Cindy Ord/Getty Pictures Information

Firm Description

Based in 1963 as a comfort retailer, CVS Well being Company (NYSE:CVS) has now grow to be a well-diversified well being options firm with the intention of offering complete and inexpensive healthcare companies. It operates in three built-in segments: Well being Care Advantages, Well being Providers, and Pharmacy & Client Wellness:

- The Well being Care Advantages phase provides a broad vary of consumer-directed medical health insurance merchandise and associated companies, together with Medicare Benefit and Medigap plans.

- The Well being Providers phase supplies a full vary of PBM options (e.g., formulary administration, pharmacy community administration). As well as, it delivers well being care companies in its medical clinics, just about, and within the house, and provides supplier enablement options.

- The Pharmacy & Client Wellness phase sells prescribed drugs in its retail pharmacies, supplies ancillary pharmacy companies, and conducts long-term care pharmacy (“LTC”) operations.

Funding Thesis

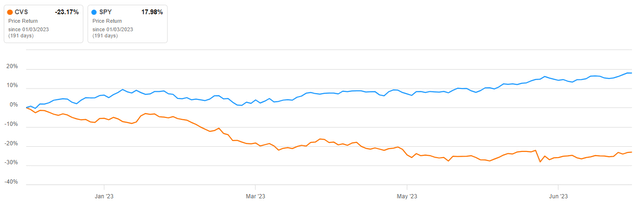

After spending years constructing a complete providing, CVS is now a stable high-quality in addition to defensive enterprise, even when the inventory efficiency appears to ignore it. For my part, there are a number of the explanation why CVS retains underperforming (YTD ~-23%) relative to the broad market.

Seekingalpha.com

First, the entrance retailer is slowly melting beneath stress from e-commerce with quite a lot of wasted area in all of the pharmacies. Nonetheless, this is a matter that CVS is effectively conscious of and it retains efficiently executing by closing “not-necessary” places. 12 months thus far, the corporate closed greater than 100 places and it stays on monitor to shut 300 shops in 2023 and the opposite 600 shops by 2024. For my part, the suitable technique can be to have in place solely the “important shops” and to go away the remainder of the job to its e-commerce arm and its supply program (i.e., CVS Carepass).

Particularly, I need to underline the significance of getting each e-commerce in addition to the “minimal/important” variety of brick-and-mortar shops, which for my part, are important to permit prospects to work together with the product bodily earlier than shopping for a must have for a lot of, to construct and keep model loyalty, and to assist prospects join with firm’s values (one thing that e-commerce can’t supply). The adoption of such a technique would instantly replicate within the firm’s margins (overhead prices down, working margins up).

Second, PBM was top-of-the-line companies on the market (a black field to many), nevertheless, it has been beneath growing stress within the final years not solely because of renewed value competitors but additionally from the legislator itself, which is targeted on including further reporting necessities and ban a number of PBM practices. Furthermore, prospects have gotten rivals, which provides further stress.

Nonetheless, due to its vertical integration with Aetna, CVS is incentivized to leverage its capabilities to cut back drug prices and therefore to vary the narrative round CVS Caremark, from being a foul neighbor to a great neighbor.

Third, the Avenue has a really cautious view on price pattern as the information from Medicare Managed Care suggests a continuation of considerable utilization with the medical profit ratio growing, in 1Q23, by 120bp YoY to 84.6%. Nonetheless, such a ratio displays extra a normalized utilization relatively than a “point-to-panic”.

Fourth, the excessive leverage and threat if downgraded to below-investment grade.

- CVS is at 4.9x Web Debt/EBITDA, the optimum can be to revert to three.5x Web Debt/EBITDA

- Bonds are at the moment rated Baa2 by Moody’s which is 2 notches above non-investment grade

- $1.72B of debt is due in 2023

Enterprise Efficiency

The enterprise retains doing effectively, even when the underside line is beneath continued stress because it retains the downward trajectory, with the latest deterioration pushed by continued pharmacy reimbursement stress, partially offset by means of generic medication. Moreover, the early closure of the acquisitions of Signify Well being and Oak Avenue Well being ought to profit the underside line in the long run as price and income synergies are prone to kick in, however it should signify an extra headwind within the brief time period. In actual fact, as said in the course of the 1Q23 earnings name:

These acquisitions considerably advance our value-based technique by including major care, home-based care, and supplier enablement capabilities to our platform. Additionally they carry cutting-edge know-how and expertise that may speed up innovation in areas corresponding to automation, analytics, and technology-enabled data-driven product improvement. The early shut of the Signify and Oak Avenue transactions enhance our potential to speed up synergy realization.

