x improve in 5 years, whereas the BATT ETF has solely moved sideways.

BATT ETF 5 yr value chart (supply) – Worth = USD 13.99

Yahoo Finance

Observe: The chart above excludes the impression of BATT paying distributions annually. You may view BATT’s previous distributions right here.

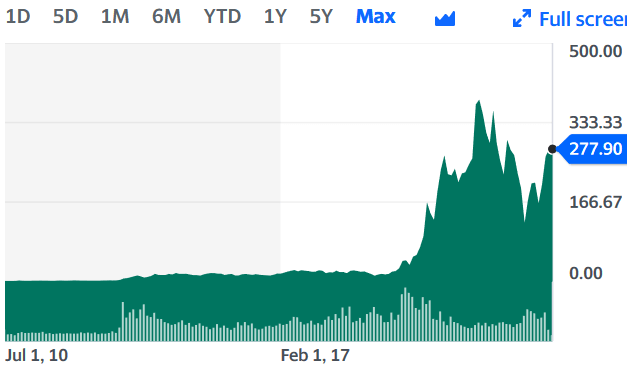

We did see an identical prevalence with the Tesla (TSLA) inventory value the place it moved sideways for 10 years earlier than surging larger. Typically a inventory or an ETF types a base for a few years, then like a sprung coil it releases larger as sentiment adjustments and the underlying fundamentals turn out to be higher understood and it will get re-rated to the next PE ratio.

Tesla long run inventory value – 10 years of base then surged larger (supply)

Yahoo Finance

A quick abstract of the BATT ETF

BATT is a broad option to play the lithium-ion battery, electrical automobile (“EV”), and EV metals increase which is anticipated this decade and subsequent.

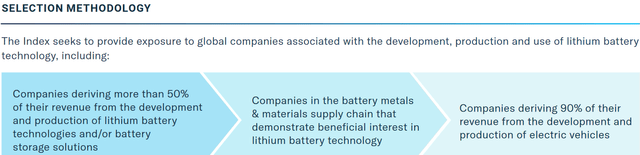

Amplify defines their BATT fund stating:

BATT is a portfolio of firms producing vital income from the event, manufacturing and use of lithium battery know-how, together with: 1) battery storage options, 2) battery metals & supplies, and three) electrical autos. BATT seeks funding outcomes that correspond typically to the EQM Lithium & Battery Expertise Index.

BATT inventory choice methodology (supply)

BATT Truth Sheet

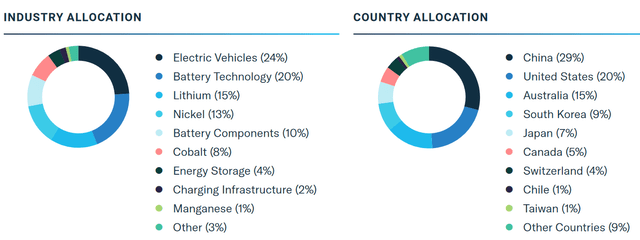

BATT is presently comprised of 103 world firms. The expense ratio is 0.59%pa.

Sector allocation (as of 30 June 2023) is dominated by EVs (24%) and battery know-how (battery producers) (20%). There’s additionally appreciable EV metals publicity to the miners of lithium (15%), nickel (14%), and cobalt (8%); in addition to battery parts firms (10%) and vitality storage firms (4%).

Nation allocation (as of 31 March 2023) of the BATT shares is China (29%), USA (18%), Australia (16%), South Korea (11%), Japan (6%), Switzerland (5%), Canada (4%) and so forth.

Sector and nation allocation as of 30 June, 2023 (supply)

BATT Truth sheet

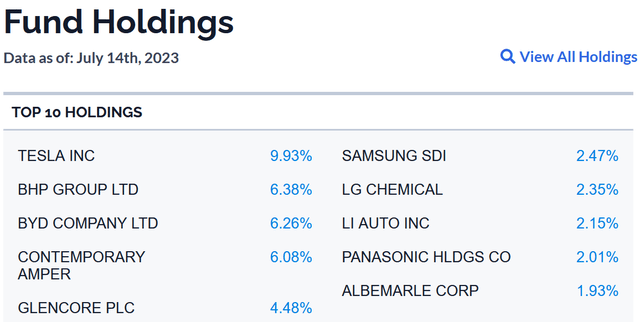

High ten holdings of the BATT ETF

The highest 10 holdings proven under look to be an excellent high 10 with publicity to the main electrical automobile producers, main battery producers, and among the main EV steel miners.

