shaunl/E+ through Getty Photos

All values are in CAD until famous in any other case.

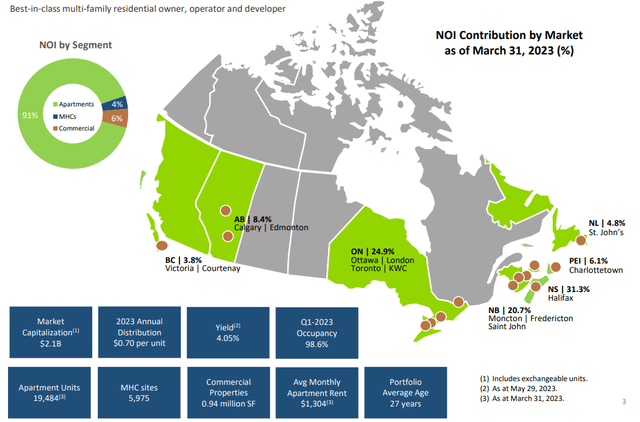

As at March 31, 2023, Killam House REIT (OTC:OTC:KMMPF, TSX:TSX:KMP.UN:CA) had a portfolio valued at $4.9 billion and comprised house buildings, manufactured residence websites or MHCs, and industrial properties. Though the funding properties are situated throughout seven Canadian provinces, the vast majority of them are within the Atlantic Canada.

2023 Investor Presentation

Additionally, as mirrored within the above graphic, the 19,484 residences do virtually all the heavy lifting by way of contribution to the web working revenue or NOI. Whereas the 230 house properties are in all the seven provinces, the 40 MHC places and the actual property funding belief, or REIT’s, 14 industrial properties reside solely within the Atlantic area and Ontario.

Occupancy and Hire

Residential REITs are having fun with the upper calls for purchased on by the tailwind of housing unaffordability resulting from rate of interest hikes. That, together with record-breaking immigration numbers, has pushed the demand for residential leases throughout the board. Unsurprisingly, Killam wanted decrease incentives to entice renters. The REIT expects the incentives to pattern even decrease than the Q1 variety of 0.5% (of rental income), for the remainder of the 12 months. General, the occupancy ranges had been larger year-over-year.

Q1-2023 MD&A

5 of the seven provinces that the REIT has a presence in are topic to lease management. This could be round 57% of its portfolio as famous within the Q1-2023 MD&A.

Q1-2023 MD&A

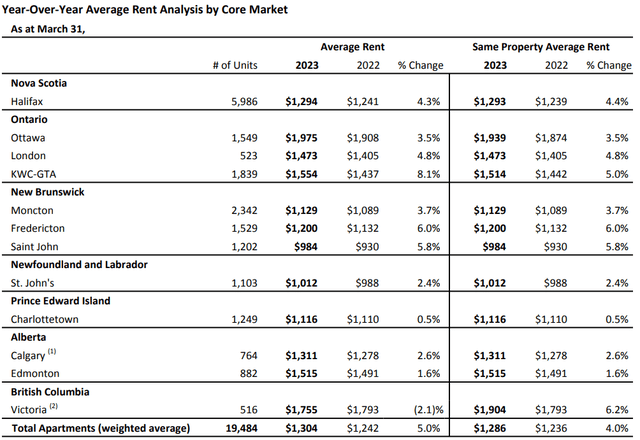

In New Brunswick, the rental management is barely relevant to MHCs. Nova Scotia has elevated this restrict to five.0% on house lease renewals for 2024 and 2025, together with a rise to five.8% on 2024 MHC lease renewals. Regardless of the controls in place, the tight rental market helped Killam obtain a 5% improve in whole common lease and a 4% improve in the identical property common lease on a year-over-year foundation.

Q1-2023 MD&A

The noteworthy decline in BC was attributable to Q2-2022 acquisitions, which might be absent in the identical property numbers of 2023.

Q1 2023 Working Outcomes

Yr-over-year larger occupancy and rents trickled right down to income numbers. Killam had a 9.6% improve in income, and a 12.3% improve in whole web working revenue or NOI to indicate for it, that regardless of a 5.8% improve in working bills.

Q1-2023 MD&A

Most of NOI was pushed by the house portfolio, with it contributing over 90% of the NOI as we noticed earlier on this article. The MHC portfolio had a 2.4% decline as working bills elevated greater than the income. Its industrial properties, comprised of retail and workplace buildings, had larger occupancy and rents in comparison with the Q1-2022 and confirmed a 16.4% improve in year-over-year NOI on account of it. The funds from operations, or FFO, quantity beat the prior 12 months, nonetheless, it was barely muted in relation to the NOI because of the 27.1% in larger curiosity bills in comparison with Q1 2022.

Q1-2023 MD&A

The weighted common rate of interest on mortgages on the finish of Q1 2023 was 2.80% in comparison with 2.63% at March 31, 2022. This quantity has been rising slowly and was 2.74% at December 31, 2022.

Q1-2023 MD&A

Coming again to the FFO, the entire 5.6% improve trickled down solely partially on a per unit foundation since Killam had comparatively larger items in 2023.

Debt and Liquidity

As of March 31, 2023, Killam had about $422 million in debt maturities over the following twelve months.

Q1-2023 MD&A

There’s actually no danger of mortgages not getting renewed as they arrive due since they’re CMHC backed. Moreover, as a result of virtually all of their debt is mortgages (secured debt), the utmost they stand to lose could be the corresponding property if a selected mortgage isn’t renewed.

2023 Investor Presentation

They are going to, nonetheless, should pony up for extra for curiosity for the reason that charges are larger. With a 103 foundation factors distinction between the maturing and anticipated rate of interest, the curiosity bills will go up by about $Four million yearly.

By way of liquidity, Killam had round $120 million accessible from its credit score amenities and money available. This together with round $70 million in unencumbered property, the REIT won’t face a disaster on this entrance.

Verdict

Powered by a robust NOI, Killam acknowledged truthful worth features on its properties in Q1.

Q1-2023 MD&A

It at present trades at a reduction to its personal calculated NAV of round $20.

This REIT is in a uncommon camp the place the analyst estimations of its NAV are larger than its personal and vary from $19.50 on the low finish to over $22 on the excessive finish. That offers a modicum of confidence that the theoretical ground is larger than the place this inventory at present trades, round $17.40. After all, shares can commerce effectively beneath NAV in occasions of misery and that’s true for Killam as effectively. Presently, the low cost is about consistent with friends like Boardwalk REIT (BEI.UN:CA) and Canadian House Properties REIT (CAR.UN:CA). On a money move a number of foundation, Boardwalk is the most costly out of the three.

Yielding round 4.1%, and based mostly on the basics, each micro and macro, the inventory is actually on the enticing aspect of issues. Killam House REIT will get a Four on our potential ache scale score.

Writer’s Ache Scale

At current, we’d have a look at $16.00 as a superb purchase level for Killam House REIT inventory. That will be about 14X ahead FFO and supply a strong margin of security for the extremely unsure rate of interest surroundings.

Please be aware that this isn’t monetary recommendation. It could appear to be it, sound prefer it, however surprisingly, it’s not. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.