Dilok Klaisataporn

Co-authored with Past Saving

There are a number of buzzwords that increase concern and angst amongst traders, and “chapter” is certainly certainly one of them. When traders hear these phrases, they promote. When different traders are promoting, it is time to search for the chance they’re leaving behind. As an earnings investor, I perceive that when the market panics, it is a possibility for me to purchase earnings at a reduced worth.

At present we will speak about an organization that noticed a sell-off because of the phrase “chapter.” No, the corporate did not file for chapter. Removed from it, the corporate has an investment-grade steadiness sheet, over $1 billion in liquidity, and well-laddered debt maturities. It has a defensive steadiness sheet that did not falter within the face of COVID.

EPR Properties (NYSE:EPR) was hit with guilt by affiliation. A high tenant filed for chapter, and its share worth fell. Buyers bought with out asking themselves what it meant for the corporate.

Now, EPR has up to date shareholders as Cineworld exits chapter, and it seems that the world did not finish. EPR remains to be gathering lease, and it negotiated a deal that gives the chance for extra upside sooner or later. Let’s have a look.

EPR Properties Updates On Regal Cinemas

Late final yr, EPR Properties noticed its share worth collapse in response to a big tenant submitting chapter. When this information first broke, we mentioned our outlook and our technique, saying:

“EPR’s administration is top-notch and they’re going to be capable to cope with no matter points Regal presents. The underside line is that the properties are important to the enterprise and are cash-flow constructive on the property stage.

It’s too early to “again up the truck” now. We’re reducing our purchase below on EPR to mirror our expectations of this headwind, nevertheless, we don’t anticipate danger to the dividend, and we anticipate to carry EPR by way of Cineworld’s reorganization.”

A key in actual property is that the owner can’t be pressured to renegotiate a lease. Because of this, the owner has plenty of leverage in any negotiations as a result of, at any time, they will merely demand that the tenant vacate the property. For a theater, that often means leaving a big quantity of private property behind and shedding 100% of the income. What’s a theater firm with no theater?

EPR additional protected itself with a “grasp lease.” A grasp lease is a lease settlement that covers a number of properties. If a tenant defaults on one property, it ends in a default on all properties. This protects the owner by making certain {that a} tenant cannot simply stroll away from a single poor-performing property. In the event that they need to preserve their “good” properties, they should pay lease on all properties.

So, whereas EPR was prepared to renegotiate the lease with Regal – in any case, EPR did not actually need all of Regal’s properties to be vacated – EPR did go to the negotiating desk with important leverage. Essentially the most highly effective lever to have obtainable in any negotiation is the flexibility to stroll away, and the opposite facet to know you’ve gotten the flexibility to stroll away. Regal wanted to lease EPR’s properties greater than EPR wanted Regal’s lease.

Previous to the chapter, Regal was paying EPR roughly $86.Three million in whole revenues. Beneath the brand new settlement, Regal can pay:

- $65 million in base lease, topic to a 10% escalator on annual lease each 5 years.

- Reimburse EPR for property-level bills (roughly $3.5 million)

- Annual share lease on all revenues exceeding $220 million.

Moreover, EPR will take possession of 16 Regal properties, 5 of which can be leased to different operators and 11 of which EPR intends to promote. So, along with what EPR is gathering from Regal, it would have income from the brand new tenants, plus money that may be reinvested from the bought properties.

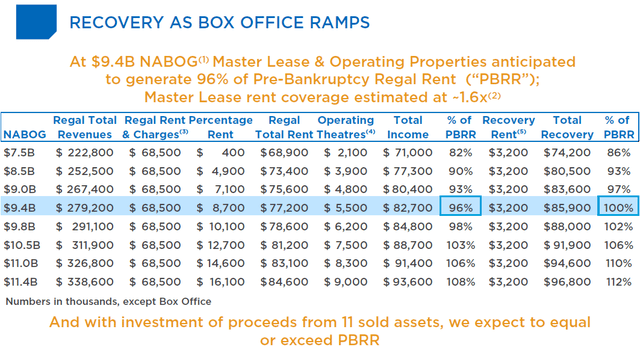

Due to the variable part, EPR is taking over some danger, but it surely’s skewed towards the upside. For revenues to be the identical as pre-bankruptcy, EPR wants Regal to have gross revenues of $279.2 million. Here’s what the maths appears like: Supply