BATT High ten holdings (supply)

BATT web site

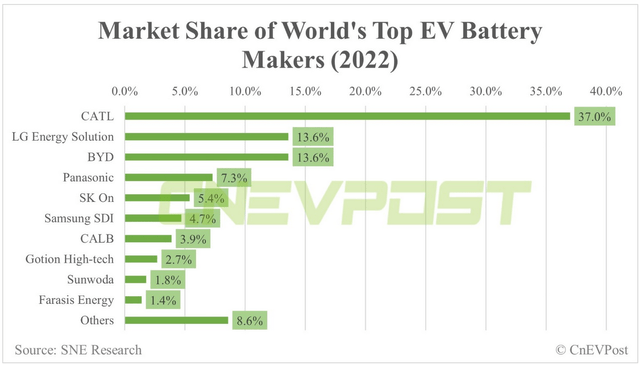

International lithium-ion battery producers by market share in 2022 – CATL leads by far with 37% share (supply)

CNEVPOST

Extra particulars right here on the BATT ETF on the Amplify BATT web site.

Valuation

Valuation seems to be very engaging on a present PE of 14.34 and dividend yield of three.71%.

As of July 13, 2023 the fund is buying and selling on a reduction of 0.63% NTA low cost.

Our view is that the valuation may be very engaging given the expansion outlook for the EV and vitality storage sectors are very robust.

EV and vitality stationary storage gross sales are forecast to surge within the decade or two forward

International electrical automobile gross sales reached 10.522m in 2022 and 13% market share (supply)

EV-Volumes

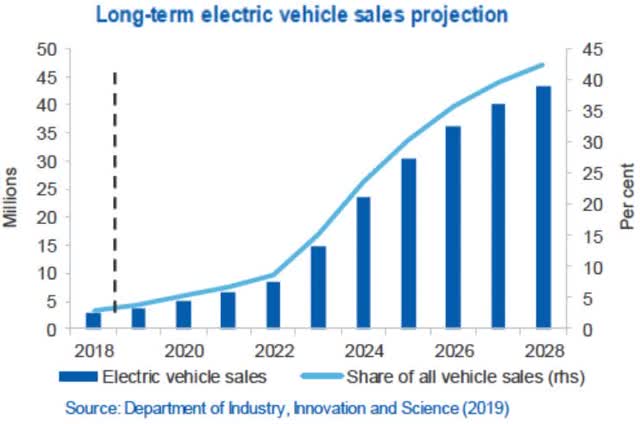

International plugin electrical automobile gross sales forecast to develop exponentially this decade

Mining.com

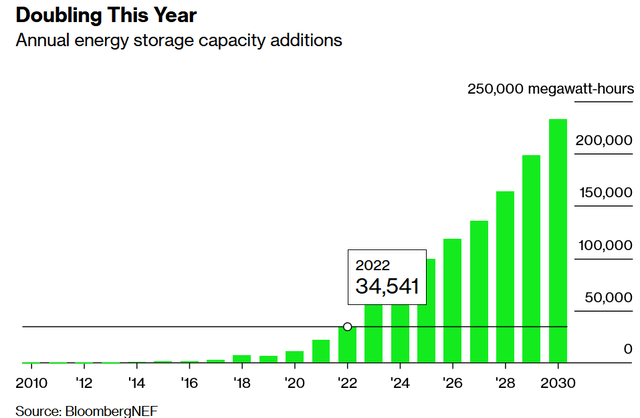

Bloomberg forecasts speedy progress in world vitality stationary storage (“ESS”) and a doubling in 2023 (supply) (Jan. 2023)

