Invoice Pugliano

Introduction

The chemical {industry} is essential – essential. Not solely is that this {industry} key in a variety of provide chains, however it is usually dwelling to a variety of very mature corporations with the flexibility to distribute juicy dividends.

Considered one of these corporations is Dow Inc. (NYSE:DOW). With its 5.3% yield, it is likely one of the strongest revenue performs within the {industry} – sadly, with out dividend progress because of its deal with debt discount.

It additionally would not assist that world deterioration in progress expectations is hurting one of the cyclical industries on this planet.

On the flip aspect, this presents alternatives.

Traders in search of revenue on this {industry} may quickly profit from a greater entry place and the truth that the corporate’s debt discount is bearing fruit. Money circulation era is robust, and it ought to quickly enable the firm to speed up shareholder distributions.

On this article, we’ll focus on all of this as we assess the chance/reward of one of many world’s oldest chemical giants.

So, let’s get to it!

The Chemical Business & Present Headwinds

As most readers will know, Europe is at the moment affected by de-industrialization, which is hitting the energy-intensive chemical {industry} very laborious.

Not solely is that this dangerous information generally, nevertheless it additionally exhibits how essential this {industry} is.

-

Chemical compounds are key within the meals provide chain: Preservatives, style enhancers, and flavors enhance the shelf life and high quality of meals, enabling world import and consumption of varied meals merchandise.

-

Polymers and plastics: The {industry} produces a majority of polymers and plastics utilized in packaging, furnishings, clothes, dwelling decor, electronics, and extra.

-

Agriculture and growth: Fertilizers and pesticides from the chemical {industry} have fueled the inexperienced revolution, rising crop yields and stopping pest assaults. This has led to each home meals safety and agricultural exports.

-

Development of the pharmaceutical {industry}: Chemical compounds are important for the manufacturing of life-saving medicine, selling medical tourism, and decreasing the price of drugs for a bigger inhabitants.

-

Important toiletries: Soaps, perfumes, deodorants, mosquito repellents, detergents, and cleansing brokers are on a regular basis merchandise which have grow to be important in our lives.

-

Developments in analysis: Chemical industries facilitate superior analysis in bio-engineering, mutation, synthetic organ manufacturing, and genetic re-engineering, contributing to India’s progress in these fields.

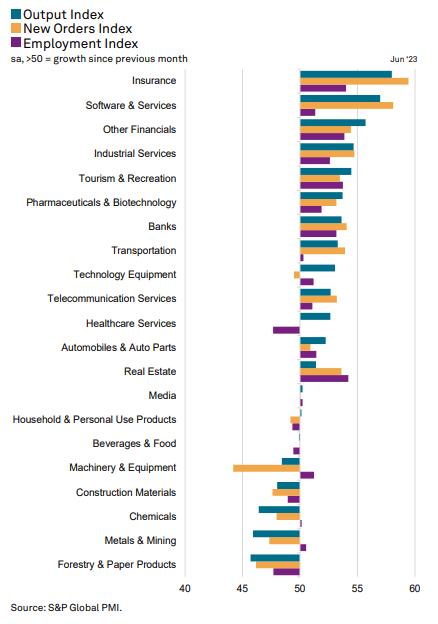

Now, this {industry} is struggling. Not solely are secular headwinds weighing on European output, however world progress is in decline. S&P World (SPGI) knowledge, we see that the chemical {industry} is likely one of the three weakest industries. The others are metals & mining and forestry. These industries are additionally extremely cyclical.

S&P World

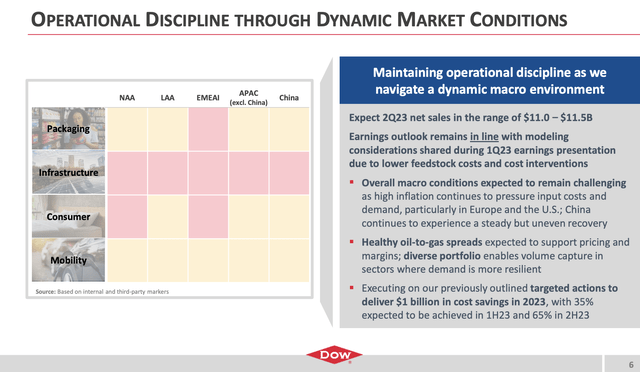

Throughout the newest Bernstein Annual Strategic Choices Convention, the corporate elaborated on these developments.

The corporate talked about that the demand for sturdy items is at the moment in a down cycle after a peak throughout the pandemic. The shift has been in the direction of a providers economic system and fast-moving shopper items. That is confirmed by the chart above.