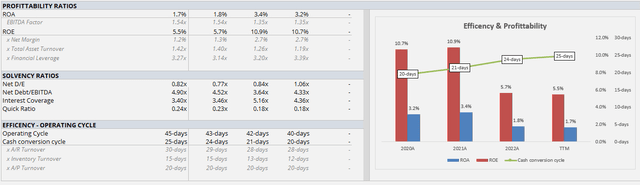

The Stability Sheet stays robust; nevertheless, we will observe a transparent deterioration within the money conversion cycle, which means that enterprise effectivity is melting. At the moment, the money conversion cycle is at 25 days, up from 21 days in 2021. The rise is pushed by decrease A/R turnover, which could point out a downturn within the economic system and a threat for an organization to expertise a rise in unhealthy debt.

Creator’s estimates

Lastly, the enterprise is very money generative, with a stable FCFF Yield of 10.8% (TTM) and a Dividend Yield of three.24% (TTM). This could profit fairness buyers as the corporate pays-down debt (i.e., de-lever)

Valuation

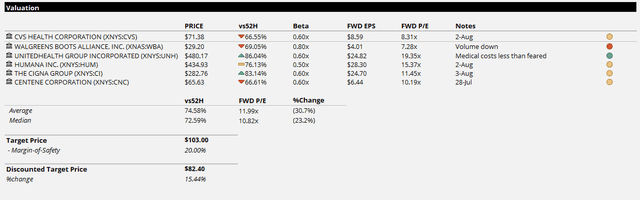

CVS trades at a reduction to its friends, regardless of a seemingly superior strategic place to many. It at the moment trades an FWD P/E of 8.31x vs a median FWD P/E of 11.99x and with the high-end being represented by UnitedHealth (UNH), which in my view deserves a premium vs friends as they’re prone to be the most effective in school because of their vertical integration of medical health insurance, information analytics, companies, PBM, and ASCs.

Creator’s estimates

Whereas the leverage at a traditionally excessive degree coupled with uncertainty across the enterprise uncertainty has put vital stress on the inventory value in latest months, in my view, most of CVS’s dangers are priced into the share value. I do imagine that the 2Q23 earnings report is probably going to supply some extra readability to buyers concerning CVS’s as-is state of affairs, sufficient to drive a multiples enlargement towards the peer common however not sufficient to drive the inventory value by means of 52W highs.

For my part, valuation is prone to stay vary certain as buyers search for additional constructive news-inflow. General, I fee CVS as a stable “Purchase”, with a good worth of $82.40/share (which includes a 20% margin of security).

Dangers

There are a major variety of headwinds with the inventory. Particularly, points by phase are:

- Leverage at a traditionally excessive degree

- PBM enterprise beneath growing scrutiny and value competitors

- Continued stress on front-store from e-commerce

Catalysts

For my part, there aren’t any actual catalysts upcoming, which is probably going one of many primary causes for the continued sell-off. Nonetheless, the next ought to signify a possible tailwind over the subsequent 12 to 18 months:

- De-leverage: bringing the Web-Debt/EBITDA under 3.5x is prone to increase the share efficiency as they’re seemingly to make use of vital FCF for repurchases.

- De-pricing: CVS’s vertical integration is prone to permit it to supply higher and cheaper care.

- Digital–Transformation: closing “pointless” shops and making the purchasers extra depending on its digital retailer is prone to considerably increase its bottom-line

- Multiples Enlargement

Ultimate Remarks

For my part, CVS is a stable free-cash-flow generative firm, which provides a superb entry-point from the valuation viewpoint with many of the dangers being priced in.

Within the brief time period, I do not see a robust catalyst which will carry the inventory again to all-time excessive ranges, nonetheless, it is a good firm for these trying to rotate from some overbought sectors (i.e., know-how) into extra defensive ones. In actual fact, I do anticipate within the subsequent 12-18 months the well being sector to be the proper place for these looking for alpha.