BloombergNEF

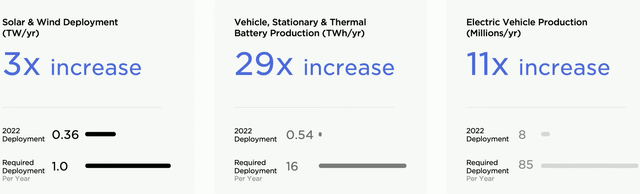

Photo voltaic & wind manufacturing wants to extend by 3x/yr, battery manufacturing by 29x/yr, BEV manufacturing by 11x/yr for a 100% renewable vitality world (supply)

Tesla 2023 shareholder assembly

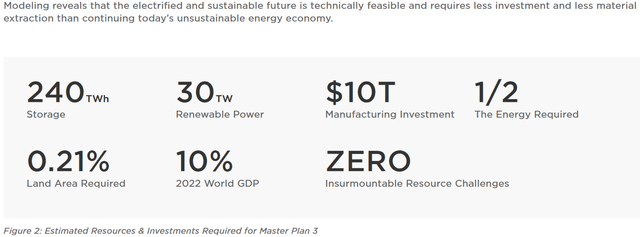

Tesla Grasp Plan Three estimates that 240 TWh of vitality storage is required to maneuver to a 100% renewable vitality world (supply)

Tesla

Dangers

- An EV gross sales slowdown and fewer demand for batteries and EV battery metals.

- Battery metals (nickel, lithium, cobalt) costs falling might negatively impression the sector of the fund invested into EV steel mining shares.

- Extra competitors, provide chain dangers, know-how change.

- ETF dangers – Amplify administration of the fund. The ETF might commerce under its web tangible property (“NTA”) worth.

- Sovereign danger – Usually low for the BATT fund. USA, Australia, South Korea, Canada, Japan is low danger. Average danger with China publicity. Additionally among the EV steel miners have ‘mines’ in larger danger nations.

- Inventory market dangers – Market sentiment. Liquidity seems to be nice. Foreign money dangers – BATT is priced in USD nonetheless solely 20% of the ETF is in U.S shares. This may imply that non-USA shares can under-perform in USD phrases when the USD is rising and vice versa.

Additional studying

A quote from the BATT ETF commentary 31 March 2023 (supply)

BATT ETF market commentary

Conclusion

The BATT ETF inventory value has performed poorly the previous few years on account of forex impacts because the USD rose (many shares are in non-USD currencies), BATT holding some China shares, the 2022 value falls throughout the sectors (EVs, battery OEMs & EV steel miners), and the powerful fairness market circumstances together with damaging fund flows the previous 1 yr (minus US$12.33m). In consequence the fund’s PE ratio has dropped considerably, particularly prior to now yr (see under).

In the meantime gross sales and the expansion outlook for EVs, lithium-ion batteries, and EV metals continues to be extraordinarily constructive. Tesla 2023 Grasp Plan and 2023 Shareholder Assembly highlighted the huge forecast improve in demand for lithium-ion batteries (240TWh, or a 29x improve in yearly manufacturing wanted) and electrical vehicles (11x improve in yearly manufacturing wanted) to maneuver to a totally sustainable renewable vitality world.

BATT’s high holdings look spot on with the highest two EV producers (Tesla & BYD [HK:1211](OTCPK:BYDDY) (OTCPK:BYDDF)), the highest two battery producers (CATL [SHE:300750] & LG Power Options [KRX:373220] (beforehand LG Chem)), and two high tier EV metals firms (Albemarle (ALB) and Glencore [LON:GLEN](OTCPK:GLNCY) (OTC:GLNCF)).

Valuation seems to be very engaging on a present PE of 14.34 and dividend yield of three.71%, particularly given the large progress outlook for the EV and vitality stationary storage (“ESS”) associated sectors. By comparability in Might 2022 the BATT ETF PE ratio was 19.51 and the yield 3.18%.

Dangers revolve largely across the sector performing poorly on account of poor EV gross sales and therefore much less demand for EVs, batteries and EV metals. Some China firms publicity provides danger. Please learn the dangers part.

We view BATT as a robust purchase, appropriate for a 5 yr plus time-frame, particularly if you’re constructive on the outlook for EV and ESS progress this decade.

As standard all feedback are welcome.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.