The housing sector has been affected, and inflation has put stress on high-ticket merchandise purchases. Mobility in electrical automobiles is robust, however inside combustion engine automobiles are slower.

Within the oil and gasoline market, oil costs stay excessive because of restricted new provide, and pure gasoline manufacturing has been comparatively robust, leading to decrease costs.

The housing market, each in China and the US, has seen a lower in year-over-year comps, with issues about industrial property overhang.

The price of proudly owning a house or having a mortgage has elevated, impacting disposable revenue. Demand for sure electronics and reminiscence system chips has decreased, whereas electrical automobiles and packaging & specialty plastics have been extra resilient.

Dow Inc.

With that mentioned, the corporate additionally highlighted the potential for pent-up demand in shopper durables, automotive, and housing. Through the convention, CEO Fitterling defined that for the housing market, stability in rates of interest and a discount within the overhang of workplace area in large cities are essential elements.

He additionally talked about that stock ranges in shopper durables and autos point out restocking alternatives, with the US and China markets exhibiting resilience in each shopper and industrial sectors.

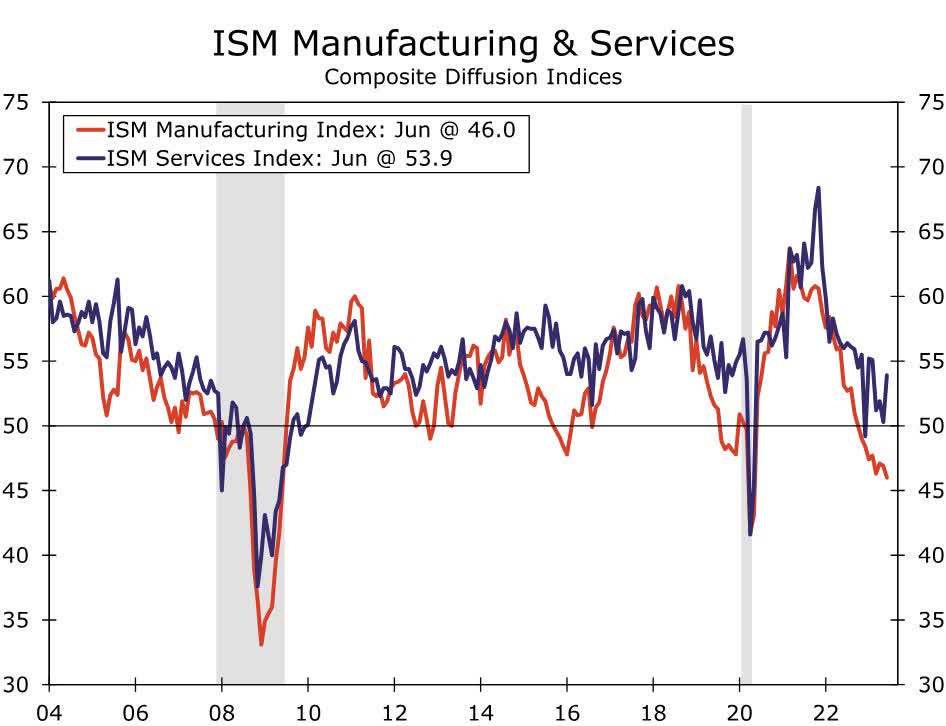

Sadly, macro situations are anticipated to stay difficult within the close to time period, which is confirmed by a brand new low within the ISM Manufacturing Index. Observe that the chart beneath additionally exhibits the divergence between manufacturing and providers.

Wells Fargo

Having mentioned that, Dow is not on standby however making nice progress to reinforce long-term shareholder worth.

The Dow Enterprise Is Bettering

Whereas the roots of this enterprise return to the 19th century, the corporate as we at the moment know it’s the results of a spin-off from DowDuPont, which was finalized in April 2019.

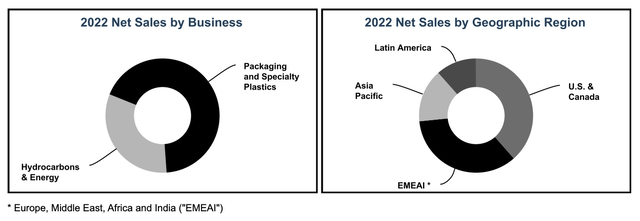

Since that spin-off, the corporate has streamlined its portfolio, specializing in market verticals that outpace GDP progress.

The corporate’s aggressive benefits embody world scale, versatile feedstock, and strategically situated operations.

Dow Inc.