EPR June 28th Presentation

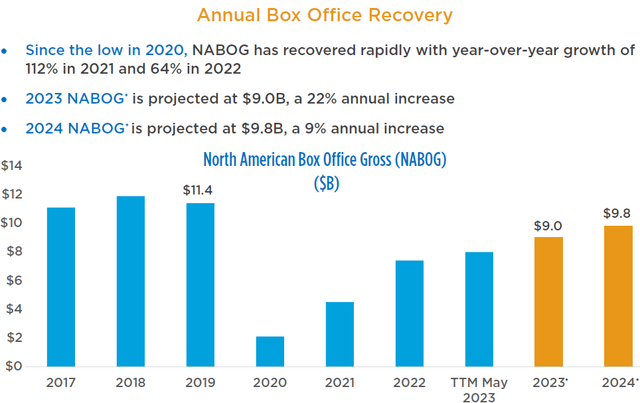

They estimate that might correlate to NABOG (North American Field Workplace Gross) of $9.four billion.

EPR June 28th Presentation

Be aware that at $9.four billion, field workplace receipts would nonetheless be nicely beneath pre-COVID ranges. With a restoration to pre-COVID ranges, EPR may very well be 110%-plus the prior lease settlement. If revenues fail to get well and stay at present ranges, EPR could be a small hit, gathering 93%-97% of pre-bankruptcy lease. One thing that might be recovered with the escalator on base lease.

General, this new lease construction does an important job at offering an affordable base lease for EPR, plus some upside if the field workplace continues to get well to pre-COVID ranges. In fact, all negotiations include some give and take.

The biggest factor that EPR is giving up is that it agreed to cease gathering on the $51.eight million in lease that was deferred throughout COVID. If Regal doesn’t default on the brand new lease for 15 years, that lease can be forgiven.

For shareholders, this deal is a constructive. It gives a transparent outlook for EPR to keep up its present dividend and has ample upside for dividend progress later this yr or early subsequent yr. With this problem behind it, EPR can now look towards the long run.

Conclusion

This can be a pretty widespread incidence available in the market. A tenant information for chapter and the value of the owner falters; a borrower defaults and lenders are punished. On the one hand, we do want to acknowledge that this stuff can have a monetary affect on the owner or lender. Then again, we have to acknowledge that chapter court docket exists for the aim of making certain that the events who’re owed cash get the absolute best restoration.

As a landlord, EPR entered into these negotiations with a positive place. If you wish to use actual property that is not yours, it’s a must to pay lease – it is that easy. At any second, EPR had the ability to stroll away from the negotiations and demand that Regal pay lease as agreed or abandon all the properties.

EPR had an incentive to offer in just a little since backfilling all of the properties would have been an costly and time-consuming process. Understanding a deal that saved Regal in enterprise was positively higher than one that might pressure them out of enterprise.

On the finish of the day, the affect on EPR’s enterprise is really minimal. They anticipate to get well 93%-97% of pre-bankruptcy lease to start out, with the potential for it to develop over 100% of the prior contract if the film business recovers to pre-COVID ranges.

Earlier than the chapter submitting, Regal accounted for 13.5% of EPRs lease. That will be plenty of lease to lose, and the market bought EPR prefer it was going to lose all of it. In actuality, EPR, in a foul state of affairs, would get well 90% of pre-bankruptcy lease, which might be a couple of 1.35% discount in EPR’s whole lease. Even that is not an enormous deal, and with extra aggressive escalators sooner or later, over the entire time period of the lease, EPR will possible accumulate extra lease than it could have if Regal had simply paid as agreed.

For earnings traders like us, this case was not a big risk to our dividend. Now that it’s behind us, we are able to sit up for the subsequent dividend hike from EPR!