scyther5

Buckle Up

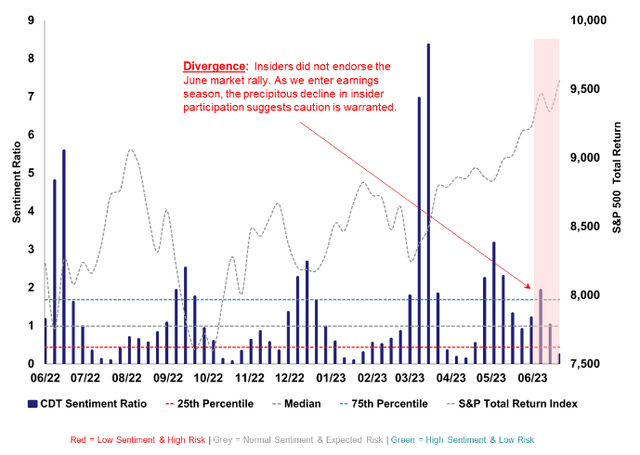

They giveth after which they taketh. As we reported final month, insiders jumped into June with each toes. In what turned out to be a prescient endorsement, insider sentiment reached a fever pitch towards the latter half of Might/starting of June.

At that time, the market rally was traditionally slim with simply the highest 5 shares within the S&P 500 index accounting for an astonishing 96% of the year-to-date positive aspects (article) – properly north of their fair proportion.

Nonetheless, that slim focus broke in June. For the month, the S&P 500 Whole Return Index rallied +6.6% and this time the market transfer benefited extra than simply the tech titans that spherical out the highest ranks of the market index (Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA) and Tesla (TSLA)).

We notice that the breadth of the market rally matched the weird breadth of insider exercise that we noticed and reported on coming into the month (Searching for Alpha).

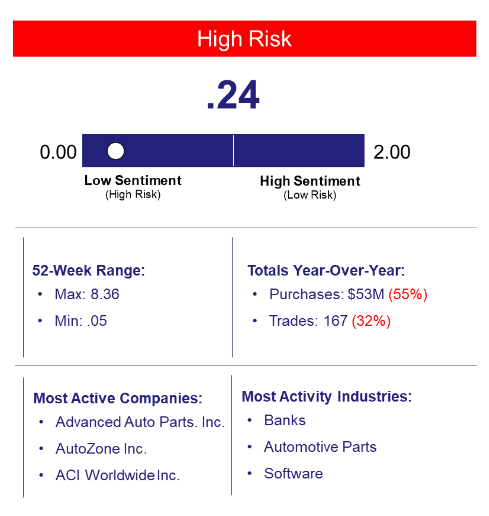

Immediately, insider enthusiasm has all however evaporated. As we go away the June rally behind and look to July, the CDT Insider Sentiment Ratio is warning of much less pleasant skies forward with the measure beneath the 25th percentile.

The poor sentiment is especially ominous given the timing of the drought which is simply days away from the beginning of the summer season earnings season (please notice that our measure seasonally adjusts for earnings blackout durations).

Partly, we consider that insider trepidation doubtless stems from valuation. At present, as a complete, the market is buying and selling at 21-22x estimated 2023 earnings, which is on the excessive facet of historical past.

Whereas on the similar time, an ever-increasing rate of interest surroundings is difficult the attractiveness of equities – the 2-year notice jumped above 5% right now. This tenuous dynamic is probably going why insiders have been eager to purchase the dips and keep away from the rallies.

Anticipate some turbulence forward.

The way it Works

Goal:

Predictive mannequin that measures the historic relationship between insider sentiment and the longer term likelihood of draw back volatility (danger).

Insider Buying and selling Exercise:

Buy exercise of an insider’s personal inventory filtered by proprietary parameters to clean noisy information.

Perception:

Government-level insider sentiment is an indicator of near-term monetary market danger.

– Low government sentiment suggests a excessive stage of danger

– Excessive government sentiment suggests a low stage of danger

Scale: A ratio of present insider buying and selling exercise in relation to historic patterns

– (zero to ∞) with a historic median measure of 1

– Beneath 1 implies an above regular stage of danger

– Above 1 implies a beneath regular stage of danger

Frequency:

The measure is up to date each day and traditionally been topic to swift and presumably excessive shifts.

*This webpage is up to date month-to-month and offers only a snapshot of the latest month-end.

Disclosures

This presentation doesn’t represent funding recommendation or a suggestion. The writer of this report, CDT Capital Administration, LLC (“CDT”) is just not a registered funding advisor. Moreover, the presentation doesn’t represent a proposal to promote nor the solicitation of a proposal to purchase pursuits in CDT’s suggested fund, CDT Capital VNAV, LLC (“The Fund”) or associated entities and will not be relied upon in reference to the acquisition or sale of any safety. Any supply or solicitation of a proposal to purchase an curiosity within the Fund or associated entities will solely be made via supply of an in depth Time period Sheet, Amended and Restated Restricted Legal responsibility Firm Settlement and Subscription Settlement, which collectively comprise an outline of the fabric phrases (together with, with out limitation, danger components, conflicts of curiosity and charges and costs) regarding such funding and solely in these jurisdictions the place permitted by relevant legislation. You’re cautioned towards utilizing this data as the idea for making a choice to buy any safety.

Sure data, opinions and statistical information regarding the trade and basic market developments and circumstances contained on this presentation have been obtained or derived from third-party sources believed to be dependable, however CDT or associated entities make any illustration that such data is correct or full. You shouldn’t depend on this presentation as the idea upon which to make any funding determination. To the extent that you simply depend on this presentation in reference to any funding determination, you accomplish that at your individual danger. This presentation doesn’t purport to be full on any matter addressed. The data on this presentation is offered to you as of the date(s) indicated, and CDT intends to replace the knowledge after its distribution, even within the occasion that the knowledge turns into materially inaccurate. Sure data contained on this presentation contains calculations or figures which were ready internally and haven’t been audited or verified by a 3rd celebration. Use of various strategies for getting ready, calculating or presenting data could result in completely different outcomes, and such variations could also be materials.

Unique Submit

Editor’s Observe: The abstract bullets for this text have been chosen by Searching for Alpha editors.