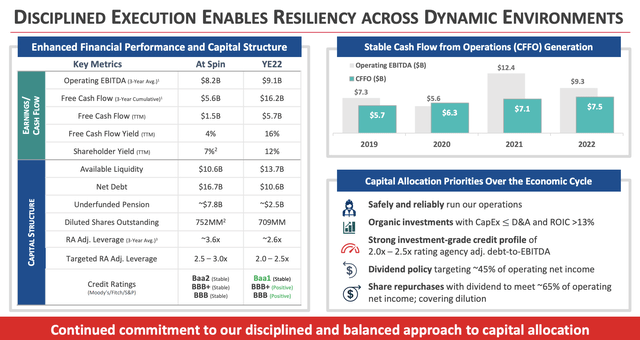

Thus far, Dow has demonstrated disciplined capital allocation and improved its financials, surpassing pre-pandemic earnings ranges, tripling three-year cumulative free money circulation, and constantly rising money circulation from operations.

In response to the corporate:

We decreased our internet debt and pension liabilities by greater than $10 billion and have delivered round 80% of internet revenue again to our shareholders since spin, effectively above our goal of 65% throughout the financial cycle.

The corporate maintains a balanced strategy to capital allocation, with a deal with common capital expenditure inside depreciation and amortization (D&A) and a goal return on invested capital of over 13%. Dow plans to return 65% of internet revenue to shareholders by means of dividends and share buybacks.

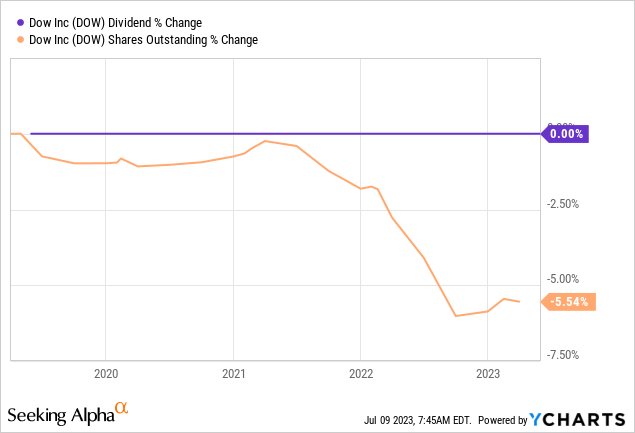

Presently, the dividend yield is 5.3%, with a 63% payout ratio. The dividend has not been hiked because the spin-off.

Nevertheless, DOW has purchased again 5.5% of its shares because the spin-off. Most of it occurred after the 2020 lockdowns when post-pandemic tailwinds began to type.

Moreover, ongoing enterprise enhancements make future dividend progress very seemingly.

Wanting on the knowledge beneath, we see a big enchancment in EBITDA – regardless of financial headwinds – an infinite enhance in free money circulation, vital debt discount, and an improve within the firm’s credit standing, which displays the corporate’s debt discount.

Dow Inc.

In response to the corporate (emphasis added):

On account of these actions on the finish of 2022, we raised our underlying earnings above pre-pandemic ranges, practically tripled our three-year cumulative free money circulation and have grown money circulation from operations yearly since spin.

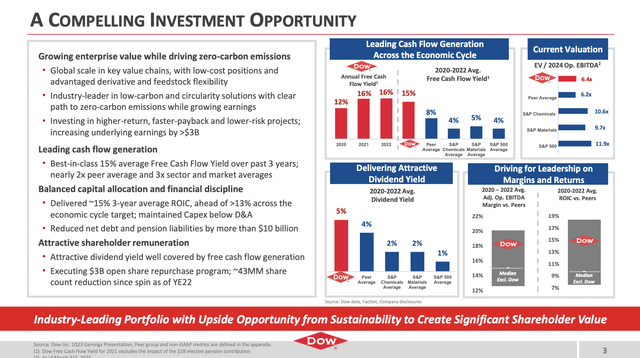

[…] Three-year common EBITDA margins and return on invested capital above the peer median, best-in-class free money circulation yield on a three-year common, which is sort of 2 instances the peer common and three instances the sector and market averages, best-in-class internet debt discount, leading to improved credit score rankings and decrease curiosity prices and above peer median shareholder remuneration with a dividend yield above the peer sector and market averages.

For now, the corporate makes the case that its dividend is protected and protected. I agree with that, as the corporate is predicted to keep up an 8-9% free money circulation yield – even with out an upswing in financial progress.

Given the more healthy steadiness sheet, I anticipate the corporate to spice up its dividend within the subsequent few years. In a state of affairs of enhancing financial progress, I would not wager towards constant annual dividend hikes that make the present juicy yield much more engaging.

It additionally must be mentioned that the corporate advantages from its capability to seize quantity in sectors with extra resilient demand, equivalent to power, agriculture, private care, and family purposes.

The corporate prioritizes sources towards high-value merchandise with regular demand, together with useful polymers, efficiency silicones, and specialty solvents. Dow additionally advantages from its improved price place and feedstock flexibility due to leveraging decrease feedstock prices and wholesome oil-to-gas spreads.

Therefore, the corporate is on observe to realize $1 billion in price financial savings in 2023, with 35% of the financial savings anticipated within the first half of the 12 months.

Dow Inc.

Whereas I anticipate the free money circulation yield to settle near 8-9%, as I discussed on this article, I do consider that the corporate will keep an industry-beating free money circulation yield.

This additionally helps the valuation.

DOW’s Valuation

DOW has misplaced roughly 1 / 4 of its market worth since its peak final 12 months. The corporate is at the moment 5% up year-to-date and 24% above its 52-week low.

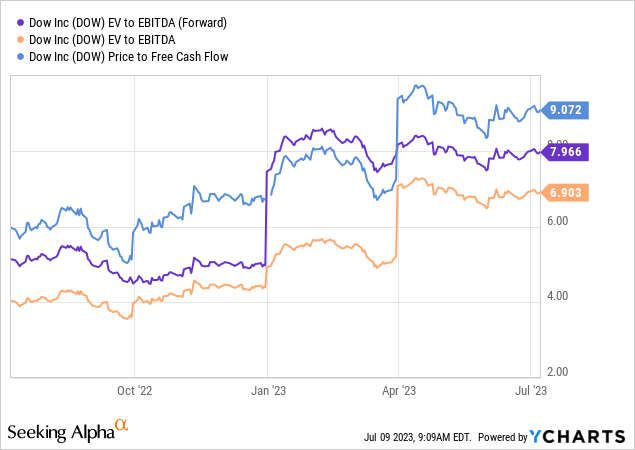

The inventory is now buying and selling at 8x ahead EBITDA and roughly 11x normalized annual free money circulation.

I do consider that DOW’s valuation is truthful, which is mirrored in its consensus worth goal of $57 (+8%).

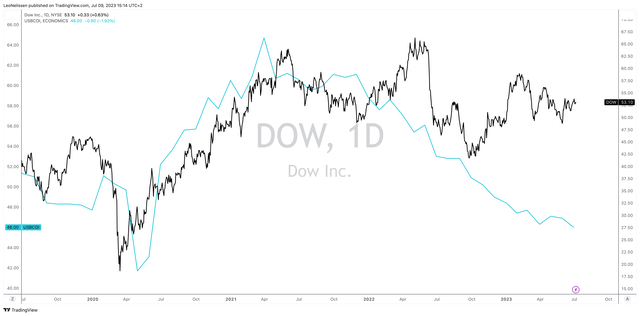

Nevertheless, I am not urging folks to leap proper in. As we mentioned on this article, financial situations are deteriorating. Therefore, I added the ISM Manufacturing Index to the chart beneath. Until we get a sudden upswing in progress expectations, I am afraid that financial progress expectations will proceed to be a extreme headwind for DOW shares.

TradingView (DOW, ISM Index)

That mentioned, it will not kill the corporate.

Traders in search of high-yield publicity on this space may profit from ready for a correction earlier than shopping for.

I could be incorrect, and DOW could possibly be at first of a robust uptrend, however given market fundamentals and the inventory’s valuation, ready for weak point is a danger I am prepared to take.

Please be at liberty to disagree with my shopping for technique.

Takeaway

In conclusion, the chemical {industry} is going through difficult instances because of world financial headwinds and de-industrialization in Europe.

Nevertheless, amidst these difficulties, there are alternatives for buyers in search of revenue. Dow Inc., one of many oldest chemical giants, presents a robust revenue play with its 5.3% dividend yield.

Whereas the dearth of dividend progress and the {industry}’s cyclicality are issues, Dow’s deal with debt discount and improved money circulation era place it effectively for future shareholder distributions.

The corporate has demonstrated disciplined capital allocation, monetary enhancements, and vital debt discount since its spin-off.

With ongoing enterprise enhancements and a robust steadiness sheet, Dow is more likely to enhance its dividend within the coming years.

Moreover, its capability to seize quantity in sectors with resilient demand and its cost-saving initiatives contribute to its optimistic outlook.

Whereas financial situations might current headwinds, affected person buyers may benefit from a possible correction earlier than contemplating an funding in DOW.